|

市場調查報告書

商品編碼

1406114

廣播設備:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Broadcast Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

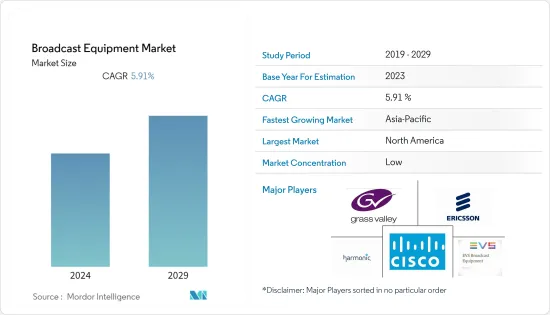

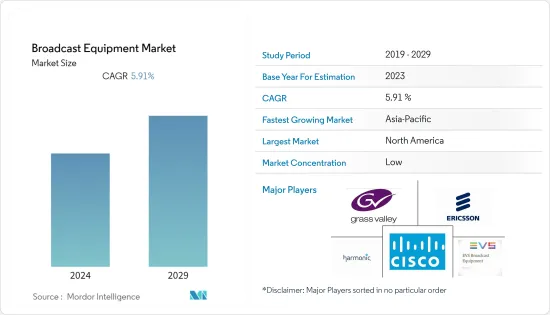

上年度廣播設備市場規模為48.9億美元,預計未來五年將達到68.8億美元,預測期內複合年成長率為5.91%。

隨著消費者的偏好從電視轉向數位媒體,廣播媒體保持相關性變得越來越困難,但至關重要。廣播電視形勢已經發生了巨大變化,必須適應時代趨勢。

過去幾十年來,消費者對更高品質影像和音訊的需求促使廣播設備產品和技術快速升級。隨著內容以 4K 和 UHD 格式製作,以相同格式進行廣播以提高觀看品質催生了 IP 直播製作技術。這對於現場製作非常重要,靈活高效的系統控制非常重要。

主要亮點

- 技術進步促使廣播公司提供優質用戶超高畫質輸出,刺激了市場成長。此外,數位頻道數量的增加以及擴大使用具有8K品質的體育廣播和4K品質的新聞廣播的尖端廣播設備正在促進市場成長的加速。

- 體育產業是全球電視觀眾最大的市場,並且正在尋找大規模分發影片內容的方法。設備和格式的激增給廣播公司、服務供應商、內容擁有者和權利持有者帶來了一些課題。租賃體育轉播設備產業也是轉播設備市場的重要收益來源。國際體育賽事的增加正在推動轉播設備租賃市場。

- 此外,收入的增加、耐用消費品購買量的增加以及快速且廉價的網際網路的可用性的增加可能會對市場成長產生積極影響。據印度 IBEF 稱,到 2024 年,電視將佔印度媒體市場的 40%,其次是數位廣告 (12%)、印刷媒體 (13%)、電影院 (9%) 以及 OTT 和遊戲產業 (8 %)。預計其次是廣告業(12%)、電影院(9%) 以及OTT 和遊戲產業(8%)。到2025年,連網智慧型電視數量預計將達到約4000-5000萬台。

- 數位音訊和影像格式的快速發展以及對製作和儲存數位影像和視訊的開放、國家或國際共識規範的需求是市場成長的課題。數位音訊和視訊的格式化和壓縮標準隨著數位技術的每一次進步而不斷發展。

- 儘管 COVID-19 存在不確定性,但市場處於有利位置,可以從經濟復甦以及產業向 IP 和雲端基礎的解決方案的過渡中受益。該行業已經達到了大多數廣播公司和媒體公司都開始採用新習慣和工作方式的地步。雲端基礎設施預計將支援遠端工作流程並消除對本地系統的依賴。對於廣播公司來說,疫情加速了分散式工作流程的採用,以提高營運敏捷性。無論是遠端製作、遠端協作還是遠端控制,相關人員都在利用 IP 串流技術與同事進行即時密切協作。

廣播設備市場趨勢

編碼器預計將經歷顯著成長

- 視訊編碼器將類比或數位視訊轉換為另一種數位視訊格式並將其傳送到解碼器。視訊編碼器輸入SDI作為未壓縮的數位視訊訊號,並將其轉換為用於電視廣播的H.264或HEVC。這些編碼器專為 ISR 和 IPTV 設計,通常接受模擬複合視訊、SDI 或乙太網路以及特定於應用程式的資料,透過無線或基於 IP 的網路傳輸到各種觀看和儲存設備。儲存設備。

- 對視訊進行編碼的目的是創建透過網路傳輸的數位副本。廣播公司可以根據其串流目標和預算選擇硬體或軟體編碼器。大多數專業廣播公司使用硬體編碼器,但由於價格昂貴,大多數初級到中級廣播公司使用直播編碼器軟體。

