|

市場調查報告書

商品編碼

1406264

石油和天然氣行業主要自動化承包商 (MAC) -市場佔有率分析、行業趨勢和統計、2024-2029 年成長預測Main Automation Contractor (MAC) In Oil & Gas Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

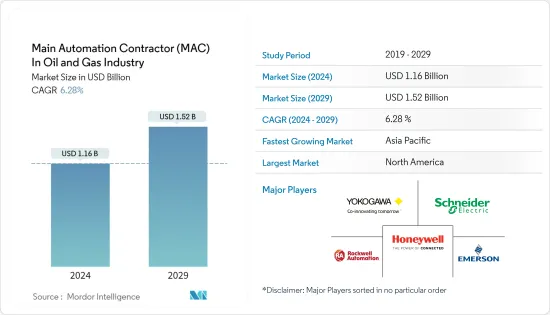

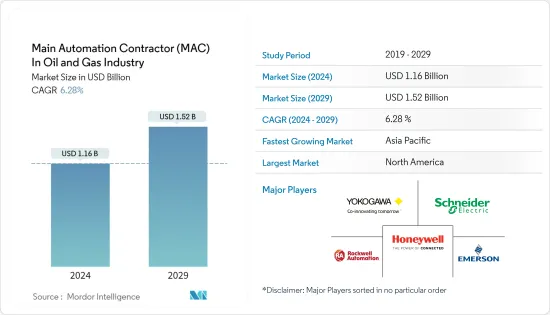

石油和天然氣產業的主要自動化承包商(MAC)將從2024年的11.6億美元成長到2029年的15.2億美元,預測期間(2024-2029年)複合年成長率為6.28%。

主要亮點

- 各終端用戶產業對石油和天然氣的需求不斷增加,以及對更高流程效率和營運效率的需求,顯著提高了機械化率和自動化解決方案的採用率,這將對石油和天然氣的成長產生積極影響。研究市場。給出。

- 在當今資訊主導的石油生產環境中,自動化的範圍正在擴大,在更靠近生產現場的地方進行更多資訊處理的情況非常重要。適當的生產和營運資料必須在石油生產系統和業務系統之間順暢流動。 MAC 的職責是設計、工程和交付所有自動化相關設備和程序,並確保這些系統安全可靠地整合,並得到必要服務的支援。

- 近年來,石油和天然氣行業自動化解決方案的普及達到了新的高度,刺激了對 MAC 服務的需求。例如,下游、中游和上游公司正在以各種方式將機器學習融入業務中,而這種成長可能會持續下去。也就是說,該產業必須採用新的營運方式。然而,最近的趨勢認知到自動化、人工智慧 (AI) 和機器學習 (ML) 等技術為該行業帶來的巨大潛力。

- 鑑於這些趨勢,供應商擴大與石油和天然氣公司合作提供 MAC 服務。例如,2022 年 6 月,ABB 與城市燃氣發行公司 Think Gas 合作,實現 Think Gas 燃氣網路的自動化營運,包括分佈在多個地點的眾多遠端終端。 ABB 建立了一個系統來監控、整合和控制整個公司的營運,實現工作流程自動化並幫助提高操作員安全。

- 此外,主要石油和天然氣公司已經看到了在各個行業實施MAC的顯著長期成果,並且有信心他們將能夠實施適當的管理、自動化/儀器、製造、執行工程師的選擇、設備安裝、設備試運行和售後支援工作順利進行,重點以MAC為手段,全面承擔計劃責任,並獲得滿意的效果。

- 然而,主要自動化承包商(MAC)實施成本仍然是所研究市場成長的主要課題。此外,MAC及相關解決方案缺乏標準化也是限制所研究市場成長的主要因素之一。

- 在 COVID-19 爆發之初,由於 MAC 供應鏈發生重大變化,以及人們日益推動向更清潔、更可靠和永續的能源來源轉型,各公司被迫調整自己的努力。事情已經完成了。然而,隨著自動化解決方案在新冠疫情期間證明了其優越性,許多石油和天然氣行業的供應商增加了對先進自動化解決方案的投資,預計將在預測期內為接受調查的市場創造機會。

石油和天然氣行業主要自動化承包商 (MAC) 市場趨勢

上游產業實現大幅成長

- 石油和天然氣行業的上游部門涉及多項鑽探活動,這些活動必須滿足嚴格的政府法規,並需要仔細規劃以降低營運成本。該行業經常處理大量空間資料來做出多項決策。該領域已採用多種流程自動化工具和分析引擎來充分利用空間資料的力量。

