|

市場調查報告書

商品編碼

1408016

智慧貨架 -市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Smart Shelf - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

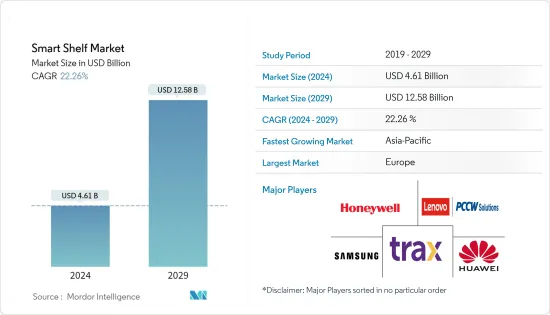

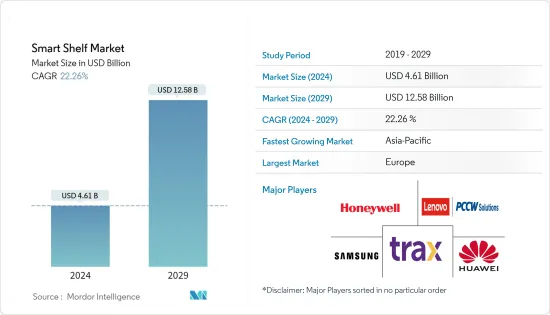

智慧貨架市場規模預計到2024年為46.1億美元,預計到2029年將達到125.8億美元,在預測期內(2024-2029年)複合年成長率為22.26%。

智慧貨架是零售商店中用於追蹤庫存的電子連接貨架。智慧貨架結合數位顯示器、RFID 標籤和感測器來提供詳細的產品資訊、交叉銷售建議和行銷。它還為零售商提供了有關客戶購物模式和偏好的寶貴見解。

主要亮點

- 推動智慧貨架市場的關鍵原因是零售商改善庫存管理以提供更智慧的補貨選項和即時參與,以及零售商使用智慧和自動化技術為客戶提供更好的購物體驗。

- 由於都市化和消費者購買力的增強,對天然材料和優質產品不斷成長的需求正在推動市場開拓。零售自動化越來越普及,零售商強烈要求透過定價最佳化和即時產品投放來提高銷售效率。這些只是推動全球市場興奮的一些主要因素。

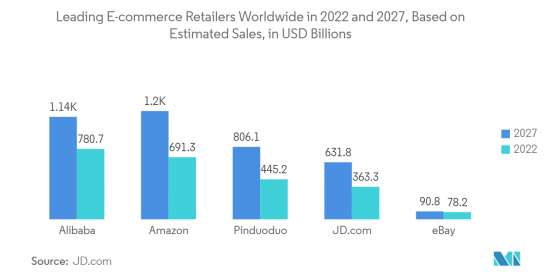

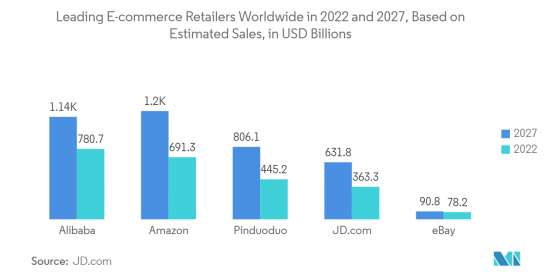

- 電商平台銷售額快速成長。這一發展為電子商務倉庫提供了有效庫存管理的新產品,為調查行業的蓬勃發展提供了機會。根據美國人口普查局數據,2022年7月至9月美國商業電商規模約2,660億美元,較上季成長3%。此外,零售額的增加也推動了該產業的發展。

- 當顧客離開商店時,RFID 追蹤不會停止。當顧客使用信用卡或簽帳金融卡或在結帳時掃描忠誠折扣卡時,零售商可以將購買歷史記錄與 RFID資料連結起來,並使用該資訊來追蹤各個顧客在商店中的行程。您可以繪製途徑或整個購物中心的地圖。這顯示RFID損害了用戶的隱私,是市場成長的障礙。