- 硬體編碼器和軟體編碼器在功能上非常相似,因為它們都獲取原始視訊檔案並將其轉換為數位檔案。硬體編碼設備僅用於編碼,而軟體編碼器與電腦的作業系統配合使用,因此編碼不是其主要功能。軟體編碼器具有圖形介面來管理轉換過程,使您可以控制位元率和流品質等因素。

- 隨著時間的推移,編碼器的效率顯著提高,為 HDTV 等現代格式和 H.264 等壓縮標準的成功做出了貢獻。目前,廣播環境中對編碼器的需求可分為三個主要領域:貢獻、初級分發和家庭分發。

- 2022 年 11 月,Z3 Technology LLC 宣布推出兩款全新的高品質、低頻寬H.265 視訊編碼器解決方案。這些創新系統是強大的 ZCube 編碼器產品線的一部分,專為工業視訊、電視牆、監控和其他低延遲視訊串流和錄製應用而設計。

- 同樣,2022年6月,Skywire Broadcast宣布與Kiloview達成策略合作夥伴關係,推出專業高階編碼P系列視訊編碼器設備,解決連接不良的問題。這款編碼器非常適合戶外直播和傳輸,例如音樂會、現場活動、現場廣播、體育賽事和緊急情況現場。

- 高畫質內容的採用、從類比廣播向數位廣播的轉變以及透過 OTT 平台輕鬆存取隨選節目都促使了對廣播設備的需求增加。此外,廣播平台正在使用視訊編碼器為其用戶提供更高的視訊質量,從而推動全球市場的發展。

預計亞太地區成長率最高

- 亞太地區包括中國、印度等人口密度高的國家。該地區是最早採用該技術的地區之一,高速網路普及越來越普遍。

- 根據思科估計,明年網路用戶數(%)可望達到72%。此外,廣泛的平均通訊速度預計將達到157.1Mbps,推動市場成長。

- 此外,根據財經新聞入口網站 Learn Bonds 最近的報告,亞洲佔全球網路用戶的一半。該地區擁有約23億網路用戶,佔全球網路普及的50.3%。

- 根據 GSMA 報告,不丹、伊朗、孟加拉和越南等國的行動普及最為顯著。該地區智慧型設備的普及也是推動該地區高等級音訊和視訊需求的因素之一。根據 GSMA 的數據,64% 的亞太地區居民已經擁有智慧型手機,預計到 2025 年普及將超過 80%。

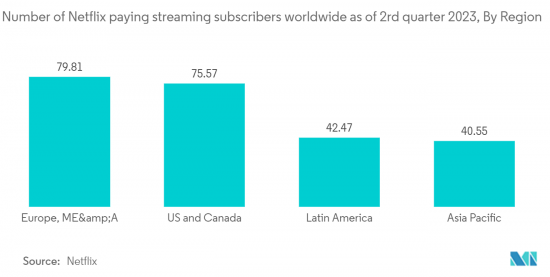

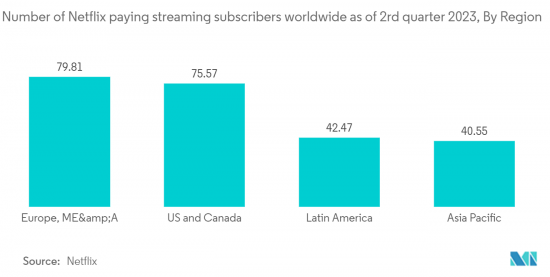

- 此外,Netflix於2023年3月宣布,計劃斥資約19億美元用於亞太地區的本地內容。預計與前一年同期比較企業收益將年增12%,達到40億美元以上,而2022年將成長9%。

- 當地供應商也在大力投資,以利用大流行帶來的機遇。 例如,去年 3 月,Signiant Inc. 宣佈收購嵌入式媒體處理軟體供應商 Kyno。 此次收購將有助於擴展其軟體定義內容交換(SDCX)SaaS平臺的功能,並整合與媒體資產互動的工具。 該平臺在全球擁有近 100 萬使用者,連接了 50,000 多家各種規模的媒體和娛樂公司。

廣播設備產業概況

廣播設備市場上各公司之間的競爭由價格、產品、市場佔有率和競爭強度決定。主要市場參與者包括思科系統公司、Telefonaktiebolaget LM Ericsson、Harmonic Inc.、Evs Broadcast Equipment Sa 和 Grass Valley。

2023年4月,思科宣布成為2023年國際足總女子世界盃的官方網路基礎設施供應商。該公司將提供一個安全的網路,連接整個奧運生態系統,從場館到活動、營運和媒體,並將促進預計全球 20 億人觀看的電視報道。

