|

市場調查報告書

商品編碼

1406212

路線最佳化軟體:市場佔有率分析、產業趨勢與統計、2024年至2029年的成長預測Route Optimization Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

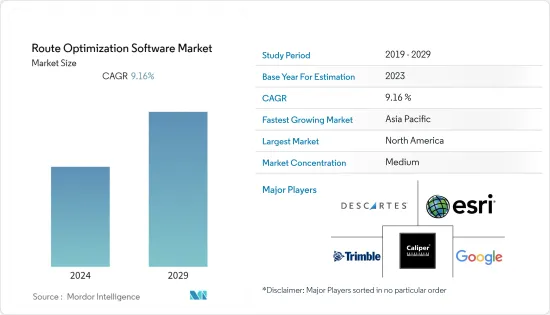

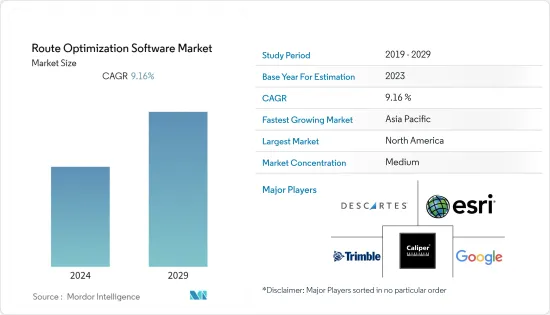

本會計年度路徑最佳化軟體市場規模預計為 35.2 億美元,預計到預測期結束時將達到 54.6 億美元,預測期內複合年成長率為 9.16%。

主要亮點

- 路線最佳化軟體可以規劃、安排和計算最高效的車輛路線,為您節省時間和金錢。如果您有多個站點、客戶會議或產品交付,路線最佳化軟體會派上用場。該軟體利用場景測試和歷史資料來確定哪些路線最慢或最堵塞,從而幫助避免交通堵塞。

- 在許多地區,物流專用解決方案正在興起。此外,物流業正在利用雲端平台和車隊管理工具。這使您能夠以最小的成本選擇路線最佳化。軟體供應商正在努力提供具有成本效益的根解決方案。該系統支援按月、季度、按年繳費。所有這些問題都促進了路線最佳化軟體的普及。物流解決方案是該領域的關鍵驅動力。該行業的另一個重要驅動力是新的重要競爭對手的引入。領先的公司正在開發新的軟體解決方案。它是基於區塊鏈、資料分析和其他技術構建的軟體。技術進步為車隊提供者提供了最佳化的路線。

- 例如,OnFleet 是一項全面的交付最佳化計劃,其中包括適用於最後一哩營運的各種規模企業的各種解決方案。此外,OnFleet 的網路平台允許使用者從各種最佳化選項、調度路線、向客戶發送交付通知等中進行選擇。此外,OnFleet 還提供以駕駛員為中心的路線規劃應用程式,具有導航和成功按時交貨所需的其他功能。另一方面,由於on-fleet專注於最後一公里,其在現場行銷、現場服務、現場銷售等其他面向現場的行業的應用受到限制。

- SaaS基礎設施的成長為該行業帶來了巨大的潛在機會。 SaaS 軟體對車隊管理的好處很多。此外,物聯網的興起可能在未來幾年加速。物聯網的使用增加創造了新的成長前景。物聯網正在演變成基於網路的服務。途徑最佳化是一種在預測期內促成變化的基於網路的服務。雲端基礎的解決方案的成本降低將創造進一步的成長機會。一個重要的雲端解決方案是途徑最佳化。由於資金籌措成本較低,未來幾年路線最佳化可能會變得更加容易。此外,對計程車和線上車輛服務不斷成長的需求將擴大未來的可能性。

- ENYP 為貧困個人和家庭提供生鮮食品。 COVID-19大流行迫使 ENYP 從食品服務轉型為以送貨為主的業務,並與 Route4Me 合作進行路線最佳化。特別是,ENYP 滿足了送貨服務需求成長 357% 的需求,同時減少了時間和差旅相關費用。 Route4Me的路線最佳化軟體使ENYP能夠快速過渡到基於交付的新營運模式,而無需投資各種資產、人員、卡車等。

- 路線最佳化軟體是一種先進的物流技術。此外,安全問題是該領域的固有障礙。路線最佳化軟體需要高速網路。此外,路線最佳化程序包含大量敏感資訊。軟體安全漏洞是該領域的一個挑戰。車隊管理也可用於交付高價值產品。由於與這些產品和服務相關的資料洩露,消費者面臨許多挑戰。這些障礙可能會阻礙預測期內整體路線最佳化市場的擴張。

