|

市場調查報告書

商品編碼

1406076

公用事業定位器:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029 年Utility Locator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

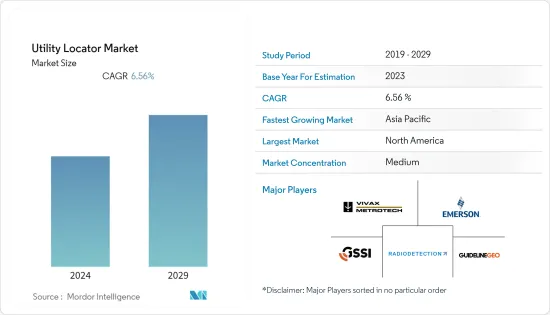

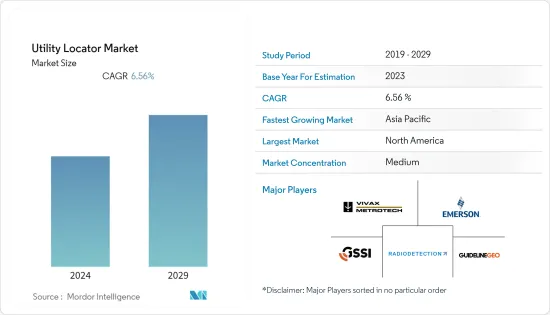

上年度公用事業定位器市值為7.981億美元,預計未來五年將達到11.202億美元,複合年成長率為6.56%。

公用事業定位使用探地雷達等技術來定位物業表面下的管道、電纜和其他服務基礎設施。此外,透過了解地下電纜和管道的位置,公用設施定位器可以避免在挖掘過程中損壞這些物品,並允許有計劃的挖掘。標準地下公用設施包括瓦斯管道、水管道和電話線。這些公用設施是您基礎設施的重要組成部分,確保它們不受干擾至關重要。

主要亮點

- 越來越多的即時漏水檢測、檢查、地下公用設施監控、政府在挖掘或建設活動之前定位地下公用設施的嚴格政策以及技術先進工具的開發等因素正在推動公用設施定位器市場的成長。

- 例如,近年來,地下公用設施工程 (SUE) 產業開發了創新方法來應對地下物件定位的課題。電磁定位器、透地雷達技術與歷史記錄等非技術手段一起使用,收集足夠的地下基礎設施資訊。

- 此外,不斷擴大的用例和技術發展正在推動供應商開發創新解決方案並將其推向市場。例如,2023 年 5 月,威猛 (Vermeer) 公司開發了一款新的支援 GPS 的 Verifier G3+ 公用事業定位器。該公司的新型公用事業定位器專為準確性、最佳化連接性和直覺控制而設計,可使用 G3+Map 行動應用程式與您的智慧型手機配對,並顯示當前索引、深度、繪製位置資訊,例如 GPS資料、設備名稱、公用事業類型和操作員。完成了這項工作。

- 此外,印尼55億美元高鐵、印度高鐵、半高鐵和動車組計劃以及各國建設計劃等多個國際計劃將持續推動公用事業定位需求未來幾年的解決方案預計將顯著促進所研究市場的成長。

- 然而,高昂的設備持有和維修成本以及缺乏專業技能可能會限制公用事業定位器市場未來的成長。然而,對即時公用事業定位工具和服務的需求不斷成長以及基礎設施劣化等因素可能為市場參與者提供充足的機會。

- 經濟成長、衰退等宏觀經濟因素在所研究市場的成長中扮演重要角色。這些因素極大地影響了新建設和公用事業計劃的金額和投資額,而這些項目是公用事業定位器的主要最終用戶。例如,北美地區景氣衰退的威脅可能會對所研究市場的成長產生限制性影響。

公用事業定位器市場趨勢

交通運輸業佔主要市場佔有率

- 交通是推動任何地區經濟發展的關鍵支柱,因此在交通相關基礎設施計劃開工前,應收集地下場地特徵等資訊,以避免計劃延誤或成本超支,重點是預防性行為。公用事業定位器透過檢測、測量和標記土地大大減少了不確定性。安裝在公用設施定位器中的電磁場和 GPS 等數位技術支援操作點之間的及時協調和通訊,提高測繪和測量等各種過程的精度和準確度。

