|

市場調查報告書

商品編碼

1408098

分離式系統:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Split Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

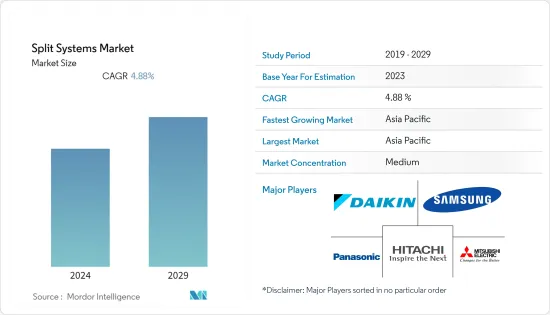

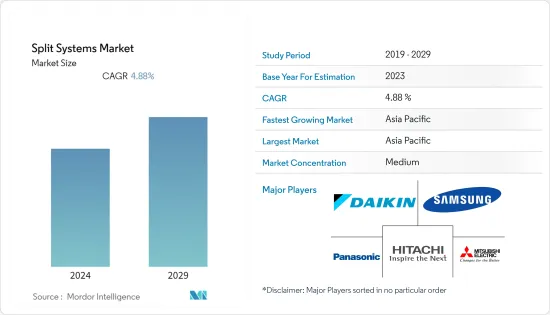

上年度分離式系統市值為 990.6 億美元,預計在預測期內將成長 4.88%。

這是由於對節能和環保產品的需求以及住宅和商業應用中擴大採用空調所致。充足的供暖和製冷對於人類健康和生產力至關重要,並且由於都市化、經濟成長和各地區極端天氣事件促使製冷需求增加,因此在全球範圍內變得越來越重要。

主要亮點

- 全球工業化、都市化快速推進是推動市場成長的關鍵因素之一。隨著世界各地建造越來越多的商業建築和住宅,對暖氣和冷氣系統、通風控制、濕度控制、空氣過濾等分離式系統的需求不斷成長。例如,根據牛津經濟研究院《2030年全球建築業預測》,到2020年的十年間,全球建築市場預計將成長4.5兆美元,達到15.2兆美元。

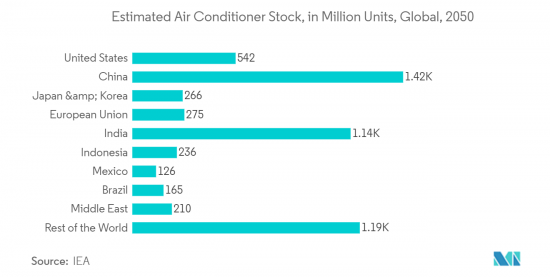

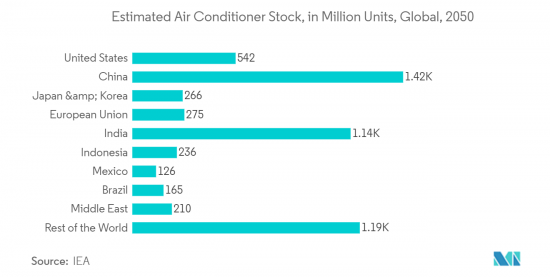

- 根據中央情報局世界概況,世界人口約 70 億,其中一半以上生活在亞洲,四分之一居住在非洲。此外,世界上人口最多的五個國家中有三個位於亞洲。畢竟亞洲也是人口成長率最高的地區。隨著都市區的不斷成長,對空調的需求不斷增加,給世界能源系統帶來了壓力。交流冷卻系統使氣候炎熱潮濕的城市和建築環境變得更加舒適。根據國際能源總署 (IEA) 的數據,到 2050 年,全球建築物中安裝的空調機組數量預計將達到 56 億台。

- 住宅對分離式系統的需求也在不斷成長,因為它們具有能源效率、成本效益和易於操作等各種優勢,使其成為市場上普及的其他空調的合適替代品。除此之外,製造工廠的增加、擴張和投資也為進入市場的多種機會鋪平了道路。

- 分離式空調的高昂初始成本可能會對需求構成課題,因為一些客戶可能對購買或升級系統猶豫不決。對於預算緊張且可能無法承擔新系統初期成本的住宅和小型企業主來說尤其如此。其次,分離式系統成本較高,投資回收期可能較長。這意味著新系統的能源效率節省的成本可能在幾年內都無法抵消初始投資。預計這將對市場成長構成課題。