路徑最佳化軟體市場趨勢

更多使用物流專用解決方案

- 物流和配送組織的路線規劃是型態先進的軟體程序,有助於最佳化運輸和交付業務。最佳路線由路線最佳化演算法確定,該演算法使用資訊更新、車輛尺寸和駕駛員時間表等即時資料。它還持續監控績效並報告駕駛員資訊、燃油效率、碳排放和其他公司關鍵績效指標。例如,路線規劃追蹤影響物流業務成長的各種 KPI。其中包括交貨時間、延誤、燃料成本、平均交貨時間和成本等。這些資訊使公司能夠專注於需要改進的領域。

- 線上銷售的成長可能為國內外物流企業創造機會,部署路線最佳化,為客戶提供更好的體驗。根據中國國家統計局統計,10年間,中國網路買家數量從2006年的不到3,400萬激增至超過4.66億,擴大了中國的電子商務業務。根據CNNIC(中國網際網路絡資訊中心)統計,截至2022年12月,中國約有8,4529萬人在網路上購買商品。

- 根據加拿大政府統計,加拿大製造業產值約1,740億美元,佔GDP總量的10%以上。加拿大製造商每年出口額超過3,540億美元,約佔出口總額的68%。此外,該國對專門從事電子商務的倉儲和物流行業的需求也很大。預計這些因素將增加所研究市場的需求。

- 2022 年 11 月,貨運管理軟體供應商 Carrier 物流, Inc. (CLI) 宣布推出新的路線邏輯和規劃最佳化解決方案。 CLI 可實現全面的碼頭最佳化,使車隊能夠以正確的順序為所有碼頭的所有客戶規劃所有貨物並放入正確的拖車中。 CLI FACTS 貨運管理系統的最新升級是一個人工智慧驅動的軟體模組,可協助貨運車隊營運商確定每輛卡車應裝載哪些貨物以及按什麼順序裝載,從而獲得專業設備、預約創建準確、全面最佳化的路線計劃,考慮一天中的時間、預測的交通量和商用車輛路線。

- 物流公司收益的增加可能會促進路線最佳化軟體的實施。例如,根據XPO Logistics的數據,這家總部位於美國的物流公司2022會計年度的總收益超過115.7億美元。它還允許路線最佳化參與者根據客戶需求開發解決方案並獲得市場佔有率。

預計北美將佔據最大的市場佔有率

- 在預測期內,北美地區預計將成為全球航線最佳化軟體市場的主導區域產業。北美在全球路徑最佳化軟體市場中的突出地位是由於提供路徑最佳化軟體解決方案的軟體供應商的高度普及以及該地區軟體提供商和交付服務供應商之間的合作而造成的。

- 該地區的客戶只需在行動電話上輕輕一按,即可使用按需送餐平台和應用程式從各種餐廳和食品連鎖店用餐。簡化的商務用車隊營運和食品供應鏈可視性有助於按需食品配送服務提供者吸引新客戶。食品宅配服務提供者使用路線最佳化軟體來檢查司機在長短路線上的進展,處理用餐的多個站點,並確保食品及時。

- 對路線最佳化軟體不斷成長的需求正在推動公司提供各種解決方案來佔領該地區的市場佔有率。例如,MapQuest 是一種受歡迎的免費網路地圖服務。儘管其支援能力與 Google Maps 和 HERE Technologies 類似,但 MapQuest 缺乏維持動態最後一哩路企業的能力。 MapQuest的Trip Planner包括基本的路線最佳化技巧和一些額外的路線規劃工具,但實用性有限。特別是,MapQuest 的路線規劃器僅允許使用者規劃最多 26 個站點的路線。因此,MapQuest 是最方便的路線規劃工具,有許多地點供個人使用和非商業司機使用,但不適合企業。

- 北美地區的公司越來越意識到透過將資料遷移到雲端而不是建置和維護新的資料儲存來獲得資金和支援的重要性,這增加了對雲端基礎的解決方案的需求,進而增加了獲得資金的重要性和支持。這正在推動該地區採用按需安全服務。雲端平台和生態系統預計將成為未來幾年數位創新爆炸性步伐和規模的跳板,因為它們具有多種優勢。

