|

市場調查報告書

商品編碼

1407934

汽車起動馬達:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Automotive Starter Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

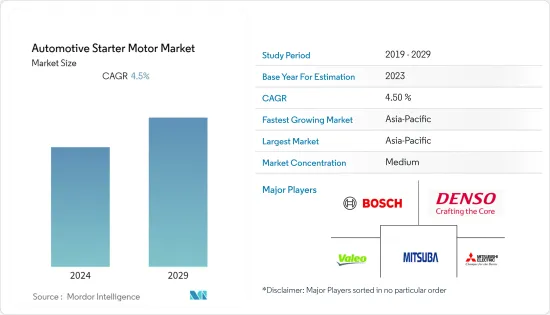

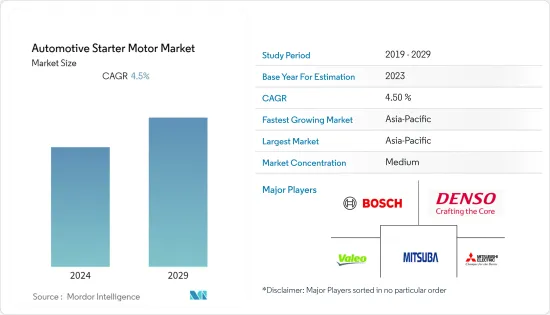

汽車起動馬達市場目前的市場規模為156.3億美元,預計未來五年將成長至203.5億美元,預測期內以收益為準年成長率為4.5%。

從中期來看,隨著全球範圍內更嚴格的廢氣法規變得更加嚴格,汽車製造商正在將生產從傳統引擎汽車轉向電動和混合動力汽車。由於微混合動力汽車和混合動力汽車汽車使用起動馬達,預計該市場將受到採用該動力傳動系統的小客車數量增加的推動。

嚴格的排放法規、燃油效率和政府激勵措施是推動汽車製造商和購買者從傳統汽車轉向混合動力汽車的主要因素。全部區域對節能汽車的需求不斷成長,正在推動消費者購買混合動力汽車,並且在預測期內可能會出現顯著的市場成長。

全球製造業的快速擴張可能會在預測期內為市場創造利潤豐厚的機會。內燃機是其他市場中規模最大、成長最快的市場,全球許多開發中國家,尤其是亞太地區,仍依賴內燃機。

汽車起動馬達市場趨勢

混合/微混合領域預計將經歷顯著成長

世界各國政府提供補貼,鼓勵購買電動和混合動力汽車。中國政府最近推出了支持新能源汽車(NEV)產業的措施,延長了原定於2020年到期的免稅和補貼。其中包括電動車、插電式混合動力汽車和燃料電池車,這些車受到了 COVID-19 疫情的嚴重影響。

此外,政府也表示新的投資可能最終促進混合動力電動車的銷售,進而支持起動馬達市場。

由於更嚴格的排放法規以及人們對低排放或零排放氣體汽車的認知不斷增強,墨西哥、印度和巴西等開發中國家對混合動力汽車產業的需求很大。這些國家的政府也提供獎勵來支持混合動力電動車的銷售。例如,

- 印度政府宣布將 FAME II(一項在全國推廣電動車的計畫)延長至 2024 年。同樣,巴西政府正在透過降低插電式混合動力汽車、混合電動車和壓縮天然氣混合動力汽車的稅率來鼓勵購買混合動力汽車。

為了滿足對混合動力汽車和微型混合動力汽車汽車日益成長的需求,許多汽車製造商正在推出配備低排放氣體動力傳動系統的產品。例如,

- 2022年,馬魯蒂SUZUKI將在印度推出班尼路的改款車型,配備啟停功能等微混合功能。

主導市場的主要企業包括大眾汽車公司、Stellantis、寶馬集團、日產汽車和三菱汽車。主要企業正在推出新產品,以確保其市場地位並保持市場領先地位。例如,

- 2022年4月,瑪莎拉蒂在義大利發布了輕度混合動力車「Maserati Grecale」。混合動力傳動系統總成有兩種輸出類型,入門級的Grecale GT搭載296ps的版本,更高等級的Modena Trim搭載325ps的版本。所有車型均配備全輪驅動和八速自動排檔變速箱。 2022 年,瑪莎拉蒂 Grecale 在日本的銷量約為 1,704 輛。

