|

市場調查報告書

商品編碼

1407050

工業緊固件:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

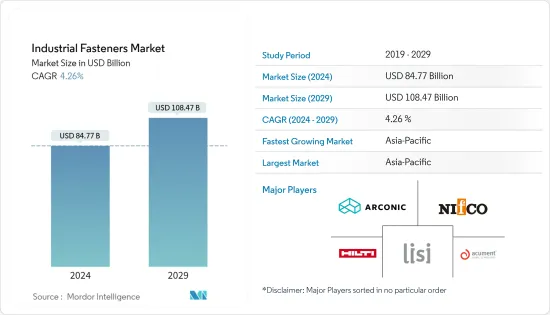

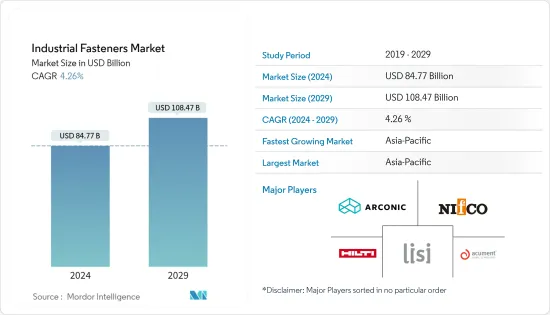

工業緊固件市場規模預計到2024年為847.7億美元,預計到2029年將達到1084.7億美元,在預測期內(2024-2029年)複合年成長率為4.26%,預計會成長。

該市場主要是由建築、汽車和航太等各個行業不斷成長的需求所推動的。

主要亮點

- 工業緊固件是由金屬、塑膠、合金和其他材料製成的各種部件。它用於各種地方永久或半永久地連接或緊固兩個或多個物體。其中許多是機械的,例如螺母、螺栓、螺柱、鉸鏈、手柄、鉚釘、旋鈕、法蘭和螺絲。對於工業應用,緊固件通常具有深螺紋。它們通常有型態,例如壓緊端蓋內六角螺絲、棒狀螺紋、滾壓端蓋和未車削的 T 形螺母。

- 隨著安全法規的顯著增加和先進技術的普及,全球工業部門的成長是推動所研究市場發展的關鍵因素之一。汽車、製造、航太以及食品和飲料行業在過去幾十年中出現了顯著成長。例如,根據 OICA 的數據,2022 年全球汽車產量約為 8,500 萬輛。

- 緊固件廣泛應用於建設產業,以非永久性方式將兩個或多個物體連接在一起,以防止分離、防止接頭洩漏和傳遞負載。近年來,建築業強勁成長,特別是在印度、中國和巴西等開發中國家中市場,預計將繼續為所研究的市場帶來成長機會。例如,根據巴西Odebrecht稱,巴西基礎建設產業的GDP預計將從2021年的813億美元增加到2025年的992億美元。

- 此外,航空工業技術的快速進步正在導致更新、更耐用的航太緊固件的生產。此硬體有助於有效容納民航機、軍用飛機、噴射機、彈道飛彈和太空火箭的零件。

- 然而,擴大用黏合和膠帶取代金屬緊固件(主要用於汽車行業的黏劑和 NVH 應用),預計將限制市場成長。

- 此外,工業緊固件,特別是金屬緊固件容易生鏽和腐蝕,而塑膠緊固件容易受熱,也仍然是影響預測期內市場成長的主要挑戰。

工業緊固件市場趨勢

主導市場的金屬

- 金屬緊固件由多種材料製成,包括鋼、不銹鋼、黃銅、鋁、青銅、鎳、銅、鈦和其他非鐵金屬。最終用戶的材料選擇主要取決於諸如所需強度、腐蝕環境的存在、應力、重量、電和磁性能、電氣、所需的電鍍/塗層、預期壽命和再生性等考慮因素。

- 金屬緊固件可以採用多種製造方法製造,包括數控加工和冷鐓。根據 Boulons Plus & Precision Bolts 的說法,超過 90% 的緊固件都是由鋼製成的,因為與其他材料相比,鋼具有固有的強度特性、可加工性以及相對較低的成本。此外,製造緊固件主要使用三種鋼:合金鋼、低碳鋼和中碳鋼。

