|

市場調查報告書

商品編碼

1406105

人工智慧基礎設施:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029AI Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

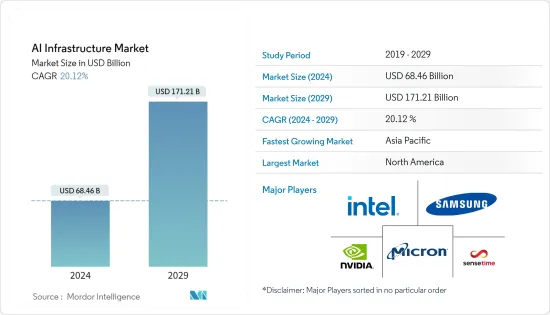

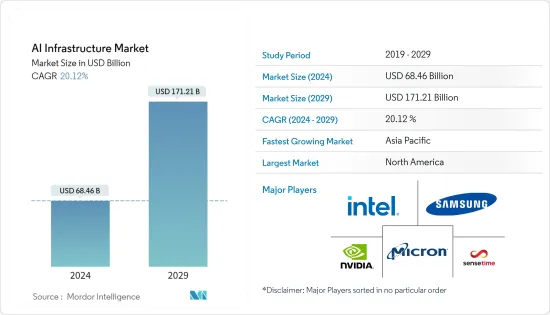

人工智慧基礎設施市場規模預計到2024年為684.6億美元,預計到2029年將達到1712.1億美元,在預測期內(2024-2029年)複合年成長率為20.12%。

主要亮點

- 近年來,隨著許多行業擴大採用人工智慧(AI)技術,全球人工智慧基礎設施市場出現了顯著成長。資料處理、訓練和推理只是人工智慧基礎設施中涉及的硬體、軟體和網路組件支援的部分人工智慧工作負載。

- 隨著多種來源資料的爆炸性成長和人工智慧演算法的改進,企業正在增加對先進人工智慧基礎設施的投資,以充分發揮人工智慧主導解決方案的潛力。雲端處理透過提供人工智慧即服務解決方案來實現人工智慧的民主化,該解決方案允許各種規模的企業啟動人工智慧應用程式,而無需對基礎設施進行大量的前期投資。

- 企業越來越認知到將人工智慧 (AI) 融入其業務流程的價值,因為自動化操作流程可以提高業務效率並降低成本。透過這種方式,公司正在利用自主流程來改善業務,改變他們為客戶服務的方式(例如透過人工智慧驅動的聊天機器人),並將創新推向新的高度。人工智慧是一組可以解決特定問題並在大量高品質巨量資料下發揮最佳作用的演算法。聊天機器人可以將企業的營運成本降低高達 30%。

- 此外,隨著IT策略的重點從資料管理轉向智慧型行動,企業越來越意識到人工智慧在支援人類解決問題、決策和創造性活動方面的作用。對於企業而言,人工智慧的採用和利用對於在競爭環境中持續成長至關重要,並且存在許多潛在的機會,包括利用人工智慧推動創新、建立網路以及識別和培育新發展的新機會。是機會。

- 人工智慧在眾多行業中的日益普及正在推動全球基礎設施人工智慧市場的顯著成長。然而,缺乏具有人工智慧技術經驗的合格人才是該行業面臨的最大問題之一。隨著企業和組織尋求利用人工智慧的潛力來刺激創新和實現競爭優勢,對人工智慧專業人才的需求不斷成長。

- COVID-19 大流行後,全球人工智慧基礎設施市場預計將見證重大的市場發展和創新。隨著企業不斷採用人工智慧技術,各行業對人工智慧基礎設施的需求仍將保持在高水準。該產業預計將由雲端基礎的人工智慧解決方案、邊緣人工智慧基礎設施和人工智慧即服務(AlaaS)服務主導。

