|

市場調查報告書

商品編碼

1408089

空氣調節機(AHU):市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Air Handling Units (AHU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

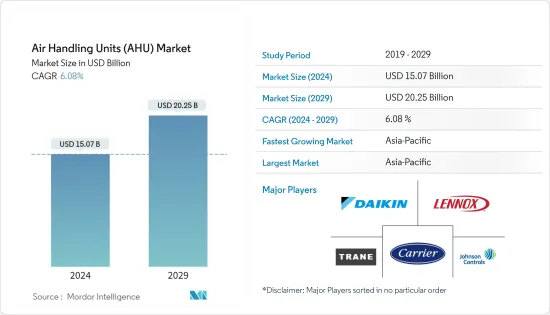

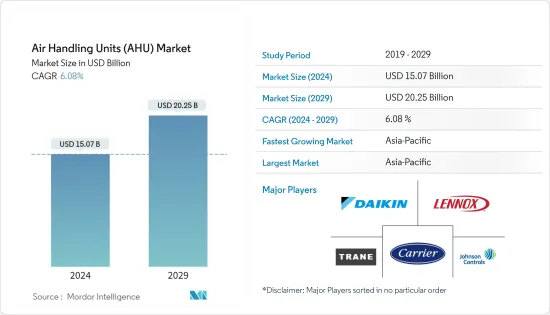

空氣調節機(AHU)市場規模預計2024年為150.7億美元,預計2029年將達到202.5億美元,預測期間(2024-2029年)複合年成長率為6.08%,預計還會成長。

主要亮點

- 空氣調節機(AHU) 通常用於有很多人參觀的大型設施,例如購物中心。這是因為許多人參觀的設施對二氧化碳排放和空氣淨化有嚴格的規定。大型設施需要將足夠量的空氣引入建築物並使用多個鼓風機進行循環。空氣調節機(AHU) 將室外空氣引入室內,從而顯著減少所需鼓風機的數量。

- 全球快速工業化和都市化是推動市場成長的主要因素之一。隨著世界各地各種商業建築和住宅的建設,作為空間供暖和製冷系統的空氣調節機(AHU)的需求顯著增加。例如,根據 CIArb 的數據,到 2030 年,全球整體建築產值預計將成長約 85%,達到 15.5 兆美元。

- 根據歐盟委員會統計,歐盟地區的建築物約佔溫室氣體排放的36%和能源消費量的40%,主要是因為建造、使用、重建和拆除。在這些建築物中,暖通空調系統佔能源使用的很大一部分。因此,對包括空氣調節機(AHU)在內的節能暖通空調系統的需求預計在預測期內將會增加。

- 此外,包括空氣空氣調節機(AHU)在內的暖通空調設備市場高度依賴建築業、政府法規以及地方政府推動基礎設施和工業及製造業發展的新舉措等行業。商業和工業部門成長的任何波動勢必對該設備的需求產生直接影響。

- 此外,北美和歐洲地區地緣政治問題和近期經濟動盪等宏觀經濟因素預計也會影響所研究市場的成長。例如,俄羅斯和烏克蘭之間的戰爭造成的能源價格上漲預計將減緩歐洲對空氣處理機組的需求,因為這些設備的能源消耗很高。

空氣調節機(AHU)市場趨勢

商業板塊佔有較大佔有率

- 空氣調節機(AHU) 用於所有商業設施,如餐廳、資料中心、醫院、學校、飯店和辦公大樓,為居住者提供舒適的環境。例如,空氣調節機(AHU)用於大中型工業和商業建築中,以調節和輸送整個建築的新鮮空氣。 AHU 是大型 HVAC 系統的組件,可引入外部新鮮空氣,對其進行清潔和調節,並根據需要加熱或冷卻。

- 空氣調節機(AHU) 具有多種尺寸和功能,可用於單一空間或整棟建築物。空氣調節機(AHU)通常安裝在商業建築的地下室或屋頂。空氣調節機(AHU) 可分配給建築物的特定區域,以根據需要提供暖氣或冷氣。

- 對環保和節能暖通空調系統不斷成長的需求正在推動這一領域的擴張。對節能且經濟高效的暖通空調解決方案的需求正在推動對空氣處理系統的需求不斷成長。與其他類型的 HVAC 系統相比,空氣調節機(AHU) 具有多種優勢,包括更高的能源效率、更低的運作成本和更好的室內空氣品質。

