|

市場調查報告書

商品編碼

1406288

採礦輸送帶 -市場佔有率分析、行業趨勢和統計、2024-2029 年成長預測Conveyor Belt In Mining Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

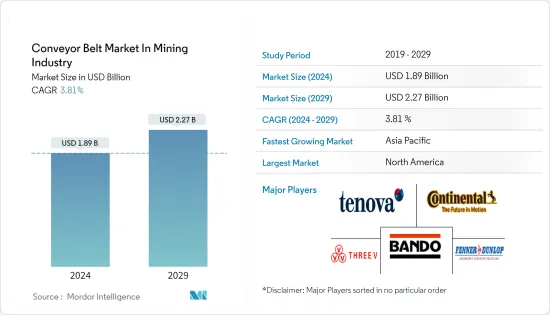

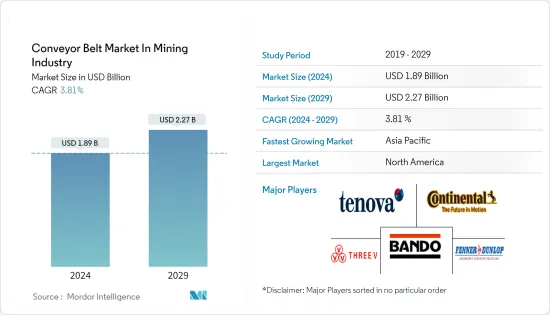

採礦輸送帶市場預計將從 2024 年的 18.9 億美元成長到 2029 年的 22.7 億美元,預測期內(2024-2029 年)複合年成長率為 3.81%。

採礦業嚴重依賴傳送帶來運輸提取的材料來加工。這就是為什麼該行業擴大投資輸送機,因為它們使工作更乾淨、更安全、更有效率。

主要亮點

- 例如,2021年10月,增強聚合物技術公司Fenner Precision Polymers宣布收購拉姆斯登公司(Lumsden Corporation),該公司是一家生產用於採石和採礦的工業傳送帶和金屬絲布以及相關解決方案的製造商。透過此次收購,芬納精密聚合物公司鞏固了其作為高度專業化輸送解決方案領先供應商的地位。這開啟了新的機遇,例如基礎設施、採礦和道路應用的金屬篩檢。

- 此外,美國著名的橡膠塗層纖維製造商 Chemprene LLC 將於 2021 年在紐約州 Beacon 投資 1400 萬美元建設一家工廠,生產輕質橡膠傳送帶、隔膜、塗層纖維和其他精密模壓產品。日程。該工廠還生產輕質橡膠輸送帶、塗層織物和模壓隔膜。這項投資將使公司能夠透過自動化和提高 225,000 平方英尺工廠的生產能力來提高效率。

- 在採礦業中,驅動技術對輸送機效能和系統運轉率有重大影響。事實證明,三相非同步馬達和齒輪箱堅固耐用、易於安裝且維護成本低。西門子等公司在散裝物料輸送技術方面擁有數十年的經驗。高運轉率、成熟的技術和低成本是此類應用的驅動解決方案的優勢。

- 在採礦實務中,所需的功率輸出和期望的採礦操作員指定轉速作為設計參數來確定散熱量。因此,在某些操作條件下,需要將齒輪單元的輸出增加到超出最初要求的水平。當輸送機在異常溫暖的氣候或冷熱差異極大的氣候下使用時,必須高度重視冷卻。為此,西門子為由 46 尺寸傳送帶驅動器組成的三個變速箱系列開發了高效能冷卻解決方案。因此,較小的齒輪裝置通常就足夠了。

- COVID-19 大流行對包括採礦業在內的所有行業的全球經濟產生了重大影響。與其他行業一樣,採礦業迫切需要遏制病毒在工人中的傳播,確保員工的安全和健康。

礦用輸送帶市場趨勢

纖維增強推動市場成長

- 纖維增強輸送帶通常用於磨蝕性負載和重負載。對於短運輸距離和低容量,它是鋼絲芯輸送帶的更實惠的替代品。在採礦、選礦和採石等大多數領域,纖維增強輸送帶都表現出色。可混合各種品質,包括耐油脂性、耐磨性、耐熱性、耐衝擊性和耐火性。

