|

市場調查報告書

商品編碼

1408146

軟體定義網路 (SDN):市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Software Defined Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

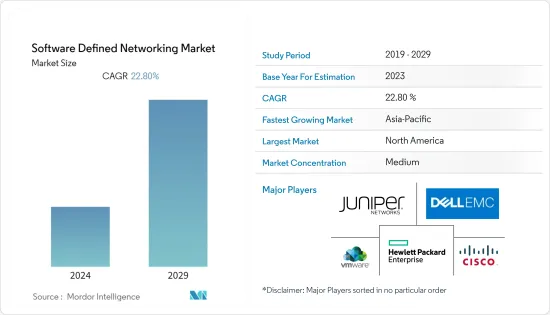

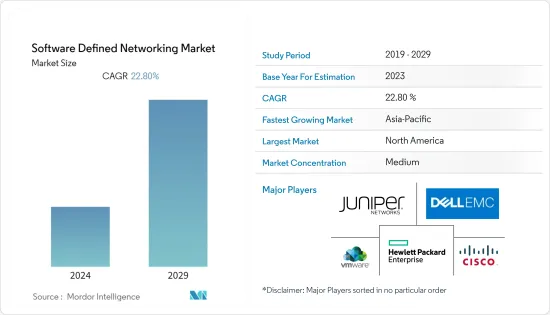

目前全球軟體定義網路(SDN)市場規模為119.1億美元,預計未來五年將達332.5億美元,預測期內複合年成長率為22.8%。

透過資料以及區塊鏈、物聯網、認知和高級分析等網路技術不斷進行的數位轉型加強了各行業對連接進步的整體採用,這極大地推動了市場。

主要亮點

- 全球軟體定義網路(SDN)市場的開拓是由雲端運算採用的快速成長、對軟體定義網路(SDN)功能虛擬的投資不斷增加(特別是為了最大限度地減少資本支出和營運費用以及各種移動服務)所推動的。受到需求成長等關鍵因素的推動; SDN 網路中雲端運算解決方案的接受度迅速提高,將在提高先進資料中心的整體可操作性、安全性和網路可管理性方面發揮關鍵作用。

- 此外,各通訊服務供應商增加對5G基礎設施的投資將有助於改善連接性並最大限度地部署SDN解決方案。此外,5G基礎設施網路的發展預計將支持SDN市場的成長。根據 5G Americas 的數據,截至 2023 年,全球 5G 用戶數約為 19 億。預計到年終將增至約28億,到2027年將增至約59億,預計將成為市場的主要驅動力。

- 此外,企業的數位化趨勢進一步推動了對強大網路服務的需求。隨著許多公司尋求增強其整體網路能力,軟體定義網路越來越受到關注。例如,2023 年 2 月,ETSI開放原始碼組織 TeraFlowSDN 宣布推出第二版 TeraFlowSDN 控制器,這是一款強大且創新的 SDN 控制器和編排器。 TeraFlowSDN 第 2 版為各個網域上的端對端傳輸網路切片提供了啟用和擴展的支援。

- 然而,經驗豐富、技術熟練的網路工程師的短缺以及安全風險和攻擊威脅的增加可能會限制整個預測期內的市場成長。

- 自 COVID-19 爆發以來,隨著企業採用遠距工作模式,對雲端基礎的解決方案的需求顯著增加。隨著遠距工作模式的興起,企業將最大限度地投資於雲端基礎的分析和保障、邊緣運算和人工智慧驅動的網路技術,這有望推動所研究的市場。

軟體定義網路 (SDN) 市場趨勢

電信和雲端基礎服務供應商預計將實現強勁成長

- 軟體定義網路因其資料流量受控、大規模網路易於管理等優點而廣泛應用於IT和通訊業。通訊技術的進步、資料消耗的增加、智慧型手機的使用增加以及物聯網/M2M 連接帶來的網際網路流量的增加正在推動軟體定義網路 (SDN) 在通訊業的採用。

