|

市場調查報告書

商品編碼

1406897

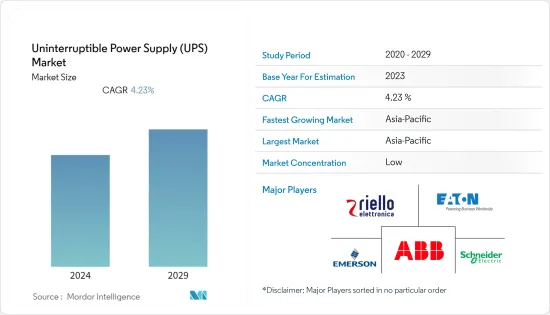

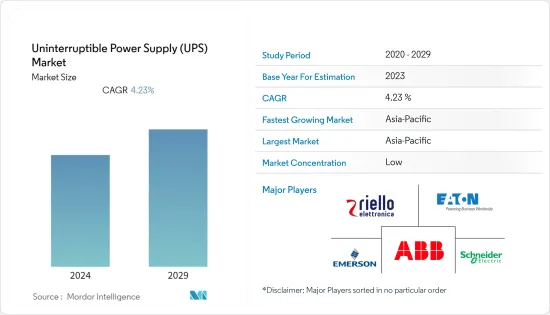

不斷電系統(UPS):市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Uninterruptible Power Supply (UPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

不斷電系統(UPS)市場規模預計將從2024年的117.2億美元成長到2029年的144.2億美元,預測期內複合年成長率為4.23%。

主要亮點

- 從中期來看,物聯網和智慧建築的成長趨勢、全球資料中心數量的增加、虛擬和雲端運算的成長趨勢、多重雲端採用和網路升級的增加預計也將推動研究市場的成長。

- 另一方面,線上式UPS的高成本以及UPS在保護重型家電斷電方面的一些限制可能會對市場成長產生負面影響,是市場的主要抑制因素之一。

- 也就是說,UPS 電池系統的技術進步,例如具有更高動作溫度的新型鋰離子 (Li-ion) 電池,預計將為傳統資料中心創造巨大的機會。 UPS 系統還可以安裝作為電網故障時的備用系統,預計將在預測期內提供成長機會。

- 亞太地區在市場中佔據主導地位,並且可能在預測期內實現最高的複合年成長率。成長主要得益於支持採用 5G 網路的現有政策框架以及對資料中心技術投資的增加。

不斷電系統(UPS)市場趨勢

備用UPS系統預計將主導市場

- 與其他 UPS 系統相比,全球對家用電器不斷成長的需求是備用 UPS 系統的主要促進因素之一。備用UPS系統對於低功耗設備來說是最經濟的選擇,因此它們是家用電器的首選選擇。 COVID-19 大流行迫使人們在家工作,增加了對桌上型電腦的需求。

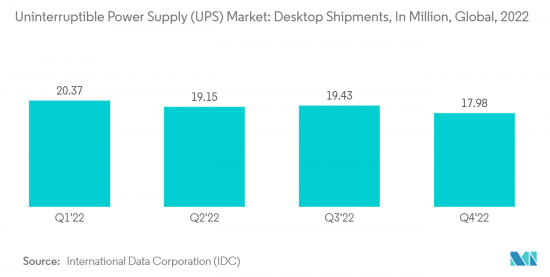

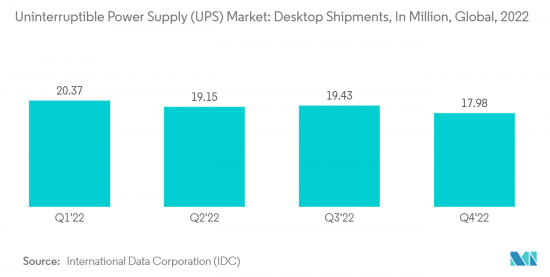

- 例如,根據國際資料中心(IDC)的數據,2022年第四季桌上型電腦全球出貨量約為1,798萬台,而去年同期約為2,337萬台。桌上型電腦正面臨筆記型電腦和桌上型電腦等行動裝置的課題,導致整體銷量下降,但未來,隨著更多專業人士在家工作,預計銷量將會增加。

- 同樣,隨著冠狀病毒促使家庭娛樂需求激增,預計在預測期內對遊戲機的需求也會增加。備用 UPS 對於遊戲機至關重要,因為不安全的電力水平可能會損壞系統,尤其是在電力品質較差的地區。

- 總體而言,備用UPS系統的需求預計主要來自家用電器,因為離線UPS系統為設備提供最便宜的電力備份和保護。由於對桌上型電腦和遊戲機的需求不斷增加,預計在預測期內該數字將會增加。

