|

市場調查報告書

商品編碼

1406099

聚脲:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Polyurea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

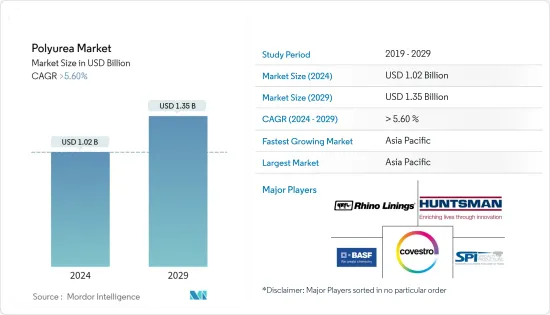

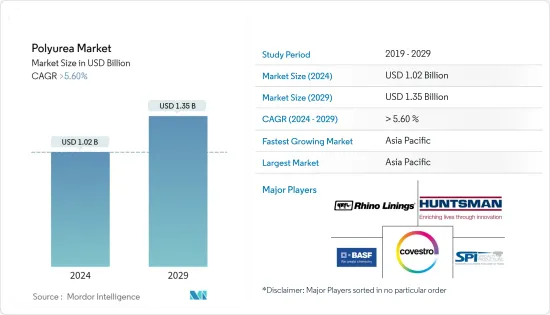

聚脲市場規模預計到2024年為10.2億美元,預計到2029年將達到13.5億美元,在預測期內(2024-2029年)複合年成長率將超過5.60%。

由於 COVID-19 大流行,市場受到生產和流動性放緩的負面影響,因為汽車、建築等行業因遏制措施和經濟中斷而被迫推遲生產。目前市場正從疫情中恢復。預計2022年市場將達到疫情前水準並持續穩定成長。

推動市場的關鍵因素之一是建設產業對聚脲的需求不斷成長。

然而,聚脲原料價格的波動預計將阻礙市場成長。

聚脲在食品工業和飲用水應用中的使用不斷增加,這可能對未來幾年的市場來說是個好兆頭。

預計亞太地區將主導市場,其中中國和印度等國家的消費量最高。

聚脲市場趨勢

建設產業對聚脲的需求不斷成長

- 聚脲是異氰酸酯組分與合成樹脂共混物的反應產物經由高級聚合而獲得的一類合成橡膠。

- 聚脲是保護管道免受腐蝕和外部影響的理想選擇,可應用於鋼製和發泡聚氨酯管道隔熱材料。

- 聚脲具有對鋼材和混凝土隔熱的能力及其高耐用性,因此結構安全,可以使用多年而無需維修。

- 亞太地區擁有世界上最大的建築業,由於中國和印度住宅建築市場的不斷擴大,預計亞太地區的住宅成長最快。

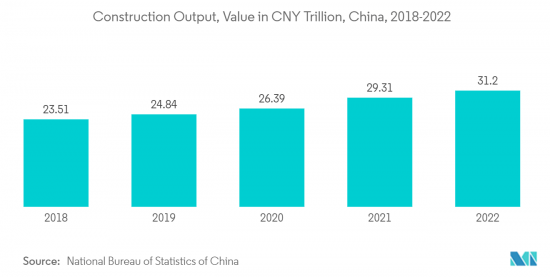

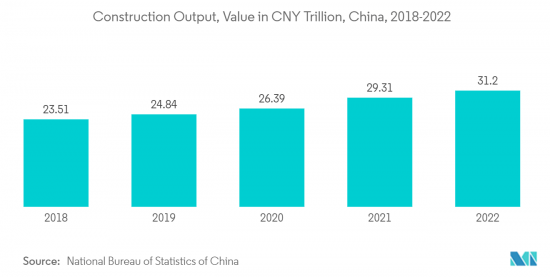

- 根據國家統計局的數據,中國的建築產值將於2022年達到峰值,達到約31.2兆元(4.61兆美元)。結果,這些因素往往會增加市場需求。

- 印度正在擴大其商業部門。該國正在進行多個計劃。例如,2022年第一季,價值9億美元的CommerzIII商業辦公綜合體開工。該計劃將在孟買戈爾岡建造一座43層的商業綜合體。該計劃預計將於 2027 年第四季完成,為預測期內的市場成長做出貢獻。