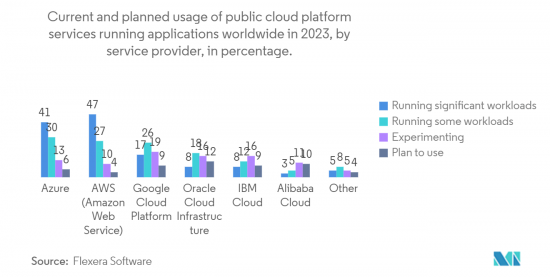

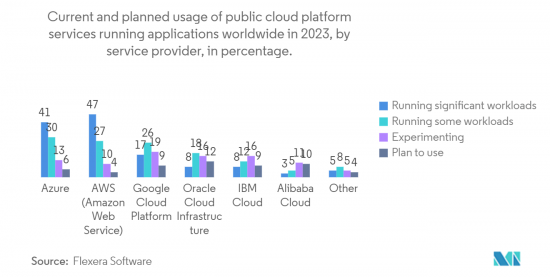

- 企業正在努力尋找有效運作IT基礎設施以及高效管理和營運其網路的方法。特別是,企業正在對儲存、運算和網路等商用硬體上的傳統 IT 技術進行現代化改造,以採用雲端技術,從而實現新網路服務的快速部署和開發。隨著企業中雲端基礎的應用程式數量的增加,雲端基礎的服務變得越來越普及。

- 過去十年,雲端處理總數有所增加,主要得益於中小企業投資的增加。由於組織中雲端基礎的應用程式數量不斷增加,雲端基礎的服務越來越受到重視。在過去十年中,雲端處理的總體使用量有所增加,這主要是由於中小型企業支出的增加。

- 此外,業內多家公司正在合作推出SDN解決方案。例如,2022年10月,5G無線基礎設施供應商EdgeQ Inc.和開放無線接取網路全球通訊行動電話電信商沃達豐宣布,他們將共同建置下一代軟體可程式5G ORAN系統.我們合作了。此次合作利用 ORAN 提供全球首款開放式可程式全內聯 L1 加速卡,支援多載波、大規模 MIMO。為了支援 5G 宏蜂窩部署,此大規模整合架構將整個 4G/5G 實體層整合到單一卡片上。

- 此外,2022年3月,諾基亞宣布將與沃達豐獨家合作,為沃達豐的多接入固定網路技術建置SDN-M&C(軟體定義網路管理器和控制器)解決方案。根據這項合作關係,兩家公司正在歐洲進行概念驗證研究。

北美市場佔有率最高

- 北美地區在促進軟體定義網路服務市場的成長方面發揮著至關重要的作用。其主要原因是先進技術的接受與採用、網路自動化的發展、雲端基礎的服務數量的增加等諸多因素。在未來五年中,我們預計大多數 IT 團隊將擴大採用 NaaS,因為供應商提供包括軟體、雲端智慧和本地硬體設備管理替代方案的混合服務。

- 此外,連網行動裝置的顯著增加推動了對增強網路服務的需求的整體成長。由於美國始終處於技術採用的前沿,該地區的連網型設備採用率最高,為市場帶來了巨大的成長機會。

- 該地區的主要企業正在聯合推出各種解決方案,以保持市場競爭力。例如,2022 年 6 月,全球領先的IT基礎設施服務供應商之一 Kyndryl 與思科宣佈建立合作夥伴關係,主要利用思科解決方案和 Kyndryl 託管服務,幫助企業客戶加速向資料主導型業務轉型。技術夥伴關係Kindril 和思科也宣布了新的私有雲端服務和網路、邊緣運算解決方案、軟體定義網路 (SDN) 解決方案以及在具有各種進階安全功能的環境中提供的多網路廣泛解決方案。,我們也將開發區域網路。

