|

市場調查報告書

商品編碼

1407029

製藥噴霧乾燥:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Pharmaceutical Spray Drying - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

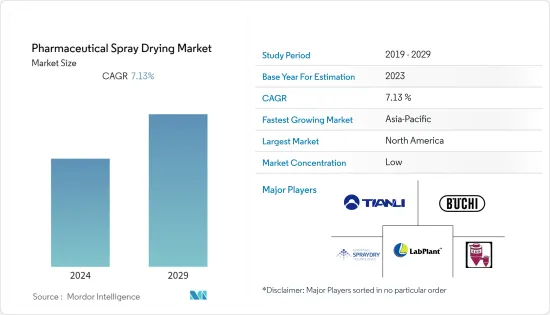

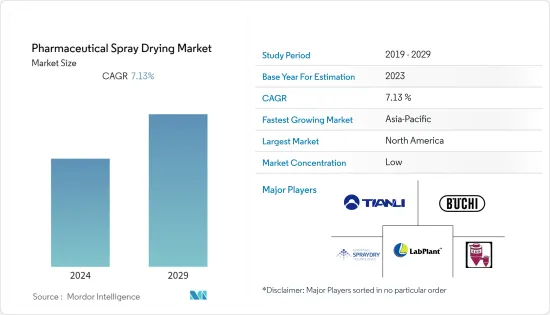

預計2024年全球藥品噴霧乾燥市場規模將達19.7億美元,2024-2029年預測期間複合年成長率為7.13%,2029年將達27.8億美元。

主要亮點

- 由於製造流程顯著放緩以及藥品供需有限,疫情的初始階段對藥品噴霧乾燥市場的成長產生了重大影響。多個國家的政府報告稱,由於 COVID-19 大流行,活性藥物成分出現短缺。同樣,根據藥品出口促進委員會(PHARMEXCIL)的數據,2021年,COVID-19大流行將增加對治療愛滋病毒、癌症、癲癇和瘧疾等各種疾病的藥物的需求,從而顯著提高藥品急劇上升。然而,藥物短缺的恢復以及 COVID-19 藥物、製藥應用和疫苗擴大使用藥物噴霧乾燥正在對市場產生積極影響。例如,根據2023 年2 月發表的一項題為“噴霧凍乾氯硝柳胺奈米晶體嵌入乾粉用於高肺部劑量輸送”的研究,氯硝柳胺(NCL)已顯示出在治療COVID- 19 方面的應用潛力。然而,開發有效的氯硝柳胺(NCL)遞送新製劑仍然是一項挑戰。在這種情況下,採用新型噴霧冷凍乾燥技術生產了含氯硝柳胺的吸入用乾粉劑(NeDPI),使藥物輸送更容易。此類案例表明,由於供應鏈中斷,市場成長最初放緩。然而,隨著供不應求的恢復以及 COVID-19 藥物和疫苗的藥物噴霧乾燥利用率的增加,市場在大流行期間受到積極影響,預計在預測期內將繼續呈上升趨勢。