- 工業緊固件中常用的不銹鋼包括200、300和400系列,其中400系列是優選的,因為它提供高耐腐蝕,同時提高了強度、耐磨性和氧化性能,因此被主要使用。這些鋼的分類是根據美國鋼鐵協會 (AISI) 的適用性進行的。

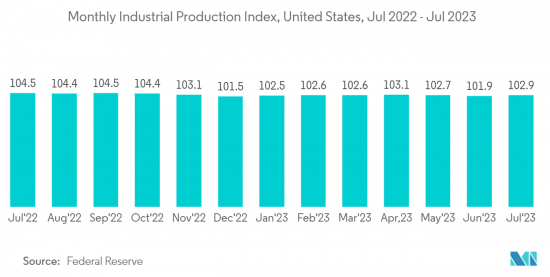

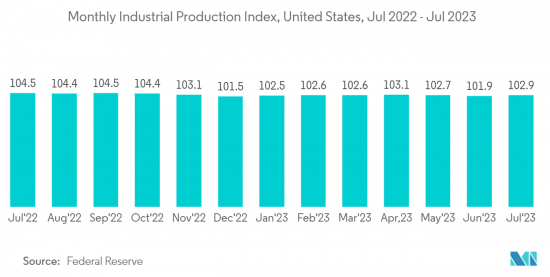

- 製造業、建設業和汽車工業等各行業的活動不斷增加,推動了對工業金屬緊固件的需求。例如,根據聯準會的數據,2023 年 7 月美國製造業生產指數達到 102.9。

- 對金屬緊固件的需求不斷增加將鼓勵供應商進一步擴大業務。例如,2023 年 7 月,Commercial Metals Company 從 MiddleGround Capital 收購了 EDSCO Fasteners LLC。 EDSCO Fasteners 是輸電市場錨固解決方案的領先供應商之一,其產品包括混凝土電線杆、緊固件和包含螺栓設計系列。

亞太市場成長顯著

- 從事汽車、機械和零件製造的跨國和國內公司對其產品的需求正在增加。此外,由於印度和中國主要製造地的製造業務迅速擴張,預計該市場將進一步成長。

- 由於存在多家中小企業,中國是該地區最大的工業緊固件生產國和出口國之一。行業公司正在投資塑膠和特殊緊固件的研究、開發和生產,以滿足最終用戶的應用需求並在競爭激烈的市場中保持成長。

- 在印度,工業緊固件的需求受到汽車產業強勁成長的推動。儘管面臨疫情的挑戰,印度汽車產業一直在穩步復甦,並受益於政府增加的投資和支持該產業的舉措。

- 此外,製造業已成為印度高成長產業之一。印度總理啟動「印度製造」計劃,使印度製造地。因此,未來幾年工業緊固件的需求可能會增加。例如,為了支持汽車和其他製造業的本地化並減少進口依賴,印度政府實施了多項 PLI(生產連結獎勵)計劃。

- 日本也是亞太地區工業緊固件的重要市場。據日本緊固件協會稱,日本緊固件產業由約 3,000 家製造商組成,每年生產價值約 1 兆日圓(69 億美元)的緊固件。多年來,該地區強勁的經濟成長也增強了市場。

工業緊固件產業概況

工業緊固件市場分散,由有影響力的參與者組成。其中一些重要參與者目前在市場佔有率方面控制著市場。這些擁有顯著市場佔有率的重要參與者正致力於擴大其海外基本客群。這些公司利用策略集體行動來增加市場佔有率和盈利。主要市場參與者包括 LISI Group、Nifco Inc.、Acument Global Technologies, Inc. 和 Hilti Corporation。

2023 年 7 月,Triangle Fastener Corporation (TFC) 宣布收購 Connective Systems &Supply, Inc. (CSS)。具體來說,該公司收購了 CSS 的一部分業務,主要專注於金屬建築、屋頂和機械承包的緊固件。

2022 年 4 月,北美領先的特殊緊固件經銷商 Lindfast Solutions Group (LSG) 宣布完成對總部位於多倫多的 Fasteners & Fittings, Inc. (F&F) 的收購。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 爆發對產業的影響

第5章市場動態

- 市場促進因素

- 建築和汽車市場強勁復甦

- 技術進步迅速,研發成本增加

- 市場挑戰

- 在某些應用中擴大使用膠帶和黏劑來取代金屬緊固件

第6章市場區隔

- 按原料分

- 金屬

- 塑膠

- 依產品

- 外螺紋緊固件

- 內螺紋緊固件

- 非螺紋緊固件

- 航太級緊固件

- 按用途

- 用於汽車

- 航太

- 建築/施工

- 工業機械

- 家用電器

- 水暖產品

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Acument Global Technologies, Inc.