因此,由於全球混合動力汽車和微型混合動力汽車數量的不斷增加,汽車起動馬達市場預計將在未來幾年內顯著成長。

亞太地區預計仍將是最大市場

亞太地區在汽車銷售方面佔據市場主導地位。該地區是主要開發中國家的所在地,許多OEM都建立了製造設施。此外,中國和印度已成為汽車行業最受歡迎的目的地。

一些國家的政府已推出改善電動和混合動力汽車基礎設施的政策,以減少碳排放。然而,儘管做出了許多努力,對內燃機動力來源的車輛的需求仍然很大,特別是商用車輛,包括公共交通車輛和採礦車輛。

目前,中國混合動力汽車市場由本田和豐田等汽車製造商主導,其車型包括本田雅閣混合和豐田Corolla混合。隨著多家汽車製造商推出新的輕度混合型,市場可能在預測期內出現強勁成長。例如

- 2022年12月,馬自達汽車公司宣布推出一款新的混合動力汽車型,該車型將配備強大的混合機構,到2025年左右,車輛將能夠僅由馬達驅動。該公司計劃透過採用「輕度混合」機制來開發自己的HV,其中引擎由電動馬達支援。

在印度,由於排放法規更加嚴格,許多公司已將重點轉向採用微混合相關技術。例如,印度的瑪魯蒂SUZUKI在該國的市場佔有率最大,該品牌產品組合中的大部分汽車都是SHVS(鈴木智慧混合動力車),具有啟動停止等微混合功能,並配備了技術。

該產業動力來源引擎車輛的銷售量整體成長。例如,目前汽車銷量全球領先的中國,2022年小客車銷量超過2,300萬輛。由於汽車銷量的增加,汽車製造商正在推出配備最新技術的新車。例如,

- 2022年6月,馬恆達在印度推出了配備汽油和柴油引擎的新一代SUV Scorpio。它配備了汽油引擎和柴油引擎,還具有啟動/停止功能。

隨著混合動力汽車和微混合動力汽車在印度和中國等國家越來越受歡迎,預計亞太地區未來幾年的整體市場也將成長。

汽車起動馬達產業概況

幾家主要企業主導著汽車起動馬達市場,包括羅伯特博世有限公司、Denso、法雷奧集團和日立汽車系統有限公司。為了提高燃油效率而對汽車輕量化的需求不斷成長,可能會在預測期內顯著成長市場。例如

- 2023 年 3 月,Proton 推出了首款輕度混合動力電動車 (MHEV) 車型 X90。 XC90車型配備48V皮帶啟動發電機(BSG)馬達、DCDC轉換器、48V鋰離子電池、電池管理系統、再生煞車系統和混合模組控制系統。

- 2022年3月,耐世特汽車宣布推出新型48V整合式皮帶驅動啟動發電機(iBSG),可混合傳統內燃機(ICE)車輛,協助OEM滿足排放氣體和燃油經濟性法規,並推出了eDrive產品線。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車銷量增加

- 市場抑制因素

- 電動車需求增加

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模)

- 依車型

- 小客車

- 商用車

- 依應用程式類型

- 內燃機(內燃機)

- 混合/微混合動力傳動系統

- 依類型

- 電動式

- 氣壓

- 油壓

- 起動馬達發電機

- 依銷售管道

- 目的地設備製造商(OEM)

- 更換/售後

- 依地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太地區其他地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭形勢

- 供應商市場佔有率

- 公司簡介

- Robert Bosch GmbH

- Denso Corporation

- Valeo Group

- Hitachi Automotive Systems Ltd.

- Lucas TVS Limited(TV Sundram Iyengar & Sons Private Limited)

- ASIMCO Technologies Ltd.

- Hella KGaA Hueck & Co.

- Tenneco Inc.