- COVID-19 之後,隨著零售商尋求利用先進技術的優勢來改善庫存管理和最佳化供應鏈,預計超市貨架市場的成長將加速。隨著電子商務的興起和消費行為的變化,零售商正在尋找創新的方法來改善店內體驗並提高客戶忠誠度。

智慧貨架市場趨勢

採用強化庫存管理預計將推動市場發展

- 隨著線上銷售的成長,企業必須以合理的價格投資於一系列始終如一的高品質產品。在這種新情況下,管理安全庫存和最佳化業務效率比以往任何時候都更加重要。因此,電子商務企業近年來增加了庫存管理軟體的使用。世界各地的零售企業都需要庫存管理系統來追蹤現有庫存並滿足不斷成長的需求。

- 零售公司正在尋找更好、更省時且更具成本效益的庫存管理方法。傳統的庫存管理系統既耗時又容易出現人為錯誤,為企業帶來時間和金錢的損失。零售商可以利用智慧貨架、自主庫存機器人和 RFID 等智慧庫存管理技術,最大限度地減少損耗並提高企業整體效率。

- 自主庫存機器人、智慧貨架和RFID等智慧庫存管理技術正在幫助零售商提高業務效率並減少損失。

- 此外,智慧庫存管理 (SIM) 的廣泛採用有助於最大限度地減少開支,並利用資料和軟體以最少的庫存滿足不斷成長的消費者需求,從而推動成長。這很有幫助。資料提供更深入的洞察來預測需求並提高效率,而自動化技術則同步多個銷售管道的庫存,以最大限度地提高收益。

歐洲佔主要市場佔有率

- 英國是全球智慧貨架市場最重要的地區之一。該地區的主要需求來源包括零售、物流和醫療保健行業。該地區的智慧貨架市場見證了多次重大合併,各個主要參與者都將其作為改善業務、接觸客戶和增加影響力以滿足各種應用要求的策略的一部分。

- 歐洲零售商,尤其是德國,是世界上最早採用電子貨架標籤(ESL)來降低營運成本的零售商之一,作為零售數位化的基礎。 2022年5月,德國數位解決方案供應商漢朔在同周舉辦的“EuroCIS 2022”展覽會上宣布並推出了全新物聯網平台“All Star”,該平台將用於實體店和零售店。- 歐洲砂漿零售,有望引領產業進入效率和盈利的新時代。

- 此外,2022年5月,快速發展的德國電子貨架標籤公司Digety與能源採集專家Nowi合作,開發了用於零售商店的太陽能電子貨架標籤。此次合作的主要目的是滿足不斷成長的市場需求,提供創新的解決方案,使零售商能夠最大限度地提高產量比率並更有效地管理整個供應鏈流程。Masu。

- 在全球智慧貨架市場中,義大利在歐洲國家中呈現出引人注目的成長速度。這主要是由於全部區域主要企業的存在以及電子貨架標籤的高普及。

- 隨著零售商擴大採用智慧貨架技術來改善業務和改善客戶體驗,法國智慧貨架市場正在快速成長。在法國,家樂福、歐尚和卡西諾等主要零售商已經在一些商店引入了智慧貨架,其他商店也可能會效仿。法國智慧貨架市場由多種因素推動,包括對即時庫存管理不斷成長的需求以及零售商最佳化業務和消除浪費的需求。

- 由於零售量的增加以及各連鎖超級市場擴大採用智慧貨架,歐洲對智慧貨架的需求預計將增加。

智慧貨架產業概況

由於多家全球公司的存在,智慧貨架市場競爭非常激烈。主要企業包括艾利丹尼森公司、AWM智慧貨架、華為技術有限公司、Dreamztech Solutions Inc.、E Ink Holdings Inc.、Focal Systems Inc.和Happiest Minds Technologies Limited。該市場的主要企業正在推出創新的新產品並建立夥伴關係和協作,以獲得競爭優勢。

- 2022 年 5 月 - 艾利丹尼森公司宣布兩項總計 4500 萬歐元的重大投資,用於擴大歐洲的製造能力並提高工廠效率,以滿足對標籤和包裝材料不斷成長的需求(4821 萬美元)。