- 此外,在美國,根據美國人口普查局的數據,2022年私人建築價值為14,342億美元,比2021年的12,795億美元成長11.7%。 2022年住宅建設支出為8,991億美元,比2021年的7,937億美元成長13.3%,支撐市場成長。

- 德國也是歐洲最大的建築業。該國的建築業繼續溫和成長,主要是由於新住宅建設項目數量的增加。該國擁有歐洲大陸最大的建築存量,預計這一趨勢在可預見的未來將持續下去。作為向永續能源系統轉型的一部分,德國的目標是到 2050 年使其建築接近氣候中和。

- 因此,由於上述因素,預測期內建設產業聚脲的應用很可能成為主導。

亞太地區主導市場

- 預計亞太地區將在預測期內主導聚脲市場。隨著中國和印度等開發中國家的人口成長、汽車產業和建設活動的成長,對聚脲的需求預計將推動該地區的聚脲需求。

- 最大的聚脲生產國是亞太地區。聚脲生產的領導公司包括BASF股份公司、科思創股份公司和亨斯曼國際有限責任公司。

- 印度政府的目標是使汽車製造業成為「印度製造」計畫的關鍵驅動力,預計將推動市場成長。根據印度汽車工業商協會(SIAM)統計,2022年印度小客車銷售量為379萬輛,較2021年小客車成長約23%。

- 在2023-2024年預算中,印度財政部長宣布撥款27億印度盧比(約33.9億美元)來促進住宅建設。這一分配比前上年度增加了近10%。預計這將大大推動住宅建設。

- 該地區建築業的成長將顯著提振市場。中國政府正致力於增加全國建築業的投資,以促進整體經濟成長。例如,近期增加基礎建設融資的措施包括提高政策性銀行貸款比例1,200億美元。政府也考慮透過特別債券安排向地方政府提供約2,200億美元的資金,為基礎建設提供資金。

- 在日本,根據國土交通省的數據,2022年將建造約859,500套住宅,與前一年同期比較增加0.4%。

- 由於上述因素,亞太地區聚脲市場預計在研究期間將顯著成長。

聚脲行業概況

聚脲市場部分整合。研究市場的主要企業(排名不分先後)包括BASF SE、Huntsman International LLC、Covestro AG、Rhino Linings Corporation、Specialty Products Inc.等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建設產業對聚脲的需求不斷成長

- 汽車產業的需求不斷增加

- 其他司機

- 抑制因素

- 原物料價格波動

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 化學結構

- 芳香

- 脂肪族的

- 類型

- 熱聚脲

- 冷聚脲

- 產品

- 襯墊

- 塗層

- 密封劑

- 最終用戶產業

- 建造

- 油漆/塗料

- 車

- 工業

- 船運

- 其他最終用戶產業(例如運輸)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Armorthane

- CITADEL FLOORS

- Covestro AG

- Dorf Ketal

- Elastothane

- Huntsman International LLC

- Lonza

- Rhino Linings Corporation

- SATYEN POLYMERS PVT. LTD.(TEVO)

- Speciality Products Inc.

- Teknos Group

第7章 市場機會及未來趨勢

- 聚脲在食品工業和飲用水應用的使用增加

- 其他機會

The Polyurea Market size is estimated at USD 1.02 billion in 2024, and is expected to reach USD 1.35 billion by 2029, growing at a CAGR of greater than 5.60% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries, such as automotive, construction, etc., were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

One of the main factors driving the market is the growing demand for polyurea from the construction industry.

However, volatility in the raw material price of polyurea is expected to hinder the growth of the market studied.

The increasing use of polyurea in the food industry and drinking water application is likely to act as an opportunity for the market studied in the coming years.

The Asia-Pacific region is expected to dominate the market with the largest consumption from countries such as China and India.

Polyurea Market Trends

Growing Demand for Polyurea from the Construction Industry

- Polyurea is a kind of elastomer that results from the reaction product of an isocyanate component and synthetic resin blend through advanced development polymerization.

- Polyurea is ideal for protecting pipes and pipelines against corrosion and external influences and can be applied to both steel and polyurethane foam, which is the thermal insulation of the pipeline.

- The ability of polyurea to insulate both steel and concrete and high durability allows for secure structures without the need for renovation for many years.

- The construction sector in the Asia-Pacific region is the largest in the world, and the highest growth for housing is expected to be registered in the Asia-Pacific region, owing to the expanding housing construction markets in China and India.

