|

市場調查報告書

商品編碼

1406086

編碼器:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Encoder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

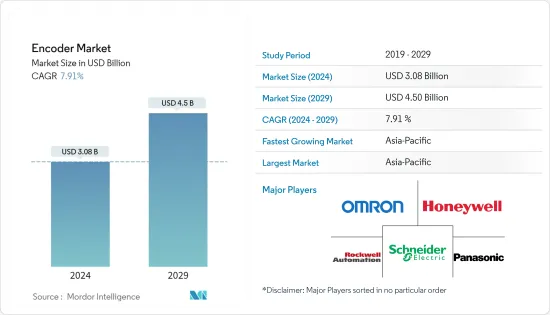

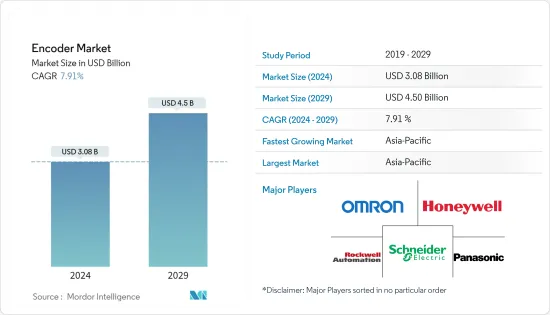

編碼器市場規模預計到 2024 年為 30.8 億美元,預計到 2029 年將達到 45 億美元,在預測期內(2024-2029 年)複合年成長率為 7.91%。

由於從資料中心到通訊各種應用對編碼器的需求不斷增加,該市場正在經歷快速成長。

主要亮點

- 高階自動化需求和工業4.0是市場成長的關鍵驅動力工業4.0指的是第四次工業革命,它將工廠自動化從傳統資訊技術系統控制的製造工廠轉向巨量資料分析和生產雲端基礎基礎設施的虛擬

- 全球許多國家都積極回應,制定策略性舉措,加強工業4.0的實施。例如,SAMARTH Udyog Bharat 4.0 是印度政府重工業和公共企業部根據印度資本財行業競爭力增強計劃提出的工業 4.0 計劃。據貿發會議稱,中國和美國在工業4.0技術的投資和能力方面處於領先地位。中國和美國擁有最大的數位平台,佔市值的90%。

- 此外,編碼器是運動控制應用的核心。編碼器將位置、速度和方向回饋給控制器和驅動器,提高驅動系統的準確性和可靠性。隨著技術的進步,編碼器也不斷進步,融入了通訊和網路領域的最新發展,為工程師在各種運動控制應用中解決所面臨的課題提供了工具。

- 編碼器的最大限制之一是它們相當複雜並且由精密部件組成。這使得它們對機械濫用的抵抗力較差,且耐熱性有限。很難找到能夠承受 120°C 以上溫度的光學編碼器。除此之外,功能安全認證很難獲得,並且可能會出現與運動控制編碼器功能相關的錯誤,引發人們對運動控制設計中關鍵功能安全問題的擔憂,這也是市場成長的重要限制因素。這些限制為市場成長帶來了課題。

- 自 COVID-19 爆發以來,工業界已轉向自動化以減少人力工作並提高效率。例如,主要零售商和雜貨店正在尋找加快自動自助結帳系統的方法,以最大限度地減少人際接觸並確保消費者和員工的安全。疫情過後,印刷業對自動化和自動化印刷設備的投資也增加。例如,Tim於 2021 年 2 月宣佈在芬蘭 Kvora 的 LUMON Oy 安裝了一條新印刷線。這些變化預計將有助於所研究市場的成長。

編碼器市場趨勢

工業部門預計將佔據大部分市場佔有率

- 編碼器可用於多種工業應用,包括線性測量、套準標記計時、捲筒紙張力、逆止器測量、輸送和填充。最標準的應用是為電動馬達的運動控制提供回饋。在工業領域,大量電力用於電動。大多數這些馬達都內建編碼器。