- 在英國,重大探勘活動帶來了格蘭多納等重要發現。據估計,格蘭德羅納是英國大陸棚1000 年來第五大傳統型天然氣蘊藏量。繼 Glendronach 取得成功之後,Total Energies 等公司正計劃在附近進行進一步的探勘活動,這可能成為上游石油和天然氣行業對自動化解決方案的重要需求來源。

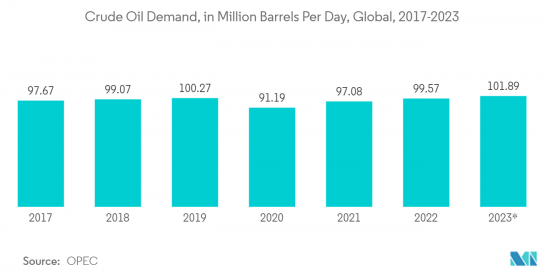

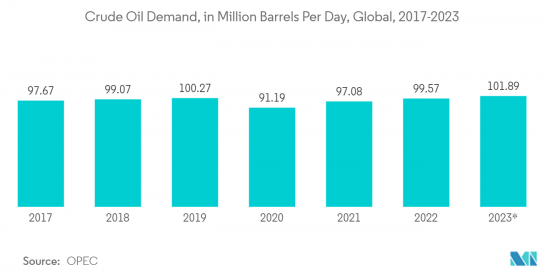

- 此外,石油和天然氣需求的成長也將推動所研究市場的機遇,因為它將顯著增加上游活動。例如,根據OPEC的預測,2023年全球石油需求預計將達到1.0189億桶/日。

- 油氣需求的增加也帶動了油氣產業上游領域的投資。例如,根據加拿大石油和天然氣生產商協會(CAPP)的數據,2023年上游石油和天然氣生產的投資預計將達到400億加元(294億美元),超過大流行前的水平。

- 同樣,在2019-2024年國家大陸棚石油和天然氣租賃計畫中,美國內政部計畫允許在約90%的現成礦區進行大陸棚探勘鑽探。該領域預計將為市場帶來新的機會。

中東和非洲錄得顯著成長

- 中東和非洲擁有強勁的石油和天然氣產業。近年來,該行業經歷了變化和課題,反映了全球趨勢。亞太地區的投資正在多元化,並且正在探索新的途徑,包括更複雜的海上和液化天然氣計劃。

- 目前正在進行多項投資以擴大該地區的石油和天然氣產能。例如,2023年1月,烏干達石油管理局開始了第一個石油鑽探計劃,目標是在2025年首次生產石油。 Kingfisher 油田是該國耗資 100 億美元的計劃的一部分,該計劃旨在開發該國艾伯特湖下的石油蘊藏量,並建造一條大型管道,透過坦尚尼亞的印度洋港口將原油運輸到國際上。

- 同樣,2022 年 9 月,阿拉伯聯合大公國宣布正在加快提高石油產能的計劃,以便在世界轉向清潔能源之前利用其石油蘊藏量。阿布達比國家石油公司 (Adnoc) 負責開採阿拉伯聯合大公國的大部分石油,該公司希望在 2025 年每天生產 500 萬桶石油。阿拉伯聯合大公國還計劃在石化燃料價格居高不下的情況下增加石油和天然氣銷售。

- 過去四十年來,沙烏地阿拉伯的石油和天然氣建設計劃迅速增加。朱拜勒和延布等工業城市是主要石油和天然氣開發計劃的所在地,包括工廠建設、石油和氣體純化、管道建設、鑽井設施、石化製造和其他公用事業。因此,中東和非洲地區活動的增加預計將在預測期內為主要自動化承包商(MAC)市場帶來機會。

石油和天然氣行業主要自動化承包商 (MAC) 概述

由於有許多在國內外提供解決方案的公司,石油和天然氣行業的主要自動化承包商(MAC)市場表現出中等競爭力。該市場表現出適度的集中度,主要行業領導者正在採取產品創新、併購、收購和合作夥伴關係等關鍵策略,以增強其解決方案並擴大其全球影響力。該市場的知名公司包括羅克韋爾自動化公司、施耐德電氣公司、橫河電機公司和霍尼韋爾國際公司。

2023 年 2 月,維美德和 Naizak Global Engineering Systems 簽訂了 Valmet DNA Automation Systems增值轉售商(VAR) 協議。該合約涵蓋沙烏地阿拉伯和巴林多個產業的應用,包括石油和天然氣、電力、用水和污水處理以及其他製程工業。兩家公司已宣布計劃建立專門的主要自動化承包商(MAC)團隊,旨在與主要分散式控制系統供應商進行有效競爭。