- 然而,不斷上漲的能源成本對業主和租戶的損益表產生直接影響。此外,烏克蘭的入侵也影響了全球能源市場,尤其是歐洲,由於歐洲國家這些能源來源稀缺,俄羅斯石油和天然氣仍然是歐洲的主要市場。然而,由於俄羅斯入侵烏克蘭,歐盟決定將俄羅斯石油進口量削減三分之二,導致能源價格急劇上升。因此,最近對節能空調系統的需求顯著增加。

分離式系統市場趨勢

住宅領域將成為最大的使用領域

- 多年來,暖氣和冷氣系統一直是住宅空間中最重要的設備之一。隨著技術的發展,傳統的暖氣和冷氣解決方案已被暖通空調和分離系統等先進技術所取代。因此,預計該產業在預測期內將繼續在所研究的市場格局中佔據顯著地位。

- 由於全球平均氣溫上升和全球氣候條件變化,預計在預測期內,對空間供暖和製冷解決方案的需求將出現強勁成長。例如,根據美國太空總署戈達德太空研究所 (GISS) 科學家的研究,自 1880 年以來,全球平均氣溫至少上升了 1.1 攝氏度(1.9 華氏度)。此外,根據威斯康辛州自然資源部的預測,到 2050 年,全球氣溫預計將上升約 1.5 攝氏度(2.7 華氏度)。

- 根據國際能源總署(IEA)統計,目前全球整體約有20億台空調在運作,其中住宅設備佔近70%。因此,為了響應2050 年淨零排放(NZE) 等全球計劃,該行業對節能解決方案的需求不斷增加,而這些技術將幫助消費者節省能源。這正在推動無管道空調解決方案和分離式空調解決方案的機會。系統市場。

- 該市場的成長前景良好,特別是考慮到中國、印度和印尼等人口稠密地區的經濟成長正在提高消費者購買舒適解決方案的能力。例如,根據萊坊 (Knight Frank) 的數據,2022 年印度各地的住宅市場將推出約 328,000住宅。根據國家產業資訊中心的數據,2022 年馬來西亞推出了 54,118 套新住宅,超過 2021 年記錄的 43,860 套新房屋。

- 同樣,根據美國人口普查局的數據,2022 年美國私人住宅額達到 8,991 億美元,高於 2018 年的 5,575.6 億美元。因此,生活空間的擴大將在預測期內為研究市場帶來機會。

- IEA表示,炎熱國家的很大一部分家庭尚未購買空調解決方案,全球氣溫上升、人口密度和經濟成長將鼓勵消費者採用此類解決方案,預計這也將推動研究市場機會。 IEA預計,到2050年,全球約三分之二的家庭將擁有空調,而中國、印度、印尼等人口眾多的國家預計將佔總數的一半左右。預計這些因素將推動市場成長。

亞太地區預計將佔據主要市場佔有率

- 由於收入水準的提高以及對高效供暖和製冷的需求不斷增加,過去 20 年來,中華人民共和國的空間製冷能源消耗顯著成長。消費能力的增強、中產階級人口的成長以及住宅和商業建築數量的增加等因素促使分離式系統的採用越來越多。此外,該地區住宅和商業建築的投資預計將推動市場需求。

- 由於消費者對能源效率和氣候變遷問題的認知不斷提高,以及政府努力推廣永續供暖和製冷普及,預計該市場將進一步成長。中國最近於2019年6月通過了生態製冷行動計畫(GCAP),其中包括冷凍產品的新能源效率和市場普及目標,鼓勵提高冷氣效率和採用環保冷媒,預計將得到推廣。

- 此外,全球冷凍行動計畫(GCAP)為中國冷凍產業設定了具體目標。至2030年,主要冷凍產品能源效率比2022年提高至少25%,環保高效製冷產品市場佔有率提高40%,大型公共建築能源效率比2022年提高30% 。這些進步加起來每年將節省 4000 億千瓦時的電力。此外,隨著GCAP的實施,空調維修計劃將涵蓋國家生態文明建設專款津貼計畫。這些舉措預計將進一步推動市場。

- 在日本,日益嚴重的污染加劇了人們對綠建築的關注,為市場參與企業擴大在日本市場的影響力創造了許多投資機會。據國際能源總署 (IEA) 稱,日本最近修訂了建築法規,要求到 2030 年所有新建建築實現零能耗,到 2050 年所有現有建築實現零能耗。這些旨在促進節能建築的法規預計將提振市場需求。

