|

市場調查報告書

商品編碼

1407062

移動機器人:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Mobile Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

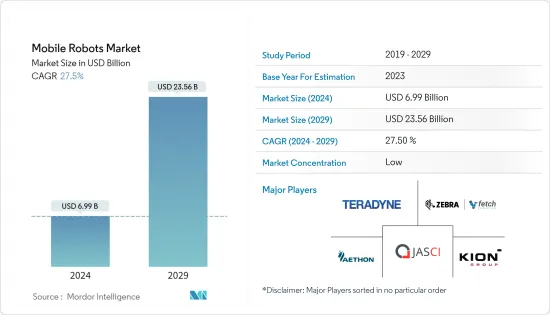

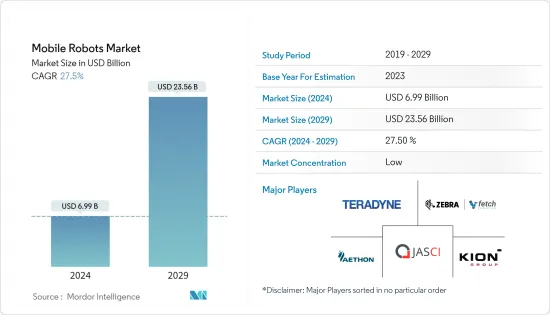

移動機器人市場規模預計到2024年將達到69.9億美元,預計2029年將達到235.6億美元,在預測期內(2024-2029年)複合年成長率為27.5%。

隨著電子商務在全球範圍內活性化,對行動機器人的需求正在擴大。倉庫自動化程度的提高以及這些機器人在各個行業中的接受度不斷提高,因為它們即使在惡劣的條件下也可以自主操作,預計將進一步推動市場擴張。此外,擴大採用自動化物料搬運和熄燈自動化等趨勢可能會在預測期內推動市場擴張。

主要亮點

- 電子商務行業的成長以及全球對高效倉儲和庫存管理的需求正在推動市場成長。例如,根據 IBEF 的數據,印度電子商務市場預計將從 2017 年的 385 億美元成長到 2026 年的 2,000 億美元。

- 由於成本下降、運費降低、客戶需求增加以及貿易全球化等因素,海運貨物的貨櫃使用量穩定增加。因此,貨櫃碼頭已成為物流網路的重要組成部分。為了滿足客戶需求,船舶能夠在港口快速裝卸至關重要。

- 移動機器人正成為港口碼頭日益普及的貨櫃運輸方式。這些無人駕駛車輛在船舶和陸地儲存地點之間轉移貨櫃。貨櫃碼頭的效率與每艘船舶在港的停留時間直接相關。因此,為了保持競爭優勢並提高貨櫃碼頭的效率,AGV正在被引入以製定更好的調度策略,同時提高營運效率。

- 隨著社交距離成為職場的常態,連網型解決方案和自動化正在幫助日常業務的持續進行。參與Honeywell研究的公司認為有必要使用移動機器人來指導工作解決方案和電腦控制設備。此外,倉庫執行軟體(48%)、揀貨技術(46%)和機器人解決方案(44%)是目前廣泛部署的解決方案,預計在不久的將來會有進一步投資。

- 工業環境中的無線通訊系統必須確保資訊的傳輸和接收在準確的時間範圍內進行。然而,由於無線通道和媒體存取控制(MAC)的性質,會出現隨機通訊延遲。這種延遲可能會導致網路控制系統的自動引導車輛出現嚴重的效能問題。

移動機器人市場趨勢

自主移動機器人(AMR)推動市場成長

- 直到最近,傳統的自動導引運輸車(AGV) 仍然是內部運輸任務自動化的唯一選擇。但現在自主移動機器人 (AMR) 正以更先進、更具適應性且價格實惠的技術威脅 AGV。

