|

市場調查報告書

商品編碼

1407949

再生碳纖維 -市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Recycled Carbon Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

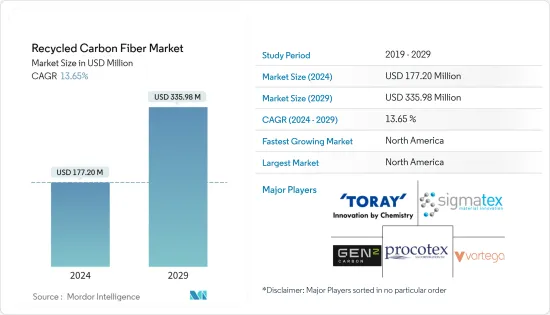

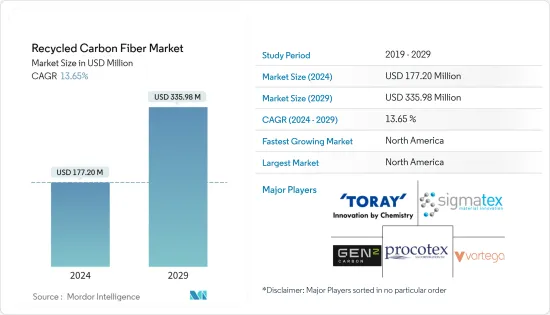

再生碳纖維市場規模預計到2024年為1.772億美元,預計到2029年將達到3.3598億美元,在預測期內(2024-2029年)複合年成長率為13.65%。

主要亮點

- 由於供應鏈中斷,2020 年的 COVID-19 對市場產生了負面影響。由於疫情蔓延,全球許多涉及碳纖維回收的製造工廠被迫嚴格暫停營運。然而,由於風力發電等各種終端用戶行業的需求增加,限制取消後,該行業已經反彈。

- 短期來看,輕型汽車需求的增加、碳纖維廢料回收的增加、風力發電領域再利用的增加以及再生碳纖維的成本效益是推動市場需求的因素。

- 再生碳纖維的各種替代品的可得性和供應鏈的安全是阻礙市場成長的因素。

- 向永續性的轉變、再生技術研發的進步以及積層製造和 3D 列印行業需求的潛在成長可能會在未來幾年為市場創造機會。

- 北美地區在市場中佔據主導地位,預計在預測期內仍將保持最高的複合年成長率。

再生碳纖維市場趨勢

航太和國防工業的應用不斷增加

- 再生碳纖維與用於製造航太和國防工業複合材料的新型碳纖維具有相似的性能。這些碳纖維為航太和國防工業中使用的零件提供了獨特的優勢,包括在惡劣條件和高溫下的耐用性、耐磨性和耐腐蝕性。

