|

市場調查報告書

商品編碼

1406088

聚苯:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Polyphenylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

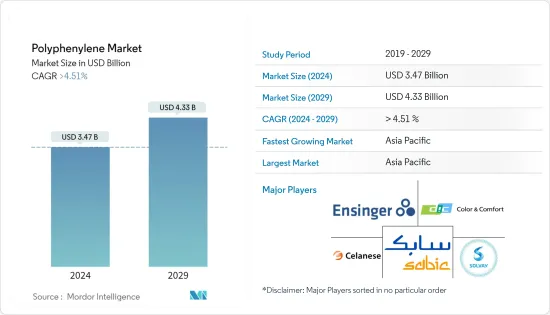

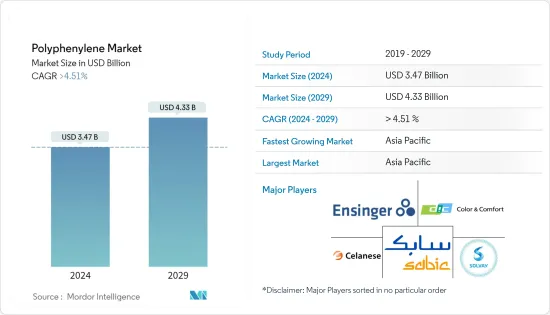

預計2024年聚苯市場規模為34.7億美元,預計2029年將達到43.3億美元,在預測期內(2024-2029年)複合年成長率將超過4.51%。

聚苯市場受到 COVID-19 大流行的負面影響,生產和運輸放緩,迫使電氣、電子和運輸等行業因遏制措施和經濟中斷而放緩生產。目前市場正從疫情中恢復。預計2022年市場將達到疫情前水準並持續穩定成長。

電氣和電子行業中聚苯的使用量不斷增加以及混合電動車的需求不斷成長是推動所研究市場成長的因素。

另一方面,與其他傳統材料相比,替代品的可用性和聚苯的高成本是限制市場成長的主要因素。

此外,聚苯在 5G 電路基板中的新興應用是預計將為研究市場帶來利潤豐厚機會的關鍵因素。

亞太地區預計將主導市場,其中中國、日本、韓國和印度佔最大的消費量。

聚苯市場趨勢

汽車和交通領域的需求增加

- 聚苯被加工成聚苯硫醚(PPS)、聚苯醚(PPO)、聚苯醚(PPE)等衍生物。聚苯撐衍生物是需要較高溫度穩定性的電動車零件的首選。

- 近年來,PPS已取代金屬、芳香族尼龍、酚醛聚合物、塊狀成型模塑等應用於多種工程汽車零件。

- 聚苯撐衍生物已成為暴露於高溫的汽車零件的理想選擇。這些可以提供高強度,同時重量輕。它們用於汽車部件,如電連接器、點火系統、照明系統、燃油系統、混合動力汽車逆變器部件和活塞。

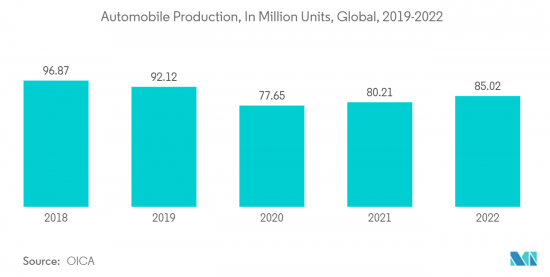

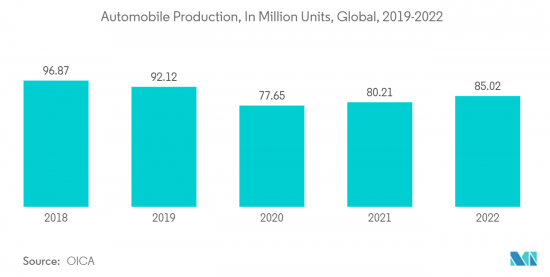

- 根據OICA(國際汽車構造組織)預測,2022年全球汽車產量將達8,502萬輛,較2021年成長6%。

- 中國是世界上最大的汽車製造國。該國的汽車行業正在不斷改進其產品,並且由於對環境問題的日益關注,正在重點生產在確保燃油效率的同時最大限度地減少排放的產品。

- 根據OICA統計,2022年全國汽車產量達2,702.1萬輛,汽車銷量達2,686.4萬輛,與前一年同期比較成長3.4%及2.1%。

- 此外,全球電動車市場正在顯著擴張,這有利於所研究的市場。例如,2022年,全球將售出約1,050萬輛純電動車(BEV)和插電式混合動力電動車(PHEV),較前一年的677萬輛成長55%。