- 由於其獨特的操作特性和模式,近年來對自主機器人的需求顯著增加。自主機器人在汽車和醫療保健等各個工業領域的使用不斷增加,以及人們對自主移動機器人優勢的認知不斷增強,都推動了對自主移動機器人的需求。然而,高昂的安裝成本和網路覆蓋範圍不足可能會限制自主移動機器人的採用。

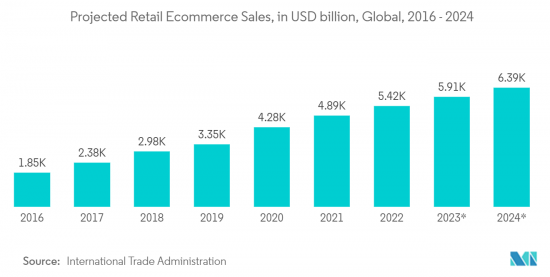

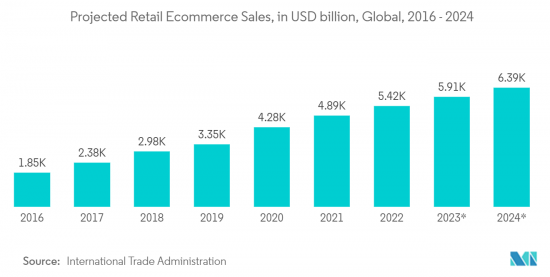

- 電子商務現已成為消費者首選的購物方式。電子商務提供的選擇、人性化的體驗以及隨時隨地購物和支付的便利性是推動電子商務產業成長的因素。根據國際貿易局預測,到2024年,全球零售電商銷售額預計將達到63,880億美元。

- 由於需要保證向經常期望即時滿足的客戶及時交貨,以及由此產生的持續追蹤和補充產品庫存的需求,電子商務公司現在使用 AMR 來提高大型倉庫和配送中心的營運效率他們運作。因此,電子商務業務的快速成長對AMR市場的成長做出了巨大貢獻。

- 此外,AMR能夠適應不同的工作流程,回應工廠流程變化,並能夠與多個頂級模組整合以滿足有效負載要求。這可以實現智慧、可靠的交付並最佳化整個流程。因此,AMR 在投資收益和生產力最佳化方面優於 AGV。

中國正在經歷快速成長

- 中國擁有全球最大的製造業,產生很大佔有率的市場需求。此外,根據工業和資訊化部 (MIIT) 的數據,儘管因 COVID-19 限制措施導致生產和物流中斷,但 2022 年中國工業產值仍與前一年同期比較成長 3.6%。根據工信部預測,2022年製造業產值預估成長3.1%,佔中國國內生產總值(GDP)的28%。

- 此外,中國政府的「中國製造2025」主導是一項國家主導的產業政策,旨在讓中國在全球高科技製造業中佔據優勢,為市場帶來顯著的成長動力。 「中國製造2025」是一個透過快速發展10個高新技術產業來更新中國製造基礎的十年計畫。主要領域包括電動車等新能源車、新一代資訊科技(IT)和通訊、尖端機器人和人工智慧等。這些領域也是第四次工業革命的核心。

- 市場的另一個重要趨勢是,許多企業正在加大投資,擴大國內產能。例如,2022年12月,ABB在中國上海正式開設了一家最先進的、全自動化、靈活的機器人工廠。該生產研發基地佔地67,000平方米,公司投資1.5億美元,將在下一代機器人生產中引入公司的數位化和自動化技術,鞏固ABB在中國機器人和自動化領域的領先地位。加強.此外,該工廠沒有傳統的固定組裝;取而代之的是智慧型、自主和移動機器人,以數位方式連接、網路和服務靈活的模組化生產單元。

- 隨著移動機器人不斷進入各種商業和工業環境以及新的參與者進入該領域,這個市場正在吸引許多中國投資者的投資。國內機器人企業近年來受惠於資金大幅增加。

- 此外,人口高齡化和人事費用上升也影響了中國對移動機器人的需求。例如,根據中國國家統計局的數據,目前中國約有14個地區,包括北京、江蘇、河北、浙江、廣東和四川,最低月薪超過2,000元人民幣(308美元)。