- 根據美國卡車運輸協會 (ATA) 的數據,卡車運輸業至少需要 50,000 名司機。美國卡車駕駛人的平均年齡為 55 歲(勞工統計局),因此隨著這些駕駛人的退休,短缺情況可能會進一步惡化。招募新司機是一項非常昂貴且艱鉅的挑戰,這使得路線規劃者充分利用現有司機變得比以往任何時候都更加重要。如此巨大的卡車時刻可能會為所研究的市場在該地區的成長創造機會。

路徑最佳化軟體產業概況

儘管路線最佳化軟體市場適度分散,但仍呈現出越來越多的成長機會。市場預計不斷有新進業者提供類似的路線最佳化軟體解決方案。隨著這些新進入者的出現,公司正在專注於產品創新以獲得競爭優勢。公司也認為資金籌措是擴大市場佔有率的一種有利可圖的方式。

2022 年 11 月,Carrier 物流, Inc. (CLI) 宣布推出新的路線邏輯和規劃最佳化解決方案,以實現全面的碼頭最佳化。此模組適用於零擔、最後一哩路和小包裹遞送服務,旨在提高效率和盈利。該系統與 CLI 的交叉轉運和堆場管理系統完全整合,提供了碼頭、對接門和裝載點所有拖車的全面可見性,並為協調交叉轉運活動和堆場移動提供了一種手段。

2022 年 5 月,全球車輛生命週期管理公司 Solera Holdings, LLC 發表了 Omnitracs One Route Modeling。 Omnitracs 單路線建模讓大型企業客戶在不中斷營運生產路線的情況下執行假設路線場景。因此,司機和當地調度可以在更短的時間內以更低的成本製定路線計劃。為 Omnitracs One 解決方案的使用者提供的路線建模允許駕駛員和車隊經理模擬停車順序、路線開始時間、行程前和行程後時間、休息和等待時間的變化。,您可以評估提案路線的影響關於成本和服務視窗。

2022年3月,高通與Trimble合作,為汽車原始OEM和層級供應商提供聯網汽車精準定位解決方案、進階駕駛輔助系統(ADAS)和自動駕駛解決方案。共乘應用程式提供精確定位 透過為智慧型手機帶來米級定位精度,駕駛人和乘客在使用即時導航應用程式時可以看到更多地圖細節和更準確的方向,您將能夠放心使用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 更多使用物流專用解決方案

- 降低硬體和連接成本

- 市場抑制因素

- 資料結構化和非結構化資料

第6章市場區隔

- 按最終用戶產業

- 按需食品

- 零售/快速消費品

- 現場服務

- 叫車服務和計程車服務

- 其他最終用戶產業

- 按組織規模

- 中小企業

- 主要企業

- 依部署型態

- 雲

- 本地

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Trimble, Inc.

- Caliper Corporation

- Descartes Systems Group Inc

- ESRI Global Inc,

- Google LLC(Alphabet Inc.)

- Llamasoft Inc.

- Microlise Group Limited

- Omnitracs LLC

- Ortec BV

- Paragon Software Systems PLC

- PTV Planung Transport Verkehr AG

- Route4me LLC

- Routific Inc.

- Verizon Connect Solutions Inc.

- WorkWave LLC

第8章投資分析

第9章市場的未來

The Route Optimization Software Market size is estimated at USD 3.52 billion in the current year and is expected to reach USD 5.46 billion by the end of the forecast period, registering a CAGR of 9.16% during the forecast period.

Key Highlights

- Route optimization software plans, schedules, and calculates the most efficient vehicle route, saving time and money. When there are several stops, client meetings, and product delivery, route optimization software comes in handy. This software aids in avoiding traffic congestion by utilizing scenario testing and historical data to determine which route is the slowest or busiest.

- Many regions are seeing an increase in logistics-specific solutions. Additionally, the logistics industry uses cloud platforms and fleet management tools. It enables them to select route optimization at a minimal cost. The software providers attempt to deliver cost-effective route solutions. This system supports monthly, quarterly, and yearly payments. All of these issues contribute to an increase in the popularity of route optimization software. The logistical solutions are the primary drivers of this sector. Another critical driver for this industry is the new vital competitors' introduction. The major players are developing new software solutions. It is software built on Blockchain, data analytics, and other technologies. The technology advancement provides fleet providers with optimized routes.

- For example, on fleet is a comprehensive delivery optimization program that includes a variety of solutions for every business size operating in the final mile. Furthermore, the Onfleet web-based platform allows users to select from various optimization choices, dispatch routes, and send delivery notifications to clients, among other things. Furthermore, Onfleet offers driver-focused route planner apps with navigation and other capabilities required for successful, on-time deliveries. Onfleet's unidimensional last-mile concentration, on the other hand, limits its applicability to other field-oriented industries such as field marketing, field service, field sales, and so on.