- 編織或織物帶汽車胎體的內部結構由一系列夾在橡膠基減震層之間的單層或多層合成纖維層組成。皮帶的上下兩側由耐磨、耐切割的橡膠覆蓋層組成。此蓋可保護輸送帶免受損壞,尤其是在輸送機裝載點。這為採礦業中使用的傳送帶提供了拉伸強度。

- 產業用紡織品中使用的合成纖維的強度、伸長率和彈性都高於先前使用的天然纖維。主要纖維有棉、黏膠人造絲、尼龍、聚酯、玻璃纖維、芳香聚醯胺等。芳香聚醯胺的韌性是鋼的七倍,而且芳香聚醯胺比鋼輕。耐400~500度C的溫度、耐濕氣、耐化學藥品,具有高耐磨性。因此,它被用於採礦輸送帶。

- 其強度極大地影響礦山產業輸送帶的承載能力和工作安全。因此,纖維增強輸送帶等材料有望變得更加普及,以提高輸送帶的強度。

- 輸送帶製造商還提供織物輸送帶表格,該表格反映了根據輸送帶上輸送的材料的不同類型和等級提案的輸送帶層數。紡織材料比輸送帶中的鋼增強材料更彈性、更節能、耐腐蝕、更高強度且更輕。隨著一些地區採礦活動的增加以及採礦投資的增加,對纖維增強輸送帶的需求預計將會增加。

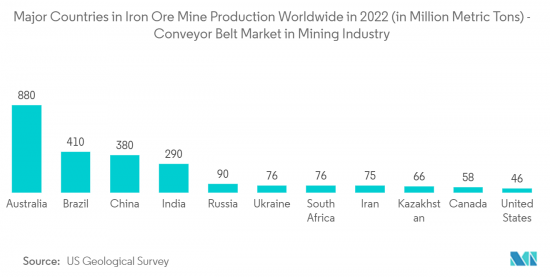

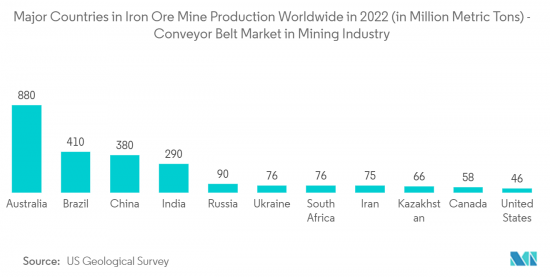

- 澳洲和巴西2022年鐵礦石產量分別為8.8億噸和4.1億噸,是生產率最高的國家之一。在澳大利亞,2022 年礦場生產了超過 8.8 億噸可用鐵礦石。此外,多個地點的採礦業正在發生各種發展,由於其廣泛的功能,預計將增加對某些類型的輸送機(例如纖維增強型)的需求。

- 此外,皮帶材料及其性能在過去幾年中發生了相當大的變化。對改善拉伸性能、耐磨性和更高經濟性的需求不斷成長,促使皮帶用戶與皮帶製造商和平面工程師合作,開發更堅固、更經濟的輸送帶。

北美市場佔有率佔據主導地位

- 由於輸送機的不斷採用,北美地區已成為輸送機的重要市場。傳送帶的成長依賴於該地區固有的採礦需求。根據BEA的數據,2022年美國GDP與前一年同期比較成長約7%。採礦業增加值付加最大,達51.7%。

- 美國地質調查局估計,2022 年美國礦山非燃料礦物產量超過 982 億美元,比 2021 年修正後的 946 億美元增加約 36 億美元。由於採礦活動的增加,預計未來採礦業對輸送機市場的需求將會很大。