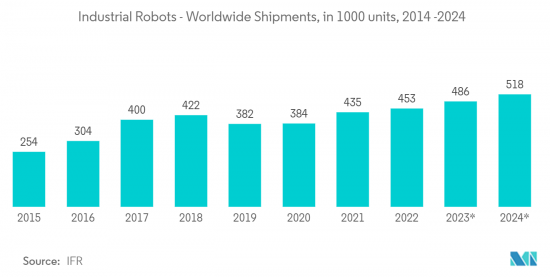

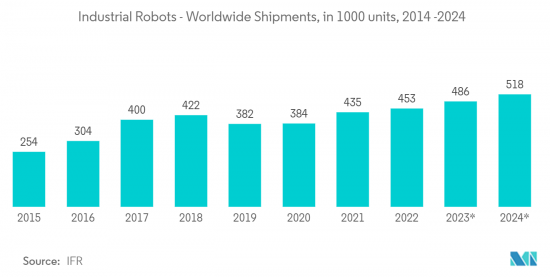

- 機器人的應用範圍越來越廣,特別是在焊接、物料搬運、組裝和研磨任務中。這些機器人需要可靠的編碼器來引導它們的運動,因為人類的監督和監督通常是有限的。

- 根據IFR統計,近年來,中國在工業機器人方面進行了大量投資,機器人密度在各國中不斷上升,並首次超越美國。在中國製造業中,運作的工業機器人數量相對於工人數量已達到每萬名員工擁有322台。韓國、新加坡、日本、德國和中國是全球製造業自動化程度最高的五個國家。這些行業擴大採用自動化預計將進一步推動市場對編碼器的需求。

- Strausak AG 等公司正在探索工業機器人技術,特別是如何加速無需操作員的工具研磨和重磨。此應用程式使用夾持臂從緊密堆疊的托盤中拾取小型工具並放回夾具中。手臂的每個軸均配備海德漢感應式EQI 1100旋轉編碼器。此編碼器在夾具尖端提供 50μm 的精度,可安全、快速且準確地定位 10mm 直徑的工具。

亞太地區成長迅速

工業化的不斷發展以及對更好的製造流程解決方案的需求正在推動市場的快速成長。亞洲擁有日本、中國和印度等大型工業中心,因此生產設備和與公司的服務合約的增加也支持了產業成長。日益激烈的市場競爭促使新產品進入市場,促進市場成長。

- 根據國際機器人聯合會(IFR)的報告,亞洲是全球最大的工業機器人市場,2021年引進的新機器人中有74%安裝在亞洲(前一年為70%)。該地區最大進口國中國的安裝量增加了 51%,出貨為 268,195 台。

- 報告稱,日本是僅次於中國的最大工業機器人市場,2021年安裝量成長22%,達到47,182台。此外,日本是全球領先的機器人製造國之一,日本工業機器人出口數量達到186,102台的新高峰。標準和自訂的旋轉編碼器和線性編碼器有效地用於電氣醫療設備和測試設備,例如手術台、檢查台、伽馬刀、X光和掃描儀。

- 據印度品牌股權基金會2021稱,為了促進醫療保健產業的發展,印度政府(GOI)推出了多項計畫來加強醫療設備產業,並加強研發(R&D)和醫療設備投資。 2000年4月至2021年6月,醫療手術器材產業吸收外資總額22.3億美元。政府對醫療領域的巨額投資可能會推動編碼器市場的發展。

- 該地區的汽車工業也佔編碼器總需求的很大一部分。例如,根據中國工業協會的數據,2022年4月,中國生產了約21萬輛商用車和99.6萬輛小客車。

- 此外,韓國擁有眾多主要汽車製造商,並保持著世界頂級汽車生產國之一和最大汽車出口國之一的地位。此外,該地區的電動趨勢正在為市場創造新的機會。

編碼器行業概況

編碼器市場由多家公司主導,包括歐姆龍、霍尼韋爾、海德漢有限公司、堡盟集團和 Posital Flava。 這些公司具有龐大的客戶群的優勢,這使得大規模生產編碼器成為可能。 強大的品牌是卓越業績的代名詞,因此老牌公司有望佔據上風。 由於他們能夠滲透市場並提供先進的產品,預計競爭對手之間的競爭將繼續下去。

它是一款革命性的絕對感應式編碼器解決方案,可在運動控制應用中實現更高水平的精確角度測量,並在最苛刻的環境中實現機器人的位置反饋。本產品適用於需要精確角度測量但在不適合光學編碼器的環境中使用的應用(例如多塵、骯髒、潮濕、高衝擊或振動環境)。

2023 年 3 月,POSITAL 宣布對其 IXARC 系列增量式旋轉編碼器進行重大升級。這種新型編碼器可能會透過降低功耗同時保持與舊型號的機械和電氣相容性來使客戶受益。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 先進汽車系統的高採用率

- 工業自動化需求不斷成長

- 市場課題

- 惡劣條件下的機械故障

第6章市場區隔

- 依類型

- 旋轉編碼器

- 線性編碼器

- 依技術

- 光學的

- 磁力型

- 光電式

- 其他

- 依最終用戶產業

- 車

- 電子產品

- 纖維

- 印刷機械

- 工業

- 醫療保健

- 其他

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 其他地區(拉丁美洲、中東、非洲)

第7章 競爭形勢

- 公司簡介

- Omron Corporation

- Honeywell International

- Schneider Electric

- Rockwell Automation Inc.