- 此外,全部區域的5G 部署和電信業者數量的增加在顯著推動市場成長方面發揮著重要作用。此外,該地區各種重要 SDN 供應商的存在以及向 5G 網路的快速遷移正在對 SDN 市場的採用產生積極影響。此外,5G技術公司之間的合作在5G技術市場中變得越來越普遍。這主要是由於公司專注於透過匯集資源、專業知識、技術和成本來建立堅實的 5G 基礎設施並支援創造性平台。

- 此外,2022年6月,美國半導體公司高通收購了Cellwize Wireless Technologies Pte. Ltd。此次收購旨在改善Qualcomm Technologies的5G網路基礎設施,將為互聯和智慧型邊緣提供動力,加速跨產業的數位轉型,並支持雲端經濟的崛起,市場成長將呈指數級擴張。

軟體定義網路 (SDN) 產業概述

全球軟體定義網路市場競爭溫和,並由主要企業組成。從市場佔有率來看,目前該市場由幾家主要企業佔據。然而,雲端運算和區塊鏈的大規模採用正在推動整個市場的需求。許多公司正在透過贏得新契約和開拓新市場來最大限度地擴大其市場佔有率。

2023 年 4 月,美國鐵塔公司子公司、領先的混合IT 解決方案供應商 Coresight 在其軟體定義網路 (SDN) 平台 Open Cloud Exchange 中新增了新的擴充網路。,我們已宣布將推出此服務。這項新服務可自動執行Oracle雲端基礎架構內的額週邊設備定功能,並在核心站點的完全託管虛擬路由器上實現雲端到雲端通訊功能。

2022 年 7 月,沃達豐升級了其軟體定義網路 (SDN),整合了多個供應商元素並實現了其全球傳輸網路的現代化。該網路為四大洲 28 個國家的通訊業者協調所有行動、固定和語音流量,為數億消費者以及獨立網路業者和內容供應商提供服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 產業生態系統分析

- 主要使用範例

- 技術分析

- 物聯網和邊緣運算

- 安全

- 雲端運算

- 市場促進因素

- 增加網路基礎設施自動化投資

- 物聯網和雲端服務的採用率不斷提高

- 市場挑戰

- 缺乏技術純熟勞工

- 安全風險和攻擊威脅

- 鄰近市場分析

- SD-WAN

- 市場估計/預測

- 成長機會與挑戰

- 主要廠商發展情形

- 安全存取服務邊際(SASE)

- 市場估計/預測

- 成長機會與挑戰

- 主要廠商發展情形

- SD-WAN

第5章市場區隔

- 按組織規模

- 中小企業

- 主要企業

- 按最終用戶

- BFSI

- 衛生保健

- 零售

- 電信和雲端服務供應商

- 製造業

- 教育機構

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章競爭形勢

- 公司簡介

- Cisco Systems

- VMware

- Dell EMC

- HPE

- Juniper Networks

- Fortinet

- Huawei Technologies

- Barracuda Networks

- Versa Networks

- Arista Networks

第7章 市場機會及未來趨勢

The Global Software Defined Networking Market is valued at USD 11.91 billion in the current year and is expected to register a CAGR of 22.8% during the forecast period to become USD 33.25 billion by the next five years. The rising digital transformation through data as well as networking technologies, such as blockchain, IoT, cognitive, and advanced analytics, strengthens the overall adoption of connectivity advances in various industries, which in turn is driving the market significantly.

Key Highlights

- The development of the global software-defined networking market is fuelled by key factors like a surge in the adoption of cloud computing, an increase in investments in software-defined networking function virtualization, especially to minimize the capital expenditure & operating expenses, and a rise in the need for various mobility services. The surge in the acceptance of cloud computing solutions in the SDN network plays a crucial role in improving the overall operability, security, and network manageability in advanced data centers.

