|

市場調查報告書

商品編碼

1406222

測試管理軟體:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Test Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

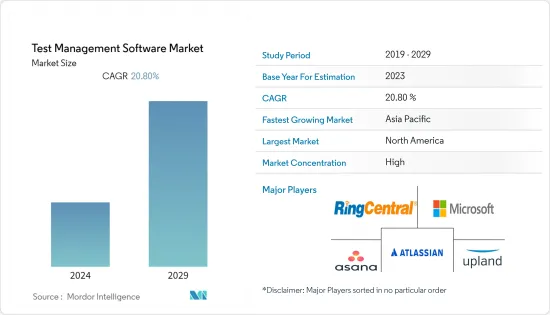

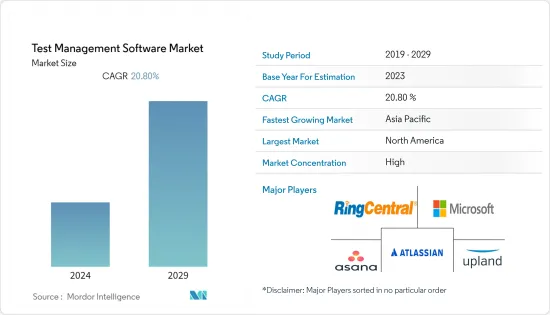

上年度測試管理軟體市值為8.7843億美元,預計未來五年將以20.8%的複合年成長率成長至27.5162億美元。

促進測試管理軟體市場成長的主要因素之一是許多公司擴大採用數位化、雲端運算技術進步、多點接觸點在一個平台上的快速整合,越來越需要分析大量的數據。大量的業務資料以產生增加的收益。

主要亮點

- 技術的快速進步導致團隊分佈在全球,增加了對測試管理軟體的需求,該軟體可以提供如此緊張的計劃進度所需的即時可見性。測試管理軟體集中管理和追蹤計劃進度,並透過更好的協作提高勞動力利用率。 Planview 進行的一項研究表明,59% 的 IT計劃由分散式團隊組成,計劃管理解決方案允許團隊線上上工作和協作,創建一個可供所有團隊成員使用的資訊輻射器。

- 此外,人工智慧在職場的日益滲透以提高組織生產力和效率正在推動測試管理軟體市場的發展。由人工智慧驅動的測試管理軟體可以有效地處理調度、提醒和跟進,無需人工輸入。透過幫助確保不遺漏任何內容,我們可以節省各種人力工作的時間。

- 此外,雲端部署有望成長,因為它們提供按需資源部署和消費敏捷性。企業更喜歡雲端部署,因為它們提供較低的資本和營運成本並且更容易存取。根據亞太經濟公司統計,APEC經濟體中小企業佔所有企業的97%以上。

- 然而,雲端基礎的測試管理軟體的快速普及引發了安全性問題,因為它使應用程式和網路面臨惡意程式碼和拒絕服務等安全威脅,從而導致資料遺失和洩漏。這種情況正在發生。因此,測試管理軟體的安全問題可能會阻礙市場的成長。

- 在 COVID-19 爆發期間,測試管理軟體發生了重大變化,其中包括機會和障礙。疫情迫使世界各地的企業和組織採用遠距工作安排,並以更虛擬和分散的方式管理活動和計劃。測試管理軟體的需求、功能和效能受到這種不斷變化的工作性質的顯著影響。

測試管理軟體市場趨勢

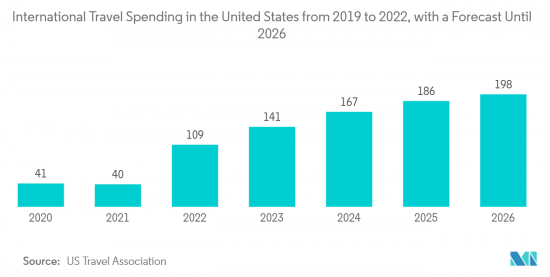

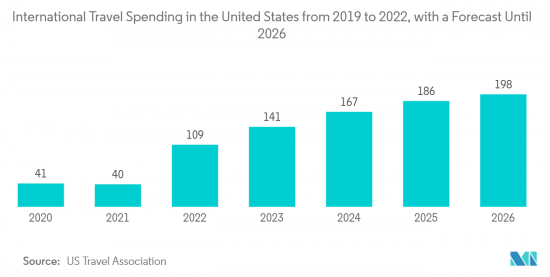

旅行和交流的成長預計將推動市場

- 旅遊業務需要營運機票預訂、酒店預訂、旅行計劃和支付等各種功能的部門和團隊之間的協作。為了促進此過程並減少時間限制內相互依賴和重複的風險,大多數大型供應商都依賴測試管理軟體。