- Arconic Corporation

- LISI Group

- Nifco Inc.

- Hilti Corporation

- Stanley Black & Decker, Inc.

- MacLean-Fogg Company

- MISUMI Group Inc.

- Precision Castparts Corp.

- SFS Group

- Illinois Tool Works Inc.

第8章投資分析

第9章 市場未來展望

The Industrial Fasteners Market size is estimated at USD 84.77 billion in 2024, and is expected to reach USD 108.47 billion by 2029, growing at a CAGR of 4.26% during the forecast period (2024-2029).

The market is majorly driven by the rising demand from different industries like construction, automotive, and aerospace.

Key Highlights

- Industrial fasteners are an extensive range of components made up of metal, plastic, alloy, and other materials. They are used in many places to join or hold together two or more objects permanently or semi-permanently. Many of these are mechanical, such as nuts, bolts, studs, hinges, handles, rivets, knobs, flanges, and screws. For industrial applications, fasteners usually have a deep thread. They typically come in varied forms, such as clinched end-cap socket head cap screws, rod threaded with bar, and rolled end-cap unturned tee nuts.

- The growth of the global industrial sector, wherein the penetration of safety regulations and advanced technologies are increasing significantly, is among the significant factors driving the development of the studied market. Industries such as automotive, manufacturing, aerospace, food, and beverage, among others, have been reporting notable growth in the last few decades. For instance, according to OICA, in 2022, about 85 million motor vehicles were produced globally.

- Fasteners are extensively used in the construction industry to join multiple objects together in a non-permanent way to avoid their separation, preventing leakage of joints and transmitting loads. In recent years, the construction sector, especially in developing regions such as India, China, and Brazil, has witnessed strong growth, which is anticipated to continue to drive opportunities in the studied market. For instance, according to Odebrecht, a Brazilian company, Brazil's infrastructure construction sector's GDP is anticipated to reach USD 99.2 billion by 2025, from USD 81.3 billion in 2021.

- Further, the rapid advancement in technology in the aviation industry has led to the production of newer and more durable aerospace fasteners. The hardware helps to effectively hold the parts of commercial airplanes, military aircraft, jets, ballistic missiles, etc., and space-bound rockets.

- However, an increase in the substitution of metal fasteners for adhesives and tapes in bonding and NVH applications, majorly in the automotive industry, is expected to restrict the market growth.

- Additionally, the susceptibility of industrial fasteners, especially made of metals, to rust and corrosion, while of plastic fasteners to heat also continues to remain among the major challenges that will impact the studied market's growth during the forecast period.

Industrial Fasteners Market Trends

Metal Segment to Dominate the Market

- Metal fasteners are manufactured from various materials, such as steel, stainless steel, brass, aluminum, bronze, nickel, copper, titanium, and other non-ferrous metals. The selection of material by the end users is primarily based on considerations such as strength required, presence of corrosive environment, stresses, weight, electrical and magnetic properties, electrical, plating/coating required, expected life, and reusability.

- Metal fasteners can be manufactured using different fabrication methods, including CNC machining and cold heading. According to Boulons Plus & Precision Bolts, because of its inherent strength properties, workability, and relative cheapness compared to other materials, over 90% of fasteners are made from steel. Additionally, three types of steel are primarily used to manufacture fasteners: alloy steel and low and medium-carbon steel.

- Common stainless steels used for industrial fasteners include the 200, 300, and 400 series, out of which the 400 series is predominantly used as they offer high corrosion resistance with strength, wear resistance, and increased oxidation properties. These steel classifications are done based on their applicability by the American Iron & Steel Institute (AISI).

- The increasing activities across various sectors, such as manufacturing, construction, and automotive, drive the demand for metal industrial fasteners. For instance, according to the Federal Reserve, the manufacturing production index reached 102.9 in the United States in July 2023.