- SaaS infrastructure growth represents a significant potential opportunity for this sector. The benefits of SaaS software in fleet management are numerous. In addition, the IoT rise will accelerate in the following years. The increased Internet of Things usage will create new growth prospects. The Internet of Things is evolving into web-based services. One such web-based service that will contribute to change during the projection period is route optimization. The low cost of cloud-based solutions will create more growth opportunities. A critical cloud solution is route optimization. Low-cost financing will make route optimization easier in the following years. Furthermore, increased demand for cab and online vehicle services will expand future potential.

- ENYP delivers fresh food to underprivileged individuals and families. Due to the COVID-19 pandemic, ENYP was forced to transition from a food pickup service to a delivery-focused business, and they collaborated with Route4Me to optimize their routing operations. ENYP, in particular, strived to reduce time and travel-related expenses while keeping up with a 357% growth in demand for their delivery services. The route optimization software from Route4Me enabled ENYP to quickly transition to a new delivery-based operational model without investing in different assets, personnel, trucks, and so on.

- Route optimization software is an advanced logistics technology. Furthermore, security issues are essential obstacles in this sector. High-speed internet is required for route optimization software. In addition, the route optimization program contains a lot of sensitive information. In this sector, a security compromise in software is a challenge. Fleet management is sometimes used to deliver pricey products. The consumer will face numerous challenges due to data leaks concerning these products and services. These obstacles will likely stifle overall route optimization market expansion during the forecast period.

Route Optimization Software Market Trends

Increasing Use of Logistics-Specific Solutions

- Route planning for logistics and distribution organizations is a form of advanced software program that aids in transportation and delivery operation optimization. The optimum route is determined by route optimization algorithms using real-time data such as traffic updates, vehicle size, and driver schedules. It also continuously monitors performance, reporting driver information, fuel efficiency, carbon emissions, and other corporate KPIs. Route planning, for example, keeps track of various KPIs influencing the logistics business growth. These include delivery times, delays, fuel expenditures, and average delivery time and cost. With this information, businesses may concentrate on areas for improvement.

- Online sales rise would create an opportunity for local and international players logistics players to deploy route optimization to provide a better experience to the customer. According to China's National Bureau of Statistics, the number of Chinese online buyers rose rapidly from under 34 million in 2006 to over 466 million users a decade later, enabling China's e-commerce business to multiply. According to CNNIC (China Internet Network Information Center), around 845.29 million people in China had purchased goods online as of December 2022.

- According to the government of Canada, Canada's manufacturing sector accounted for approximately USD 174 billion, representing more than 10% of its total GDP. Every year, Canada's manufacturers export over USD 354 billion, making up about 68% of the country's total exports. There is also considerable demand from the warehousing and logistics sector dedicated to e-commerce activity in the country. These factors are expected to boost the need for the studied market.

- In November 2022, Carrier Logistics Inc. (CLI), a freight management software provider, introduced a new routing logic and planning optimization solution. It enables complete terminal optimization, allowing fleets to have every shipment for every customer at every terminal planned for the right trailer in the correct sequence very quickly and automatically. The AI-powered software module, the most recent upgrade to the CLI FACTS freight management system, assists trucking fleet operators in determining which deliveries should be loaded onto each truck and in what order, resulting in exact, fully optimized route plans that account for specialty equipment, appointment time windows, predicted traffic, and commercial vehicle routing.

- The revenue rise of logistics firms would enable them to deploy route optimization software. For instance, according to XPO Logistics, the US-based logistics company recorded a total revenue of over USD 11.57 billion in the fiscal year of 2022. It also allows route optimization players to develop solutions according to the customer's needs and capture the market share.

North America is Expected to Hold Largest Market Share

- Over the projected period, the North American region is expected to emerge as the dominant regional industry in the worldwide route optimization software market. North America's prominent industry positioning in the global route optimization software market can be attributed to several factors, including a high penetration of software vendors providing route optimization software solutions and an increasing number of collaborations between software providers and delivery service providers in the region.

- Customers in the region can order meals from various restaurants or food chains with a single tap on their mobile phones using on-demand food delivery platforms and applications. Simplified commercial vehicle operations and visibility into the food supply chain aid in acquiring new clients for on-demand food delivery service providers. Food delivery service providers could use route optimization software to verify the driver's progress on long and short routes, handle several stops for meal delivery, and ensure timely food delivery.