2023 年 4 月,Harmonic 宣佈在邁阿密、波士頓和舊金山等關鍵指定市場區域 (DMA) 推出 NEXTGEN TV 服務,使提供具有增強視訊品質和更高頻寬效率的 ATSC 3.0 頻道成為可能。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

- 研究框架

- 二次調查

- 初步調查

- 對資料進行三角測量並產生見解

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 由於多格式支持,對編碼器的需求不斷擴大

- 透過 OTT 服務擴展 D2C 供應

- SAAS 解決方案的採用率增加

- 市場課題/抑制因素

- 用於廣播的媒體格式和轉碼器缺乏標準化

第6章市場區隔

- 依技術

- 類比廣播

- 數位廣播

- 依產品

- 天線

- 交換器

- 影像伺服器

- 編碼器

- 發射機中繼器

- 其他

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Cisco Systems Inc.

- Telefonaktiebolaget LM Ericsson

- Evs Broadcast Equipment SA

- Grass Valley

- Harmonic Inc.

- Clyde Broadcast

- Sencore Inc.

- Eletec Broadcast Telecom Sarl

- AVL Technologies Inc.

- ETL Systems Ltd.

第8章投資分析

第9章市場的未來

The Broadcast Equipment Market size was valued at USD 4.89 billion in the previous year and is expected to register a CAGR of 5.91 % during the forecast period to become USD 6.88 billion by the next five years. With the change in consumer preference from TV to digital media, it is becoming increasingly difficult but essential for broadcast media to remain pertinent. The landscape of broadcast television is undergoing significant changes, and there is a need to adapt in order to stay current.

Over the last few decades, consumers' demand for better-quality video and audio has rapidly upgraded broadcast equipment products and technology. With content being produced in 4k and UHD formats, broadcasting in the identical format for enhanced viewing quality has resulted in IP live-production technology. This is significant for live production, where a premium is placed on flexible and efficient system control.

Key Highlights

- Technological advancement has further driven broadcasters to provide UHD output to their premium users, fueling market growth. Moreover, the rise in digital channels and the increasing utilization of cutting-edge broadcasting devices, featuring 8K video quality for sports coverage and 4K quality for news coverage, contribute to the acceleration of market growth.

- The sports section is the biggest market for TV viewers worldwide, finding ways to deliver video content at scale. The increasing number of devices and formats presents several challenges for broadcasters, service providers, content owners, and rights holders. The rental sports broadcast equipment sector is another significant revenue generator for the broadcast equipment market. The increasing number of international sports tournaments drives the rental market for broadcast equipment.

- Moreover, the rising income, increasing purchases of consumer durables, and the increasing availability of fast and cheap internet will positively impact the market growth. As per IBEF, India, television is projected to constitute 40% of the Indian media market in 2024, trailed by digital advertising (12%), print media (13%), Cinema (9%), and the OTT & gaming industries (8%), advertising (12%), cinema (9%), and the OTT and gaming industries (8%). By 2025, it is anticipated that the quantity of linked intelligent televisions will reach around 40-50 million.

- The rapidly developing nature of digital audio and video formats and the need for open, domestic, or international agreement norms for generating and preserving digital video and audio are challenging the market's growth. Norms for digital audio and video formats and compression methods are evolving with every new advancement in digital technology.

- Notwithstanding the uncertainties of COVID-19, the market was well-positioned to benefit from an economic revival and the industry transition to IP and Cloud-based solutions. The industry has reached a stage where new habits and means of working have settled for most broadcast and media organizations. Cloud infrastructure is expected to support remote workflows and eliminate dependency on on-premises systems. For broadcasters, the pandemic has accelerated the adoption of distributed workflows for greater operational agility. Whether for remote production, remote collaboration, or remote operation, broadcast professionals leverage IP streaming technology to collaborate closely with their peers in real time.

Broadcast Equipment Market Trends

Encoders is Expected to Witness Significant Growth

- Video encoders convert analog or digital video to another digital video format for delivery to a decoder. Video encoders input SDI as an uncompressed digital video signal into H.264 or HEVC for television broadcasting. These encoders are designed for ISR, and IPTV typically accepts analog composite video, SDI, or Ethernet, along with application-specific metadata, for transporting to different viewing or storage devices over a wireless or IP-based network viewing via computer monitors or for being captured by storage devices.

- The purpose of encoding a video is to create a digital copy transmitted over the internet. Broadcasters can choose between a hardware or software encoder, depending on the purpose of the stream and the budget. Most professional broadcasters use hardware encoders, but due to the high price point, most beginner-level to mid-experienced broadcasters go with live streaming encoder software.

