|

市場調查報告書

商品編碼

1407935

汽車板簧:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Automotive Leaf Spring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

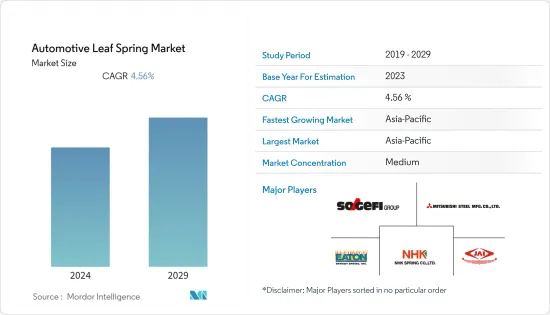

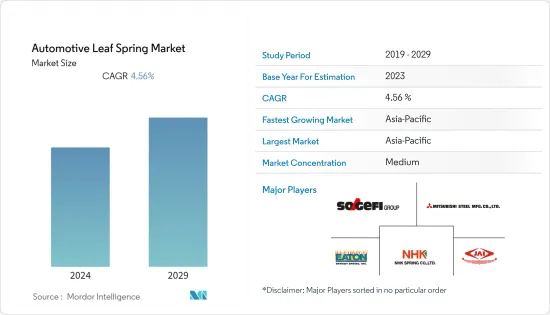

汽車鋼板彈簧市場目前的市場規模為58.8億美元,預計未來五年將達到75.1億美元,預測期內複合年成長率約為4.56%。

從長遠來看,商用車需求的增加以及車輛舒適性需求的增加將推動市場的發展。此外,全球電子商務產業的顯著發展預計將帶動輕型商用車的需求,以滿足汽車製造商的需求,從而增加全球對汽車板簧的需求。此外,運動型多用途車文化在印度、中國和美國國家不斷發展,這將推動市場成長。

例如,根據高階汽車製造商梅賽德斯·奔馳的預測,SUV 在印度整體小客車市場中的佔有率將從五年前的 22% 成長到 2022 年的 47%。

然而,隨著時間的推移,彈簧往往會失去其結構並下垂。不均勻的下垂會改變車輛的橫向載重並輕微影響操控性。它也會影響軸相對於安裝座的角度。加速和煞車扭矩會導致纏繞和振動。這可能會阻礙預測期內的市場成長。

2022年,中國將成為小客車銷售量最高的國家,其次是印度和日本,亞太地區將主導汽車板簧市場。

主要亮點

- 例如,根據國際汽車工業組織的數據,中國將在2022年成為小客車銷售量最高的國家,達到2,300萬輛。此外,該地區的大多數供應商都在尋求使用優質材料製造輕量化解決方案。

此外,由於複合材料板簧重量輕且耐用,因此擴大取代傳統板簧。因此,上述因素將推動市場成長。

汽車板簧市場趨勢

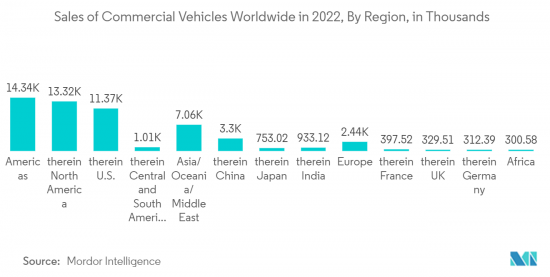

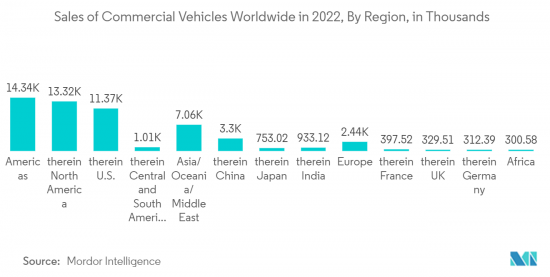

商用車銷售量增加推動市場成長

新興國家和已開發國家可支配收入的增加、建設活動的增加和都市化預計將推動商用車的採用並促使市場成長。考慮到這種情況,製造商正在透過重量規定來致力於車輛設計和客製化車輛的創新。

此外,物流市場正在轉向提供以客戶為中心的解決方案,增加了對商用車的需求。政府的支持性政策和措施增加了對商用電動車的需求。北美和亞太地區的電動巴士和重型卡車註冊量增加。