- 2022 年 5 月 - 艾利丹尼森公司與物聯網先驅 Wiliot 合作,將物聯網擴展到新的水平,創造造福人類和地球的物聯網新時代。艾利丹尼森將利用其研發能力和規模來設計和製造第二代 Wiliot 標籤,這是一款配備藍牙的郵票大小的電腦。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 採用強化庫存管理

- 零售業對即時庫存資訊和庫存管理的需求不斷成長

- 市場挑戰

- 關於內建資料標籤的隱私問題

第6章市場區隔

- 按成分

- 硬體

- 物聯網感測器

- RFID 標籤和閱讀器

- 電子貨架標籤 (ESL)

- 相機

- 軟體

- 服務

- 硬體

- 按用途

- 庫存控制

- 價格管理

- 內容管理

- 貨架圖管理

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- Trax Technology Solutions

- Lenovo PCCW Solutions Limited

- Samsung Electronics Co. Ltd

- AWM Smart Shelf

- Happiest Minds Technologies Limited

- E Ink Holdings Inc.

- Avery Dennison Corporation

- Intel Corporation

- NXP Semiconductors NV

第8章投資分析

第9章市場的未來

The Smart Shelf Market size is estimated at USD 4.61 billion in 2024, and is expected to reach USD 12.58 billion by 2029, growing at a CAGR of 22.26% during the forecast period (2024-2029).

Smart shelves are electronically connected shelves used in retail outlets to track inventory. Smart shelves use a combination of digital displays, RFID tags, and sensors to provide detailed product information, cross-selling recommendations, and marketing. They also provide retailers with valuable insights into customer shopping patterns and preferences.

Key Highlights

- The primary reasons driving the Smart Shelf Market are the commission of improved inventory management by retail to make smarter restocking options and real-time involvement, as well as the use of intelligence and automation technologies by retail to provide a better shopping experience for customers.

- Rising demand for natural and premium products promotes market development due to increased urbanization and consumer buying power. Retail automation is growing more popular, and there is a strong demand among retailers for pricing optimization and enhanced operating effectiveness with real-time product placement. These are only a few of the major factors fueling the market's global rise.

- E-commerce platform sales are rapidly increasing; this development provides a chance for the researched industry to flourish by giving new items to e-commerce warehouses to manage effective inventory management. According to the US Census Bureau, commercial e-commerce in the United States was about USD 266 billion from July to September 2022, a 3% increase over the past quarter. Furthermore, rising retail sales is also propelling the industry.

- RFID tracking does not stop when a customer leaves the store. If customers pay with a credit or debit card or scan a loyalty discount card at checkout, retailers may link the purchases to the RFID data and use the information to map out individual customers' travels around the store, or even an entire shopping complex. This indicates it is harming the user's privacy, which acts as an obstacle to the growth of the market.

- Post-COVID-19, the mart shelves market is expected to grow faster as retailers seek to leverage advanced technologies' benefits to improve inventory management and optimize their supply chain. With the rise of e-commerce and changing consumer behavior, retailers are looking for innovative ways to enhance the in-store experience and increase customer loyalty.

Smart Shelf Market Trends

Adoption of Enhanced Inventory Management is Expected to Drive the Market

- With increasing online sales, it is important for businesses to invest in a robust pipeline of fairly priced, consistent, and high-quality goods. In this new context, managing safety inventories and optimizing operational efficiency is more important than ever. As a result, e-commerce businesses have increased their usage of inventory management software in recent years. Inventory management systems are required by retail companies all around the globe to assist them in keeping track of their existing inventory and meet escalating demand.

- Retailers are seeking better, more time-efficient, and cost-effective inventory management methods. Traditional inventory management systems are time-consuming and prone to human mistakes, both of which cost firms time and money. Retailers can minimize shrinkage and enhance overall company efficiency by using smart inventory management technologies, such as smart shelves, autonomous inventory robots, RFID, and so on.

- Smart inventory management methods, such as autonomous inventory robots, smart shelves, and RFID, are assisting retailers in becoming more operationally effective and reducing loss.

- Additionally, this increased adoption of Smart Inventory Management (SIM) helps to minimize expenses and drive growth by utilizing data and software to assist in meeting rising consumer demand with the least amount of inventory. Data provides greater insight, allowing to estimate demand and enhance efficiency, while automated technology synchronizes the inventory across numerous sales channels, maximizing revenues.