- 例如,美國有超過 5,600 萬公里(3,500 萬英里)的已知公共公用設施,其中大部分仍未確定。可用的公共公用設施包括電線、煤氣管道、管道(大大小小的)、電話和網線,如果運輸機構在沒有收集足夠資訊的情況下挖掘地下,所有這些都可能面臨風險。您可能會暴露。

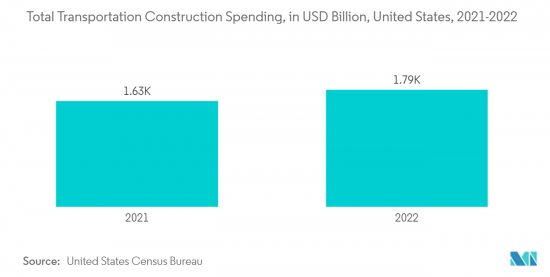

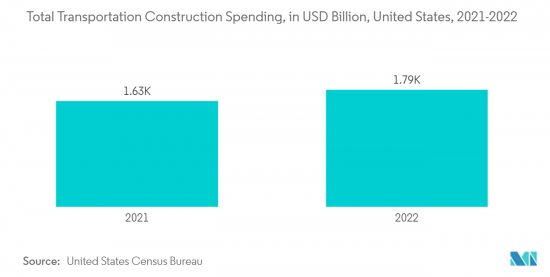

- 由於汽車保有量的增加、政府投資和都市化等因素,世界各地的道路和高速公路建設正在穩步成長。根據美國人口普查局數據,2022年美國交通建設支出總額約1,7,929億美元,較2021年成長約10.2%。這些趨勢為該地區研究市場的成長創造了良好的前景。

- 印度、中國、巴西和越南等新興經濟體對支持交通基礎建設計劃的投資顯示出高成長。例如,根據道路運輸和公路部的數據,印度MoRTH截至2022年12月已建設5,337公里國家公路,並已訂單。這種趨勢有利於市場成長,因為這些計劃經過多個已經擁有各種公用事業基礎設施的城市和住宅。

預計北美市場將顯著成長

- 北美是採用新技術的已開發國家之一,因此預計在預測期內也將在公用事業定位器市場中佔據主要佔有率。美國和加拿大等已開發國家對增強監控和創新建築設備的需求增加也支持了北美市場的成長。

- 美國電信行業正在蓬勃發展,經歷了技術供應商和幾家大公司的共同努力,通過推出5G服務獲得先發優勢。 例如,2022 年 3 月,Verizon 和 Live Nation 宣佈建立 5G 技術合作夥伴關係。 Verizon將為美國各地的標誌性場館配備專為大型活動打造的5G超寬頻。 由於光纖電纜在電信網路的發展和擴展中發揮著重要作用,預計這些趨勢將對所研究市場的增長產生積極影響。

- 在北美地區,地方政府正在實施或規劃多個大型交通基礎設施開發計劃,這也為所研究的市場帶來了機會。例如,加拿大政府目前正在研究一個新的高頻鐵路計劃,旨在為加拿大人提供清潔、高效和安全的交通。 2023年初,加拿大政府公佈了可以提交該計劃提案的實體。

- 此外,國家地下資產登記諮詢小組 (NUAR) 記錄稱,地下資產定位的不確定性每年美國經濟造成平均500 億美元的損失,並在過去20 年中造成1,500 多人死亡,近400 人受傷和死亡。這種不確定性是由於地下物體和測繪資訊缺失或不準確而導致高速公路建設延誤的主要原因。公用事業測繪的這種不確定性正在推動該地區最尖端科技的解決方案的成長。

公用事業定位器產業概述

公用事業定位器市場競爭適中,由 GSSI、Guideline Geo、Vivax-Metrotech 和 Emerson Electric 等大公司組成。從市場佔有率來看,目前該市場由幾家大型企業佔據主導地位。擁有主導市場佔有率的公司正致力於擴大全球基本客群。這些公司還利用策略合作計劃來增加市場佔有率和盈利。

2023 年 1 月,海克斯康旗下公司徠卡測量系統 (Leica Geosystems) 宣布推出鑽井和公用事業專業人員的最新解決方案。新推出的產品,包括徠卡DD175公用設施定位器和徠卡DA175訊號發射器,補充了該公司現有的徠卡DD100系列,使操作員更容易檢測地下公用設施,對確保現場工作人員的安全很有幫助。

透地雷達 ( GPR) 產品。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 宏觀經濟趨勢對公共設施搜尋市場的影響