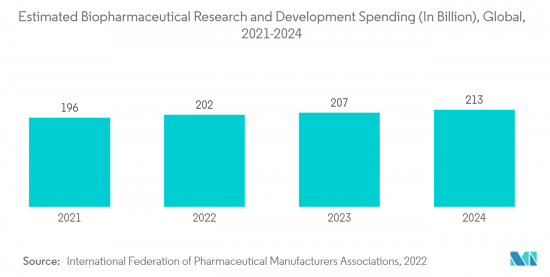

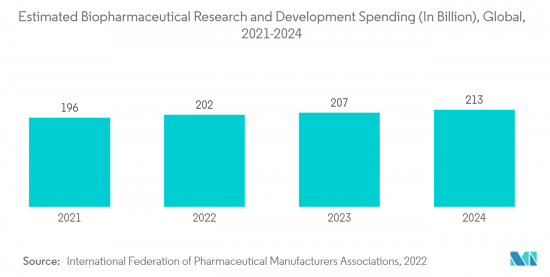

- 慢性病盛行率增加、技術進步、產品穩定性提高以及研發費用增加是推動市場成長的主要因素。藥品研發投入增加,採用不同的商業策略,先進的技術,以及噴霧乾燥方法的優勢,如乾燥速度快、適應性強、與熱敏材料相容、易於保持產品品質等。製藥業擴大採用噴霧乾燥方法,從而推動了預測期內的市場成長。根據 PharmTech 2022 年 2 月發表的學術期刊報道,生物製藥藥物開發的增加導致可以替代傳統液體和冷凍乾燥固態的生物製藥的增加。乾燥正在增加。新的藥物噴霧乾燥方法可以顯著控制所生產粉末的特性,從而提供顯著的下游加工優勢。透過適當的製程開發,噴霧乾燥還可以直接壓縮無定形固體分散體 (ASD) 製劑,從而避免壓片前造粒的需要。由於這些技術進步,大多數製藥公司更喜歡噴霧乾燥而不是傳統方法。

- 此外,慢性病的增加也推動了市場的成長。例如,根據國際糖尿病聯盟2021年發布的資料,約有5.37億成年人患有糖尿病,預計2030年約有6.43億人患有糖尿病。另據報導,四分之三的成年人患有糖尿病,二分之一的成年人(2.4 億人)患有未確診的糖尿病。同樣,根據國際糖尿病聯盟 2021 年發布的報告,超過 120 萬名青少年和兒童患有第 1 型糖尿病。此外,根據 2023 年美國癌症協會大腸直腸癌統計數據,預計 2023 年美國將有超過 153,020 名成年人被診斷出患有大腸腸癌。這些數字包括美國106,970 例結腸癌新病例和 46,050 例直腸癌新病例。因為製藥噴霧乾燥是大多數製藥公司生產高品質藥品的首選技術。慢性疾病患者數量的增加預計將推動對高品質治療藥物開發的需求,這可能會推動對噴霧乾燥技術的需求。因此,慢性病的高盛行率預計將對預測期內的市場成長產生積極影響。

- 然而,噴霧乾燥相關的高成本以及對經驗豐富的操作員的需求可能會阻礙預測期內的市場成長。

醫藥噴霧乾燥市場趨勢

預計輔料製造領域在預測期內將大幅成長

- 藥用輔料是活性藥物成分 (API) 以外的物質,經過適當的安全性評估,並有意包含在藥物傳輸系統中。透過噴霧乾燥法生產乾燥顆粒包括將賦形劑溶解在水性或有機溶劑中,然後在高於溶劑汽化點的溫度下使用高壓空氣透過細霧化噴嘴將所得溶液霧化而完成。由此釋放的微小液滴被快速乾燥,然後透過旋風機構收集。顆粒尺寸由溶液中賦形劑的濃度和施加到氣流的壓力控制。

- 輔料的優勢和不斷增加的研究是市場的主要促進因素。賦形劑能夠實現藥物輸送,對藥物製劑至關重要,有時佔藥物製劑的 80-90%。對於品牌藥物,使用新型賦形劑可以最佳化藥物性能和格式,開發以前未開發的候選藥物,並提供最佳化患者格式的創新藥物。因此,考慮到這些分子的優勢,製藥公司正在對這些賦形劑的生產進行巨額投資。因此,噴霧乾燥的使用擴大用於特殊製造,從而導致該領域的成長。

- 此外,不斷增加的研究工作預計也將推動該領域的成長。例如,2021 年 9 月,美國食品藥物管理局(USFDA) 啟動了一項新的試驗計畫,審查用於滿足新藥物配方中未滿足需求的新型輔料。透過該計劃,FDA 打算加速輔料的開發,這些輔料可能在輔料製造商和藥物開發商之前提到使用現有輔料存在困難的情況下有用。政府的此類舉措預計將在預測期內支持該行業的成長。