- 回收的碳纖維正在飛機上取代鋁,以提高燃油效率。更輕的材料和結構使軍用飛機能夠攜帶更多的燃料和有效載荷,民航機能夠攜帶更多的燃料和有效載荷。

- 使用輕量材料可以減少溫室氣體排放和送往垃圾掩埋場的廢棄物量。例如,波音787飛機的重量減輕了20%,燃油效率提高了近10%至12%。

- 此外,航太越來越青睞回收碳纖維來解決飛機廢棄物的關鍵問題。據估計,到 2030 年,全球航太業將有約 6,000 至 8,000 架飛機達到使用壽命。

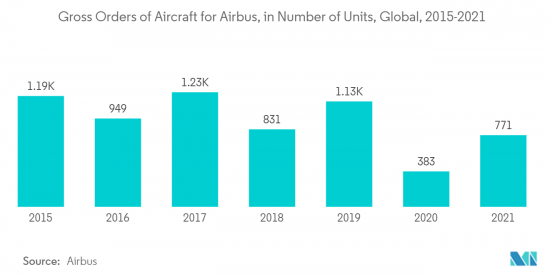

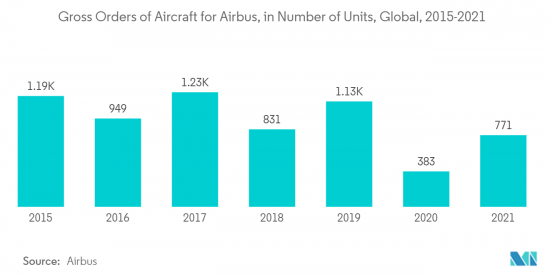

- 空中巴士的目標是在 2020 年至 2025 年間回收 95% 的碳纖維廢棄物,並在航太重新利用 5%。空中巴士 2021 年的飛機訂單總數為 771 架,而 2020 年為 383 架。

- 乘客數量的增加和飛機退役的增加預計將導致未來 20 年需要 44,040 架新噴射機(價值 6.8 兆美元)。到 2038 年,全球民航機預計將達到 50,660 架,涵蓋所有可能繼續服役的新飛機和噴射機。

- 根據國際航空運輸協會(IATA)統計,2020年全球商業航空公司營收為3,730億美元,預計與前一年同期比較將達4,720億美元,年增26.7%。此外,預計到2022年終將達到6,580億美元。

- 據波音公司預計,到2040年,全球民航機持有超過49,000架,其中中國、歐洲、北美和亞太國家各佔新飛機交付的20%左右,其餘20%來自其他國家據說正在向新興市場轉移。

- 由於這些因素,再生碳纖維市場預計在預測期內將在全球範圍內成長。

北美市場佔據主導地位

- 北美地區預計將主導市場。在該地區,美國是 GDP 最大的經濟體。美國和加拿大是世界上成長最快的新興經濟體之一。

- 快速成長的汽車和航太工業正在推動北美地區研究市場的成長。策略開拓、成熟的汽車製造商、領先的再生碳纖維製造商的存在以及與再生碳纖維產品相關的技術進步都有助於該地區的市場成長。

- 美國是該地區再生碳纖維消費的領導者,並被各大公司使用。由於對輕量材料以減輕車輛重量的需求不斷增加,該地區汽車和航太最終用途行業中回收碳纖維的使用不斷增加。

- 此外,美國聯邦航空管理局(FAA)的數據顯示,2020年該國商用飛機數量總計5,882架,與前一年同期比較下降22.9%。然而,預計到 2041 年,飛機數量將增加至 8,756 架,複合年成長率為 2%。預計這將增加航太多種應用對碳纖維的需求。

- 在加拿大,魁北克複合材料開發中心(CDCQ)進行與包括碳纖維在內的各種複合材料價值鏈相關的各種活動。該中心也積極致力於碳纖維回收利用。

- 在全球範圍內,加拿大在民用飛行模擬方面排名第一,在民用引擎生產方面排名第三,在民航機生產方面排名第四。加拿大是唯一一個在每個主要類別中均排名前五名的國家。加拿大航太70%以上的產品出口到六大洲190多個國家。

- 加拿大的風力發電佔發電量的3.5%,使其成為該地區第二重要的可再生能源發電來源。風力發電在實現全球淨零碳排放方面發揮關鍵作用。加拿大是世界上可再生能源生產和使用的領先國家之一,因為它是一個擁有多種能源來源的地區,包括水力、生質能、風能和太陽能。

- 由於這些因素,預計該地區的再生碳纖維市場在預測期內將穩定成長。

再生碳纖維產業概況

再生碳纖維市場得到部分整合。該市場的主要企業包括(排名不分先後)Toray Industries Inc.、Procotex、Vartega Inc.、Gen 2 Carbon Limited 和 Sigmatex。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 輕量化車輛需求不斷成長

- 回收碳纖維廢料並擴大其在風力發電領域的再利用

- 再生碳纖維的成本效益

- 抑制因素

- 各種替代品的可得性

- 再生碳纖維供應鏈安全

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(銷售))

- 類型

- 切碎的再生碳纖維

- 粉碎再生碳纖維

- 供應來源

- 汽車廢料

- 航太廢料

- 其他

- 最終用戶產業

- 車

- 航太/國防

- 風力發電

- 體育用品

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 其他

- 南美洲

- 中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Alpha Recyclage Composites

- Carbon Conversions

- Carbon Fiber Recycling

- Carbon Fiber Remanufacturing

- Gen 2 Carbon Limited

- Karborek RCF

- Mitsubishi Chemical Holdings Corporation.