第5章市場動態

- 市場促進因素

- 對即時地下探測工具的需求不斷成長

- 增加對檢查劣化的基礎設施的投資

- 市場課題

- 設備持有及維護成本高

第6章市場區隔

- 依報價

- 裝置

- 服務

- 依目標

- 金屬公用事業

- 非金屬公用事業

- 依技術

- 電磁場

- 透地雷達

- 其他

- 依用途

- 油和氣

- 電

- 運輸

- 用水和污水

- 通訊

- 其他

- 依地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭形勢

- 公司簡介

- Vivax-Metrotech

- Guideline Geo

- Radiodetection Ltd.

- Sensors & Software Inc.

- Geophysical Survey Systems, Inc

- Subsite Electronics(Charles Machine Works)

- Emerson Electric

- Leica Geosystem

- Irth Solutions

- ProStar Geocorp

- Ridge Tool Company

- Honeywell International Inc.

第8章投資分析

第9章市場的未來

The Utility Locator Market was valued at USD 798.1 million in the previous year and is expected to register a CAGR of 6.56%, reaching USD 1,120.2 million by the next five years. Utility Locating uses technology such as ground penetrating radar to locate pipes, cables, and other service infrastructure under the surface of a site. Utility Locators can also chart where underground cables and pipes are so that damage to these things can be avoided and planned around during excavation. Standard underground utilities include gas lines, water pipes, and telephone lines. These utilities are a vital part of the infrastructure, and the need for them to remain undisturbed is paramount.

Key Highlights

- Factors such as increased real-time detection of leakages, inspections, monitoring of underground utilities, stringent government policies to locate underground utilities before excavating and construction activities, and the development of technologically advanced tools are driving the utility locator market's growth.

- For instance, over the past few years, the subsurface utility engineering (SUE) industry has developed innovative ways of tackling the challenges of locating underground utility infrastructure. Geophysical technologies like electromagnetic locators and ground-penetrating radars are used alongside non-technical means, like historical records, to gather sufficient subsurface infrastructure information.

- Furthermore, the expanding use cases and technological developments are also encouraging the vendors to develop innovative solutions and launch them in the market. For instance, in May 2023, Vermeer Corporation developed the new GPS-enabled Verifier G3+ utility locator. Designed to deliver accuracy, optimized connectivity, and intuitive controls, the new utility locator from the company pairs with smartphones using the G3+ Map mobile app to plot location information, including current index, depth, GPS data, device name, utility type, and the operator who performed the work.

- Additionally, several international projects such as the high-speed rail line in Indonesia for USD 5.5 billion, the high and semi-high-speed rail and bullet train projects in India, and construction projects across various countries are expected to continue to drive the demand for utility locating solutions drastically in the coming years, driving the growth of the studied market.

- However, the equipment's high possession and maintenance costs and lack of expert skills can limit the future utility locator market's growth. Nevertheless, factors such as the growing demand for real-time utility locating tools and services and deteriorating infrastructure will provide abundant opportunities to the players in the market.

- Macroeconomic factors such as economic growth, recession, etc., play a crucial role in the growth of the studied market. These factors significantly influence the value and volume of investments in new construction and utility projects, which are among the primary end-users for utility locators. For instance, the looming threat of recession in the North American region may have a restraining impact on the growth of the studied market.

Utility Locator Market Trends

Transportation Sector to Hold Significant Market Share

- As transportation is a crucial pillar in facilitating the economic development of any region, significant emphasis is given to gathering information such as subsurface site characterizations before starting the construction of transportation-related infrastructure projects to prevent possible delays and cost overruns in a project. Utility locators detect, survey, and mark the land, significantly reducing uncertainty. Digital technologies such as electromagnetic fields and GPS in utility locators aid timely coordination and communication between operational points in various processes such as mapping and survey, enhancing precision and accuracy.

- For instance, more than 56 million kilometers (35 million miles) of known underground utilities exist in the United States, and many remain unidentified. Available underground utilities include electric and gas lines, pipes (both large and small), telephone, and internet cables, all of which could be at risk if a transportation agency digs into the earth without gathering adequate information.

- Road and highway construction across the world has been growing steadily, driven by increased car ownership, government investment, and urbanization. According to the US Census Bureau, in 2022, total transportation construction spending in the United States was about USD 1,792.9 billion, up by around 10.2% from the value of 2021. Such trends create a favorable outlook for the growth of the studied market in the region.