- 此外,藥品需求的增加、輔料製造設備的新投資以及政府促進藥品和其他藥品國內生產的措施預計將在預測期內推動市場成長。例如,2023 年 6 月,Croda, Inc. 開始在賓州建造一座新工廠,以擴大其藥用輔料製造能力。據該公司稱,新工廠將生產用於 mRNA 疫苗和基因編輯療法等新型療法的藥物傳輸系統的原料。因此,新的賦形劑生產設施的推出預計將增加對噴霧乾燥的需求,因為它是賦形劑生產的重要組成部分之一。

- 因此,由於噴霧乾燥技術在輔料製造中的重要性非常高,因此該技術提供的優勢和不斷增加的輔料製造設施數量預計將在預測期內推動該領域的成長。

預計北美將在預測期內佔據最大佔有率

- 由於大型製藥企業的存在、藥品需求量大、技術先進、醫藥品研究開發費用高等因素,北美預計將佔較大比例。越來越多的公司專注於市場擴張並採取業務策略來維持其市場地位,預計這將支持市場成長。

- 例如,2022年1月,Eurofins(合約開發和製造組織)宣布擴大其在北美現有的噴霧乾燥開發和製造服務。此次擴張使 Eurofins 能夠進一步補充其致力於提高臨床開發和小型商業項目溶解度的廣泛服務。

- 慢性病負擔的增加以及對藥物研發活動的投資增加是預計在預測期內推動該地區藥物噴霧乾燥市場的一些主要促進因素。例如,根據美國癌症協會2022年報告,2022年日本將報告約190萬癌症病例,其中乳癌是最常見的癌症型態。

- 此外,隨著對乾燥藥品的需求不斷增加,該公司正在獲取先進的噴霧乾燥技術以提高生產和工作流程。預計此類收購將在預測期內進一步推動美國市場的成長。

- 例如,2023年5月,服務於生物製藥行業的合約開發和受託製造廠商(CDMO)和臨床試驗供應服務公司Experic宣布推出其噴霧乾燥能力,以支援生物製藥配方和開發,並宣布新增功能。

- 因此,由於慢性病的高盛行率和對原料藥生產設施的投資,預計在預測期內北美的藥品噴霧乾燥市場將會成長。

製藥噴霧乾燥產業概述

由於不同參與者的存在,藥品噴霧乾燥市場變得分散。主導市場的一些參與者包括山東天利乾燥設備有限公司、Buchi Labortecknik AG、European SprayDry Technologies 和 Labplant UK。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 慢性病盛行率增加

- 技術進步和產品穩定性提高

- 研發費用增加

- 市場抑制因素

- 與噴霧乾燥相關的高成本且需要熟練的操作人員

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔-市場規模:按金額(美元)

- 按用途

- 輔料製造

- 封裝

- 提高生物有效性

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- GCC

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭形勢

- 公司簡介

- GEA Group Aktiengesellschaft

- SPX Flow

- Hovione

- Shandong Tianli Drying Equipment Corporation Ltd.

- Buchi Labortecknik AG

- European SprayDry Technologies

- Labplant UK

- New AVM Systech Pvt. Ltd.

- Advanced Drying Systems

- Lemar Drying Engineering

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 90725

The pharmaceutical spray drying market size is expected to grow from USD 1.97 billion in 2024 to USD 2.78 billion by 2029, at a CAGR of 7.13% during the forecast period (2024-2029).

Key Highlights

- The initial phase of the pandemic has had a substantial impact on the growth of the pharmaceutical spray drying market owing to the significant decline in manufacturing processes and restricted demand and supply of drugs. The government of several countries has reported that active pharmaceutical ingredients are in short supply because of the COVID-19 pandemic. Likewise, according to the Pharmaceutical Export Promotion Council (PHARMEXCIL), in 2021, the COVID-19 pandemic resulted in a massive spike in medicine prices due to increased demand for drugs to treat a variety of diseases, including HIV, cancer, epilepsy, and malaria. However, the recovery from the shortage and increasing use of pharmaceutical spray drying for COVID-19 drugs, drug applications, and vaccines have positively impacted the market. For instance, according to the study titled, 'Spray freeze-dried niclosamidenanocrystals embedded dry powder for high dose pulmonary delivery,' published in February 2023, niclosamide(NCL) has shown potential applications for treating COVID-19. However, the development of new formulations for effective niclosamide(NCL) delivery is still challenging. In such cases, niclosamide-embedded dry powder for inhalation (NeDPI) was fabricated by a novel spray freeze-drying technology, making it easier for drug delivery. Therefore, such instances indicate that the market initially witnessed slow growth owing to supply chain disruption. However, with the recovery from shortage and increasing use of pharmaceutical spray drying for COVID-19 drugs and vaccines, the market witnessed a positive impact during the pandemic and is expected to continue the upward trend over the forecast period.