- 此外,科技顛覆可能為旅遊公司帶來與客戶和收益流互動的新方式,包括 5G 技術的推出、人工智慧的發展和更好的語音搜尋。

- 為了成功地完成這項工作,團隊合作和溝通必須有效。透過提供共用工作區、任務註釋、文件共用和統一通訊功能等功能,測試管理軟體可實現無縫協作。這些工具可以增強團隊合作、鼓勵資訊共用並加快決策速度。

- 該公司現在專注於影片廣告、橫幅廣告、部落格和內容等數位行銷,以產生新的銷售線索,以維持其在市場中的地位。他們的行銷工作嚴重依賴測試管理軟體。隨著網路的普及和旅遊業內部競爭的加劇,在行銷和業務功能方面,市場力量被認為占主導地位。

- 測試管理軟體的擴充性和可自訂性使公司能夠隨著業務的成長而擴展它,並根據其獨特的需求進行客製化。您可以根據公司的需求定義角色和權限、建立任務範本並配置工作流程。由於其適應性,測試管理軟體被各種規模和行業的公司所使用,並且可以根據每個組織的需求和工作流程進行客製化。

北美預計將獲得主要市場佔有率

- 由於 BFSI、零售、IT 和電訊等各個行業擴大採用測試管理軟體,北美預計將成為一個重要的市場。在這些行業中,對有效追蹤和管理日常任務以及高度發展的IT基礎設施的需求不斷成長。該地區是技術採用和IT基礎設施最佳化的先驅。

- 該地區也是採用雲端服務的先驅。由於擴大採用雲端基礎的任務管理,該地區的市場預計在預測期內將成長。此外,測試管理軟體供應商在該地區擁有強大的影響力,為市場成長做出了貢獻。其中包括 Microsoft Corporation、Upland Software Inc.、RingCentral、Asana Inc. 等。

- 此外,根據美國小型企業管理局 (SBA) 的統計,美國有超過 302 億小型企業使用測試管理軟體來降低與其內部技術系統相關的複雜性。小型企業約占美國所有企業的 99.9%。因此,北美中小企業數量的增加預計將推動市場成長。

- 去年,LinearB 宣布與現代軟體團隊的協作之家 Clubhouse 建立合作夥伴關係。產品之間的技術整合透過關聯計劃、程式碼、Git 活動和版本的資料,為團隊提供詳細的計劃可見性和基於團隊的指標。

- 此外,任務軟體管理市場不斷湧現新的新興企業,該市場正得到不斷成長的區域投資的進一步支持。例如,去年 6 月,軟體新興企業Epsilon3 宣布已籌集 1,500 萬美元,用於擴展其管理太空計劃的解決方案套件。 A 輪資金籌措由現有投資者 Lux Capital主導,旨在支援 Epsilon3 的網路平台,該平台提供專門為太空船製造和營運設計的協作工具。我明白了。

測試管理軟體產業概述

測試管理軟體市場主要由微軟公司、Upland Software, Inc.、Atlassian Corporation, Inc.、RingCentral, Inc. 和 Asana Inc. 等幾家大公司主導。這些擁有顯著市場佔有率的領先公司致力於擴大海外基本客群。這些公司正在利用策略合作措施來提高市場佔有率和盈利。然而,隨著技術進步和產品創新,中小企業正在透過獲取新契約和開拓新市場來增加其市場佔有率。

- 2022 年 12 月 - 雲端 CRM 供應商 Simple Systems 宣布推出工作流程自動化功能,讓您在 CRM 中建立工作流程。無程式碼自動化功能利用圖形介面而不是傳統的電腦編碼。工作流程對於客戶關係管理系統中的各種流程非常有用,例如自動化宣傳活動和領先評分員的行銷工作。