- 商業部門消耗了整個北美能源消耗的大部分。據環境服務公司Carbon Reform稱,美國商業區包括約600萬棟建築,總占地面積達970億平方英尺。此外,所有商業房地產 90% 以上的占地面積使用某種形式的機械式暖氣和冷氣系統。此外,不斷擴大的建築業預計將推動市場發展,並促進商業建築的整體能源需求。

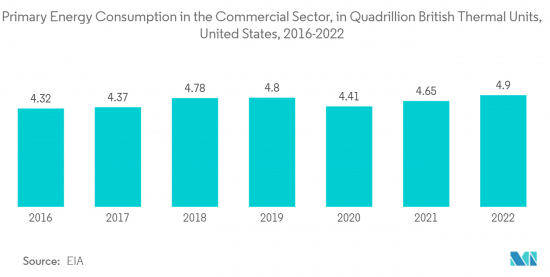

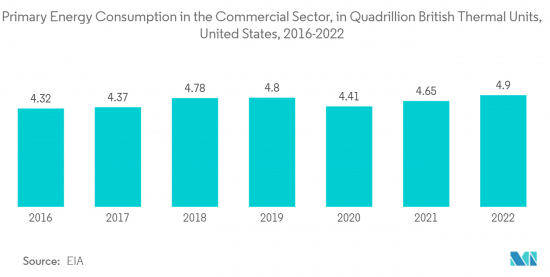

- 根據 EIA 的數據,2022 年,美國商業部門消耗了約 4.9 兆英國熱單位的初級能源。根據 EIA 的數據,2022 年美國商業部門消耗了約 4.9 兆英國熱量單位的初級能源。因此,預計在預測期內,能源消耗的增加將推動該國對節能空氣處理機組的需求。

亞太地區預計將錄得最快成長

- 預計在預測期內,亞太地區的空氣調節機(AHU)市場將成長最快。這主要是由於基礎設施和建築計劃投資的增加,以及該地區對節能技術的需求不斷成長。由於智慧型空調機組等技術的開拓,預計該市場將在預測期內成長。

- 印度和中國等國家正迅速崛起為亞太地區的藥品製造地。在製藥業,空氣調節機(AHU) 主要用於維持藥品和其他物品的調節氣氛,特別是具有高衛生標準以防止污染。由於麗水單硝基苯製造廠和大士生物醫學園新疫苗生產設施等新化學和製藥設施的開拓,預計該地區的空氣處理系統市場將成長。

- 亞洲工業部門的快速成長是其佔最大佔有率的主要原因之一。此外,該地區開發中國家(包括印度、日本、中國和韓國)的都市化和商業化程度不斷提高,預計將增加對空氣處理系統的需求。此外,可支配收入的增加和生活方式的改變也推動了對舒適生活空間的需求,這是決定市場方向的關鍵因素。

- 亞太地區對於世界實現淨零排放和向綠色能源轉型的努力至關重要。隨著許多政府制定國家和區域計劃和計劃來促進節能工作,「綠色」趨勢正在整個亞太地區爆發。政府措施為暖通空調和建築自動化系統綠色能源效率領域的工程師提供了廣闊的前景。

- 此外,環境立法在亞太地區普及,例如澳洲的最低能源績效標準(MEPS)、中國的綠色建築評估標籤(GBEL)以及印度的能源效率標準和標籤計畫(BEE標籤計畫) 。因此,該領域的暖通空調產業正在轉向環保空調機組和全球暖化潛勢 (GWP) 較低的節能技術。

空氣調節機(AHU) 產業概覽

除了擁有已建立的分銷網路外,AHU市場還擁有許多佔據主導市場佔有率的大型供應商,這增加了競爭對手之間的對抗關係。然而,不斷成長的需求鼓勵了新進入者,市場已轉向碎片化階段。許多製造商都將能源效率作為他們的主要關注點之一。此外,市場上的主要供應商都參與併購活動和合作夥伴關係,以獲得更高的普及和市場佔有率。主要市場參與者包括DAIKIN INDUSTRIES、開利公司、特靈公司和江森自控。

2023 年 5 月,Colmac Coil Manufacturing, Inc. 推出了最新的 HygenAir A+H 衛生空氣處理器。據該公司稱,該空氣處理器旨在改善衛生關鍵的加工室環境內的衛生狀況,幫助食品加工商提高工人安全並保持高質量,以幫助美國農業自訂滿足該部的嚴格要求。