- The increasing prevalence of chronic diseases, technological advancements, improvements in the stability of products, and increasing research and development spending are the major factors propelling market growth. With the increasing pharmaceutical spending on research and development, adoption of various business strategies, and advanced technology, and the advantages offered by the spray drying methods, such as quick-drying, adaptability, compatibility with heat-sensitive materials, and ease of product quality maintenance, spray drying methods are being increasingly adopted in the pharmaceutical industry, boosting market growth over the forecast period. According to the journal published in February 2022 by PharmTech, the increased development of biologic-based drugs has fueled the demand for spray drying as an alternative for the manufacturing and processing of biologics instead of the more traditional liquid or lyophilized solid forms. The new pharmaceutical spray drying methods offer remarkable control over the properties of the manufactured powders, with significant downstream advantages. With adequate process development, spray drying can also enable amorphous solid dispersion (ASDs) formulations that are directly compressible, thus bypassing the need for granulation prior to tableting. Thus, owing to such technological advancements, the majority of pharmaceutical companies are adopting spray drying over traditional methods.

- In addition, increasing cases of chronic diseases are also propelling market growth. For instance, according to the data published by the International Diabetes Federation in 2021, around 537.0 million adults are living with diabetes, and by 2030, around 643.0 million people are expected to live with diabetes. It also reported that 3 out of 4 adults live with diabetes, and around 1 out of 2 adults (240.0 million) are living with undiagnosed diabetes. Similarly, according to the report published by the International Diabetes Federation in 2021, more than 1.2 million adolescents and children are living with type 1 diabetes. Furthermore, according to the American Cancer Society Colorectal Cancer Statistics in 2023, over 153,020 adults are estimated to be diagnosed with colorectal cancer in 2023 in the United States. These numbers include 106,970 new cases of colon cancer and 46,050 new cases of rectal cancer in the United States, as pharmaceutical spray drying is a technique preferred by most pharmaceutical companies to produce quality drugs. Increasing cases of chronic diseases are anticipated to boost the demand for quality drug development for treatment, which in turn may boost the demand for spray-drying techniques. Thus, the high prevalence of chronic diseases is expected to positively impact the market growth over the forecast period.

- However, the high cost associated with spray drying and the requirement of experienced operators is likely to hinder the market growth over the forecast period.

Pharmaceutical Spray Drying Market Trends

Excipient Production Segment is Expected to Witness Considerable Growth Over the Forecast Period

- Pharmaceutical excipients are substances other than the active pharmaceutical ingredient (API) that have been appropriately evaluated for safety and are intentionally included in a drug delivery system. Manufacturing dry particles by the spray-drying method proceeds in such a way that excipients are dissolved in aqueous or organic solvents, after which the solution thus obtained is sprayed through a narrow atomization nozzle with high pressurized air at a temperature higher than the vaporization point of the solvent. The fine droplets thus emitted are quickly dried, followed by a collection of particles generated by a cyclone mechanism. The particle size is regulated by the concentration of excipients in the solution and the pressure given to the airflow.

- The advantages of excipients and increasing research work are the major drivers for the market. Excipients are essential to the formulation of drug products because they enable the effective delivery of drug substances and can account for as much as 80-90% of the drug product formulation. For branded drugs, novel excipients could be used to optimize drug product performance and presentation and possibly develop candidates that were deemed undevelopable, leading to transformative medicines with optimized patient presentations. Hence, considering the advantages of these molecules, pharmaceutical companies are investing huge amounts in manufacturing these excipients; therefore, there is increasing use of spray drying for the exception production, posting the segment growth.