- 印度對分離式空調的需求每年都在穩定成長。這一成長的背後是中階人口的擴張、氣候變遷導致的氣溫上升以及住宅和商業設施數量的增加,促使對室內空調(RAC)的需求增加。

- 根據國際能源總署最近的政策審查,韓國政府的生態新政如果得到有效實施,將加速韓國向清潔能源轉型,並將其定位為未來能源產業的領導者。此外,韓國承諾在2050年實現碳中和,反映了其減少對石化燃料和能源進口依賴的決心。這些政府措施預計將增加對節能冷卻解決方案的需求並刺激市場。

- 空間冷凍是全球成長最快的建築能源消耗,尤其是在東南亞。近年來,該地區用於製冷的用電量顯著增加。根據國際能源總署 (IEA) 的報告,目前東南亞只有 15% 的家庭擁有空調,這表明重點地區的擴張潛力巨大。隨著收入的增加、能源供應的改善和富裕程度的擴大,東南亞更多人口將越來越能夠負擔得起分離式空調,從而創造巨大的市場需求。

分離系統產業概況

分離式系統市場適度分散,主要參與企業包括大金工業有限公司、三菱電機公司、日立有限公司、三星電子和松下公司。市場參與企業正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

- 2023年5月-三菱電機宣布將投資約189.1億印度盧比(2.27億美元)在印度泰米爾納德邦建立新廠。該公司已在泰米爾納德邦政府推動的指導下簽署了合作備忘錄。該工廠將採取多項措施實現碳中和,包括透過增加隔熱層以及使用高效空調和熱水系統來減少二氧化碳排放。

- 2023 年 2 月 - 三星宣布推出 WindFreeAcs 系列,以滿足消費者對功能強大的空調的需求,該空調兼具快速製冷、節能、清潔空氣、便利和美觀。 WindFree技術旨在消除冷固態空氣,透過23,000個微孔以0.15m/s的速度分散空氣,確保冷卻速度加快43%,強大的冷卻能力和完美的提供最大的舒適度。新產品包括36個型號的無風潤髮乳。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 新興國家可支配所得的增加促使對分離式系統的需求不斷成長

- 辦公室和智慧住宅的建設不斷增加,對分離系統的需求也預計會增加。

- 市場課題

- 高昂的安裝和維護成本預計將對市場產生負面影響

第6章市場區隔

- 依設備類型

- 迷你分裂

- 多分割

- 可變冷媒流量 (VRF)

- 其他

- 依用途

- 住宅

- 商務用

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 東歐洲

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Daikin Industries, Ltd.

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Carrier Corporation

- Electrolux AB

- Sharp Corporation

- Lennox International Inc.

- Midea Group Co., Ltd.

第8章供應商市場佔有率分析

第9章 分離系統出貨數量

第10章投資分析

第11章投資分析市場的未來

The split systems market was valued at USD 99.06 billion in the previous year and is expected to grow 4.88% during the forecast period, owing to the demand for energy-efficient and environmentally friendly products and the increasing adoption of air conditioning in residential and commercial applications. Adequate heating and cooling are essential to human health and productivity and are becoming more important globally due to urbanization, the growing economy, and the increasing need for cooling due to extreme weather conditions in different regions.

Key Highlights

- The rapid rise in industrialization and urbanization around the world is one of the primary factors driving market growth. The significant increase in the construction of different commercial and residential buildings worldwide is creating considerable demand for split systems such as space heating and cooling systems, ventilation control, humidity control, as well as air filtration. For instance, as per the Oxford Economics report on A Global Forecast for Construction to 2030, the global construction market is expected to grow by USD 4.5 trillion over the decade to 2020 to reach USD 15.2 trillion.

- According to the CIA - World Fact Book, the global population amounts to around 7 billion people, and more than half of the global population is living in Asia, while one-quarter of the global population resides in Africa. Moreover, three out of five of the most populous countries in the world are located in Asia. Ultimately, the highest population growth rate is also found there. As urban populations continue to grow, the increased demand for ACs has put a strain on global energy systems. AC cooling systems have made cities and built environments more hospitable in otherwise hot and humid climates. According to the International Energy Agency (IEA), the number of AC units in buildings across the world is projected to hit 5.6 billion by 2050.