- 2022 年 10 月 - Workflow Labs 是一家專注於透過自動化軟體解決方案幫助電子商務企業充分發揮潛力的公司,宣布推出其 HelpDesk 軟體的第一階段。 HelpDesk 是一款創新的電子商務工作流程管理工具,提供易於使用的儀表板,幫助在亞馬遜電子商務平台上開展業務的公司最大限度地減少在重複性任務上花費的時間,提高戰略可擴充性,並為成長創造時間。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 中小型企業快速採用雲端基礎的任務管理解決方案

- 測試管理軟體與第三方工具的整合度不斷提高,以及人工智慧和機器學習領域的技術進步

- 市場抑制因素

- 企業對安全和隱私的擔憂增加

第6章市場區隔

- 按成分

- 軟體

- 按服務

- 按組織規模

- 中小企業

- 主要企業

- 依部署型態

- 雲

- 本地

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 零售業

- 製造業

- 旅遊/旅遊

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Microsoft Corporation

- Upland Software, Inc.

- Atlassian Corporation, Inc.

- RingCentral, Inc.

- Pivotal Software, Inc.

- Asana, Inc.

- Azendoo SAS

- QuickBase, Inc.

- Redbooth, Inc.

- Workfront, Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Task Management Software Market was valued at USD 878.43 million in the previous year and is expected to grow at a CAGR of 20.8%, reaching USD 2751.62 million by the next five years. One of the major factors contributing to the growth of the task management software market is growing adoption of digitalisation by a lot of firms, tech advances in cloud computing, quick integration of multipoint touchpoints on one platform and greater need for an analysis of vast business data so that they can generate revenue increases.

Key Highlights

- Rapid advancement in technology has led to globally distributed teams and driven the requirement of task management software to provide the real-time visibility needed in such demanding project schedules. It helps enterprises centrally manage and track the scheduled advancement of the project and promote improved workforce utilization through better collaboration. According to the survey conducted by Planview, 59% of all IT projects consist of dispersed teams and use project management solutions that allow teams to work and collaborate online and make it possible to create information radiators available to all team members.

- Moreover, increasing penetration of artificial intelligence in the workplace to enhance the productivity and efficiency of the organization is driving the task management software market. Artificial intelligence-enabled task management Software is enabled to effectively handle schedules, reminders, and follow-ups and eliminate the need for human inputs. It can save humans time in their various efforts by helping to ensure that nothing is overlooked.

- Moreover, cloud deployment is expected to witness growth, as it provides the agility of on-demand resource deployment and consumption. Enterprise prefers the cloud deployment type, as it offers easy of access, along with reduced capital & operational expenses. According to Asia-Pacific Economic Corporation, SMEs account for over 97% of all businesses across APEC economies.

- However, the rapid adoption of cloud-based task management software has created security concerns as applications and networks are under persistent security threats such as malicious code and service denial that can lead to data loss and leakage. Thus, the task management software's security concern can hamper the market's growth.

- The task management software saw substantial changes during the COVID-19 epidemic, including opportunities as well as obstacles. Businesses and organizations all across the world were compelled by the epidemic to adopt remote work arrangements and manage their acctivities and projects in a more virtua and distributed way. The need for, features and capabilities of task managment software were significantly impacted by this change in the nature of work.

Task Management Software Market Trends

Rise in the Travel and Transportation are Expected to Drive the Market

- The business of travel requires that departments and teams operating a variety of functions, such as booking tickets, hotel reservations, transport plans or payments, work together. To facilitate this process and reduce the interdependence and risk of overlaps within time limits, a majority of major suppliers are relying on task management software.

- In addition, some technical disruptions which may lead to new ways for travel firms to interact with their customers and revenue streams include the deployment of 5G technologies, artificial intelligence developments, better voice search.

- To handle tasks successfully, teamwork and communication must be effective. By offering features like shared workspaces, task comments, file sharing and integrated communication capabilities, task management software enables smooth collaboration. These tools strenghthen teamwork, encourage information sharing and failitate quick decision-making, which boosts output and yeilds better project results.

- Businesses are now concentrating on digital marketing, e.g. video advertising, banner ads, blogs and content for generating new leads to retain their position in the market. For their marketing activities, they have a high degree of reliance on task management software. Due to increasing internet penetration and competition within the travel sector, it is estimated that market dominance will prevail with regard to marketing business functions.