2023年5月,中央空調先進空氣處理系統供應商Edgetech Air Systems Pvt. Ltd.在印度Central Vista計劃安裝了智慧空氣處理機組。據該公司稱,安裝的空氣處理機將配備先進的分析以及監控和分析系統,以提供即時運作智慧並有助於提高能源效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 人口成長與都市化帶動市場需求

- 對節能暖通空調系統的需求增加

- 市場挑戰

- 取決於宏觀經濟經濟狀況

- 競爭加劇導致報酬率受到限制

第6章市場區隔

- 按類型

- 包裹

- 模組

- 自訂

- 其他類型

- 按最終用戶

- 住宅

- 商業的

- 產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Daikin Industries Ltd.

- Carrier Corporation

- TRANE Inc.(Trane Technologies PLC)

- Lennox International Inc.

- Johnson Controls International PLC

- Systemair AB

- TROX GmbH

- Swegon Group AB(Investment AB Latour)

- Hitachi Ltd

- Blue Star Limited

第8章投資分析

第9章市場的未來

The Air Handling Units Market size is estimated at USD 15.07 billion in 2024, and is expected to reach USD 20.25 billion by 2029, growing at a CAGR of 6.08% during the forecast period (2024-2029).

Key Highlights

- Air handling units (AHUs) are commonly used in large facilities visited by many people, such as shopping malls, as such facilities frequented by people are subjected to strict regulations regarding the exhaustion of carbon dioxide and air cleanliness. A large facility must let adequate amounts of air into the building and use multiple blower fans and other equipment to circulate the air. As the air handling units deliver outside air into the rooms, they can significantly reduce the number of required blower fans.

- The rapid rise in industrialization and urbanization around the world is one of the primary factors driving market growth. The significant increase in the construction of different commercial and residential buildings worldwide creates considerable demand for Air Handling Units as a space cooling and heating system. For instance, as per CIArb, the volume of construction output is anticipated to grow by about 85 percent globally to USD 15.5 trillion by 2030.

- According to the European Commission, buildings in the EU region are responsible for around 36 percent of GHG emissions and 40 percent of energy consumption, mainly from construction, usage, renovation, and demolition. HVAC systems account for a considerable share of energy usage in these buildings. Hence, the demand for energy-efficient HVAC systems, including air handling units, is anticipated to gain traction during the forecast period.

- Furthermore, the HVAC equipment market, including air handler units, is highly dependent on sectors such as construction, government regulations, and new initiatives by the governments of various regions to boost the infrastructure and industrial and manufacturing sectors. Any fluctuations in the growth in the commercial and industrial sectors are bound to impact the demand for this equipment directly.

- Additionally, macroeconomic factors such as geo-political issues and the recent economic instability witnessed in the North American and European regions are also anticipated to influence the studied market's growth. For instance, the growing energy prices, owing to the Russia-Ukraine war, are anticipated to slow down the demand for air handling units in Europe as energy consumption by these devices is higher.

Air Handling Units (AHU) Market Trends

Commercial Segment to Occupy a Significant Share

- Air Handling Units are used in any commercial structure, such as restaurants, data centers, hospitals, schools, hotels, and office buildings, to provide inhabitants with a comfortable environment. For instance, an air handling unit (AHU) is used in medium- and large-sized industrial or commercial buildings to condition and transport fresh air throughout the structure. AHUs are a component of the bigger HVAC system; they draw fresh outdoor air in, clean and condition it, and then heat or cool it as necessary.

- Air handler units can be utilized for either a single space or an entire building due to their wide range of size and functionality. They are frequently located in the basement or on the roof of commercial-sized buildings. The air handler unit can then be allocated to particular regions of a building to deliver heating or cooling as needed.

- The increasing demand for environmentally friendly and energy-efficient HVAC systems is credited with driving the segment's expansion. The need for energy-efficient and cost-effective HVAC solutions is driving the increased demand for air handling systems. Air handling units provide several advantages over other types of HVAC systems, including higher energy efficiency, cheaper running costs, and better indoor air quality.

- The commercial sector consumes a large portion of North America's overall energy consumption. There are approximately 6 million buildings in the business sector of the United States, totaling 97 billion square feet of floor space, according to the environmental services firm Carbon Reform. Additionally, mechanical heating and cooling systems are used in some capacity on more than 90 percent of the total commercial floor space. Additionally, it is anticipated that the expanding construction sector will drive the market and contribute to the overall energy requirements for commercial buildings.

