|

市場調查報告書

商品編碼

1406907

丙二醇:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Propylene Glycol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

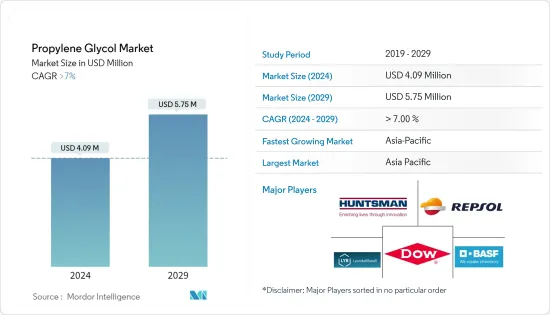

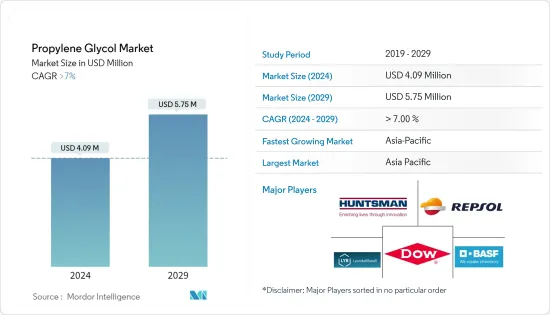

丙二醇市場規模預計到2024年為409萬美元,預計到2029年將達到575萬美元,在預測期內(2024-2029年)複合年成長率超過7%。

由於全國範圍內的封鎖、嚴格的社交距離措施和供應鏈中斷,COVID-19大流行對市場產生了負面影響,對運輸、建築和建造等終端用戶行業產生了負面影響,從而影響了丙二醇市場。 。不過,限購解除後,市場穩定復甦。由於丙二醇運輸和製藥終端用戶行業的消費增加,市場已顯著復甦。

主要亮點

- 食品加工和添加劑產業的需求不斷增加,汽車產業的需求不斷增加,以及各個最終用戶產業對溶劑的需求不斷增加,預計將推動丙二醇市場的發展。

- 由於丙二醇的大量消耗而引起的健康問題預計將阻礙市場的成長。

- 丙二醇生產的工業規模直接合成方法的開拓預計將在預測期內創造市場機會。

- 由於運輸、建築和製藥最終用戶產業對丙二醇的需求不斷增加,預計亞太地區將主導市場。

丙二醇市場趨勢

交通運輸終端用戶產業主導市場

- 丙二醇廣泛應用於交通運輸領域。它是一種黏稠、無色、無味的液體。吸濕性強,溶於醇、酯、水、胺、酮。與鹵代烴的混溶性低,與脂肪族烴不混溶。它在交通運輸行業中有著廣泛的應用。

- 丙二醇用於生產耐火煞車油和液壓液、運輸行業中用於引擎冷卻等應用的冷媒、油漆原料的初始原料、飛機的除冰原料以及飛機的熱載體。高溫應用。將被使用。丙二醇也用於製備不飽和聚酯樹脂,在交通運輸領域發揮多種作用。

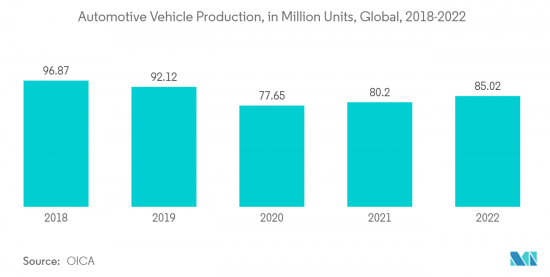

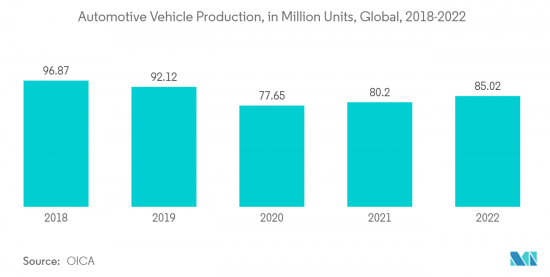

- 全球汽車產量的成長預計將推動丙二醇市場。根據OICA(國際汽車構造組織)預測,2022年全球汽車產量將達8,502萬輛,而2021年為8,020萬輛,成長率為6%。中國、美國和印度是世界上最重要的汽車市場。

- 美國是僅次於中國的全球第二大汽車市場,在全球汽車市場中佔有很大佔有率。根據OICA統計,2022年美國汽車產量達1,006萬輛,而2021年為915萬輛,成長率為9%。這加強了汽車產業的成長並刺激了對丙二醇市場的需求。

- 根據波音《2023-2042年商業展望》,到2042年,新型商用噴射機的需求預計將達到42,595架飛機,達到8兆美元。到 2042 年,全球噴射機持有幾乎翻倍,達到 48,600 架,每年成長 3.5%。航空公司將用新的、更省油的飛機取代全球約一半的機隊。