移動機器人產業概況

移動機器人市場競爭激烈,已進入分散化階段,多家企業在競爭相當激烈的市場空間中爭奪注意力。此外,公司的策略決策,例如新產品發布、投資和聯盟,預計將改變競爭形勢。主要市場參與者包括 Teledyne Inc.、Fetch Robotics、Aethon Inc. 和 KION Group AG。

2023 年 4 月,創新倉庫管理和自動化解決方案供應商 JASCI Software 與 Tompkins Robotics 合作,推出大量揀選和機器人單元分類技術。該公司還投資於研發,為客戶提供增強和創新的產品。

2023 年 3 月,ClearPath 旗下公司 OTTO Motors 推出了 OTTO 600,這是同類產品中最具挑戰性和敏捷性的 AMR。從 OTTO 600 簡介來看,OTTO Motors 目前持有市場上最大的自動物料搬運車輛車隊。 OTTO 600 是一款 AMR,專為在最嚴苛的工廠環境中運作而設計,採用全金屬結構和 IP54 防護等級。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 電子商務的快速成長導致倉庫自動化

- 已開發國家人事費用增加

- 市場抑制因素

- 高資本要求和連接問題

第6章市場區隔

- 依產品

- 自動導引運輸車(AGV)

- 自主機器人(AMR)

- 按外形尺寸

- 堆高機

- 拖車/曳引機/拖船

- 單位負荷

- 組裝

- 透過導航感測器

- 反射鏡

- QR 圖碼

- 雷射/LiDAR

- 相機、混合(相機和 LiDAR)和其他導航感測器

- 按使用環境

- 製造業(汽車、電氣/電子、食品和飲料、化學品/製藥和其他商業環境)

- 非製造業(物流中心/配送中心/倉庫)

- 按地區

- 美國

- 歐洲

- 亞太地區(不包括中國)

- 中國

- 世界其他地區

第7章競爭形勢

- 公司簡介

- Teradyne Inc(Mobile Industrial Robots ApS(MIR))

- Fetch Robotics

- JASCI LLC

- Aethon Inc.

- KION Group AG

- SCOTT TECHNOLOGY LIMITED

- Murata Machinery Ltd

- Toyota Material Handling US

- John Bean Technologies(JBT)Corporation

- 6 River Systems Inc

- inVia Robotics Inc.

- IAM Robotics LLC

- GreyOrange Pte Ltd

- Clearpath Robotics Inc.

- Geek+Inc

- Omron Corporation

- Daifuku Co. Ltd

第8章 廠商排名分析

第9章投資分析

第10章投資分析未來展望

The Mobile Robots Market size is estimated at USD 6.99 billion in 2024, and is expected to reach USD 23.56 billion by 2029, growing at a CAGR of 27.5% during the forecast period (2024-2029).

Due to increased e-commerce activity worldwide, demand for mobile robots is expanding. Due to their capacity to maneuver autonomously in challenging situations, factors such as growing warehouse automation and rising acceptance of these robots across various industries are further projected to drive market expansion. Furthermore, the rising adoption of automated material handling and trends like lights-out automation will likely drive market expansion throughout the projection period.

Key Highlights

- The growth in the e-commerce industry and the need for efficient warehousing and inventory management worldwide are driving the market growth. For instance, according to IBEF, the Indian e-commerce market is expected to flourish from USD 38.5 billion in 2017 to USD 200 billion by 2026.

- Factors such as decreasing costs, lower rates of transport, rising customer demand, and globalization of trade have caused a steady increase in the use of containers for sea-borne cargo. Consequently, container terminals have become an important component of logistic networks. It is paramount that ships are unloaded and loaded promptly at the port to satisfy customer demand.