AI基礎設施市場趨勢

企業作為最終用戶正在快速成長

- 人工智慧基礎設施市場的企業部分包括來自各個行業的公司,他們利用人工智慧來獲得相對於競爭對手的優勢、推動創新並提高業務效率。人工智慧正在徹底改變每個產業的業務營運和策略決策,從大型跨國組織到中小企業(SME)。

- 人工智慧技術為從汽車和資訊亭到公共電網和金融網路的一切領域帶來了新的自動化水平。然而,對於旨在實現世界自動化的公司來說,首先實現自身自動化變得極為重要。隨著資料負載變得更大、更複雜,以及基礎設施本身從資料中心擴展到雲端和邊緣,這些新環境的配置、最佳化和退役速度似乎將迅速超過人類操作員的能力。這意味著現場層面將非常需要人工智慧來滿足人工智慧舉措的需求。

- 此外,如果世界各地的企業要成功從型態營運向全數位化型態轉型,人工智慧將發揮關鍵作用。在自動化基礎設施支援、安全、資源配置和其他關鍵活動方面,人工智慧的價值無可估量。該技術的主要優點是,它可以比手動方法更快、更準確地分析大型資料集,為決策者提供對影響業務的隱藏因素的精細洞察。

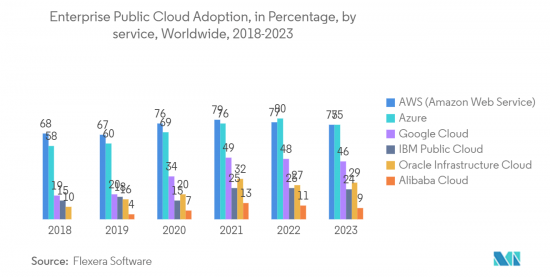

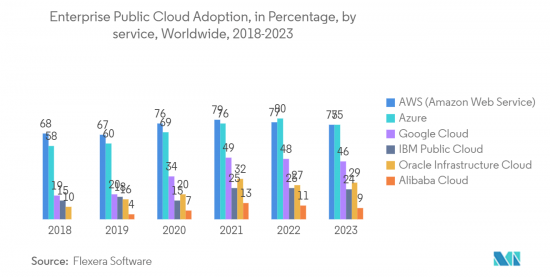

- 根據Flexera Software的數據,75%的企業受訪者表示他們將在2023年採用Microsoft Azure作為其公共雲。 AWS,Microsoft Azure和Google Cloud被稱為超大規模供應商,是世界上最大的雲計算平臺供應商。 企業 AI 基礎設施市場是影響 AI 快速採用的關鍵因素之一。 各行各業的企業都在利用人工智慧來提高生產力、改善客戶服務並實現戰略目標。 企業在決定人工智慧驅動的創新在未來將如何發展方面至關重要,有助於鞏固人工智慧作為革命性技術的地位,使公司能夠在數據驅動的環境中蓬勃發展。

北美佔據主要市場佔有率

- 由於美國各行業採用人工智慧基礎設施,並得到人工智慧處理器市場發展的支持,北美地區對市場佔有率做出了重大貢獻,並推動了市場成長。

- 近年來,人工智慧基礎設施的普及令人矚目,為許多領域和應用帶來了變化。美國人工智慧基礎設施市場向廣泛的受訪者開放,包括科技巨頭和大型科技公司、新興企業和雲端服務供應商,他們希望部署人工智慧(AI)技術來滿足企業的特定需求。事實上,他們正在競相提供先進的解決方案。

- 亞馬遜網路服務(AWS)、微軟Azure、Google雲端平台和IBM等服務供應商正在為AI基礎設施市場做出貢獻。這些大型科技公司提供廣泛的人工智慧專用硬體加速。其廣泛的全球基礎設施使各種規模的公司能夠以付費使用制存取人工智慧資源,從而使人工智慧的採用變得更加容易。

- 此外,政府投資和舉措、高科技新興企業以及醫療保健和企業等多個領域的基礎設施發展正在進一步推動人工智慧基礎設施市場的成長。人工智慧的發展和應用正在塑造美國技術格局的未來,並可能在預測期內提振市場。

