|

市場調查報告書

商品編碼

1406237

汽車動力方向盤馬達:市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測Automotive Power Steering Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

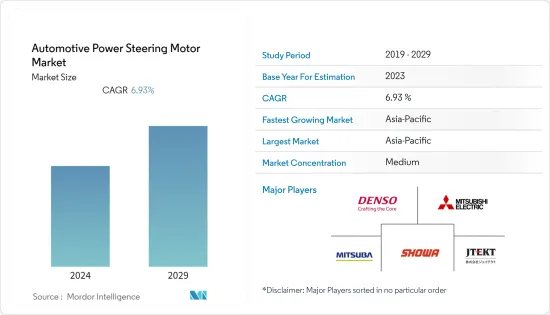

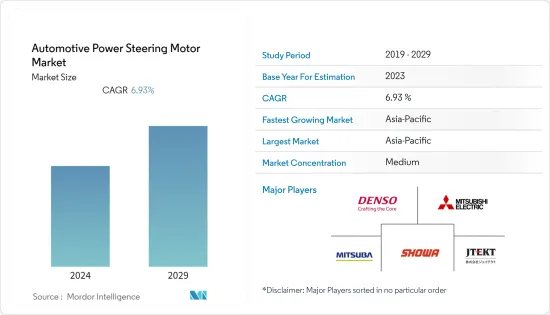

汽車動力方向盤馬達市場規模預計將從2024年的186.6億美元成長到2029年的248.9億美元,預測期間(2024-2029年)複合年成長率為6.93%。

由於對配備動力轉向系統的車輛的需求不斷成長,汽車動力方向盤馬達市場正在穩步成長。隨著消費者尋求駕駛舒適性和轉向簡單性更高的汽車,包括電動方向盤系統 (EPS) 在內的動力轉向系統現已成為許多汽車的標準配備。

按地區分類,亞太地區預計將主導汽車動力方向盤馬達市場。亞太動力方向盤馬達市場主要受到汽車產銷量增加、汽車快速電動、更嚴格的排放法規以及消費者可支配收入增加的推動。因此,隨著人們越來越追求安全和舒適,對汽車的需求也增加。

汽車動力方向盤馬達的市場趨勢

對配備動力轉向系統的車輛的需求增加

動力轉向系統顯著減少了輔導員轉動方向盤所需的體力。這使得車輛的操縱更加容易,特別是在低速行駛和停車時。駕駛因素是不需要對方向盤施力,這使得長時間駕駛不那麼累,讓更多的人更容易用車,包括那些對自己體力沒有信心的人。

消費者的偏好正在轉向具有先進功能的汽車,以提供更舒適、更方便的駕駛體驗。動力轉向系統滿足這些偏好並有助於提高車輛的整體品質。

動力轉向系統已成為許多現代汽車的標準配備,消費者也開始對它們抱持期待。汽車製造商透過將動力轉向系統涵蓋其車輛中來滿足這一需求,使其成為從緊湊型汽車到 SUV 和卡車等各個細分市場的標準配置或可用選項。

- 2022年10月,豐田開始量產搭載JTEKT格特線控轉向(SBW)技術的豐田bZ4X。

- 隨著中國對電動方向盤系統的需求增加,2022年8月,德國汽車零件供應商採埃孚將撥款4,742萬美元擴建其上海工廠。預計到 2024 年,這項投資將使電動輔助轉向系統的銷售額比現在增加超過 1.4 億美元。

預計亞太地區將在預測期內主導市場

亞太動力轉向市場主要由汽車產銷售的成長所推動。 APS 馬達不斷進步技術,以滿足政府安全標準和排放法規。該地區對 EPS 的需求不斷增加,導致OEM和汽車製造商推出配備 EPS 的新車並結成合作夥伴關係以增加市場佔有率。

快速都市化是許多亞太國家的突出趨勢。隨著人們遷移到都市區,對能夠在擁擠的城市街道上行駛且易於停車的汽車的需求不斷成長。使都市區駕駛更易於管理的動力轉向系統的需求很大。在亞太地區,人們對電動車和混合汽車(EV 和 HEV)的興趣與日俱增。其中許多車輛都配備了電動方向盤(EPS)系統,從而增加了對動力方向盤馬達的需求。

- 2022年9月,吉利汽車與海拉合作開發了一系列可量產的轉向線系統(SBW),計畫於2026年開始實施。

- 2021年11月,蒂森克虜伯擴大與常州國家高新區的合作關係,並重申承諾追加投資2億美元,在中國建立世界一流的汽車電子輔助轉向(EPS)系統工廠。

汽車動力方向盤馬達產業概況

汽車動力方向盤馬達市場適度整合,現有廠商佔據最大佔有率,同時也有新廠商進入市場。為了保持領先於競爭,公司正在建立合資夥伴關係並推出具有先進技術的新產品。例如

- 2022年,博世汽車轉向系統投資2,300萬美元,並投入1,800萬美元研發。此外,在過去 12 個月裡,該公司還迎來了 200 多名生產和支援職位的新員工。

- 2022年10月,蔚來汽車與採埃孚公司簽署策略合作協議,合作開發線控轉向(SBW)產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 易於轉向

- 市場抑制因素

- 成本和價格敏感性

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模)

- 按車型

- 小客車

- 商用車

- 按動力轉向類型

- 液壓動力方向盤(HPS)

- 電動方向盤(EPHS)

- 電動方向盤(EPS)

- 依產品類型

- 齒條輔助型(REPS)

- 立柱輔助型(CEPS)

- 小齒輪輔助型(PEPS)

- 依需求類別

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 墨西哥

- 阿拉伯聯合大公國

- 其他

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- JTEKT Corporation

- Nexteer Automotive

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- NSK Ltd

- Showa Corporation(Hitachi Astemo)

- Thyssenkrupp AG

- Delphi Automotive(Borgwarner Inc.)