- The residential demand for split systems has also been gaining momentum as there are various benefits like energy efficiency, cost-effectiveness, and quite operations, enclosed with the split systems that make it a suitable alternative for customers in regard to the other air conditioners prevailing in the market. In addition to this, the growing number of manufacturing plants, expansion, and investments have also been paving the way for multiple opportunities to enter the market.

- The high initial cost of split air conditioners can be challenging for its demand because it may deter some customers from purchasing or upgrading their systems. This is especially true for homeowners or small business owners who may have limited budgets and may not be able to afford the upfront costs of a new system. Secondly, the high cost of split systems can result in longer payback periods for customers. This means that the cost savings that result from the improved energy efficiency of the new system may not offset the initial investment for several years. This is expected to challenge the market's growth.

- However, rising energy costs directly impact the profit/loss statements of building owners and tenants. Moreover, the invasion of Ukraine affected energy markets around the world, particularly in Europe, which remains the primary market for Russian oil and gas owing to the lack of these energy sources in European countries. However, as a consequence of Russia's invasion of Ukraine, the European Union decided to cut Russian oil imports by two-thirds, resulting in a surge in energy prices. Consequently, the demand for energy-efficient air conditioning systems has recently increased significantly.

Split Systems Market Trends

Residential Sector to be the Largest Application Segment

- Heating and cooling systems have been among the crucial facilities within residential spaces for years. With technology evolving, the traditional form of heating and cooling solutions has been replaced by advanced technologies such as HVAC and split systems. As a result, the segment is anticipated to continue to hold a notable presence in the studied market's context during the forecast period.

- With the global average temperature increasing and climatic conditions changing globally, the demand for space cooling and heating solutions is anticipated to grow at a significant rate during the forecast period. For instance, according to research by scientists at NASA's Goddard Institute for Space Studies (GISS), since 18,80, the earth's average global temperature has increased by at least 1.1° Celsius (1.9° Fahrenheit). Furthermore, according to the projections by the Wisconsin Department of Natural Resources, by 2050, global temperature is anticipated to increase by about 1.5 degrees Celsius (2.7° degrees Fahrenheit).

- According to the International Energy Agency (IEA), currently, about 2 billion air conditioning units are in operation globally, wherein residential operational units account for nearly 70% of the total, making space cooling one of the leading driving factors of rising electricity demand in buildings. Hence, the sector is witnessing a rising demand for energy-efficient solutions to stay on track with global initiatives such as the Net Zero Emissions by 2050 (NZE), which in turn is driving opportunities in the ductless air conditioning solutions and split systems market as these technologies helps the consumers in saving energy.

- The growing global population is driving the demand for residential units, which is also creating a favorable outlook for the studied market's growth, especially considering the economic growth of highly populous regions, including China, India, Indonesia, etc., which is enhancing the capability of consumers to spend on comfort solutions. For instance, according to Knight Frank, in 2022, about 328 thousand housing units were launched in the residential housing market across India. According to the National Property Information Centre, in 2022, new launches for residential property stood at 54,118 units in Malaysia, higher than the 43,860 units recorded in 2021.

- Similarly, according to the U.S. Census Bureau, in 2022, the value of private home construction in the United States reached USD 899.1 billion, from USD 557.56 billion in 2018. Hence, the expansion of residential spaces will drive opportunities in the studied market during the forecast period.

- According to IEA, a significant portion of homes in hot countries have not yet purchased air conditioning solutions, which is also anticipated to drive opportunities in the studied market as the increasing global temperature, population density, and economic growth will drive consumers to adopt such solutions. IEA estimates around 2/3 of the world's households will have an air conditioner by 2050, with countries with a higher population, including China, India, and Indonesia, anticipated to account for about half of the total number. These factors are expected to aid the market's growth.

Asia-Pacific is Expected to Hold Significant Market Share

- The People's Republic of China has experienced significant growth in space-cooling energy consumption over the past two decades due to rising income levels and a growing need for efficient heating and cooling. Factors such as increased spending power, a growing middle-class population, and a rise in the number of residential and commercial buildings have all contributed to the increased adoption of split systems. Furthermore, the region's investments in residential and commercial construction are expected to drive market demand.