例如,2023年8月,印度政府核准70億美元在169個城市運行1萬輛電動公車。

MHCV(中型和重型商用車)的興起正在推動亞太等地區的生產,塔塔汽車等汽車巨頭正在關注商用車生產的新技術。此外,許多公司正在專注於開發用於電動車和輕型商用車的複合材料板簧,因為複合材料板簧可以最大限度地減少噪音、振動和聲振粗糙度。此外,與鋼級板簧相比,複合材料板簧重量減輕 40%,應力集中降低 76.39%,變形減少 50%。

印度汽車工業協會預計, 上年度中型和重型商用車銷量將從240,577輛增加到359,003輛,輕型商用車銷量將從475,989輛增加到603,465輛。

因此,隨著商用車銷售和產量的增加,對板簧的需求將持續增加,促進市場成長。

預計亞太地區將在市場中發揮關鍵作用

在亞太地區,電子商務業務的成長正在推動運輸業的擴張。根據分析,印度是全球人口最多的國家,雖然電商僅佔印度零售市場的6%,但卻是全球成長最快的市場之一。

隨著印度和中國汽車製造業的擴張,亞太地區可能會在全球市場上取得重大開拓。例如,根據國際汽車工業協會的統計,全球排名前五的汽車生產國都在亞太地區,其中中國排名第一,日本排名第二,印度排名第三。

看到亞太地區汽車生產和銷售的成長,各公司正專注於開發新技術並投資研發活動以滿足需求。

例如,2022年12月,THACO朱萊工業園宣佈在越南成立塔科工業。 該公司的戰略是大規模開發和製造鋼板彈簧等產品。 隨著新的研發中心和機械中心的建設,正在投資使產品和服務多樣化。

上述因素,加上高銷量和大規模投資,將推動市場成長。

汽車板簧產業概況

該地區的汽車板簧市場高度整合,伊頓底特律彈簧公司、索格菲公司、三菱鋼鐵製造公司、NHK SPRING、賈姆納汽車工業有限公司等主要參與者佔據了主要市場佔有率。。

許多參與企業正在投資新技術並專注於新產品的推出,以在競爭中保持領先地位。

- 2022年5月,東風汽車RUS宣布將在俄羅斯推出DF6皮卡。 DF6 是一款車架皮卡車,具有堅固、可靠的結構、舒適性和越野能力。堅固的車身底部配有雙橫臂前懸吊和後獨立板簧,非常適合俄羅斯道路。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 商用車銷售量增加

- 市場抑制因素

- 隨著時間的推移,彈簧的結構往往會鬆動

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模(單位:美元))

- 類型

- 半橢圓形

- 橢圓

- 拋物線

- 其他類型

- 汽車模型

- 小客車

- 輕型商用車

- 大型商用車

- 銷售管道

- OEM

- 售後市場

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 其他

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- EATON Detroit Spring, Inc.

- Sogefi SpA

- Mitsubishi Steel Mfg. Co., Ltd.

- NHK SPRING Co.,Ltd.

- Jamna Auto Industiries Ltd.

- Rassini

- Mack Springs Pvt. Ltd.

- EMCO INDUSTRIES

- Roc Springs

- Dendoff Springs Ltd.

第7章 市場機會及未來趨勢

The Automotive Leaf Spring Market is valued at USD 5.88 billion in the current year and is expected to reach USD 7.51 billion within the next five years, registering a CAGR of about 4.56% during the forecast period.

Over the long term, the market is driven by the demand increase in demand for commercial vehicles and an increased demand for vehicle comfort. Furthermore, the significant development of the e-commerce industry across the globe is likely to foster the demand for light commercial vehicles to cater to the demand of vehicle manufacturers, increasing worldwide demand for automobile leaf springs. Furthermore, the growing culture of sports utility vehicles in countries like India, China, and the United States will drive the market growth.

For example, according to premium car Manufacturer Mercedes Benz, the share of SUVs in the overall Indian passenger cars market grew to 47% in 2022, which was 22% five years back.

However, the springs tend to lose structure and sag over time. When the sag is uneven, it might change the vehicle's cross weight, which can impair the handling slightly. It can also affect the angle of the axle to the mount. Acceleration and braking torque can generate wind-up and vibration. It might hamper the market growth during the forecast period.

Asia-Pacific dominates the automotive leaf spring market owing to China's highest passenger car sales in 2022, followed by India and Japan.

Key Highlights

- For instance, According to the International Organisation of Motor Vehicle Manufacturers, China contains the highest no sales of passenger vehicles at 23 million units in 2022. Moreover, the majority of suppliers in the region seek to produce lightweight solutions utilizing superior materials as it allows them to adhere to the set standards.