2022年10月,橫河電機作為主要自動化承包商(MAC)獲得了一份重要契約,負責在荷蘭鹿特丹港建造殼牌PLC荷蘭氫一號工廠。該工廠將利用離岸風力發電產生的電力來生產可再生氫氣。荷蘭氫氣一期工廠預計將於 2025 年開始運作,將成為歐洲最大的可再生氫氣生產設施。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 傳統方法與MAC方法(降低成本方法)的比較

- MAC最佳實踐

- 主要使用案例

第5章市場動態

- 市場促進因素

- 石油和天然氣公司越來越偏好 MAC 方法,以避免計劃管理和整合複雜性

- 市場課題

- COVID-19對市場的影響以及主要石油和天然氣公司的支出削減計劃

第6章市場區隔

- 依行業分類

- 上游(海上和陸上)

- 中產階級

- 下游

- 依計劃規模

- 中小型(500萬美元至3000萬美元)

- 規模大(超過3,100萬美元)

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Rockwell Automation Inc.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Honeywell International Inc.

- Emerson Electric Co.

- Siemens AG

- ABB Ltd

第8章投資分析

第9章市場的未來

The Main Automation Contractor In Oil & Gas Industry is expected to grow from USD 1.16 billion in 2024 to USD 1.52 billion by 2029, at a CAGR of 6.28% during the forecast period (2024-2029).

Key Highlights

- The growing demand for oil and gas across various end-user industries has significantly enhanced the rate of mechanization and the adoption of automation solutions, along with the demand for a higher process and operational efficiency, which positively influences the studied market's growth.

- With the increasing scope of automation in today's information-driven oil production environment, handling more information processing close to the production site is critical. Suitable production and operational data should flow smoothly between oil production and business systems. MAC's responsibility is to design, engineer, and deliver all automation-related equipment and procedures and ensure that these systems are integrated safely and securely and supported by necessary services.

- In the oil and gas industry, the penetration of automation solutions has been touching new heights in recent years, which is fueling the demand for MAC services. For instance, downstream, midstream, and upstream firms have integrated machine learning into their operations in many ways, which may continue to grow. Although, the industry needs to adopt new ways of operating. However, recent trends recognize the immense potential of technologies such as automation, artificial intelligence (AI), and machine learning (ML) can have on the industry.

- Considering such trends, vendors are increasingly entering into partnerships with oil & gas companies to offer MAC services. For instance, in June 2022, ABB partnered with Think Gas, a city gas distribution company, to automate operations across Think Gas' gas network, including many remote terminals spread across multiple locations. ABB created a system to monitor, integrate, and control operations across the company, automating workflows to support operators in improving safety.

- Furthermore, large oil and gas companies are focusing on leveraging MAC as a means of undertaking full project responsibility and delivering satisfactory results by facilitating proper management, automation/instrumentation, manufacture, selection of execution engineers, installation of equipment, commissioning equipment, and after-sales support as MAC implementation has demonstrated significant results in long-term, across various industries.

- However, the cost of implementation of the main automation contractor (MAC) continues to remain among the major challenging factors for the growth of the studied market. Furthermore, the lack of standardization of MAC and related solutions are also among the major restraining factors for the growth of the studied market.

- During the initial outbreak of COVID-19, companies were forced to coordinate their efforts due to the significant changes caused by the pandemic in the MAC supply chain and the growing movement to switch to cleaner, more dependable, and more sustainable energy sources. However, with automation solution proving their supremacy during the COVID period, a significant number of vendors operating in the oil & gas industry are anticipated to increase their investment in advanced automation solutions, creating opportunities in the studied market during the forecast period.

Main Automation Contractor (MAC) in Oil & Gas Market Trends

Upstream Segment to Witness Significant Growth

- The upstream sector of the oil and gas industry involves several drilling activities that must meet stringent government regulations and require intense planning to cut operational costs. Often, the industry deals with vast sets of spatial data to make several decisions. Several process automation tools and analytical engines are employed in the sector to harness the complete power of spatial data.

- Considerable exploration activity in the United Kingdom has led to crucial discoveries such as Glendronach, which is estimated to be the fifth-largest conventional natural gas reserve on the UK Continental Shelf in the millennium. Following Glendronach's success, companies such as Total Energies plan further exploration activities in the vicinity, which may be a significant source of demand for automation solutions from the upstream oil and gas sector.

- Furthermore, the growing demand for oil and gas also drives opportunities in the studied market as it significantly increases upstream activities. For instance, according to OPEC, the global crude oil demand is anticipated to reach 101.89 million barrels per day in 2023.