- 在美國,政府透過行政命令對採礦業提供支持,包括開發重要礦物和監管變革,以支持營運。儘管如此,政府也正在投資創造市場需求的採礦活動。例如,2023年4月,作為拜登總統投資美國計畫的一部分,美國能源局(DOE)將從兩黨基礎設施法案中提供高達4.5億美元,用於投資現有和以前的礦場。宣布將發展清潔能源示範計劃。

- 此外,由於該地區採礦業投資的增加,預計在研究期間市場需求將大幅成長。例如,2023年6月,英澳礦業公司力拓宣布有意其位於美國猶他州肯尼科特工廠投資9.2億美元,以增加銅供應。除了露天礦業務外,力拓預計未來 10 年內 NRS 還將額外生產 25 萬噸銅。計劃於 2024 年開始生產。

- 加拿大是世界上採礦業最活躍的國家之一。根據加拿大礦業協會統計,加拿大在鈾、鎳、鉀、鈷、鋁、鑽石、鈦和黃金等13種主要礦產和金屬的生產方面名列前五名。

- 加拿大礦業協會預計,2021年採礦業將繼續在加拿大經濟中發揮重要作用,貢獻該國GDP的5%,即1,250億美元。這些功能為製造商提供了各種機會來改進其產品並滿足採礦業的輸送帶需求。

- 加拿大的採礦業是世界上最大的採礦業之一。據加拿大政府稱,加拿大在 6,500 個砂石、礫石和採石場以及 200 多個礦山生產 60 種礦物和金屬。 2021年,加拿大礦業產值為555億美元。此外,加拿大也核准到 2030 年在關鍵礦產計畫上支出約 38 億加元(28 億美元)。此類政府投資將加強該地區的採礦業,並需要使用傳送帶來實現其廣泛的應用。

礦山輸送帶產業概況

礦用輸送帶市場競爭激烈,退出障礙高。為了維持市場地位,公司不斷創新並建立策略夥伴關係。

- 2022 年 7 月 - 中國無錫博頓皮帶宣布推出世界上第一條碳中和輸送機,作為獨家計劃的一部分,將交付給智利必和必拓 Spence 銅礦。

- 2022 年 4 月 - Boehmer 集團推出適用於港口 U 型輸送機系列的混合輸送機技術。這項新技術利用了管道輸送機和槽式輸送機技術的現有專業知識。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 市場促進因素

- 基礎建設發展和建築業成長

- 日益重視職業安全

- 市場挑戰

- 高資本要求

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 類型

- 鋼絲

- 纖維增強

- 其他類型

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭形勢

- 公司簡介

- Zhejiang Sanwei Rubber Item Co. Ltd

- Fenner Dunlop Australia Pty Ltd(Michelin Group)

- Bando Chemical Industries Ltd

- ContiTech AG

- Tenova SpA

- Phoenix Conveyor Belt Systems GmbH

- Oriental Rubber Industries Pvt. Ltd

- Zhejiang Double Arrow Rubber Co. Ltd

- Bridgestone Group

- GKD Gebr. Kufferath AG

第7章 投資分析

第8章 市場機會及未來趨勢

The Conveyor Belt Market In Mining Industry is expected to grow from USD 1.89 billion in 2024 to USD 2.27 billion by 2029, at a CAGR of 3.81% during the forecast period (2024-2029).

The mining industry heavily relies on conveyor belts to transport materials taken for processing. Hence, the industry is witnessing an increase in conveyor belt investments as it makes operations cleaner, safer, and more productive.

Key Highlights

- For instance, In October 2021, Fenner Precision Polymers, a reinforced polymer technology company, announced the acquisition of Lumsden Corporation, a manufacturer of industrial conveyor belting and wire cloth for the quarry and mining industry and related solutions. The deal strengthens the position of Fenner Precision Polymers as a major supplier of highly specialized conveying solutions. It opens new opportunities like metal screening for infrastructure, mining, and road applications.