- Moreover, the rising investments by various telecom service providers in 5G infrastructure would help to improve connectivity and maximize the deployment of SDN solutions. Also, the evolution of the 5G infrastructure network would help boost the SDN market's growth. According to 5G Americas, as of 2023, there are around 1.9 billion 5G subscriptions worldwide. It is anticipated to increase to about 2.8 billion by the end of the year 2024 and 5.9 billion by 2027, which in turn is expected to drive the market considerably.

- Also, the enterprise's propensity toward digitalization further propels the demand for robust network services. Many companies are looking to enhance their overall network capabilities, which is where Software Defined Network is gaining traction. For instance, in February 2023, ETSI Open Source Group TeraFlowSDN declared the 2nd launch of TeraFlowSDN controller, a robust and innovative SDN controller and orchestrator. TeraFlowSDN Release 2 delivers validated and extended support for slicing end-to-end transport networks over various domains.

- However, the lack of experienced and skilled network engineers and the rise in security risks and attack threats can restrict market growth throughout the forecast period.

- Since the outbreak of COVID-19, the demand for cloud-based solutions significantly grew owing to remote working models being adopted by enterprises. With the rising remote working model, companies maximized investments in cloud-based analytics and assurance, edge computing, and AI-powered networking technologies, which were expected to boost the studied market.

Software Defined Networking Market Trends

Telecom and Cloud-Based Service Provider is expected to witness a significant growth

- Software-defined networking is widely used in the IT and telecommunication industry due to advantages such as data traffic control and easily manageable large networks. The advancement of communication technologies, increased data consumption, the expansion of smartphone use, and the rise of internet traffic as a result of IoT/M2M connectivity together drive the adoption of software-defined networking in the telecommunications industry.

- Enterprises are striving to run their IT infrastructure efficiently and find ways to manage and operate their networks effectively. Enterprises are modernizing traditional IT techniques on commodity hardware, such as storage, computing, and networking, especially to incorporate cloud technologies that allow rapid deployment and development of new network services. With an increasing number of cloud-based applications across enterprises, cloud-based services are becoming significantly popular.

- Over the past decade, the total adoption of cloud computing has been rising mainly due to the increasing investments from small and medium enterprises. The cloud-based services are becoming prominent as the number of cloud-based apps in organizations grows. The overall usage of cloud computing has increased over the last decade, which is primarily due to the increased expenditures from small and medium-sized businesses.

- Moreover, various companies in the industry are parting to launch SDN solutions. For instance, in October 2022, EdgeQ Inc., a provider of 5G wireless infrastructure, and Vodafone, a global telecoms mobile operator in Open Radio Access Networks, collaborated to create the next-generation, software-programmable 5G ORAN systems. The partnership would utilize ORAN to provide the world's first open programmable, completely in-line L1 accelerator card to support multi-carrier, massive MIMO. To handle the 5G macro cell deployments, this massively integrated architecture converges the whole 4G/5G Physical layer into a single card.

- Additionally, In March 2022, Nokia declared that it was chosen exclusively to collaborate with Vodafone on creating software-defined network manager and controller (SDN-M&C) solutions for the multi-access fixed network technology of the company. Both companies are performing proof-of-concept studies in Europe under the terms of the partnership.

North America to Hold the Highest Market Share

- The North American region plays a very crucial role in terms of enhancing the growth of the software-defined network service market. It is mainly because of factors like the Inclining toward acceptance and implementation of advanced technology, development in network automation, the rise in the number of cloud-based services, and many others. Over the next five years, most IT teams are expected to increasingly adopt NaaS as suppliers provide hybrid offerings that involve software, cloud intelligence, and the alternative for the management of on-premises hardware devices.

- Moreover, substantial growth in connected and mobile devices is spiking the rise in the overall demand for enhanced network services. Since the United States has always stayed at the forefront of technology adoption, the region has witnessed the maximum adoption of connected devices, driving the market's growth opportunities significantly.