亞太地區預計將主導市場

- 亞太地區仍處於發展中,馬來西亞、柬埔寨、菲律賓等國家停電頻繁,供電不穩定。該地區 UPS 系統的主要最終用戶包括該地區蓬勃發展的工業/製造業、電信、商業和住宅部門。

- 在亞太地區,製造業對各國經濟做出了重要貢獻,其中中國是最大的製造業中心。日本、印度、韓國和印尼是亞太地區的主要貢獻者。同時,越南、馬來西亞和新加坡等國家的佔有率預計將在預測期內增加。

- 製造業的自動化,包括基於電腦的控制系統、可程式邏輯控制 (PLC) 單元和製程控制應用,正在推動工業設施中對 UPS 系統的需求。

- UPS 系統在停電期間提供備份,並保護設備免受電源故障的影響,例如電源驟降、突波、欠壓、過壓、線路雜訊、頻率波動、開關瞬變和諧波失真。因此,UPS系統已成為電訊、工程、製造、研發、教育、醫藥、IT、BPO、航空、銀行等幾乎所有工業的必備品。

- 製造業涉及面廣,包括汽車工業、食品加工業、半導體、鋼鐵業等眾多行業,波動性和破壞性的電力給各行業帶來重大的經濟損失,難以平穩運行。電能質量設備,例如UPS 系統。

- 停電和不穩定的電力供應會對嚴重依賴優質電力順利運作的工業和企業造成重大損害。然而,在印度和中國等開發中國家,當局難以維持優質電力。

- 例如,據印度投資局稱,到2026-27年,印度發電裝置容量將接近620GW,其中38%為煤炭,44%為可再生。印度透過大幅擴大可再生能源發電能力實現能源來源多元化和 24x7 供電的目標估計將成為市場的關鍵驅動力。電力需求的成長、可支配收入的增加以及對可靠電力供應的需求預計將在預測期內支持印度不斷電系統(UPS)市場。

- 因此,由於上述因素,亞太地區預計將成為預測期內成長最快的不斷電系統(UPS)市場。

不斷電系統(UPS) 產業概述

不斷電系統(UPS)市場較為分散。主要企業(排名不分先後)包括 Riello Elettronica SpA、EATON Corporation PLC、Emerson Electric Co.、ABB Ltd 和 Schneider Electric SE。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 資料中心數量增加

- 擴大多重雲端採用和網路升級

- 抑制因素

- UPS 保護重型設備免受斷電影響的局限性

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 容量

- 小於10kVA

- 10至小於100kVA

- 100kVA以上

- 類型

- 備用UPS系統

- 線上UPS系統

- 線上互動式UPS系統

- 應用

- 資料中心

- 通訊

- 醫療保健(醫院、診所等)

- 工業的

- 其他用途

- 地區(依地區分類的市場分析{2028年之前的市場規模和需求預測(僅依地區分類)})

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 亞太地區其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 中東和非洲其他地區

- 北美洲

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Riello Elettronica SpA

- EATON Corporation PLC

- Emerson Electric Co.

- Delta Electronics Inc.

- ABB Ltd

- Schneider Electric SE

- Hitachi Ltd

- Mitsubishi Electric Corporation

- General Electric Company

- Cyber Power Systems Inc.

- Aspex Inc.

第7章 市場機會及未來趨勢

- 不斷進步的 UPS 電池系統技術

簡介目錄

Product Code: 72364

The Uninterruptible Power Supply (UPS) Market size is expected to grow from USD 11.72 billion in 2024 to USD 14.42 billion by 2029, registering a CAGR of 4.23% during the forecast period.

Key Highlights

- Over the medium term, the rising trend of IoT and smart buildings, a growing number of data centers worldwide, the growing trend of virtualization and cloud computing, and the growing adoption of multi-cloud and network upgrades are also expected to drive the growth of the market studied.

- On the other hand, the high cost of online UPS and a few limitations of UPS for protecting heavy appliances from power failure may negatively impact the market's growth and is one of the major restraints for the market.

- Nevertheless, technological advancements in UPS battery systems, such as new lithium-ion (Li-ion) batteries with high operating temperatures, are expected to create immense opportunities in traditional data centers. UPS systems can also be installed as a backup system when the electricity grid fails and are expected to provide growth opportunities in the forecast period.

- The Asia-Pacific region dominates the market and is likely to register the highest CAGR during the forecast period. The growth is mainly driven by the existing framework of policies supporting the adoption of 5G networks and increasing investments in data center technologies.

Uninterruptible Power Supply (UPS) Market Trends

Standby UPS System Expected to Dominate the Market

- The growing demand for consumer electronics across the globe is one of the major drivers for standby UPS systems compared to other UPS systems, as the standby UPS system is the most preferred option for consumer electronics as it is the most economical option for devices with low power consumption. Due to the COVID-19 pandemic, the demand for desktop computers increased as people were forced to work from home.