- Mobile Robots are increasingly becoming the popular mode of container transport in seaport terminals. These unmanned vehicles transfer containers between ships and storage locations on land. The e?ciency of a container terminal is directly related to the amount of time each vessel spends in the port. Hence, to maintain competitive advantage and increase the efficiency of the container terminal, AGVs are being deployed that formulate good dispatching strategies and simultaneously enhance operational efficiencies.

- With social distancing becoming more common in the workplace, connected solutions and automation assist in continuing daily operations. The use of mobile robots guides work solutions, and computer-controlled equipment has been regarded as necessary by companies in Honeywell's Study. Moreover, warehouse execution software (48 percent ), order-picking technology (46 percent ), and robotic solutions (44 percent ) have been widely implemented solutions currently, which are also most expected to receive further investment soon.

- Wireless communication systems in industrial environments must guarantee that the information is sent and received within precise time bounds. However, the nature of the radio channels and the medium access control (MAC) generates random communication delays. These delays can cause severe performance problems in automated guided vehicles for networked control systems.

Mobile Robots Market Trends

Autonomous Mobile Robot (AMR) to Witness the Market Growth

- Until recently, traditional automated guided vehicles (AGVs) were the only option for automating internal transportation tasks. However, in the present day, autonomous mobile robots (AMRs) threaten AGVs with their more advanced, adaptable, and affordable technology.

- Due to their unique operational characteristics and patterns, the demand for autonomous robots has recently increased significantly. Growth in the application of autonomous robots in different industrial sectors such as automotive and healthcare and raising awareness about the benefits of autonomous mobile robots fuel the demand for autonomous mobile robots. However, high costs associated with the setup and insufficient internet connectivity coverage might limit the adoption of autonomous mobile robots.

- E-commerce has now emerged as the preferred mode of shopping for customers. The choices it offers, the user-friendly experience it provides, and the convenience of shopping and paying for it from anywhere at any time are some of the factors driving the growth of the e-commerce industry. According to the International Trade Administration, global retail e-commerce sales are expected to reach USD 6,388 billion by 2024.

- Driven by the need to ensure timely delivery to their customers, who often expect instant gratification, and the resulting need to continually track and restock inventory of the goods, e-commerce companies are now using AMRs to improve the operational efficiencies of the big warehouses and distribution centers they operate. Thus, the rapid growth of the e-commerce business is contributing in a significant way to the growth of the AMR market.

- Further, AMRs can adapt to different workflows, accommodate factory process changes, and allow integration with several top modules to meet payload requirements. This enables smart, reliable deliveries and optimizes overall processes. Consequently, AMRs are superior to AGVs regarding return on investment and productivity optimization.

China to Witness Rapid Growth

- China has the world's largest manufacturing industry, generating a significant share of market demand. Moreover, the country's industrial output grew by 3.6% in 2022 from the previous year, as per the Ministry of Industry and Information Technology (MIIT), despite production and logistics disruptions from COVID-19 curbs. The manufacturing sector's output was estimated to have risen by 3.1% in 2022, accounting for 28% of China's gross domestic product (GDP), according to the MIIT.

- Moreover, the Chinese government's Made in China 2025 initiative, a state-led industrial policy that seeks to make China dominant in global high-tech manufacturing, provides significant growth momentum to the market. Made in China 2025 is a ten-year plan to update the country's manufacturing base by rapidly developing ten high-tech industries. Chief among these are electric cars and other new energy vehicles, next-generation information technology (IT) and telecommunications, and advanced robotics and artificial intelligence. These sectors are also central to the fourth industrial revolution.

- Increasing investments by many players in expanding their production capacities in the country is another important trend for the market. For instance, in December 2022, ABB officially opened its state-of-the-art, fully automated, and flexible robotics factory in Shanghai, China. The 67,000 m2 production and research facility represents a USD 150 million investment by the company and is likely to deploy the company's digital and automation technologies to manufacture next-generation robots, enhancing ABB's robotics and automation leadership in China. Moreover, there are no traditional, fixed assembly lines in the facility; instead, intelligent, autonomous mobile robots connect to, network, and service flexible, modular production cells digitally.