Furthermore, because of their lightweight and great durability, composite leaf springs are progressively replacing conventional leaf springs. Thus, the above factors will drive the market growth.

Automotive Leaf Spring Market Trends

Increasing sales of Commercial Vehicles boost the market growth

The rise in disposable incomes in both developing and developed countries and growing construction activities and urbanization are also projected to drive the adoption of commercial vehicles, which will result in the growth of the market. Considering the scenario, manufacturers are working on innovating vehicle design and customizing vehicles according to weight regulations.

Moreover, the logistics market shifted to offering customer-centric solutions, making the growing need for commercial vehicles. Supportive policies and initiatives by governments raised the demand for commercial electric vehicles. Electric buses and heavy-duty truck registrations increased in North America and Asia Pacific.

For instance, in August 2023, the Indian Government approved USD 7 billion to run 10,000 electric buses in 169 cities.

Due to rising MHCV (Medium and Heavy Commercial Vehicle), production is growing in regions like the Asia-Pacific, and automotive giants such as Tata Motors are focusing on new technologies for the production of commercial vehicles. Many companies are also focusing on developing composite leaf springs for electric vehicles and LCVs since composite leaf springs may minimize noise, vibration, and harshness. Furthermore, the composite leaf springs are 40% lighter, with a 76.39% lower stress concentration, and deform 50% less than steel-graded leaf springs.

The Society of Indian Automobile Manufacturers states that sales of medium and heavy commercial vehicles increased from 2,40,577 to 3,59,003 units, and light commercial vehicles increased from 4,75,989 to 6,03,465 units in FY-2022-23, compared to the previous year.

Thus, with the rise in adoption of commercial sales and production, demand for leaf springs will continue to grow and contribute to market growth.

Asia-Pacific is Anticipated to Play a Significant Role in the Market

In the Asia-Pacific region, the increasing e-commerce businesses are fueling the expansion of the transportation industry. According to our analysis, with the largest population in the world and only 6% of India's retail market coming from e-commerce, the market is one of the fastest growing in the world.

With expanding vehicle manufacturing in India and China, the Asia-Pacific region is likely to experience considerable development in the global market. For instance, according to the International Organisation of Motor Vehicle Manufacturers, the top 5 car production countries in the world are dominated by Asia-Pacific, with China being the first, followed by Japan and India.

Seeing the growth in production and sales of vehicles in the Asia-Pacific region, companies are focusing on making investments in R&D activities to develop new technologies and cater to the demand.

For instance, in December 2022, THACO Chu Lai Industrial Park announced the establishment of THACO INDUSTRIES in Vietnam. The corporation sets the strategy for the development and manufacturing of products like leaf springs on a large scale. It invests in diversifying its products and services by the construction of a new R&D center and mechanical center.

The above factors, coupled with high sales of vehicles and major investments, will fuel the market growth.

Automotive Leaf Spring Industry Overview

The Automotive Leaf Spring market in the region is fairly consolidated, with major players like EATON Detroit Spring, Inc., Sogefi SpA, and MITSUBISHI STEEL MFG. CO., LTD., NHK SPRING Co., Ltd., and Jamna Auto Industries Ltd., capturing the major market share amongst others.

Many players are investing in new technologies to gain the upper hand over their competition and focusing on new launches.

- In May 2022, Dongfeng Motor RUS announced the launch of the DF6 pickup truck in Russia. It is a frame pickup with robust and dependable construction, as well as comfort and off-road capability. The strong undercarriage, with double-wishbone front suspension and a rear-dependent leaf spring, is suitable for Russian roads.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increase in Sales of Commercial Vehicles

- 4.2 Market Restraints

- 4.2.1 The Spring tends to Loose Structure With Time

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 Type

- 5.1.1 Semi-Elliptic

- 5.1.2 Elliptic

- 5.1.3 Parabolic

- 5.1.4 Other Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicle

- 5.2.3 Heavy Commercial Vehicle

- 5.3 Sales Channel

- 5.3.1 OEMs

- 5.3.2 Aftermarkets

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 EATON Detroit Spring, Inc.

- 6.2.2 Sogefi SpA

- 6.2.3 Mitsubishi Steel Mfg. Co., Ltd.

- 6.2.4 NHK SPRING Co.,Ltd.

- 6.2.5 Jamna Auto Industiries Ltd.

- 6.2.6 Rassini

- 6.2.7 Mack Springs Pvt. Ltd.

- 6.2.8 EMCO INDUSTRIES

- 6.2.9 Roc Springs

- 6.2.10 Dendoff Springs Ltd.