- For instance, according to the International Data Center (IDC), the global shipment of desktops totaled in the fourth quarter of 2022 to about 17.98 million units compared to the fourth quarter previous year, which was just about 23.37 million. Desktop personal computers face challenges from mobile devices such as laptops and desktops, which is led to an overall decline in sales; however, in the future, it is expected to increase as more professionals work from home.

- Similarly, the demand for gaming consoles is expected to increase during the forecast period and was aided by the coronavirus pandemic as it led to a surge in demand for home entertainment. A standby UPS is essential for gaming consoles, especially in areas with poor power quality, as unsafe levels of electricity can damage the system.

- Overall, the demand for standby UPS system is primarily expected to come from consumer electronics as offline UPS system provides the devices with the least expensive power backup and protection. It is expected to increase during the forecast period due to the increasing demand for desktop PC and gaming consoles.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region is developing, with frequent blackouts and unstable power supply across the region, especially in countries like Malaysia, Cambodia, the Philippines, and several others. Major end-users of UPS systems in the region include the region's booming industrial and manufacturing, telecom, commercial, and residential sectors.

- In the Asia-Pacific region, the manufacturing sector is one of the major contributors to the economy of various countries, with China being the largest hub of the manufacturing sector. Japan, India, South Korea, and Indonesia are a few major contributors to Asia-Pacific. In contrast, countries like Vietnam, Malaysia, and Singapore are expected to increase their share during the forecast period.

- Automation in the manufacturing sector involving computer-based control systems, Programmable Logic Control (PLC) units, and process control applications has prompted the need for UPS systems in industrial facilities.

- UPS systems provide backup in case of electric power failure and protect equipment from power glitches like power sags, surges, under voltage, over-voltage, line noise, frequency variations, and switching transient and harmonic distortions. Hence, UPS systems have become essential to almost all industries like telecom, engineering, manufacturing, R&D, education, medicine, IT, BPO, aviation, banking, etc.

- The manufacturing sector covers a wide range of industries, including the automotive industry, food processing industry, semiconductors, steel manufacturing, and many more, all requiring power quality equipment like UPS systems for smooth operations as fluctuating and disruptive power causes significant monetary losses to the industries.

- Power cuts and variable power supply cause significant damage to industries and businesses that rely heavily on good quality electricity for smooth operations. However, maintaining good quality power in developing countries like India and China is difficult for the authorities.

- For instance, according to Invest India, by 2026-27, India's power generation installed capacity will likely be nearly 620 GW, 38% of which will be from coal and 44% from renewable energy. India's aim to diversify its energy sources and the target to provide a 24x7 electricity supply by making a large addition of renewable energy generation capacities is estimated to be a significant driver for the market. The growing electricity demand, increasing disposable income, and the need for a reliable power supply are expected to support the UPS market in India during the forecast period.

- Therefore, based on the abovementioned factors, Asia-Pacific is expected to become the fastest-growing UPS market during the forecast period.

Uninterruptible Power Supply (UPS) Industry Overview

The uninterruptible power supply (UPS) market is fragmented. Some of the major players (in no particular order) include Riello Elettronica SpA, EATON Corporation PLC, Emerson Electric Co., ABB Ltd, and Schneider Electric SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Number of Data Centers

- 4.5.1.2 Growing Adoption of Multi-Cloud and Network Upgrades

- 4.5.2 Restraints

- 4.5.2.1 Limitations of UPS for Protecting Heavy Appliances from Power Failure

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Less than 10 kVA

- 5.1.2 10-100 kVA

- 5.1.3 Above 100 kVA

- 5.2 Type

- 5.2.1 Standby UPS System

- 5.2.2 Online UPS System

- 5.2.3 Line-interactive UPS System

- 5.3 Application

- 5.3.1 Data Centers

- 5.3.2 Telecommunications

- 5.3.3 Healthcare (Hospitals, Clinics, Etc.)

- 5.3.4 Industrial

- 5.3.5 Other Applications

- 5.4 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States of America

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Riello Elettronica SpA

- 6.3.2 EATON Corporation PLC

- 6.3.3 Emerson Electric Co.

- 6.3.4 Delta Electronics Inc.

- 6.3.5 ABB Ltd

- 6.3.6 Schneider Electric SE

- 6.3.7 Hitachi Ltd

- 6.3.8 Mitsubishi Electric Corporation

- 6.3.9 General Electric Company

- 6.3.10 Cyber Power Systems Inc.

- 6.3.11 Aspex Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Technological Advancements in UPS Battery Systems

02-2729-4219

+886-2-2729-4219