- 此外,北美也是世界飛機生產中心。美國是該地區最大的飛機市場。空中巴士公司和波音公司是全國最大的飛機製造商。例如,2022年空中巴士交付了661架商用飛機,年終新增訂單1,078架。同樣,波音公司也訂單了 57 737 架 Max 8噴射機,預計 2025 年交付。

- 因此,由於上述因素,運輸終端用戶產業預計將在預測期內推動丙二醇市場。

亞太地區主導市場

- 由於汽車、建築、食品和食品和飲料等終端用戶行業的需求不斷增加,預計亞太地區將主導丙二醇市場。在該地區,中國、印度和日本是最大的丙二醇市場。

- 丙二醇用於製備不飽和聚合物樹脂,用於製造管道和地板等建築產品。在油漆工業中,丙二醇用作油漆的溶劑。

- 中國是全球最大的建築市場,佔全球整體建築投資的20%。到 2030 年,中國預計將在建築方面花費近 13 兆美元。因此,預計國內丙二醇前景樂觀。

- 印度政府積極支持住宅建設,為約13億人提供住宅。未來七年,該國預計將投資約1.3兆美元用於住宅建設,並建造6000萬套新住宅。預計到 2024 年,該國經濟適用住宅將增加約 70%。

- 此外,丙二醇也用於多種食用物品,包括咖啡飲料、液體甜味劑、冰淇淋、攪打乳製品和蘇打水。食品和飲料需求的增加預計將在該地區創造丙二醇市場。

- 中國是該地區最大的食品和飲料市場。根據中國國家輕工業委員會統計,2022年年銷售額超過280萬美元的主要食品生產企業收益累計超過1.53兆美元。與2021年相比,總收入與前一年同期比較增5.6%,顯示食品業成長強勁。

- 由於上述因素,亞太地區丙二醇市場預計在預測期內將大幅成長。

丙二醇產業概況

丙二醇市場本質上是部分一體化的。該市場的主要企業包括(排名不分先後)LyondellBasell Industries Holdings BV、 BASF SE、Repsol、Dow 和 Huntsman International LLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 食品加工及添加劑業丙二醇需求

- 汽車產業需求增加

- 各個最終用戶產業對溶劑的需求不斷增加

- 抑制因素

- 大量食用丙二醇引發的健康問題

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 按年級

- 工業

- 食品和飲料

- 藥品

- 按用途

- 香味

- 防凍劑/消泡劑

- 不飽和聚酯樹脂

- 化學中間體

- 其他用途(抗氧化劑、家用產品等)

- 按最終用戶產業

- 運輸

- 建築/施工

- 食品和飲料

- 個人護理

- 藥品

- 其他最終用戶產業(電子、油漆等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ADEKA CORPORATION

- ADM

- AGC Chemicals

- BASF SE

- Chaoyang Chemicals, Inc.

- Dow

- Golden Dyechem

- Huntsman International LLC

- INEOS

- Lonza

- LyondellBasell Industries Holdings BV

- Repsol

- Shell plc

- SKC Chemicals

- Sumitomo Chemical Co., Ltd.

第7章 市場機會及未來趨勢

- 工業規模直接合成丙二醇的開發

- 其他機會

The Propylene Glycol Market size is estimated at USD 4.09 million in 2024, and is expected to reach USD 5.75 million by 2029, growing at a CAGR of greater than 7% during the forecast period (2024-2029).

The COVID-19 pandemic had negatively impacted the market due to nationwide lockdowns, strict social distancing measures, and disruption in supply chains, which negatively affected the transportation, building, and construction end-user industries, thereby affecting the market for propylene glycol. However, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the rise in consumption of propylene glycol transportation and pharmaceuticals end-user industries.

Key Highlights

- The increasing demand from the food-processing and additives industry, the growing demand from the automotive industry, and the rising demand for solvents from various end-user industries are expected to drive the market for propylene glycol.

- The health issues created by the high consumption of propylene glycol are expected to hinder the market's growth.

- The development of industrial-scale direct synthesis methods for propylene glycol production is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market due to rising demand for propylene glycol in transportation, building and construction, and pharmaceutical end-user industries.

Propylene Glycol Market Trends

Transportation End-User Industry to Dominate the Market

- Propylene glycol is widely used in the transportation sector. It is a viscous, colorless, odorless liquid. It is highly hygroscopic and soluble in alcohols, esters, water, amines, and ketones. It has limited miscibility with halogenated hydrocarbons and is not miscible with aliphatic hydrocarbons. It has a wide variety of applications in the transportation industry.

- Propylene glycol is used to produce fire-resistant brake and hydraulic fluids, coolants used in the transportation industry for applications like engine cooling, and more, as an initial for raw materials of paints, as a raw material for de-icing of planes, and as a heat transfer fluid for high-temperature applications. Propylene glycol is also used to prepare unsaturated polyester resins, with various roles in the transportation sector.