- 近年來,由於技術進步,加拿大人工智慧基礎設施市場顯著成長。人工智慧的使用正在改變該國多個行業的業務運作方式。隨著企業抓住人工智慧在提高效率、生產力和客戶體驗方面的巨大潛力,對強大人工智慧基礎設施的需求不斷增加。加拿大人工智慧基礎設施市場的成長是由最終用戶的企業所推動的。

- 在金融領域,加拿大銀行率先採用人工智慧技術來最佳化流程、改善客戶體驗。人工智慧驅動的應用程式、虛擬援助和其他解決方案管理客戶查詢。隨著這些金融機構加強人工智慧力度,對高效能運算和資料儲存能力等人工智慧基礎設施的需求不斷增加。

AI基礎設施產業概況

人工智慧基礎設施市場由專注於在競爭激烈的市場空間中獲得差異化點的全球參與者組成。此外,Cerebra Systems 和 Graphcore 等 AI 基礎設施市場的新興企業正在提供專門的 AI 加速器產品,以與 NVIDIA 和 Google 等老牌巨頭競爭。該市場的特點是產品差異化程度適中,產品普及不斷提高,市場競爭激烈,技術創新不斷進步。

2023 年 6 月,英特爾發布了第四代英特爾至強可擴充處理器、英特爾至強 CPU Max 系列和英特爾資料中心 GPU Max 系列。這些先進產品旨在大規模解決和克服複雜的運算課題。英特爾的方法將 CPU 核心與專為特定工作負載量身定做的專用加速器結合起來,以提供更高的效能和效率,最終實現最佳的總體擁有成本 (TCO)。

2023 年 7 月,NVIDIA 宣布 NVIDIA DGX Cloud 現已廣泛使用,提供強大的工具,幾乎可以將任何企業轉變為人工智慧主導的組織。該服務具有可透過 Oracle 雲端基礎架構存取的數千個 NVIDIA GPU,可供立即使用。此外,美國和英國均設有 NVIDIA 基礎設施,為人工智慧舉措提供進一步的可及性和支援。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 消費者議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 高效能運算資料中心對人工智慧硬體的需求增加

- 擴大工業物聯網和自動化技術的應用

- 拓展機器學習與深度學習技術的應用

- 汽車和醫療保健等行業產生的大量資料

- 市場抑制因素

- 該行業缺乏熟練的專業人才

第6章市場區隔

- 依產品

- 硬體

- 處理器

- 貯存

- 記憶

- 軟體

- 硬體

- 依發展

- 本地

- 雲

- 混合

- 依最終用戶

- 企業

- 政府

- 雲端服務供應商

- 依地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 韓國

- 日本

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 以色列

- 南非

- 其他中東/非洲

- 北美洲

第7章 競爭形勢

- 公司簡介

- Intel Corporation

- Nvidia Corporation

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- Sensetime Group Inc

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Amazon Web Services Inc.

- Cisco Systems Inc.

- Arm Holdings

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Advanced Micro Devices

- Synopsys Inc.

第8章投資分析

第9章市場的未來

The AI Infrastructure Market size is estimated at USD 68.46 billion in 2024, and is expected to reach USD 171.21 billion by 2029, growing at a CAGR of 20.12% during the forecast period (2024-2029).

Key Highlights

- Due to the growing adoption of artificial intelligence (AI) technologies across numerous industries over the past few years, the global AI infrastructure market has grown impressive. Data processing, training, and inference are just a few of the AI workloads supported by the hardware, software, and networking components involving AI infrastructure.

- Businesses are investing more and more in advanced AI infrastructure in an effort to fully realize the potential of AI-driven solutions due to the explosion of data from multiple sources and improvements in AI algorithms. Cloud computing has played a crucial part in democratizing AI by providing AI-as-a-service solutions that allow businesses of all sizes to launch AI applications without making major upfront infrastructure investments.