- Moreover, Chemprene LLC, a prominent maker of rubber-coated textiles in the United States, producing lightweight rubber conveyor belting, diaphragms, coated fabrics, and other precision molded products, plans to spend USD 14 million on its Beacon, New York, factory in 2021. Lightweight rubber conveyor belts, coated textiles, and molded diaphragms are also produced at the factory. The investment will enable the company to automate and increase production capacity at the 225,000-square-foot facility, resulting in increased efficiency.

- In the mining industry, drive technology significantly influences conveyor performance and system availability. Three-phase asynchronous motors plus gear units have proved a robust, quick-to-install, low-maintenance variant here. Players like Siemens have decades of experience in bulk material conveyor technology. High availability, proven technology, and low costs are the advantages of driving solutions for these applications.

- In mining industry practices, the required output and desired mining operator specify rotary speed as design parameters, determining the heat to be dissipated, which may strongly influence the dimensioning process. This has partly resulted in operating conditions that make a gear unit advisable larger than the output originally necessitates. If conveyor belts operate in climatic zones that are unusually warm or even inclined to extreme heat-cold fluctuations, a lot of attention must be paid to cool. For this reason, Siemens has developed correspondingly efficient cooling solutions for its three gear-unit series, comprising 46 conveyor belt drive sizes. So in many cases, a smaller gear unit may prove to be sufficient.

- The COVID-19 pandemic had significant impacts on the global economy across all industries, including mining. Like other industries, the mining industry is witnessing immediate challenges to stop the spread of the virus amongst the workers and ensure that the staff is safe and healthy.

Mining Conveyor Belt Market Trends

Textile Reinforced to Drive the Market's Growth

- Conveyor belts with textile reinforcement are typically used for abrasive and heavy-duty goods. They are a more affordable alternative to steel cord belts for shorter transporting distances and lesser capacities. For most sectors like mining, mineral processing, and quarrying, the textile-reinforced conveyor belt is excellent. It can be blended with many different qualities, such as covers that are grease, abrasion, heat, impact, and fire resistant.

- The internal structure of a textile or fabric belt carcass consists of a single or multi-layered series of synthetic fabric layers interlaced between rubber-based shock-absorbent layers. The top and bottom sides of the belt consist of hard-wearing, abrasion, and cut-resistant rubber covers. The covers protect the belt from damage, especially at the loading points of the conveyor. This provides the tensile strength to the conveyor belt used in the mining industry.

- The strength, extension, and flexibility of synthetic fibers used in technical woven fabrics are higher than natural fibers used earlier. The primary fibers are cotton, viscose rayon, nylon, polyester, glass, and aramid. The aramid tenacity is seven times that of steel, and aramid is lighter than steel. It resists temperatures of 400-500 ºC, dampness, and chemicals and has high abrasion resistance. Thus, it is used in mining conveyor belts.

- Their strength significantly influences the carrying capacity and operating safety of conveyor belts in the mining industry. Thus, materials like textile-reinforced conveyor belts are anticipated to become more prevalent to boost the conveyor belt's strength.

- The belting manufacturers also supply tables for fabric belting, reflecting the number of plies proposed for a belt based on the different types and grades of materials to be transported on the belt. The fabric material is better than steel reinforcement in conveyor belts as textiles make it much more flexible, energy-efficient, corrosion-resistant, high-strength, and lightweight. With the rising Mining activities across several regions and the increase in investments in the Mining industry, the need for Textile reinforced type conveyor belts is expected to rise.

- Australia and Brazil, which produced 880 million metric tons and 410 million metric tons of iron ore, respectively, in 2022, are among the countries with the highest production rates. In Australia, mines produced over 880 million metric tons of useable iron ore in 2022. Additionally, several locations are seeing a variety of developments in the mining industry, which is anticipated to increase demand for certain types of conveyor belts, such as the Textile Reinforced type, due to its extensive features.

- Also, belt materials and their properties have undergone considerable changes over the past years. The growing need for increased tensile properties, abrasion resistance, and higher economy has encouraged belt users to collaborate with belting manufacturers and plane engineers to develop tougher and more economical conveyor belting.