- The scalability and customizability of task management software enables businesses to scale it as their operations expand and adjust it to their unique demands. According to their own needs, business can define roles and permission, build task templates and configure workflows. Due to its adaptibility, task management software may be used by businesses of different sizes and sectors and tailored to their own organizational needs and workflows.

North America is Expected to Witness Significant Market Share

- North America is anticipated to be a prominent market due to the growing adoption of task management software across various industries, like BFSI, retail, IT, and Telecom. There is an increasing demand among these industries to efficiently track and manage day-to-day tasks and highly evolving IT infrastructure. The region is a pioneer in technology adoption and IT infrastructure optimization.

- Also, the region is a pioneer in the adoption of cloud services. With the rise in the adoption of cloud-based task management, the market is expected to grow over the forecast period in the region. In addition, vendors of task management software have a strong presence in the region and contribute to the growth of the market.. Some include Microsoft Corporation, Upland Software Inc., RingCentral, and Asana Inc.

- Furthermore, According to the US Small Business Administration (SBA), more than 30.2 billion small businesses in the United States use task management software to reduce the complexity involved in internal technological systems. Small businesses comprise about 99.9% of all US businesses. Thus, the rise in the number of small and medium-sized companies in North America is expected to drive the market's growth.

- Organizations are looking forward to collaborating to enhance task management. prior to previous year, LinearB announced a partnership with Clubhouse, the collaborative home for modern software teams, By providing a full picture of the product and engineering lifecycles, this will allow software development teams to continuously improve project delivery. Technical integration between the products will offer teams detailed project visibility and team-based metrics by correlating data across projects, code, Git activity, and releases.

- Moreover, new startups are emerging in the task software management market and further getting support from rising regional investments. For instance, previous year in June, Software startup Epsilon3 announced that it had raised USD 15 million to extend its suite of solutions for managing space projects. The Series A financing round was been led by existing investor Lux Capital, to support Epsilon3's web based platform providing collaboration tools specifically designed for the manufacture and operation of spacecraft.

Task Management Software Industry Overview

The task management software market is concentrated and is dominated by a few major players like Microsoft Corporation, Upland Software, Inc., Atlassian Corporation, Inc., RingCentral, Inc, and Asana Inc. These significant players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- December 2022 - Cloud CRM vendor Simple Systems introduced a workflow automation feature that will enable users to create workflows in the CRM. The no-code Automation utilizes a graphical interface rather than traditional computer coding. For a large variety of processes in your customer relationship management system, including marketing activities carried out by Automated Campaigns and Lead Scorers, workflows can be very useful.

- October 2022 - Workflow Labs, a company focused on helping eCommerce businesses realize their full potential through automated software solutions, declared the launch of the first phase of its HelpDesk software. HelpDesk, an innovative eCommerce workflow management tool, is an easy-to-use dashboard that would enable businesses operating on the Amazon eCommerce platform to minimize the overall time spent on repetitive tasks, creating more time for strategic scalability and growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of Cloud-Based Solution for Task Management by SMEs

- 5.1.2 Increasing Integration of Task Management Software with Third-Party Tools and Technological Adavncement in Areas of AI and ML

- 5.2 Market Restraints

- 5.2.1 Increasing Security and Privacy Concerns Among Enterprises

6 MARKET SEGMENTATION

- 6.1 By Components

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Organization Size

- 6.2.1 Small & Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Deployment Mode

- 6.3.1 Cloud

- 6.3.2 On-Premise

- 6.4 By End-User Industry

- 6.4.1 BFSI

- 6.4.2 IT and Telecommunication

- 6.4.3 Retail

- 6.4.4 Manufacturing

- 6.4.5 Travel and Tourism

- 6.4.6 Other End-user Industries

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Microsoft Corporation

- 7.1.2 Upland Software, Inc.

- 7.1.3 Atlassian Corporation, Inc.

- 7.1.4 RingCentral, Inc.

- 7.1.5 Pivotal Software, Inc.

- 7.1.6 Asana, Inc.

- 7.1.7 Azendoo SAS

- 7.1.8 QuickBase, Inc.

- 7.1.9 Redbooth, Inc.

- 7.1.10 Workfront, Inc.