- The rise in route optimization software demand is driving firms to provide different solutions to capture the market share in the region. For example, MapQuest is a well-known free web mapping service. While similar in supported features to Google Maps and HERE Technologies, MapQuest lacks the capabilities to sustain a dynamic last-mile company. Although the MapQuest trip planner includes basic route optimization skills and a few more route planning tools, its utility is limited. MapQuest's route planner, in particular, only allows users to plan routes with up to 26 stops. As a result, MapQuest is the finest accessible route planner with many stops for personal use and non-commercial drivers, but it is not appropriate for businesses.

- The increasing realization among enterprises in the North American region about the importance of holding money and aid by moving their data to the cloud instead of building and maintaining new data storage is driving the demand for cloud-based solutions and, hence, the adoption of on-demand security services in the region. Owing to multiple benefits, cloud platforms, and ecosystems are anticipated to serve as a launchpad for an explosion in the pace and scale of digital innovation over the next few years.

- According to the American Trucking Association (ATA), the industry needs at least 50,000 drivers. The average age of US truck drivers is 55 (Bureau of Labor Statistics), so the shortage might worsen as these drivers retire. Attracting new drivers is highly expensive and challenging, so it is more critical than ever that route plans get the most out of the existing driver force. Such a vast truck moment would create an opportunity for the studied market to grow in the region.

Route Optimization Software Industry Overview

Route Optimization Software Market, despite being moderately fragmented, is increasing growth opportunities. The market is witnessing continuous new entrants offering similar route optimization software solutions. Due to these new entrants, companies are focusing on making product innovations to gain a competitive advantage. Also, the companies view fundraising as a lucrative way to expand their market presence.

In November 2022, Carrier Logistics Inc. (CLI) introduced a new routing logic and planning optimization solution that enables full terminal optimization, allowing fleets to very quickly and automatically have every shipment for every customer at every terminal planned for the right trailer in the right sequence. For less-than-truckload, last mile, and parcel delivery services, the module aims at improving efficiency and profitability. This system is integrated fully into CLI cross dock and yard management systems, which provide overall visibility of all trailers at terminals, docking doors, and loading points in addition to providing the means for coordinating Crossdock Activities with Yard Moves.

In May 2022, Solera Holdings, LLC, a global vehicle lifecycle management player, released Omnitracs One Route Modeling. Omnitracs One Route Modeling allows large business customers to run what-if routing scenarios without disrupting operational production routes. As a result, drivers and local dispatching may create route plans in less time and at a lower cost. Route Modeling, available to Omnitracs One solution users, allows drivers and fleet managers to simulate modifications to stop sequences, route start times, pre-end post-trip time, breaks, and layovers to assess the impact of a suggested route on cost and service windows.

In March 2022, Qualcomm and Trimble collaborated to provide high-accuracy positioning solutions for connected vehicles, Advanced DriverAssistance Systems (ADAS), and autonomous driving solutions to automotive OEMs and Tier 1 suppliers. By introducing meter-level location accuracy for smartphones with more accurate positioning for a ride-sharing app, both driver and rider can have a better experience with map detail and more precise directions when using real-time navigation applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impacts of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of Logistics-Specific Solutions

- 5.1.2 Declining Hardware and Connectivity Costs

- 5.2 Market Restraints

- 5.2.1 Handling Structured and Unstructured Data

6 MARKET SEGMENTATION

- 6.1 By End User Vertical

- 6.1.1 On-Demand Food Delivery

- 6.1.2 Retail and FMCG

- 6.1.3 Field Services

- 6.1.4 Ride Hailing & Taxi Services

- 6.1.5 Other End User Verticals

- 6.2 By Size of the Organization

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprises

- 6.3 By Deployment Mode

- 6.3.1 Cloud

- 6.3.2 On-Premise

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Trimble, Inc.

- 7.1.2 Caliper Corporation

- 7.1.3 Descartes Systems Group Inc

- 7.1.4 ESRI Global Inc,

- 7.1.5 Google LLC (Alphabet Inc.)

- 7.1.6 Llamasoft Inc.

- 7.1.7 Microlise Group Limited

- 7.1.8 Omnitracs LLC

- 7.1.9 Ortec BV

- 7.1.10 Paragon Software Systems PLC

- 7.1.11 PTV Planung Transport Verkehr AG

- 7.1.12 Route4me LLC

- 7.1.13 Routific Inc.

- 7.1.14 Verizon Connect Solutions Inc.

- 7.1.15 WorkWave LLC