- Panasonic Corporation

- Baumer Group

- Renishaw PLC

- Dynapar Corporation(Fortive Corporation)

- FAULHABER Drive Systems

- Pepperl+Fuchs International

- Hengstler GMBH(Fortive Corporation)

- Maxon Motor AG

- Dr. Johannes Heidenhain GmbH

- POSITAL FRABA Inc.(FRABA BV)

- Sensata Technologies

第8章投資分析

第9章 市場未來展望

The Encoder Market size is estimated at USD 3.08 billion in 2024, and is expected to reach USD 4.5 billion by 2029, growing at a CAGR of 7.91% during the forecast period (2024-2029).

The market is witnessing rapid growth due to the increasing demand for encoders in multiple applications, from data centers to telecommunication.

Key Highlights

- The need for high-end automation and Industry 4.0 are the major factors driving the growth of the market. Industry 4.0 describes the fourth industrial revolution, a new world where factory automation moves beyond manufacturing plants controlled by conventional information technology systems to a cloud-based infrastructure that permits big data analytics and the virtualization of production processes.

- Many countries worldwide have positively responded to Industry 4.0 by developing strategic initiatives to strengthen its implementation. For instance, SAMARTH Udyog Bharat 4.0 is an Industry 4.0 initiative of the Ministry of Heavy Industry & Public Enterprises, Government of India, under its scheme on Enhancement of Competitiveness in the Indian Capital Goods Sector. According to the UNCTAD, China and the United States are leaders in investment and capacity in Industry 4.0 technologies. They are home to the largest digital platforms, accounting for 90 percent of the market capitalization.

- Furthermore, encoders are central to motion control applications. They can offer feedback on position, speed, and direction to a controller or drive to increase the accuracy and reliability of a drive system. As technology advances, so do encoders, incorporating the latest developments in communications and networking and offering engineers tools to solve challenges they face across a diverse array of motion control applications.

- One of the most significant limitations of encoders is that they can be reasonably complex and comprise some delicate parts. This makes them less tolerant of mechanical abuse and restricts their allowable temperature. One would be hard-pressed to find an optical encoder that will survive beyond 120ºC. In addition to this, rising concern about functional safety issues, which is of significant importance in any motion control design, is also a notable limitation for the market's growth as the acquisition of functional safety certification can be arduous, and there can be some errors associated with the functionality of the motion control encoders. Such limitations pose a challenge to the market's growth.

- Since the outbreak of COVID-19, industries were looking for automation to reduce human interaction and enhance efficiency. For instance, leading retail and grocery outlets explored ways to ensure faster, automated self-checkouts that minimized human contact and kept shoppers and employees safe. Increased investment in automation and automated printing equipment has also been observed in the printing industry, which has been instigated by the pandemic. For instance, in February 2021, Thieme announced that it installed a new printing line at LUMON Oy in Kouvola, Finland, which allowed an automatic adaptation of different glass sizes to be printed without screen change or manual cleaning. These changes are expected to aid the growth of the market studied.

Encoder Market Trends

Industrial Sector is Expected to Hold Major Market Share

- Encoders are utilized in multiple industrial applications, such as linear measurement, registration mark timing, web tensioning, backstop gauging, conveying, filling, and more. The most standard application is providing feedback on the motion control of electric motors. In the industrial sector, a significant amount of electricity goes to electric power motors. Most of these motors have encoders incorporated into them.

- Robots are experiencing a growing number of application areas, especially for operations like welding, material handling, assembly, and grinding. Since there is typically limited human oversite or monitoring, these robots must have reliable encoders to help guide their movement.

- As per the IFR, China's massive investment in industrial robotics in recent years has moved its position up among various other countries for robot density, surpassing the United States for the first time. The number of operational industrial robots relative to the number of workers reached 322 units per 10,000 employees in the manufacturing industry in China. South Korea, Singapore, Japan, Germany, and China are the world's top five most automated manufacturing countries. Such an increase in the adoption of automation in the industries is expected to further fuel the demand for encoders in the market.

- Companies, such as Strausak AG, are exploring industrial robotics, specifically in terms of the ways it can accelerate operator-free grinding and re-sharpening tools. In this application, a gripper arm is used to pick small tools from tightly loaded pallets into the fixture and back. Every axis of the arm includes HEIDENHAIN's inductive EQI 1100 rotary encoder. This encoder allows the accuracy of 50 µm at the tip of its gripper for the safe, quick, and precise placement of tools with diameters as small as 10 mm.