- The market is anticipated to experience further growth due to the increasing consumer consciousness regarding energy efficiency, climate change issues, and government initiatives aimed at promoting sustainable heating and cooling solutions. China's recent introduction of the Green Cooling Action Plan (GCAP) in June 2019, which includes new energy efficiency and market penetration objectives for cooling products, is expected to drive improvements in cooling efficiency and the adoption of eco-friendly refrigerants.

- Moreover, the Global Cooling Action Plan (GCAP) has established specific objectives for China's cooling industry. By 2030, there should be a minimum 25% increase in energy efficiency for major cooling products, a 40% rise in the market share of environmentally friendly and efficient cooling products, and a 30% improvement in energy efficiency for large public buildings compared to 2022 levels. These advancements will result in a combined annual electricity savings of 400 billion kWh. Additionally, the implementation of the GCAP has led to the inclusion of cooling retrofit projects in China's Special Fund for Ecological Civilization Construction subsidy program. Such initiatives are expected to drive the market further.

- The escalating pollution levels in Japan have prompted the nation to intensify its emphasis on environmentally friendly buildings, thereby presenting numerous investment opportunities for industry participants to expand their presence in the Japanese market. As per the International Energy Agency (IEA), Japan has recently revised its building regulations, mandating zero-energy performance for all new constructions by 2030 and for all existing structures by 2050. These regulations aimed at promoting energy-efficient buildings are expected to bolster market demand.

- The demand for Split Air Conditioners in India is steadily rising each year. This growth can be attributed to the expanding middle-class population, rising temperatures due to climate change, and increasing residential and commercial structures, resulting in a higher demand for Room Air Conditioners (RAC).

- The International Energy Agency's recent policy review suggests that the Korean government's Green New Deal, if effectively executed, will expedite Korea's transition to clean energy and position the nation as a leader in future energy industries. Additionally, Korea's commitment to achieving carbon neutrality by 2050 reflects its determination to reduce reliance on fossil fuels and energy imports. Such government initiatives are expected to drive the need for energy-efficient cooling solutions, thereby driving the market.

- Space cooling is the most rapidly expanding energy consumption in buildings globally, particularly in Southeast Asia. In recent years, there has been substantial growth in the region's electricity usage for cooling purposes. The International Energy Agency (IEA) reports that merely 15% of households in Southeast Asia presently utilize air conditioning, indicating substantial potential for expansion in crucial areas. As incomes rise, energy accessibility improves, and affluence spreads, the demand for Split Acs will become increasingly affordable for a larger population in Southeast Asia, thereby creating a significant market demand.

Split Systems Industry Overview

The Split Systems Market is moderately fragmented, with the presence of major players like Daikin Industries, Ltd., Mitsubishi Electric Corporation, Hitachi, Ltd., Samsung Electronics Co., Ltd., and Panasonic Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2023 - Mitsubishi Electric announced an investment of about INR 1,891 crore (USD 227 million) into setting up a new factory in Tamil Nadu, India. The company has signed a memorandum of understanding with TN's guidance, which the State Government promoted. The plant would undertake several initiatives for carbon neutrality, including limiting CO2 emissions by increasing thermal insulation and using highly effective air conditioning and hot water systems.

- February 2023 - Samsung announced introducing the WindFreeAcs lineup to address consumers' need for a powerful air conditioner that combines fast cooling, energy efficiency, clean air, and convenience with great aesthetics effortlessly. WindFreetechnology is designed to eliminate cold solid air and distributes air at a speed of 0.15 m/s through 23,000 micro-holes, promising 43% faster cooling, providing powerful cooling and perfect comfort. The new product range includes 36 WindFreeair conditioner models.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising disposable income in developing countries is contributing to the growth in the demand for Split Systems

- 5.1.2 Increase in construction of office and smart homes is expected to increase the demand for Split Systems

- 5.2 Market Challenges

- 5.2.1 High installation cost and maintenance cost is expected to negatively affect the market

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Mini-split

- 6.1.2 Multi-split

- 6.1.3 Variable Refrigerant Flow (VRF)

- 6.1.4 Others

- 6.2 By Application

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Eastern Europe

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries, Ltd.

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Hitachi, Ltd.

- 7.1.4 Samsung Electronics Co., Ltd.

- 7.1.5 Panasonic Corporation

- 7.1.6 Carrier Corporation

- 7.1.7 Electrolux AB

- 7.1.8 Sharp Corporation

- 7.1.9 Lennox International Inc.

- 7.1.10 Midea Group Co., Ltd.