- Considering a large commercial sector, the sector is also among the leading consumer of electricity in the United States; according to EIA, in 2022, about 4.9 quadrillion British thermal units of primary energy was consumed by the commercial sector in the United States. Hence, the growing energy consumption is anticipated to drive the demand for energy-efficient air handling units in the country during the forecast period.

Asia-Pacific is Expected to Register the Fastest Growth

- The air handling unit (AHU) market is anticipated to grow fastest in the Asia-Pacific region during the projected period, primarily due to the expanding infrastructure and building project investments and increased demand for energy-efficient technologies in the area. This market is anticipated to rise throughout the projected period due to technological developments such as intelligent AHUs.

- Countries like India and China are fast emerging as the pharmaceutical manufacturing hub in the Asia Pacific region. In the pharmaceutical business, air handling units are primarily used to maintain a regulated atmosphere for medicines and other items with high sanitation standards to prevent contamination, among other things. Due to the development of new chemical and pharmaceutical facilities like the Yeosu Mononitrobenzene Manufacturing Plant and Tuas Biomedical Park New Vaccine Production Facility, the market for air handling systems is anticipated to grow in the region.

- The fast-increasing industrial sector in Asia is one of the primary causes responsible for the most significant share. It is also anticipated that growing urbanization and commercialization in this region's developing nations, including India, Japan, China, and South Korea, will raise demand for air handling systems. Additionally, the rising disposable income and changing lifestyle also drive demand for pleasant living spaces, which is a significant element driving the market's direction.

- The Asia-Pacific region is crucial to global efforts to attain net zero and a transition to green energy. The "green" trend is exploding throughout Asia-Pacific due to numerous governments establishing national or regional initiatives and programs to promote energy conservation efforts. The government's initiatives provide enormous prospects for technologists in the green and energy efficiency sectors of HVAC and building automation systems.

- Moreover, environmental laws are becoming more prevalent in Asia-Pacific, including the Australian Minimum Energy Performance Standards (MEPS), China's Green Building Evaluation Label (GBEL), and India's Bureau of Energy Efficiency Standards and Labeling Program (BEE Labeling Program), among others. As a result, the HVAC industry in this area is turning toward environmentally friendly AHUs with low Global Warming Potential (GWP) and energy-efficient technology.

Air Handling Units (AHU) Industry Overview

The competitive rivalry in the AHU market is growing, as the market comprises many large vendors that command a prominent market share besides having access to well-established distribution networks. However, the growing demand is encouraging new players to enter the market, shifting its landscape towards a fragmented stage. Many manufacturers are focusing on energy efficiency as one of the key concerns. Moreover, major vendors in the market studied are involved in both M&A activities and partnerships to gain higher penetration and market share. Some key market players include Daikin Industries, Carrier Corporation, TRANE Inc., and Johnson Controls, among others.

In May 2023, Colmac Coil Manufacturing, Inc. launched its latest HygenAir A+H Hygienic Air Handler. According to the company, the air handler is designed to improve hygiene inside processing room environments wherein sanitation is critical and is custom-engineered to help food processors increase worker safety and meet the strict requirements of the USDA by maintaining high quality.

In May 2023, Edgetech Air Systems Pvt. Ltd., a provider of advanced air handling systems used in central air conditioning, installed Smart Air Handling Units in India's Central Vista Project. According to the company, the installed air handlers are equipped with advanced analytics and monitoring and analytics systems to provide real-time operational intelligence and contribute to energy efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Population and Urbanization is Driving Market Demand

- 5.1.2 Increasing Demand for Energy-efficient HVAC Systems

- 5.2 Market Challenges

- 5.2.1 Dependence on Macroeconomic Conditions

- 5.2.2 Growing Competition to Limit Margins

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Packaged

- 6.1.2 Modular

- 6.1.3 Custom

- 6.1.4 Other Types

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Ltd.

- 7.1.2 Carrier Corporation

- 7.1.3 TRANE Inc. (Trane Technologies PLC)

- 7.1.4 Lennox International Inc.

- 7.1.5 Johnson Controls International PLC

- 7.1.6 Systemair AB

- 7.1.7 TROX GmbH

- 7.1.8 Swegon Group AB (Investment AB Latour)

- 7.1.9 Hitachi Ltd

- 7.1.10 Blue Star Limited