- The increase in the global production of automotive vehicles is expected to drive the market for propylene glycol. According to the Organisation Internationale des Constructeurs d'Automobiles" (OICA), global automotive vehicle production reached 85.02 million in 2022, compared to 80.2 million manufactured in 2021, at a growth rate of 6%. China, the United States, and India are the most prominent automotive vehicle markets globally.

- The United States is the second-largest automotive market in the world after China, which occupies a significant share of the global automotive vehicles market. According to OICA, in 2022, the United States automotive vehicle production reached 10.06 million compared to 9.15 million units manufactured in 2021, at a growth rate of 9%. This enhanced the growth of the automobile industry, which has stimulated the market demand for propylene glycol.

- According to the Boeing Commercial Outlook 2023-2042, the demand for new commercial jets by 2042 is expected to reach 42,595 units, valued at USD 8 trillion. The global fleet will nearly double to 48,600 jets by 2042, expanding by 3.5% annually. Airlines will replace about half of the global fleet with new, more fuel-efficient models.

- Moreover, North America is the hub for aeroplane production in the world. The United States is the largest market for airplanes in the region. Airbus and Boeing are the largest manufacturers of airplanes in the country. For instance, in 2022, Airbus delivered 661 commercial aircraft, registering 1,078 gross new orders by the end of the year. Similarly, Boeing Aeroplane OEM company received orders for 57 of the 737 Max 8 jets, with delivery expected through 2025.

- Hence, owing to the factors mentioned above, the transportation end-user industry is anticipated to drive the market for propylene glycol during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for propylene glycol with the increasing demand from automotive, construction, food, and beverage end-user industries. China, India, and Japan are the largest markets for propylene glycol in the region.

- Propylene glycol is used to prepare unsaturated polymer resins, which are used to make construction products like duct pipes and floor sheets, among others. In the paint industry, propylene glycol is used as a solvent in paints.

- China is the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings and construction by 2030. This is anticipated to create a positive outlook for propylene glycol in the country.

- The Indian government has been actively boosting housing construction to provide houses to about 1.3 billion people. The country is likely to witness around USD 1.3 trillion of investment in housing over the next seven years, to witness the construction of 60 million new houses in the country. The availability of affordable housing in the country is expected to increase by around 70% by 2024.

- Furthermore, propylene glycol is also used in various edible items such as coffee-based drinks, liquid sweeteners, ice cream, whipped dairy products, and sodas. The increase in demand for food and beverage products is expected to create a market for propylene glycol in the region.

- China is the largest market for food and beverage in the region. According to the China National Light Industry Council, major food manufacturing companies with an annual turnover of over USD 2.8 million reported revenues of over USD 1.53 trillion in 2022. Compared to 2021, the total revenue registered a year-on-year growth of 5.6%, indicating strong growth in the food industry.

- Owing to the above-mentioned factors, the market for propylene glycol in the Asia-Pacific region is projected to grow significantly during the forecast period.

Propylene Glycol Industry Overview

The propylene glycol market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) LyondellBasell Industries Holdings BV, BASF SE, Repsol, Dow, and Huntsman International LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand for Propylene Glycol in the Food Processing and Additives Industry

- 4.1.2 The Increasing Demand from the Automotive Industry

- 4.1.3 Rising Demand for For Solvents From Various End-User Industries

- 4.2 Restraints

- 4.2.1 Health Issues Created by The High Consumption of Propylene Glycol

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Grade

- 5.1.1 Industrial

- 5.1.2 Food and Beverage

- 5.1.3 Pharmaceutical

- 5.2 Application

- 5.2.1 Flavoring Agent

- 5.2.2 Antifreeze and Deicer Agent

- 5.2.3 Unsaturated Polyester Resins

- 5.2.4 Chemical Intermediates

- 5.2.5 Other Applications (Antioxidants, Household Care, etc.)

- 5.3 End-user Industry

- 5.3.1 Transportation

- 5.3.2 Building and Construction

- 5.3.3 Food and Beverages

- 5.3.4 Personal Care

- 5.3.5 Pharmaceuticals

- 5.3.6 Other End-user Industries (Electronics, Paints and Coatings, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADEKA CORPORATION

- 6.4.2 ADM

- 6.4.3 AGC Chemicals

- 6.4.4 BASF SE

- 6.4.5 Chaoyang Chemicals, Inc.

- 6.4.6 Dow

- 6.4.7 Golden Dyechem

- 6.4.8 Huntsman International LLC

- 6.4.9 INEOS

- 6.4.10 Lonza

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 Repsol

- 6.4.13 Shell plc

- 6.4.14 SKC Chemicals

- 6.4.15 Sumitomo Chemical Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Industrial-scale Direct Synthesis Method for Propylene Glycol Production

- 7.2 Other Opportunities