- Hardware and software encoders function very similarly, as they both take RAW video files and convert them into digital files. Hardware encoding devices have the sole purpose of encoding, while software encoders work with a computer's operating system; thus, encoding is not the primary function. Software encoders have graphic interfaces to manage the conversion process and allow control over elements, such as bitrate and stream quality.

- The effectiveness of encoders significantly improved during the forecast, and it has played a role in the success of modern formats, like HDTV, and compression standards, like H.264. Currently, the demand for encoders in broadcast settings can be categorized into three key domains: contribution, primary distribution, and home distribution.

- In November 2022, Z3 Technology LLC announced the introduction of two new high-quality, low-bandwidth H.265 video encoder solutions. These innovation systems are part of the robust ZCube line of encoders designed for industrial video, video walls, surveillance, and other low-latency video streaming and recording applications.

- Similarly, in June 2022, Skywire Broadcast announced a strategic collaboration with Kiloview to launch a professional high-end encoding P series video encoder device to solve the poor connectivity issue. This encoder perfectly suits outdoor live streaming and transmissions in concerts, live events, field broadcasts, sports, emergency spots, etc.

- The adoption of high-definition content, the transition from analog to digital broadcasting, and easy access to on-demand content through OTT platforms contribute to increased demand for broadcast equipment. Furthermore, broadcasting platforms use video encoders to provide subscribers with improved video quality, driving the global market.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is home to some densely populated countries such as China and India. The region is one of the fastest adopters of technology with increasing high-speed internet penetration.

- According to Cisco estimates, it is expected that the number of internet users (%) will reach 72% in the coming year. Additionally, broad average speeds are expected to reach 157.1 Mbps, fueling the market's growth.

- Furthermore, according to a recent financial news portal Learn Bonds report, Asia accounts for half of the internet users worldwide. The region has about 2.3 billion internet users, with 50.3% of global internet penetration.

- Countries such as Bhutan, Iran, Bangladesh, and Vietnam are demonstrating the most significant mobile penetration advances, according to a GSMA report. The implementation of smart devices in the region is another factor fueling the demand for high-definition audio and videos in the region. As per GSMA, 64% of the residents in APAC already possess smartphones, and the adoption is expected to cross the 80% market by 2025.

- Furthermore, in March 2023, Netflix announced plans to spend approximately USD 1.9 billion on local content in the Asia-Pacific region. The company will likely grow revenue in 2023 by 12% year-on-year to exceed USD 4 billion compared with 9% growth in 2022.

- Local vendors are also investing heavily to capitalize on the opportunities brought by the pandemic. For instance, in March last year, Signiant Inc. announced the acquisition of Kyno, which provides embedded media processing software. The acquisition helps Signiant Inc. extend the functionality of the Software-Defined Content Exchange (SDCX) SaaS platform, incorporating tools for engagement with media assets. With almost one million users globally, the platform connects more than 50,000 Media & Entertainment companies of all sizes.

Broadcast Equipment Industry Overview

The competitive rivalry between various firms in the broadcast equipment market depends on price, product, or market share, along with the intensity with which they compete. Some major market players include Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Harmonic Inc., Evs Broadcast Equipment Sa, and Grass Valley.

In April 2023, Cisco announced that it became the Official Network Infrastructure Provider of the FIFA Women's World Cup 2023. The company will provide a safe network to link the complete tournament ecosystem, from the locations to activities to management to media, and facilitate the conveyance of the telecast, which is expected to be viewed by 2 billion individuals globally.

In April 2023, Harmonic announced the power of NEXTGEN TV services in major designated market areas (DMAs), including Miami, Boston, and San Francisco, enabling the delivery of ATSC 3.0 channels with enhanced video quality and greater bandwidth efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Encoders due to Support for Multiple Formats

- 5.1.2 Growing D2C Offerings through OTT Services

- 5.1.3 Increased Adoption of SAAS Solutions

- 5.2 Market Challenges/restraints

- 5.2.1 Lack of Standardization of Media Formats and Codecs Used for Broadcasting

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Analog Broadcasting

- 6.1.2 Digital Broadcasting

- 6.2 By Product

- 6.2.1 Dish Antennas

- 6.2.2 Switches

- 6.2.3 Video Servers

- 6.2.4 Encoders

- 6.2.5 Transmitters and Repeaters

- 6.2.6 Other Products

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Evs Broadcast Equipment SA

- 7.1.4 Grass Valley

- 7.1.5 Harmonic Inc.

- 7.1.6 Clyde Broadcast

- 7.1.7 Sencore Inc.

- 7.1.8 Eletec Broadcast Telecom Sarl

- 7.1.9 AVL Technologies Inc.

- 7.1.10 ETL Systems Ltd.