- Also, according to the National Bureau of Statistics of China, China's construction output peaked in 2022 at a value of about CNY 31.20 (USD 4.61 trillion). As a result, these factors tend to increase the market demand.

- India is expanding its commercial sector. Several projects have been going on in the country. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office in Goregaon, Mumbai. The project is expected to be completed in Q4 2027, thus benefitting the market growth during the forecast period.

- Further, in the United States, according to the US Census Bureau, the value of private construction in 2022 stood at USD 1,434.2 billion, 11.7% higher than the USD 1,279.5 billion in 2021. Residential construction spending in 2022 was USD 899.1 billion, up 13.3% from USD 793.7 billion in 2021, thus supporting the market growth.

- In addition, Germany has the largest construction industry in Europe. The country's construction industry has been growing slowly, which is majorly driven by the increasing number of new residential construction activities. The country is home to the continent's largest building stock and is expected to continue in the foreseeable future. Germany aims to have an almost climate-neutral building stock by 2050 as part of its ongoing transition to a sustainable energy system.

- Hence, owing to the above-mentioned factors, the application of polyurea from the construction industry is likely to dominate during the forecast period.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for polyurea during the forecast period. The rising demand for polyurea, along with the growing population, automotive sector, and construction activities in developing countries like China and India, is expected to drive the demand for polyurea in this region.

- The largest producers of polyurea are located in the Asia-Pacific region. Some of the leading companies in the production of polyurea are BASF SE, Covestro AG, Huntsman International LLC, and others.

- The Indian government aims to make automobile manufacturing the main driver of the 'Make in India' initiative, which is anticipated to enhance the growth of the market studied. According to the Society of Indian Automobile Manufacturers (SIAM), a total of 3.79 million passenger vehicles were sold in India in 2022, witnessing a growth rate of around 23% compared to the passenger vehicles sold in the year 2021.

- In the budget 2023-2024, the Indian finance minister announced an allocation of INR 2.7 lakh crore (~USD 3.39 billion) for boosting housing construction. This allocation increased by nearly 10% as compared to the previous year. This will provide a significant boost to housing construction.

- The market is significantly boosted by the growing construction sector in the region. The Chinese government is focusing on enhancing investments across the construction sector in the country to boost overall economic growth. For instance, recent moves to increase financing for infrastructure construction include a USD 120 billion increase in the lending ratio of policy banks. The government is also considering allowing local governments to spend up to about USD 220 billion of the special bond quota through which local governments fund infrastructure construction.

- In Japan, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan, in 2022, approximately 859.5 thousand housing developments were initiated in Japan, which represented an increase of 0.4% compared to the previous year.

- Owing to the above-mentioned factors, the market for polyurea in the Asia-Pacific region is projected to grow significantly during the study period.

Polyurea Industry Overview

The polyurea market is partially consolidated in nature. The major players in the studied market (not in any particular order) include BASF SE, Huntsman International LLC, Covestro AG, Rhino Linings Corporation, and Speciality Products Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand of Polyurea from Construction Industry

- 4.1.2 Growing Demand from Automotive Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Price

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Chemical Structure

- 5.1.1 Aromatic

- 5.1.2 Aliphatic

- 5.2 Type

- 5.2.1 Hot Polyurea

- 5.2.2 Cold Polyurea

- 5.3 Product

- 5.3.1 Lining

- 5.3.2 Coating

- 5.3.3 Sealants

- 5.4 End-user Industry

- 5.4.1 Construction

- 5.4.2 Paints and Coatings

- 5.4.3 Automotive

- 5.4.4 Industrial

- 5.4.5 Maritime

- 5.4.6 Other End-user Industries (Transportation, Etc.)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Armorthane

- 6.4.2 CITADEL FLOORS

- 6.4.3 Covestro AG

- 6.4.4 Dorf Ketal

- 6.4.5 Elastothane

- 6.4.6 Huntsman International LLC

- 6.4.7 Lonza

- 6.4.8 Rhino Linings Corporation

- 6.4.9 SATYEN POLYMERS PVT. LTD. (TEVO)

- 6.4.10 Speciality Products Inc.

- 6.4.11 Teknos Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Polyurea in Food Industry and Drinking Water Application

- 7.2 Other Opportunities