Asia-Pacific to Register Fastest Growth

The growing industrialization and demand for better solutions for manufacturing processes are driving the growth of the market at a rapid pace. As Asia is home to large industrial hubs, such as Japan, China, and India, the increasing production facilities and service agreements with businesses are also propelling industry growth. Increasing market rivalry has resulted in the introduction of new items to the market, which has boosted the market's growth.

- According to a report by the IFR (International Federation of Robotics), Asia is the world's largest market for industrial robots; 74 percent of all newly deployed robots in 2021 were installed in Asia, compared to 70 percent in the previous year. Installations for the region's largest adopter, China, increased by 51 percent, with 268,195 units shipped.

- As per the report, Japan followed China as the largest market for industrial robots; installations increased by 22 percent in 2021, with 47,182 units. Moreover, the country is the world's predominant robot manufacturing country, with exports of Japanese industrial robots achieving a new peak level of 186,102 units. Both standard and custom rotary and linear encoders are effectively utilized in electro-medical and laboratory equipment, such as operating and examination tables, Gamma Knife and X-ray, Scanners, and many more.

- According to the Indian Brand Equity Foundation 2021, to promote the medical industry, the Government of India (GOI) launched several programs to strengthen the medical device sector, focusing on research and development (R&D) and 100 percent FDI for medical devices. Between April 2000 and June 2021, FDI in the medical and surgical appliances industry totaled USD 2.23 billion. Such huge investments by the government in the medical sector will drive the market for encoders.

- The automotive industry in the region also accounts for a significant share of the total demand for encoders. For instance, according to the China Association of Automobile Manufacturers, around 210,000 commercial vehicles and 996,000 passenger cars were produced in China in April 2022.

- Moreover, South Korea has maintained its position as one of the world's top automotive manufacturing countries and one of the largest automotive exporters, owing to the presence of many major car makers in the country. Additionally, the trends toward electrification in the region are unlocking new opportunities for the market.

Encoder Industry Overview

The encoder market comprises various players, such as Omron Corporation, Honeywell, Heidenhain GmbH, Baumer Group, and Posital Fraba Inc., among others. The companies have the advantage of a large client base, enabling them to produce large volumes of encoders, a key factor in ensuring better profits and economies of scale in the sensor market. As strong brands are synonymous with good performance, long-standing players are expected to have the upper hand. Owing to their market penetration and the ability to offer advanced products, the competitive rivalry is expected to continue to be high.

In March 2023, Celera Motion announced the introduction of the Field Calibration IncOder, which is a groundbreaking new absolute inductive encoder solution that enables next-level accuracy angle measurement in motion control applications and position feedback in robotics in the most demanding environments. The product is designed for applications that need precise angle measurements but in conditions not suited for optical encoders: dusty, dirty, and wet environments or in conditions where high shocks and vibrations are common.

In March 2023, POSITAL announced the launch of a major upgrade to its IXARC family of incremental rotary encoders that features new magnetic sensor technology and more energy-efficient embedded microcontrollers. The new encoders are likely to benefit customers by reducing power consumption while remaining mechanically and electrically compatible with earlier models.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Adoption in Advanced Automotive Systems

- 5.1.2 Rising Demand For Industrial Automation

- 5.2 Market Challenges

- 5.2.1 Mechanical Failures in Harsh Conditions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rotary Encoder

- 6.1.2 Linear Encoder

- 6.2 By Technology

- 6.2.1 Optical

- 6.2.2 Magnetic

- 6.2.3 Photoelectric

- 6.2.4 Other Technologies

- 6.3 By End-user Industry

- 6.3.1 Automotive

- 6.3.2 Electronics

- 6.3.3 Textile

- 6.3.4 Printing Machinery

- 6.3.5 Industrial

- 6.3.6 Medical

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World (Latin America and Middle East and Africa)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Omron Corporation

- 7.1.2 Honeywell International

- 7.1.3 Schneider Electric

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Panasonic Corporation

- 7.1.6 Baumer Group

- 7.1.7 Renishaw PLC

- 7.1.8 Dynapar Corporation (Fortive Corporation)

- 7.1.9 FAULHABER Drive Systems

- 7.1.10 Pepperl+Fuchs International

- 7.1.11 Hengstler GMBH (Fortive Corporation)

- 7.1.12 Maxon Motor AG

- 7.1.13 Dr. Johannes Heidenhain GmbH

- 7.1.14 POSITAL FRABA Inc. (FRABA BV)

- 7.1.15 Sensata Technologies