- As mobile robots continue to make their way into various commercial and industrial settings and new players enter the sector, the market has been drawing increasing investments from many Chinese investors. Domestic robotics companies have been benefiting from a significant increase in funds in recent years.

- Moreover, the aging population and increasing labor costs are also influencing the demand for mobile robots in China. For instance, according to the National Bureau of Statistics of China, about 14 regions in China currently have a minimum monthly wage of over RMB 2,000 (USD 308), including Beijing, Jiangsu, Hebei, Zhejiang, Guangdong, and Sichuan.

Mobile Robots Industry Overview

The mobile robots market is competitive, moving towards a fragmented stage owing to the growing interest of several companies vying for attention in a fairly contested market space. Further, companies' strategic decisions, such as new product launches, investments, and collaborations, are expected to change the competitive landscape. Some key market players include Teledyne Inc., Fetch Robotics, Aethon Inc., and KION Group AG, among others.

In April 2023, JASCI Software, a provider of innovative warehouse management and automation solutions, partnered with Tompkins Robotics to launch batch pick and robotic unit sortation technology that would revolutionize how goods are sorted and stored in warehouses. Further, the company also aims to invest in research and development initiatives with the aim of providing its customers with enhanced and innovative products on the market.

In March 2023, OTTO Motors, a Clearpath company, unveiled the OTTO 600, the most challenging and agile AMR in its class. With the introduction of the OTTO 600, OTTO Motors now has the market's largest fleet of autonomous material-handling vehicles. The OTTO 600 is an AMR built to perform in the most demanding factory environments, with an all-metal construction and an IP54 rating.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth of E-commerce Leading to Warehouse Automation

- 5.1.2 Increasing Labor Costs in the Developed Nations

- 5.2 Market Restraints

- 5.2.1 High Capital Requirements and Connectivity Issues

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Automated Guided Vehicle (AGV)

- 6.1.2 Autonomous Mobile Robot (AMR)

- 6.2 By Form Factor

- 6.2.1 Forklifts

- 6.2.2 Tow/Tractor/Tug

- 6.2.3 Unit Load

- 6.2.4 Assembly Line

- 6.3 By Navigation Sensor

- 6.3.1 Reflector

- 6.3.2 QR Code

- 6.3.3 Laser/LiDAR

- 6.3.4 Camera, Hybrid (Camera & LiDAR) and Other navigation sensors

- 6.4 By Environment of Operation

- 6.4.1 Manufacturing (Automotive, Electrical & Electronics, Food & Beverage, Chemical & Pharmaceuticals and Other Environments of Operation)

- 6.4.2 Non-Manufacting (Logistics Centers/Distribution Centers/Warehouses)

- 6.5 By Geography

- 6.5.1 United States

- 6.5.2 Europe

- 6.5.3 Asia-Pacific (Excluding China)

- 6.5.4 China

- 6.5.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Teradyne Inc (Mobile Industrial Robots ApS (MIR))

- 7.1.2 Fetch Robotics

- 7.1.3 JASCI LLC

- 7.1.4 Aethon Inc.

- 7.1.5 KION Group AG

- 7.1.6 SCOTT TECHNOLOGY LIMITED

- 7.1.7 Murata Machinery Ltd

- 7.1.8 Toyota Material Handling US

- 7.1.9 John Bean Technologies (JBT) Corporation

- 7.1.10 6 River Systems Inc

- 7.1.11 inVia Robotics Inc.

- 7.1.12 IAM Robotics LLC

- 7.1.13 GreyOrange Pte Ltd

- 7.1.14 Clearpath Robotics Inc.

- 7.1.15 Geek+ Inc

- 7.1.16 Omron Corporation

- 7.1.17 Daifuku Co. Ltd