Europe Holds Significant Market Share

- The United Kingdom is one of the most significant regions in the global smart shelf market. The major sources of demand in the region include the retail, logistics, and healthcare sectors. The smart shelf market within the region is witnessing various several significant mergers, acquisitions, and investments by the key major players as part of its strategy to improve business and their presence to reach customers and meet their requirements for various applications.

- European retailers, especially Germany, are some of the world's earliest adopters of electronic shelf labels (ESLs) to reduce operations costs as a foundation for retail digitalization. In May 2022, at the week's EuroCIS 2022 trade show, the new IoT platform All-Star was released and introduced by the digital solutions provider Hanshow, with operations in Germany, which is expected to drive Europe's brickandmortar retail into a new era of efficiency and profitability.

- Also, in May 2022, Digety, a fast-growing electronic shelf label company from Germany, partnered with Nowi, which specializes in energy harvesting, to develop solar-powered electronic shelf labels used in retail stores. This collaboration primarily aims to meet the surging market demand to offer retail stores an innovative solution that would further enable them to maximize their yield and manage their overall supply chain processes more effectively.

- Italy has a significant growth rate in the global smart shelf market among the various European countries. It is mainly due to the presence of key major players as well as a higher penetration rate of electronic shelf labels within the entire region.

- The smart shelves market in France is growing rapidly as retailers increasingly adopt smart shelf technology to improve their operations and enhance the customer experience. In France, major retailers such as Carrefour, Auchan, and Casino have already implemented smart shelves in some of their stores, with others likely to follow suit. The market for smart shelves in France is being driven by several factors, including the increasing demand for real-time inventory management and the need for retailers to optimize their operations and reduce waste.

- The growing retail sales volume, along with the rising adoption of smart shelves in various chains of supermarkets, is expected to increase the demand for smart shelves in Europe.

Smart Shelf Industry Overview

The Smart Shelf Market is competitive in nature because of the presence of several global companies. Some of the key players are Avery Dennison Corporation, AWM Smart Shelf, Huawei Technologies Co. Ltd, Dreamztech Solutions Inc., E Ink Holdings Inc., Focal Systems Inc., Happiest Minds Technologies Limited, and many others. Key players in this market are introducing new innovative products and forming partnerships and collaborations to gain competitive advantages.

- May 2022 - Avery Dennison Corporation announced two major investments for expanding its manufacturing capacity and improving factory efficiency in Europe to meet the growing demand for its label and packaging materials, with an investment of EUR 45 million (USD 48.21 million).

- May 2022 - Avery Dennison Corporation and Wiliot, the Internet of Things pioneer, partnered to scale the IoT to the next level, creating a new era of IoT that benefits people and the planet. Avery Dennison would leverage its R&D capabilities and scale to design and manufacture second-generation Wiliot tags, which are stamp-sized computers powered by Bluetooth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Enhanced Inventory Management

- 5.1.2 Growing Demand for Real-Time Stock Information and Inventory Management in the Retail Sector

- 5.2 Market Challenges

- 5.2.1 Privacy Concerns Regarding Inbuilt Data Tags

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 IoT Sensors

- 6.1.1.2 RFID Tags and Readers

- 6.1.1.3 Electronic Shelf Lables (ESL)

- 6.1.1.4 Cameras

- 6.1.2 Software

- 6.1.3 Service

- 6.1.1 Hardware

- 6.2 By Application

- 6.2.1 Inventory Management

- 6.2.2 Pricing Management

- 6.2.3 Content Management

- 6.2.4 Planogram Management

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Rest of the Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.3.6 Rest of the Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of the Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 Trax Technology Solutions

- 7.1.4 Lenovo PCCW Solutions Limited

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 AWM Smart Shelf

- 7.1.7 Happiest Minds Technologies Limited

- 7.1.8 E Ink Holdings Inc.

- 7.1.9 Avery Dennison Corporation

- 7.1.10 Intel Corporation

- 7.1.11 NXP Semiconductors NV

![智慧貨架市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1342030.png)