- Enterprises increasingly recognize the value of incorporating artificial intelligence (AI) into their business processes, as they improve operational efficiency and reduce cost by automating process flows. Thus, companies have been using autonomous processes to improve operations and change the face of customer service (for example, through AI-powered chatbots) while spurring innovation to new heights. AI is a set of algorithms that can solve a specific set of problems and works best with a significant volume of high-quality Big Data. Chatbots can cut down the operational costs for businesses by up to 30%.

- Furthermore, as the focus of IT strategy moves from data management to intelligent action, enterprises have been increasingly recognizing the role of AI in supporting humans in problem-solving, decision-making, and creative endeavors. Enterprises recognize that implementing and using AI is critical for their continued growth in the competitive environment, with many potential opportunities, such as new opportunities using AI to drive innovation, make connections, and identify and foster new developments.

- The increasing implementation of artificial intelligence across numerous industries is driving the huge rise of the global market for AI in infrastructure. However, the lack of qualified personnel with experience in AI technology is one of the biggest issues this industry has to deal with. The need for competent AI specialists has increased as businesses and organizations try to take advantage of AI's potential to spur innovation and achieve a competitive edge.

- The global AI infrastructure market is anticipated to experience substantial development and innovation post the COVID-19 pandemic. Businesses will continue to adopt AI technology, which will keep demand for AI infrastructure high across all sectors. The industry is expected to be dominated by cloud-based AI solutions, edge AI infrastructure, and AI as a Service (AlaaS) services.

AI Infrastructure Market Trends

Enterprises to be the Fastest Growing End User

- The AI infrastructure market's enterprise segment includes a wide range of businesses from various sectors that are using AI to gain an advantage over rivals, spur innovation and improve operational efficiency. AI is revolutionizing corporate operations and strategic decision-making across all industries, from huge multinational organizations to small and medium-sized enterprises (SMEs).

- Artificial intelligence technology has brought new levels of automation to everything ranging from vehicles and kiosks to utility grids and financial networks. However, it has become crucial for the enterprise aiming to automate the world to automate itself first. As data loads become larger and more complex and the infrastructure itself extends beyond data centers into the cloud and edge, the speed at which these new environments are provisioned, optimized, and decommissioned will rapidly exceed the capabilities of human operators. This means AI will be highly required on the ground level to handle the demands of AI initiatives.

- Further, if enterprises around the globe want to successfully carry out their transformation from traditional modes of operation to fully digitized ones, AI will play a crucial role. AI is invaluable when it comes to automating infrastructure support, security, resource provisioning, and a host of other critical activities. The major advantage of this technology is its capability to analyze massive data sets at higher speeds and greater accuracy than manual processes, offering decision-makers granular insight into the otherwise hidden forces affecting their operations.

- According to Flexera Software, 75% of enterprise respondents indicated adopting Microsoft Azure for public cloud usage in 2023. AWS, Microsoft Azure, and Google Cloud, or hyper scalers, are among the highest cloud computing platform providers worldwide. The market for AI infrastructure for businesses is one of the key factors influencing the rapid use of AI. Businesses in a variety of sectors are using AI to boost productivity, increase customer service, and accomplish strategic goals. Enterprises will be essential in determining how AI-driven innovations will develop in the future, helping to solidify AI's status as a revolutionary technology that enables companies to succeed in a data-driven environment.

North America to Hold Major Market Share

- The North American region is contributing a significant portion to the market share due to the adoption of AI infrastructure in various industries in the USA, which is supported by the development of AI processors, and fueling the market's growth.

- Recently, AI Infrastructure has significantly increased in popularity, changing numerous fields and applications. The AI Infrastructure market in the United States is characterized by a broad set of respondents, including tech giants or Big Techs, startups, and cloud service providers competing to provide creative and advanced solutions that address the specific demands of enterprises looking to deploy artificial intelligence (AI) technologies.

- Cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, IBM, and others contribute to the AI Infrastructure market. Such Big Tech firms provide a wide range of AI-focused hardware acceleration. Their extensive worldwide infrastructure allows businesses of all sizes to access AI resources on a pay-as-you-go-basis, making AI adoption more accessible.

- Furthermore, government investment and initiatives, tech startups, and infrastructure development in multiple sectors such as healthcare, enterprises, and others further fuel the growth of the AI Infrastructure market. AI development and applications are shaping the future of the United States' technological landscape and will boost the market in the forecast period.

- The AI Infrastructure market in Canada has grown significantly in recent years due to technological advancements. The use of AI is changing the way business function in the country across multiple industries. As businesses grasp AI's enormous potential to improve efficiency, productivity, and customer experience, the demand for robust AI Infrastructure has increased. Enterprises, by End Users, are driving the growth of the AI Infrastructure market in Canada.

- In the financial sector, Canadian banks were the initial adopters of AI technologies to optimize procedures and improve client experiences. AI-powered applications, virtual assistance, and other solutions manage customer inquiries. As these financial institutions ramp up their AI activities, the demand for AI Infrastructure, such as high-performance computing and data storage capabilities, grows.

AI Infrastructure Industry Overview

The AI infrastructure market comprises global players focusing on gaining a point of difference in the contested market space. In addition, startups in the AI infrastructure market, including Cerebras Systems and Graphcore, provide specialized AI accelerators to take on well-established giants like NVIDIA and Google Inc. This market is characterized by moderately high product differentiation, growing product penetration levels, and high levels of competition, with a high level of innovation, which is intended to aim at gaining an edge in the market. Some of the major market players are Intel Corporation, Nvidia Corporation, Samsung Electronics Co. Ltd, Micron Technology Inc., and Sensetime Group Inc.

In June 2023, Intel introduced its 4th Gen Intel Xeon Scalable processors and the Intel Xeon CPU Max Series and Intel Data Center GPU Max Series. These advanced offerings are designed to tackle and overcome complex computing challenges on a large scale. Intel's approach involves aligning CPU cores with specialized accelerators tailored for specific workloads, resulting in enhanced performance and improved efficiency, ultimately leading to an optimal total cost of ownership.

In July 2023, NVIDIA announced that NVIDIA DGX Cloud is now widely accessible, offering powerful tools that can transform almost any business into an AI-driven organization. This service is readily available, featuring thousands of NVIDIA GPUs accessible through Oracle Cloud Infrastructure. Additionally, NVIDIA's infrastructure is present in both the United States and the United Kingdom, providing further accessibility and support for AI initiatives.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for AI Hardware in High-performance Computing Data Centers

- 5.1.2 Increasing Applications of IIoT and Automation Technologies

- 5.1.3 Rising Application of Machine Leaning and Deep Learning Technologies

- 5.1.4 Huge Volume of Data Being Generated in Industries such as Automotive and Healthcare

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals in the Industry

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Hardware

- 6.1.1.1 Processor

- 6.1.1.2 Storage

- 6.1.1.3 Memory

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.2.3 Hybrid

- 6.3 By End-User

- 6.3.1 Enterprises

- 6.3.2 Government

- 6.3.3 Cloud Service Providers

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 South Korea

- 6.4.3.4 Japan

- 6.4.3.5 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 United Arab Emirates

- 6.4.5.3 Qatar

- 6.4.5.4 Israel

- 6.4.5.5 South Africa

- 6.4.5.6 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Nvidia Corporation

- 7.1.3 Samsung Electronics Co. Ltd

- 7.1.4 Micron Technology Inc.

- 7.1.5 Sensetime Group Inc

- 7.1.6 IBM Corporation

- 7.1.7 Google LLC

- 7.1.8 Microsoft Corporation

- 7.1.9 Amazon Web Services Inc.

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Arm Holdings

- 7.1.12 Dell Inc.

- 7.1.13 Hewlett Packard Enterprise Development LP

- 7.1.14 Advanced Micro Devices

- 7.1.15 Synopsys Inc.