- Major companies in the region are collaborating and launching various solutions to remain competitive in the market. For instance, in June 2022, Kyndryl, the world's significant IT infrastructure services provider, and Cisco declared a technology partnership to help and assist enterprise customers boost their transformation into data-driven businesses mainly powered by Cisco solutions and Kyndryl managed services. Kyndryl and Cisco would also develop new private cloud services and networks, as well as edge computing solutions, software-defined networking solutions, and multi-network wide area network offerings delivered in an environment with various advanced security capabilities.

- Moreover, the increase in 5G rollouts and telecom companies across the region is playing a significant role in terms of driving market growth significantly. Also, the presence of various crucial SDN providers and the quick shift to 5G networks in this region positively impact the SDN market adoption. Further, the surge in the collaborations between 5G tech firms is becoming more common in the market for 5G technologies. This is mainly due to the firm's focus on building a solid 5G infrastructure and supporting creative platforms by pooling their resources, expertise, technology, and costs.

- Further, in June 2022, Qualcomm, a semiconductor firm located in the United States, acquired Cellwize Wireless Technologies Pte. Ltd. This acquisition is intended to improve Qualcomm Technologies' 5G network infrastructure, which would power the connected, intelligent edge, fuel the digital transformation of the sectors, and assist the rise of the cloud economy which in turn will augment the market growth drastically.

Software Defined Networking Industry Overview

The Global Software Defined Networking market is moderately competitive and comprises major players. In terms of market share, few key market players currently dominate the market. However, the massive adoption of cloud computing and blockchain is increasing the market's overall demand. Many companies are maximizing their market presence by securing new contracts and tapping new markets.

In April 2023, CoreSite, a significant hybrid IT solutions provider and subsidiary of American Tower Corporation, declared the introduction of new enhanced network services to its software-defined networking platform, the Open Cloud Exchange. The new services would automate the additional provisioning functionality within the Oracle Cloud Infrastructure and direct its cloud-to-cloud communication capabilities on CoreSite's fully managed virtual routers.

In July 2022, Vodafone upgraded its software-defined networking (SDN) to integrate several supplier elements and modernize its worldwide transport network. Hundreds of millions of consumers, as well as independent internet and content providers, were served by this network, which coordinated all of the telco's mobile, fixed, and voice traffic across 28 nations on four continents.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the market

- 4.4 Industry Ecosystem Analysis

- 4.5 Key Usecases

- 4.6 Technology Analysis

- 4.6.1 IoT and Edge Computing

- 4.6.2 Security

- 4.6.3 Cloud Computing

- 4.7 Market Drivers

- 4.7.1 Rising investment toward automation of network infrastructure

- 4.7.2 Increasing adoption of IoT and cloud services

- 4.8 Market Challenges

- 4.8.1 Lack of skilled workforce

- 4.8.2 Security risks and attack threats

- 4.9 Adjacent Market Analysis

- 4.9.1 SD-WAN

- 4.9.1.1 Market estimation and forecast

- 4.9.1.2 Growth opportunities and challenges

- 4.9.1.3 Key vendor developments

- 4.9.2 Secure Access Service Edge (SASE)

- 4.9.2.1 Market estimation and forecast

- 4.9.2.2 Growth opportunities and challenges

- 4.9.2.3 Key vendor developments

- 4.9.1 SD-WAN

5 MARKET SEGMENTATION

- 5.1 By Organization size

- 5.1.1 SMEs

- 5.1.2 Large Enterprises

- 5.2 By End User

- 5.2.1 BFSI

- 5.2.2 Healthcare

- 5.2.3 Retail

- 5.2.4 Telecom and Cloud Service Providers

- 5.2.5 Manufacturing

- 5.2.6 Education

- 5.2.7 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems

- 6.1.2 VMware

- 6.1.3 Dell EMC

- 6.1.4 HPE

- 6.1.5 Juniper Networks

- 6.1.6 Fortinet

- 6.1.7 Huawei Technologies

- 6.1.8 Barracuda Networks

- 6.1.9 Versa Networks

- 6.1.10 Arista Networks