- Investments in projects supporting the transporting infrastructure are growing at a higher rate across developing countries such as India, China, Brazil, Vietnam, etc. For instance, according to the Ministry of Road Transport & Highways, India's MoRTH constructed 5337 km of National Highways till December 2022 and was also awarded 6318 km of National Highway contracts. As these projects pass through several cities and residential areas wherein various utility infrastructures are already laid out, such trends favor the studied market's growth.

North America is Expected to Showcase Significant Market Growth

- North America has been among the leading adopters of new technologies; hence, the region is anticipated to continue to account for a significant share of the utility locator market over the forecast period. Factors such as the increasing demand for enhanced surveillance and innovative construction equipment in advanced economies, including the United States and Canada, also support the studied market's growth in North America.

- The telecommunication sector in the United States is flourishing and experiencing collaborative measures by several major players with the technology provider to gain a first-mover advantage by rolling out the 5G service. For instance, in March 2022, Verizon and Live Nation announced a 5G technology partnership. Verizon is outfitting iconic venues across the United States with 5G Ultra Wideband built for significant scale events. As fiber optic cables play a crucial role in the development/expansion of telecommunication networks, such trends are anticipated to influence the studied market's growth positively.

- In the North American region, several major transportation infrastructure development projects are either underway or are being outlined by the regional governments, which is also creating opportunities in the studied market. For instance, the Canadian government is currently working on a new High Frequency Rail project that aims to provide clean, efficient, and safe transportation to Canadians. In early 2023, the Canadian government announced the groups that would be able to submit proposals for this project.

- Furthermore, according to the record of the NUAR (National Underground Asset Registry Advisory Group), the uncertainty of locating underground utilities costs the U.S. economy an average of USD 50 billion annually, with more than 1,500 injuries and nearly 400 deaths over the past 20 years. The uncertainty factor is a significant cause of highway construction delays due to missing or inaccurate information about underground utilities or mapping. These uncertainties of mapping utilities bolstered the growth of cutting-edge technology-based solutions in the region.

Utility Locator Industry Overview

The Utility Locator Market is moderately competitive and consists of several major players such as GSSI, Guideline Geo, Vivax-Metrotech, Emerson Electric, and many more. In terms of market share, few major players currently dominate the market. Players with a prominent share of the market focus on expanding their customer base globally. These companies are also leveraging strategic collaborative initiatives to increase their market share and profitability.

In January 2023, Leica Geosystems, part of Hexagon, launched their latest solution for excavation and utility professionals. The new launches, including the Leica DD175 utility locator and Leica DA175 signal transmitter, complement the company's existing Leica DD100 series and can help operators easily detect underground utilities to ensure the safety of site workers.

In October 2022, Radiodetection, a major provider of utility locating solutions, expanded its Ground Penetrating Radar (GPR) offerings with the introduction of LMX150 FINDAR, a compact resolution utility locating system that complements the company's traditional pipe and cable locators.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends on the Utility Locator Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Real-Time Detection Tools for Underground Utilities

- 5.1.2 Increase Investment for Inspection of Deteriorating Infrastructure

- 5.2 Market Challenges

- 5.2.1 High Possession and Maintenance Costs of the Equipment

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Equipment

- 6.1.2 Services

- 6.2 By Target

- 6.2.1 Metallic Utilities

- 6.2.2 Non-Metallic Utilities

- 6.3 By Technique

- 6.3.1 Electromagnetic Field

- 6.3.2 Ground Penetrating Radar

- 6.3.3 Other Techniques

- 6.4 By Application

- 6.4.1 Oil & Gas

- 6.4.2 Electricity

- 6.4.3 Transportation

- 6.4.4 Water and Sewage

- 6.4.5 Telecommunications

- 6.4.6 Other Applications

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vivax-Metrotech

- 7.1.2 Guideline Geo

- 7.1.3 Radiodetection Ltd.

- 7.1.4 Sensors & Software Inc.

- 7.1.5 Geophysical Survey Systems, Inc

- 7.1.6 Subsite Electronics (Charles Machine Works)

- 7.1.7 Emerson Electric

- 7.1.8 Leica Geosystem

- 7.1.9 Irth Solutions

- 7.1.10 ProStar Geocorp

- 7.1.11 Ridge Tool Company

- 7.1.12 Honeywell International Inc.