- In addition, increasing research work is also anticipated to propel the segment growth. For instance, in September 2021, the UInted States Food and Drug Administration (USFDA launched a new pilot program to review novel excipients for use in meeting unmet needs in formulating new drug products. Through this program, the FDA intends to raise the development of excipients that may be useful in scenarios where excipient manufacturers and drug developers have cited prior difficulty in using existing excipients. Such initiatives by the government are expected to boost segment growth over the forecast period.

- Additionally, the rising demand for pharmaceuticals, new investments in the facilities for excipient production, and government initiatives to promote domestic manufacturing of drugs and other pharmaceutical products are expected to boost the market's growth over the forecast period. For instance, in June 2023, Croda, Inc. started constructing its new Pennsylvania facility to enhance its pharmaceutical excipients manufacturing capacity. As per the company, the new facility will be involved in manufacturing ingredients for drug delivery systems used in novel therapeutic drugs such as mRNA vaccines and gene editing therapies. Hence, the launch of new excipient manufacturing facilities is expected to boost the demand for spray dryers as they are one of the essential components for excipient production.

- Therefore, owing to the enormous significance of the spray drying technique in excipient production, the advantages offered by this technique and an increasing number of excipient manufacturing facilities are expected to boost segment growth over the forecast period.

North America is Expected to held Largest Share Over the Forecast Period

- North America is anticipated to have a significant share owing to factors such as the presence of major pharmaceutical players, high demand for pharmaceutical products, technological advancement, and high pharmaceutical research and development expenditure in the region. The increasing company focus on expansion and adopting business strategies to withhold their position in the market is likely to boost the growth of the market.

- For instance, in January 2022, Eurofins (Contract Development and Manufacturing Organization) announced the expansion of its existing spray dry development and production services in North America. With this expansion, Eurofins can further complement a broad range of services specializing in solubility enhancement for clinical development and small-scale commercial programs.

- The increasing burden of chronic diseases and increasing investment in pharmaceutical research and development activities are some of the major driving factors that are expected to drive the pharmaceutical spray drying market in the region over the forecast period. For instance, according to the 2022 report of the American Cancer Society, about 1.9 million cases of cancer were reported in the country in 2022, with breast cancer being the most prevalent form of cancer.

- Moreover, with the rising demand for dried pharmaceutical products, companies are acquiring advanced spray-drying technologies to enhance their production and workflow. Such acquisitions are further expected to boost the market's growth in the United States over the forecast period.

- For instance, in May 2023, Experic, a contract development and manufacturing organization (CDMO) and clinical trial supply services company serving the biopharmaceutical industry, announced the addition of spray drying capabilities to support the formulation and development of biopharmaceuticals.

- Therefore, owing to the high prevalence of chronic diseases and investment in active pharmaceutical ingredient manufacturing facilities, the pharmaceutical spray drying market is expected to grow in North America over the forecast period.

Pharmaceutical Spray Drying Industry Overview

The pharmaceutical spray drying market is fragmented due to the presence of various players in the market. Some of the players who are dominating the market are Shandong Tianli Drying Equipment Corporation Ltd, Buchi Labortecknik AG, European SprayDry Technologies, and Labplant UK, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Chronic Diseases

- 4.2.2 Technological Advancements and Improvements in the Stability of Products

- 4.2.3 Increasing Research and Development Spending

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with Spray Drying and Requirement of Experienced Operators

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Application

- 5.1.1 Excipient Production

- 5.1.2 Encapsulation

- 5.1.3 Enhancing Bioavailability

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 GEA Group Aktiengesellschaft

- 6.1.2 SPX Flow

- 6.1.3 Hovione

- 6.1.4 Shandong Tianli Drying Equipment Corporation Ltd.

- 6.1.5 Buchi Labortecknik AG

- 6.1.6 European SprayDry Technologies

- 6.1.7 Labplant UK

- 6.1.8 New AVM Systech Pvt. Ltd.

- 6.1.9 Advanced Drying Systems

- 6.1.10 Lemar Drying Engineering

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219