- Procotex

- Shocker Composites LLC

- Sigmatex

- Toray Industries Inc.

- Vartega Inc.

第7章 市場機會及未來趨勢

- 轉向永續性

- 再生技術研發進展

- 積層製造和3D列印領域的潛在需求不斷增加

簡介目錄

Product Code: 91476

The Recycled Carbon Fiber Market size is estimated at USD 177.20 million in 2024, and is expected to reach USD 335.98 million by 2029, growing at a CAGR of 13.65% during the forecast period (2024-2029).

Key Highlights

- The market was negatively impacted by COVID-19 in 2020 due to disruption in the supply chain. As the pandemic spread, many manufacturing plants involved in the recycling of carbon fiber globally were shut down due to the strict lockdowns. However, the sector has been recovering since restrictions were lifted owing to increased demand from various end-user industries, such as wind energy.

- Over the short term, the rising demand for lightweight vehicles, growing carbon fiber scrap recycling, its increasing reuse in the wind energy sector, and the cost-effectiveness of recycled carbon fiber are some of the factors driving the market demand.

- The availability of various substitutes and supply chain security for recycled carbon fiber are the factors hindering the market's growth.

- Shifting focus toward sustainability, advancement in research and development for recycling techniques, and increasing potential demand from additive manufacturing and 3D printing sectors are likely to create opportunities for the market in the coming years.

- The North American region is expected to dominate the market and is likely to witness the highest CAGR during the forecast period.

Recycled Carbon Fiber Market Trends

Increasing Usage in the Aerospace and Defense Industry

- Recycled carbon fiber possesses similar properties to new carbon fiber used for manufacturing composites that are used in the aerospace and defense industry. These carbon fibers offer specific advantages to components used for the aerospace and defense industry, such as durability in harsh conditions and at high temperatures, abrasion resistance, and corrosion resistance.

- Recycled carbon fiber has replaced aluminum in aircraft to improve fuel economy. Lightweight materials and structures allow military aircraft to carry more fuel and payload while in commercial aircraft.

- Lightweight materials are used to reduce greenhouse gas emissions and the amount of waste sent to landfills. For instance, the Boeing 787 was made 20% lighter, which helped in increasing the fuel economy by nearly 10% to 12%.

- Moreover, the preference for recycled carbon fiber is also increasing in the aerospace industry to manage the significant problem of aircraft waste. It is estimated that, in the global aerospace industry, about 6000-8000 aircraft will reach the end of their service life by 2030, which may create a potential source for carbon recycling in the industry.

- Airbus has set a target of recycling 95% of its carbon fiber waste by 2020-2025, with 5% recycled back into the aerospace sector. The gross orders of aircraft for airbus were 771 units in 2021, as compared to 383 units in 2020.

- The growing passenger volumes and increasing retirements of aircraft are expected to drive the need for 44,040 new jets (valued at USD 6.8 trillion) over the next two decades. The global commercial fleet is expected to reach 50,660 aircraft by 2038, considering all the new aircraft and jets that may remain in service.

- According to the International Air Transport Association (IATA), the global revenue for commercial airlines was valued at USD 373 billion in 2020 and was estimated at USD 472 billion in 2021, registering a growth rate of 26.7% Y-o-Y. Furthermore, the revenue was expected to reach USD 658 billion by the end of 2022.

- According to Boeing, by 2040, the worldwide commercial fleet will exceed 49,000 planes, with China, Europe, North America, and the Asia-Pacific countries each accounting for around 20% of new plane deliveries and the remaining 20% going to other rising markets.