- Hyundai Mobis Co. Ltd

- Mando Corp.

- DY Auto

- Denso Corporation

- Mitsubishi Electric

第7章 市場機會及未來趨勢

The Automotive Power Steering Motor Market size is expected to grow from USD 18.66 billion in 2024 to USD 24.89 billion by 2029, registering a CAGR of 6.93% during the forecast period (2024-2029).

The market for automotive power steering motors witnessed steady growth, driven by the increasing demand for vehicles equipped with power steering systems. As consumers seek vehicles with enhanced driving comfort and ease of steering, power steering systems, including electric power steering (EPS), became standard features in many automobiles.

Among regions, Asia-Pacific is anticipated to dominate the automotive power steering motor market. The Asia-Pacific power steering motor market is primarily driven by growing vehicle production and sales, rapid electrification of vehicles, rising stringency of emission norms, and increasing disposable income of consumers. It, in turn, is increasing the demand for vehicles, owing to the growing preference for safety and comfort.

Automotive Power Steering Motor Market Trends

Increasing Demand for Vehicles Equipped With Power Steering Systems.

Power steering systems significantly reduce the physical effort required by drivers to turn the steering wheel. It makes it easier to maneuver vehicles, especially at low speeds or when parking. Drivers no longer need to exert as much force on the wheel, reducing fatigue during long drives and making the vehicle more accessible to a broader range of individuals, including those with limited physical strength.

Consumer preferences shifted toward vehicles with advanced features that provide a more comfortable and convenient driving experience. Power steering systems align with these preferences and contribute to a positive perception of the vehicle's overall quality.

As power steering systems became standard features in many modern vehicles, consumers expect them. Automakers responded to this demand by incorporating power steering into their vehicle models, making it a standard feature or an available option across various segments, from compact cars to SUVs and trucks.

- In October 2022, Toyota commenced mass production of the Toyota bZ4X equipped with JTEKT's steer-by-wire (SBW) technology.

- In August 2022, with the increasing demand for electric power steering systems in China, German automotive supplier ZF is allocating USD 47.42 million for the expansion of a plant in Shanghai. The investment is projected to boost sales of electric power steering systems by more than USD 0.14 billion by 2024 compared to the current year.

Asia-Pacific Region Likely to Dominate the Market During the Forecast Period

The Asia-Pacific power steering market is primarily driven by growing vehicle production and sales. Technological advancements are being made to APS motors to meet government safety standards and emission norms. As the EPS demand increases in the region, OEMs and vehicle manufacturers are launching new vehicles with EPS and forming alliances to enlarge their market share.

Rapid urbanization is a prominent trend in many Asia-Pacific countries. As people move to urban areas, there is a growing need for vehicles that can navigate congested city streets and offer ease of parking. Power steering systems that make urban driving more manageable are in high demand. The Asia-Pacific region witnessed a growing interest in electric and hybrid vehicles (EVs and HEVs). Many of these vehicles are equipped with electric power steering (EPS) systems, contributing to the demand for power steering motors.

- In September 2022, Geely and Hella collaborated to develop a series of production-ready steer wire (SBW) systems with plans for its implementation starting in 2026.

- In November 2021, ThyssenKrupp extended its partnership with Changzhou National Hi-Tech District and reaffirmed its dedication to investing an extra USD 200 million to create a worldwide facility for automotive electronic power steering (EPS) systems in China.

Automotive Power Steering Motor Industry Overview

The automotive power steering motor market is moderately consolidated, with existing market players holding the most significant shares and new players entering the market. For the edge over competitors, companies are entering joint venture partnerships and launching new products with advanced technology. For instance,

- In the year 2022, Bosch Automotive Steering allocated USD 23 million towards investments and dedicated USD 18 million to research and development efforts. During the past 12 months, the company also welcomed over 200 new employees in production and support roles.

- In October 2022, NIO entered into a strategic cooperation agreement with ZF outlining their collaboration in the development of steer-by-wire (SBW) products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Ease of Steering

- 4.2 Market Restraints

- 4.2.1 Cost and Price Sensitivity

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Power Steering Type

- 5.2.1 Hydraulic Power Steering (HPS)

- 5.2.2 Electric Power Hydraulic Steering (EPHS)

- 5.2.3 Electric Power Steering (EPS)

- 5.3 By Product Type

- 5.3.1 Rack Assist type (REPS)

- 5.3.2 Column Assist type (CEPS)

- 5.3.3 Pinion Assist type (PEPS)

- 5.4 By Demand Category

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 US

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 UK

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 UAE

- 5.5.4.4 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 JTEKT Corporation

- 6.2.2 Nexteer Automotive

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 Robert Bosch GmbH

- 6.2.5 NSK Ltd

- 6.2.6 Showa Corporation (Hitachi Astemo)

- 6.2.7 Thyssenkrupp AG

- 6.2.8 Delphi Automotive (Borgwarner Inc.)

- 6.2.9 Hyundai Mobis Co. Ltd

- 6.2.10 Mando Corp.

- 6.2.11 DY Auto

- 6.2.12 Denso Corporation

- 6.2.13 Mitsubishi Electric