- 上述因素預計將顯著增加汽車和交通運輸領域對聚苯的需求,並推動市場區隔成長。

亞太地區主導市場

- 聚苯最大的市場是亞太地區。在中國、日本、韓國和印度等國家,由於汽車和交通、電氣和電子等產業的成長,對聚苯的需求不斷增加。

- 在亞太地區,各國政府正在採取有利於電動車採用和擴大電動車製造基礎設施的優惠政策。預計這將在預測期內對該地區的電動車市場產生重大推動作用。

- 中國政府的政策發展包括限制對新內燃機火車頭製造廠的投資,以及提案到 2025 年收緊輕型小客車的平均燃油經濟性。

- 亞洲國家生活水準的提高也促使大眾對電動和混合動力汽車使用意識的提高。

- 亞太地區也是全球領先的電氣和電子設備生產國,其中包括中國、日本、韓國和馬來西亞等國家。印度也正在成為亞洲電子產品的製造地。這樣一個成熟的產業預計將吸引該地區對聚苯及其衍生物的需求。

- 因此,電氣和電子行業使用量的增加和應用範圍的擴大預計將推動市場成長。在電子領域,中國製造商正在建立海外生產基地,拓展國際市場。

- 例如,2023年3月,TCL透過在越南、馬來西亞、墨西哥和印度設立海外工廠生產電視機、模組和太陽能電池,擴大了在國際市場的影響力。此外也與巴西當地企業合作,共同開發生產設施、供應鏈和研發基礎設施。

- 此外,根據電子與資訊科技部的數據,2022 會計年度印度消費性電子產品(電視、配件、音訊)產值將超過 7,450 億印度盧比(94.6 億美元)。這支持了市場成長。

- 此外,根據日本電子情報技術產業協會(JEITA)的數據,2022年日本電子產業國內產值預計為111,243億日元(851.9億美元),與前一年同期比較成長2% .正在顯示。

- 因此,上述最終用戶需求的增加預計將推動亞太地區的成長。

聚苯產業概況

聚苯市場分為多個部分。研究市場的主要企業包括(排名不分先後)SABIC、Ensinger、Celanese Corporation、DIC CORPORATION、Solvay 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大在電氣和電子產業的應用

- 混合動力電動車的需求增加

- 其他司機

- 抑制因素

- 替代品的可得性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 類型

- 聚苯硫醚

- 聚苯醚

- 聚苯醚

- 最終用戶產業

- 電力/電子

- 汽車/交通

- 其他最終用戶產業(例如塗料)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 墨西哥

- 加拿大

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業採取的策略

- 公司簡介

- Biesterfeld AG

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- DIC Corporation

- Emco Industrial Plastics

- Ensinger

- KUREHA CORPORATION

- LG Chem

- Mitsubishi Chemical Group of companies

- Nagase America LLC

- RTP Company

- SABIC

- Solvay

- Sumitomo Bakelite Co., Ltd.

- TORAY INDUSTRIES, INC.

- Tosoh Europe BV

第7章 市場機會及未來趨勢

- 5G電路基板應用

- 其他機會

The Polyphenylene Market size is estimated at USD 3.47 billion in 2024, and is expected to reach USD 4.33 billion by 2029, growing at a CAGR of greater than 4.51% during the forecast period (2024-2029).

The polyphenylene market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility, wherein industries such as electrical and electronics, transportation, and others were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

The growing usage of polyphenylene in the electrical and electronics industry and increasing demand for hybrid electric vehicles are the factors driving the growth of the studied market.

On the flip side, the availability of substitutes and the high cost associated with polyphenylene over other conventional materials are key factors limiting the growth of the market studied.

Moreover, the emerging applications of polyphenylene in 5G circuit board is a key factor expected to act as a lucrative opportunity for the studied market.

Asia-Pacific is expected to dominate the market, with the largest consumption from China, Japan, South Korea, and India.

Polyphenylene Market Trends

Increasing Demand from Automotive and Transportation Segment

- Polyphenylene is processed into its derivatives, like polyphenylene sulfide (PPS), polyphenylene oxide (PPO), and polyphenylene ether (PPE). Polyphenylene derivatives are preferred in electric auto parts that require higher temperature stability.

- In recent years, PPS successfully replaced metal, aromatic nylons, phenolic polymers, and bulk molding compounds in various engineered vehicle components.

- Polyphenylene derivatives become the ideal choice for automotive parts exposed to high temperatures. These can provide high strength while being light in weight. These are used in vehicle components, like electrical connectors, ignition systems, lighting systems, fuel systems, hybrid vehicle inverter components, and pistons.