- The growing demand for metal fasteners encourages vendors to expand their presence further. For instance, in July 2023, Commercial Metals Company acquired EDSCO Fasteners LLC from MiddleGround Capital. EDSCO Fasteners is among the leading providers of anchoring solutions for the electrical transmission market, and its offerings include an engineered line of anchor cages, fasteners, and bolts that are primarily manufactured from rebar and used widely to secure high-voltage electrical transmission poles to concrete foundations.

The Asia-Pacific Market to Grow Significantly

- Several multinational and domestic players engaged in automotive, machinery, and Component Manufacturing Operations have increased the product demand across the Asia-Pacific. In addition, the key manufacturing hubs across India and China are further expected to foster market growth due to the rapid expansion of manufacturing operations in these countries.

- China is one of the largest producers and exporters of industrial fasteners in the region, owing to the presence of several small and medium-scale players. Industry players are investing in R&D and production of plastic and specialty fasteners to cater to application-specific demand by end-users and sustainably in the highly competitive market.

- In India, the demand for industrial fasteners is led by the strong growth in the automotive sector. Despite the challenges of the pandemic, the Indian automotive industry is recovering steadily, also benefiting from the increasing government investments and initiatives to support this sector.

- In addition, Manufacturing has emerged as one of the high-growth sectors in India. The Prime Minister of India launched the 'Make in India' program to make India a global manufacturing hub. Thus, the demand for industrial fasteners will likely rise in the coming years. For instance, to support localization and reduce import dependency on the auto and other manufacturing sectors, the Indian government has been running several PLI (production-linked incentive) schemes.

- Japan is also a significant market for industrial fasteners in the Asia Pacific. According to the Fasteners Institute of Japan, The Japanese fastener industry comprises approximately 3,000 manufacturers that produce around JPY 1 trillion (USD 6.9 billion) of fasteners annually. Over the years, the solid economic growth in the region has also strengthened the market.

Industrial Fasteners Industry Overview

The industrial fasteners market is fragmented and consists of some influential players. Some of these important actors currently manage the market in terms of market share. These significant players with a noticeable share in the market concentrate on expanding their customer base across foreign countries. These businesses leverage strategic collaborative actions to improve their market percentage and profitability. Some key market players include LISI Group, Nifco Inc., Acument Global Technologies, Inc., Hilti Corporation, etc.

In July 2023, Triangle Fastener Corporation (TFC) announced the acquisition of Connective Systems & Supply, Inc. (CSS). In particular, the company acquired the segment of CSS's business primarily focused on fasteners for metal building, roofing, and mechanical contractors.

In April 2022, LindFast Solutions Group (LSG), a major distributor of specialty fasteners in North America, announced the completion of its purchase of Toronto-based Fasteners and Fittings, Inc. (F&F), which has a leading position in imperial, metric, and stainless steel fasteners market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Revival in the Construction and Automotive Markets

- 5.1.2 Rapid Technological Advancement and Increased Spending in R&D

- 5.2 Market Challenges

- 5.2.1 Increase in the Substitution of Metal Fasteners by Tapes and Adhesives in Some Applications

6 MARKET SEGMENTATION

- 6.1 By Raw Materials

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.2 By Products

- 6.2.1 Externally threaded fasteners

- 6.2.2 Internally threaded fasteners

- 6.2.3 Non-threaded fasteners

- 6.2.4 Aerospace grade fasteners

- 6.3 By Application

- 6.3.1 Automotive

- 6.3.2 Aerospace

- 6.3.3 Building and Construction

- 6.3.4 Industrial Machinery

- 6.3.5 Home Appliances

- 6.3.6 Plumbing Products

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Acument Global Technologies, Inc.

- 7.1.2 Arconic Corporation

- 7.1.3 LISI Group

- 7.1.4 Nifco Inc.

- 7.1.5 Hilti Corporation

- 7.1.6 Stanley Black & Decker, Inc.

- 7.1.7 MacLean-Fogg Company

- 7.1.8 MISUMI Group Inc.

- 7.1.9 Precision Castparts Corp.

- 7.1.10 SFS Group

- 7.1.11 Illinois Tool Works Inc.