- The growing demand for oil & gas is also driving investments in the upstream segment of the oil and gas industry. For instance, according to the Canadian Association of Petroleum Producers (CAPP), oil and natural gas investment in upstream production is anticipated to reach CAD 40 billion (USD 29.4 billion) in 2023, surpassing the pre-pandemic levels.

- Similarly, under the National Outer Continental Shelf Oil and Gas Leasing Program for 2019-2024, the US Department of the Interior is planning to allow offshore exploratory drilling in about 90% of the Outer Continental Shelf acreage. The sector is expected to open up new opportunities to the market.

Middle-East and Africa to Register Considerable Growth

- Middle-East and Africa boast a robust oil and gas sector. In recent years, the industry has mirrored global trends and experienced changes and challenges. Investment across the Asia pacific region is becoming more diverse, and new avenues are being explored, such as more complex offshore and LNG projects.

- Several investments are being made for the region's oil and gas capacity expansions. For instance, in January 2023, the Petroleum Agency of Uganda launched its first oil drilling program to meet its target of first oil output in 2025. The Kingfisher field is part of a USD 10 billion scheme to develop the country's oil reserves under Lake Albert and build a vast pipeline to ship the crude internationally via an Indian Ocean port in Tanzania.

- Similarly, in September 2022, the United Arab Emirates announced that it is accelerating a plan to raise its oil production capacity as it attempts to leverage its crude reserves before the world transitions to cleaner energy. Abu Dhabi National Oil Co. (Adnoc), which pumps almost all the United Arab Emirates oil, wants to produce 5 million barrels daily by 2025. The United Arab Emirates also aims to sell more oil and natural gas while fossil fuel prices stay high.

- Saudi Arabia witnessed exponential growth in oil and gas construction projects in the last four decades. Major oil and gas development projects have been constructed in industrial cities, such as Jubail and Yanbu, including the construction of plants, oil and gas refineries, construction of pipelines, well oil setups for extraction, petrochemical manufacturing industries, and other utilities. Hence, the growing activities in the Middle East & African region are anticipated to drive opportunities in the main automation contractor (MAC) market during the forecast period.

Main Automation Contractor (MAC) in Oil & Gas Industry Overview

The automation contractor market in the oil and gas industry exhibits moderate competitiveness, owing to the presence of numerous players offering solutions both domestically and internationally. The market demonstrates a moderate level of concentration, with major industry leaders employing key strategies such as product innovation, mergers, acquisitions, and partnerships to enhance their solutions and expand their global presence. Prominent players in this market include Rockwell Automation Inc., Schneider Electric SE, Yokogawa Electric Corporation, and Honeywell International Inc.

In February 2023, Valmet and Naizak Global Engineering Systems inked a Value Added Reseller (VAR) Agreement pertaining to Valmet DNA Automation Systems. This agreement encompasses applications in various sectors, including oil, gas, power, water, wastewater, and other process industries in Saudi Arabia and Bahrain. Both companies have laid out plans to establish a dedicated Main Automation Contractor (MAC) team, with the objective of competing effectively with major distributed control system vendors.

In October 2022, Yokogawa Electric Corporation secured a significant contract as the main automation contractor (MAC) for the construction of Shell PLC's Holland Hydrogen I plant located in the Dutch port of Rotterdam. This plant is set to produce renewable hydrogen, utilizing electricity generated from an offshore wind farm. Upon its anticipated operational launch in 2025, the Holland Hydrogen I plant is poised to become the largest renewable hydrogen production facility in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Traditional Approach vs. MAC Approach (Cost Savings Approach)

- 4.4 MAC Best Practices

- 4.5 Key Use Cases

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Preference of Oil and Gas Companies for a MAC Approach to Avoid Project Management and Integration Complexities

- 5.2 Market Challenges

- 5.2.1 Impact of COVID-19 on the Market and Planned Spending Cuts from Major Oil and Gas Companies

6 MARKET SEGMENTATION

- 6.1 By Sector

- 6.1.1 Upstream (Offshore and Onshore)

- 6.1.2 Midstream

- 6.1.3 Downstream

- 6.2 By Project Size

- 6.2.1 Small and Medium (USD 5 million to USD 30 million)

- 6.2.2 Large (USD 31 million and Above)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 Schneider Electric SE

- 7.1.3 Yokogawa Electric Corporation

- 7.1.4 Honeywell International Inc.

- 7.1.5 Emerson Electric Co.

- 7.1.6 Siemens AG

- 7.1.7 ABB Ltd