- Mitsuba Corporation

- BorgWarner Inc

- Mitsubishi Electric Corporation

第7章 市場機會及未來趨勢

The Automotive Starter Motor Market is valued at USD 15.63 billion in the current year and is anticipated to grow to USD 20.35 billion by the next five years, registering a CAGR of 4.5% in terms of revenue during the forecast period.

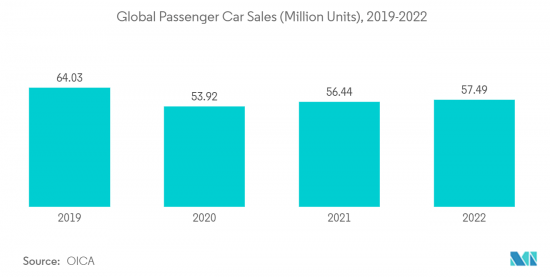

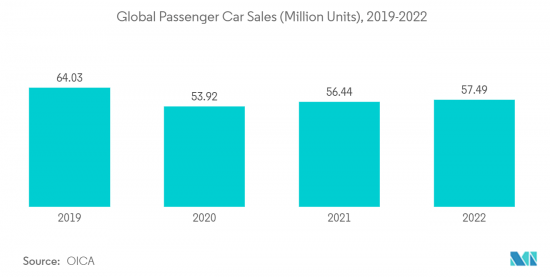

Over the medium term, with rising strict emission standards around the globe, auto manufacturers are progressively shifting their production from conventional engine vehicles to electric and hybrid. As vehicles running in micro-hybrid and hybrid vehicles use starter motors, the increase in the number of passenger cars running on this powertrain is expected to drive the market.

Stringent emission standards, fuel efficiency, and government incentives are the major factors driving automakers and buyers to shift toward hybrid vehicles from conventional vehicles. Rising demand for fuel-efficient vehicles across the region is encouraging consumers to buy hybrid vehicles, which is likely to witness major growth for the market during the forecast period.

The rapid expansion of manufacturing industries across the globe is likely to create lucrative opportunities for the market during the forecast period. As many developing countries across the globe, especially in the Asia-Pacific region, still majorly rely on IC engines, it is the largest and the fastest growing among others.

Automotive Starter Motor Market Trends

Hybrid/Micro-Hybrid Segment is Expected to Witness Significant Growth

Governments all over the world are providing subsidies to encourage people to buy electric and hybrid automobiles. By extending tax exemptions and subsidies that were set to expire by 2020, the Chinese government recently introduced measures to support the new energy vehicle (NEV) industry. It includes electric vehicles, plug-in hybrid vehicles, and fuel cell vehicles - which were severely impacted by the COVID-19 outbreak.

In addition, the government hinted at new investments that could eventually boost the sales of hybrid electric vehicles, in turn aiding the starter motor market.

Due to strict emission regulations and the rising awareness of low or zero-emission vehicles, the hybrid vehicle industry is experiencing a significant demand in developing nations like Mexico, India, and Brazil. The governments of these nations are also offering incentives to aid the sales of hybrid electric vehicles. For instance,

- The Indian government announced that FAME II, a program designed to promote electric mobility throughout the nation, would be extended through 2024. Similarly, the Brazilian government is promoting the purchase of hybrid vehicles by lowering the tax rate, including plug-in hybrids, hybrid electric vehicles, and CNG hybrids.

To cater to the increased demand for Hybrid and Micro-Hybrid vehicles, many car makers are launching products running on the low emission powertrain. For instance,

- In 2022, Maruti Suzuki launched a facelift of Baleno in India, which comes with micro-hybrid features like the start-stop function.

Some of the major players dominating the market are Volkswagen SE, Stellantis, BMW Group, Nissan Motor Corp., and Mitsubishi Motors. Key players are launching new products to secure their market position and stay ahead of the market curve. For instance,

- In April 2022, Maserati introduced the Maserati Grecale, a mild-hybrid vehicle in Italy. The hybrid powertrain comes in two outputs, with entry-level Grecale GTs getting a 296 hp version while up-level Modena trims get 325 hp. All models come with all-wheel drive and eight-speed automatic gearboxes. The Maserati Grecale witnessed a sale of around 1,704 units in 2022 in the country.