- Owing to all these factors, the market for recycled carbon fiber is likely to grow globally during the forecast period.

The North American Region to Dominate the Market

- The North American region is expected to dominate the market. In the region, the United States is the largest economy in terms of GDP. The United States and Canada are among the fastest emerging economies in the world.

- The fast-growing automotive and aerospace industries are driving the growth of the market studied in the North American region. Strategic developments, the presence of established car manufacturers, leading recycled carbon fiber manufacturers, and technological advancements related to recycled carbon fiber products all contribute to the market's growth in this region.

- The United States is the region's leader in the consumption of recycled carbon fiber, which is used by major corporations. Due to the growing demand for lightweight materials to reduce vehicle weight, the use of recycled carbon fiber in the automotive and aerospace end-use industries has increased in the region.

- Moreover, in the United States, according to the Federal Aviation Administration (FAA), the number of aircraft in the country's commercial fleet accounted for 5,882 in 2020, witnessing a decline rate of 22.9% compared to the previous year. However, the commercial fleet is projected to increase to 8,756 in 2041, with an average annual growth rate of 2% per year. This is expected to increase the demand for carbon fiber from multiple applications in the aerospace industry.

- In Canada, the country has a Centre de developpement des composites du Quebec (Composite Development Centre of Quebec) (CDCQ) engaged in various activities related to the value chain of various composite materials, including carbon fibers. The center is also actively involved in the recycling of carbon fiber as one of its major activities.

- Globally, Canada ranks first in civil flight simulation, third in civil engine production, and fourth in civil aircraft production. It is the only nationally ranked in the top five of all the key categories. The Canadian aerospace industry exports over 70% of its products to over 190 countries across six continents.

- Wind energy in Canada accounts for 3.5% of electricity generation, being the region's second most important renewable energy source. Wind energy plays a crucial role in reaching global net-zero carbon emissions. Canada is one of the world leaders in producing and using renewable power due to its diversified geography with hydro, biomass, wind, and solar energy sources.

- Due to all such factors, the market for recycled carbon fiber in the region is expected to have steady growth during the forecast period.

Recycled Carbon Fiber Industry Overview

The recycled carbon fiber market is partially consolidated in nature. Some of the major players in the market include Toray Industries Inc., Procotex, Vartega Inc., Gen 2 Carbon Limited, and Sigmatex, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand For Lightweight Vehicles

- 4.1.2 Growing Carbon Fiber Scrap Recycling and its Reuse in the Wind Energy Sector

- 4.1.3 Cost Effectiveness of Recycled Carbon Fiber

- 4.2 Restraints

- 4.2.1 Availability of Various Substitutes

- 4.2.2 Supply Chain Security for Recycled Carbon Fiber

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Revenue)

- 5.1 Type

- 5.1.1 Chopped Recycled Carbon Fiber

- 5.1.2 Milled Recycled Carbon Fiber

- 5.2 Source

- 5.2.1 Automotive Scrap

- 5.2.2 Aerospace Scrap

- 5.2.3 Other Sources

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Wind Energy

- 5.3.4 Sporting Goods

- 5.3.5 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpha Recyclage Composites

- 6.4.2 Carbon Conversions

- 6.4.3 Carbon Fiber Recycling

- 6.4.4 Carbon Fiber Remanufacturing

- 6.4.5 Gen 2 Carbon Limited

- 6.4.6 Karborek RCF

- 6.4.7 Mitsubishi Chemical Holdings Corporation.

- 6.4.8 Procotex

- 6.4.9 Shocker Composites LLC

- 6.4.10 Sigmatex

- 6.4.11 Toray Industries Inc.

- 6.4.12 Vartega Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Toward Sustainability

- 7.2 Advancement in Research and Development for Recycling Techniques

- 7.3 Increasing Potential Demand from Additive Manufacturing and 3D Printing Sectors

02-2729-4219

+886-2-2729-4219