- According to the Organisation Internationale des Constructeurs d'Automobiles(OICA), 85.02 million vehicles were produced across the globe in 2022, witnessing a growth rate of 6% compared to 2021, thereby enhancing the demand for polyphenylene derivatives, which are employed for various automotive parts.

- China is the largest manufacturer of automobiles in the world. The country's automotive sector has been shaping up for product evolution, with the country focusing on manufacturing products to ensure fuel economy while minimizing emissions, owing to the growing environmental concerns.

- According to OICA, automobile production and sales in the country reached 27.021 million and 26.864 million, respectively, in 2022, up 3.4% and 2.1% from the previous year.

- Further, the global electric vehicle market is expanding significantly which is benefitting the market studied. For instance, in 2022, around 10.5 million units of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold across the globe, witnessing a growth rate of 55% compared to 6.77 million units sold in the previous year.

- All factors above are likely to significantly enhance the demand for polyphenylene in the automotive and transportation segment, and thus will propel the growth of the market studied.

Asia-Pacific to Dominate the Market

- Asia-Pacific represents the largest market for polyphenylene. In countries like China, Japan, South Korea, and India, the demand for polyphenylene has been increasing due to growing industries like automotive and transportation and electrical and electronics.

- In the Asia-Pacific region, the governments have adopted favorable policies toward the adoption of electric vehicles and the expansion of manufacturing infrastructure for electric vehicles. This, in turn, is anticipated to provide a huge impetus to the electric vehicle market in the region during the forecast period.

- The Chinese government policy developments include the restriction of investments in new ICE-vehicle manufacturing plants and a proposal to tighten the average fuel economy of its light-duty passenger vehicle fleet by 2025.

- Increasing standards of living in Asian countries have also led to increased awareness among the people of the use of electric and hybrid vehicles.

- The Asia-Pacific region is also the dominant producer of electrical and electronics across the world, with countries such as China, Japan, South Korea, and Malaysia contributing toward it. India is also emerging as a manufacturing hub for electronic products in Asia. This established industry is expected to attract demand for polyphenylene and its derivatives from the region.

- Thus, the increasing usage and widening arena of application in the electrical and electronics industry is expected to drive market growth. In the electronics segment, Chinese manufacturers are setting up overseas production bases in order to expand in the international markets.

- For instance, In March 2023, TCL broadened its presence in international markets by establishing factories abroad, producing televisions, modules, and photovoltaic cells in Vietnam, Malaysia, Mexico, and India. In addition, it has formed partnerships with local companies in Brazil to collaboratively develop production facilities, supply chains, and an R&D infrastructure.

- Further, according to the Ministry of Electronics and Information Technology, the production value of consumer electronics (TV, accessories, and audio) across India was above INR 745 billion (USD 9.46 billion) in fiscal year 2022. Thus supporting the growth of the market.

- Moreover, as per the Japan Electronics and Information Technology Industries Association (JEITA), the domestic production by the Japanese electronics industry was estimated at JPY 11,124.3 billion (USD 85.19 billion) in 2022, witnessing a growth rate of 2% compared to the previous year.

- Thus, rising demand from the end-user mentioned above industries is expected to drive growth in the Asia-Pacific region.

Polyphenylene Industry Overview

The polyphenylene market is partially fragmented in nature. The major players in the studied market (not in any particular order) include SABIC, Ensinger, Celanese Corporation, DIC CORPORATION, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage in Electrical and Electronics Industry

- 4.1.2 Increasing Demand from Hybrid Electric Vehicles

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitute

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyphenylene Sulfide

- 5.1.2 Polyphenylene Oxide

- 5.1.3 Polyphenylene Ether

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Automotive and Transportation

- 5.2.3 Other End-user Industries (Coatings, Etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Biesterfeld AG

- 6.4.2 Celanese Corporation

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 DIC Corporation

- 6.4.5 Emco Industrial Plastics

- 6.4.6 Ensinger

- 6.4.7 KUREHA CORPORATION

- 6.4.8 LG Chem

- 6.4.9 Mitsubishi Chemical Group of companies

- 6.4.10 Nagase America LLC

- 6.4.11 RTP Company

- 6.4.12 SABIC

- 6.4.13 Solvay

- 6.4.14 Sumitomo Bakelite Co., Ltd.

- 6.4.15 TORAY INDUSTRIES, INC.

- 6.4.16 Tosoh Europe B.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Applications in 5G Circuit Board

- 7.2 Other Opportunities