Hence, with the increase in the number of hybrid and micro-hybrid vehicles across the globe, the automotive starter motor market is expected to witness significant growth in the following years.

Asia-Pacific is Expected to Remain the Largest Market

Asia-Pacific dominated the market in terms of vehicle sales. With major developing and developed countries in this region, many OEMs are establishing manufacturing facilities. Additionally, China and India became the most popular destination for the automotive industry.

Governments in several nations set forth policies in place to improve the infrastructure for electric and hybrid electric vehicles to lower their carbon footprint. However, despite numerous efforts, there is still a considerable demand for vehicles that are powered by internal combustion engines, particularly for commercial vehicles, including vehicles for mass transit and mining applications.

The hybrid vehicle market in China is currently being led by automakers like Honda and Toyota, whose models include the Honda Accord Hybrid and Toyota Corolla Hybrid. Several vehicle manufacturers introduced new models of mild hybrid in the country, which in turn is likely to witness major growth for the market during the forecast period. For instance,

- In December 2022, Mazda Motor Corporation introduced a new hybrid vehicle model equipped with a strong hybrid mechanism that will allow it to be driven solely by a motor around 2025. The company plans to develop the HV in-house, adopting a "mild hybrid" mechanism to support the engine with a motor.

Many players in India are shifting focus to incorporate technology associated with micro-hybrid, owing to the stringent emission norms. For instance, Maruti Suzuki in India holds the largest market share in the country, and most of the cars in the brand's portfolio come with SHVS (Smart Hybrid Vehicle By Suzuki) technology that gets micro-hybrid features like idle start-stop.

Internal combustion engine-powered car sales as a whole are increasing in this area. For instance, China, which presently leads the world in vehicle sales, sold more than 23 million passenger automobiles in 2022. Owing to the rise in vehicle sales, car makers are launching new vehicles with the latest technology. For instance,

- In June 2022, Mahindra launched its new generation of Scorpio SUV in India that comes powered by a gasoline and a diesel engine. With that, the car also features a start-stop feature.

Because of the rising popularity of hybrid and micro-hybrid vehicles in countries like India and China, the overall market is expected to grow in the Asia-Pacific region in the upcoming years.

Automotive Starter Motor Industry Overview

Several key players, such as Robert Bosch GmbH, Denso Corporation, Valeo Group, Hitachi Automotive Systems Ltd., and others, dominate the automotive starter motor market. The rise in demand for lightweight vehicles to enhance vehicle fuel efficiency is likely to witness major growth for the market during the forecast period. For instance,

- In March 2023, Proton introduced its first mild-hybrid electric vehicle (MHEV) model, the X90. The XC90 model is equipped with a 48 V Belt-Starter Generator (BSG) motor, a DCDC converter, a 48 V lithium-ion battery, a battery management system, a recuperation braking system, and a hybrid module control system.

- In March 2022, Nexteer Automotive introduced a new eDrive product line with the launch of a 48 V integrated Belt-Driven Starter Generator (iBSG) that hybridizes conventional internal combustion engine (ICE) vehicles to help OEMs meet emissions and fuel efficiency regulations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Vehicle Sale

- 4.2 Market Restraints

- 4.2.1 Increase in demand for Electric Vehicles

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Application Type

- 5.2.1 Internal Combustion Engine (IC Engine)

- 5.2.2 Hybrid/Micro-Hybrid Powertrain

- 5.3 By Type

- 5.3.1 Electric

- 5.3.2 Pneumatic

- 5.3.3 Hydraulic

- 5.3.4 Starter Motor Generator

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturers (OEM)

- 5.4.2 Replacement/Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 Uinted Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Denso Corporation

- 6.2.3 Valeo Group

- 6.2.4 Hitachi Automotive Systems Ltd.

- 6.2.5 Lucas TVS Limited (T V Sundram Iyengar & Sons Private Limited)

- 6.2.6 ASIMCO Technologies Ltd.

- 6.2.7 Hella KGaA Hueck & Co.

- 6.2.8 Tenneco Inc.

- 6.2.9 Mitsuba Corporation

- 6.2.10 BorgWarner Inc

- 6.2.11 Mitsubishi Electric Corporation