North America to Dominate Market Share

- The North American region has been a prominent market for conveyor belts owing to their continued adoption across the industry. The growth of conveyor belts has been dependent on the inherent demand for mining in the region. According to BEA, the United States GDP increased by around 7% in 2022 when measured in chained 2012 U.S. dollars compared to the previous year. The value added to GDP by the mining sector increased by the largest at 51.7%.

- U.S. Geological Survey estimated that U.S. mines produced non-fuel mineral commodities worth over USD 98.2 billion in 2022, an increase of about USD 3.6 billion above the 2021 revised total of USD 94.6 billion. As a result of increased mining activities, the conveyor belt market is projected to experience significant demand from the mining industry in the future years.

- In the United States, government support for mining through presidential orders, such as for essential minerals development or regulatory changes, has assisted the business. Despite this, the government is also investing in mining activities that produce market demand. For example, in April 2023, as part of President Biden's Investing in America plan, the U.S. Department of Energy (DOE) announced up to USD 450 million from the Bipartisan Infrastructure Law to develop clean energy demonstration projects on existing and former mine lands.

- Moreover, the demand for the market is anticipated to grow significantly throughout the study period as a result of the increased investments in the region's mining sector. For instance, the Anglo-Australian mining corporation Rio Tinto declared in June 2023 that it intended to invest USD 920 million at its Kennecott facility in Utah, U.S., to increase its supply of copper. In addition to open-cut operations, Rio Tinto anticipates the NRS to produce a further 250,000 tonnes of copper over the following ten years. Production is expected to begin in 2024.

- Canada is home to one of the most active mining industries in the world. According to the Mining Association of Canada, the country ranks in the top five members involved in producing 13 major minerals and metals, including uranium, nickel, potash, cobalt, aluminum, diamonds, titanium, and gold.

- According to the Mining Association of Canada, the mining sector continued to play a significant role in the Canadian economy in 2021, contributing USD 125 billion or 5% of the country's GDP. These capabilities give manufacturers various chances to improve their products and meet the demand for these belts in the mining industry.

- The mining sector in Canada is one of the biggest in the world. According to the Canadian government, Canada produced 60 minerals and metals at 6,500 sand, gravel, and stone quarries and over 200 mines. In 2021, Canada's mining production was worth USD 55.5 billion. Additionally, Canada approved spending roughly 3.8 billion Canadian dollars (USD 2.8 billion) on a crucial minerals plan through 2030. Such government investments will strengthen the mining sector in the area, necessitating the use of conveyor belts due to their widespread application.

Mining Conveyor Belt Industry Overview

The Conveyor Belt Market in Mining Industry is highly competitive with high barriers to exit of a firm from the industry. To retain their market position, the organizations keep innovating and entering into strategic partnerships.

- July 2022 - Wuxi Boton Belt Co, Ltd, based in China, announced the launch of the world's first carbon-neutral conveyor belts for delivery to BHP's Spence copper mine in Chile as a part of an exclusive project.

- April 2022 - BEUMER Group announced the launch of its hybrid conveyor technology under its U-Shape conveyor family for ports. The new technology leveraged its existing expertise in the pipe and troughed belt conveying technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Market Drivers

- 4.4.1 Rise in Infrastructure Development and Building Industry

- 4.4.2 Increased Emphasis on Workplace Safety

- 4.5 Market Challenges

- 4.5.1 High Capital Requirements

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Steel Cord

- 5.1.2 Textile Reinforced

- 5.1.3 Other Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Zhejiang Sanwei Rubber Item Co. Ltd

- 6.1.2 Fenner Dunlop Australia Pty Ltd (Michelin Group)

- 6.1.3 Bando Chemical Industries Ltd

- 6.1.4 ContiTech AG

- 6.1.5 Tenova SpA

- 6.1.6 Phoenix Conveyor Belt Systems GmbH

- 6.1.7 Oriental Rubber Industries Pvt. Ltd

- 6.1.8 Zhejiang Double Arrow Rubber Co. Ltd

- 6.1.9 Bridgestone Group

- 6.1.10 GKD Gebr. Kufferath AG