|

市場調查報告書

商品編碼

1406065

包裝塗料添加劑:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Packaging Coating Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

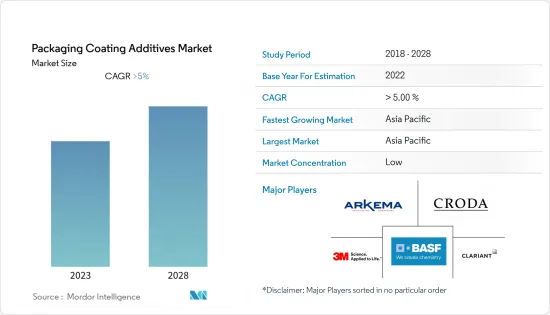

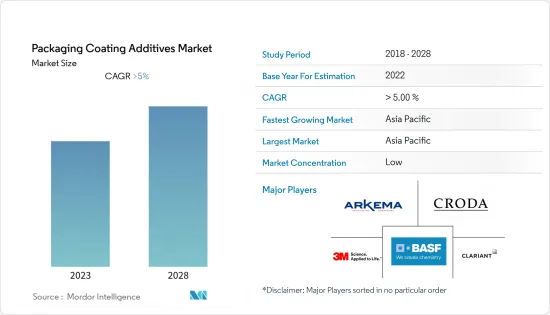

包裝塗料添加劑市場規模預計2024年為8.2億美元,預計2029年將達到10.1億美元,預測期內(2024-2029年)複合年成長率為5,預計成長超過% 。

COVID-19大流行擾亂了包裝塗料添加劑市場,由於全球供應鏈中斷和政府法規,導致銷售、生產和分銷減少。然而,隨著許多經濟體恢復正常,市場似乎正在向大流行前的階段發展。

工業包裝需求的不斷成長以及食品和飲料包裝應用中對防霧和抗菌添加劑的需求不斷成長預計將推動市場成長。

另一方面,政府對塑膠使用的嚴格政策和原料價格的波動阻礙了市場的成長。

新興國家和已開發國家對軟性塗料添加劑的需求不斷成長以及電子商務趨勢預計將為市場成長提供充足的機會。

亞太地區主導全球市場,中國、印度和日本等國家的消費量龐大。

包裝塗料添加劑市場趨勢

食品和飲料包裝領域的需求增加。

- 包裝材料容易有摩擦、化學穩定性等問題。為了提高包裝塗層材料的性能,添加添加劑以提高 pH 穩定性、消除表面摩擦並在包裝食品中誘導抗菌性能。

- 由於消費者可支配消費量的增加和忙碌的生活方式,全球食品和加工食品的消費正在增加,這刺激了對包裝被覆劑的需求,因此包裝塗料添加劑市場將擴大。

- 包裝和食品銷售的增加食品有助於增加對包裝塗料添加劑的需求,因為它們有助於防止食品腐敗和洩漏並延長包裝食品的使用壽命。

- 此外,使用防霧包裝塗料添加劑有助於增加包裝食品的銷售量,因為它可以保持包裝塗料的透明度和透視性,使食品對顧客可見。

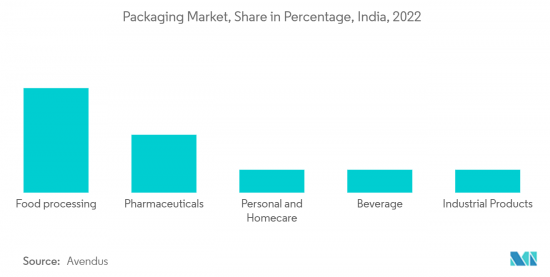

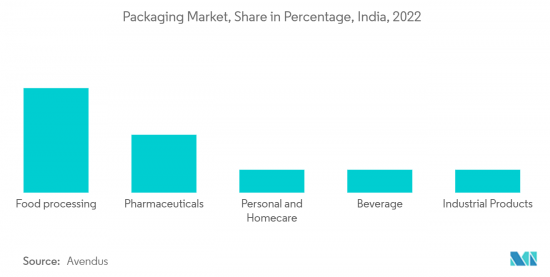

- 據印度投資局稱,印度快速成長的食品加工業預計到2025-2026年產值將達到5,350億美元,正在推動印度食品和飲料包裝行業的顯著成長,預計到2029年產值將達到5,350億美元預計將達860 億美元,年增率為14.8%。這種成長推動了對包裝黏劑和塗層黏劑,它們是食品包裝的重要組成部分。

- 消費者習慣的變化正在推動美國飲料產業的顯著成長。根據PMMI的飲料報告,預計2018年至2028年北美飲料產業將成長4.5%。北美的大部分飲料銷售都是由美國賣家實現的。

- 由於上述因素,包裝塗料添加劑市場預計在預測期內將快速成長。

亞太地區主導市場

- 預計亞太地區在預測期內將主導包裝塗料添加劑市場。隨著中國和印度等國家中階收入的顯著增加以及對包裝食品的需求增加,該地區對包裝塗料添加劑的需求正在增加。

- 電子商務的成長預計將為該地區的包裝塗料行業以及包裝塗料添加劑市場提供利潤豐厚的機會。尤其是食品和飲料包裝領域正在經歷快速成長。

- 中國在電子商務市場中佔有最大佔有率,佔電子商務總銷售額的30%以上。

- 對永續性的日益重視正在推動折疊紙盒製造商推出創新的包裝解決方案,特別是在乳製品行業。 2022年3月,SIG India推出了不使用鋁的無菌紙盒,以滿足印度對紙盒乳製品日益成長的需求。

- 作為邁向永續包裝的重要一步,ITC Limited 的 Yippee!該品牌於 2023 年 2 月被廢棄,YiPPee!將它們轉變為環保的生活方式產品,例如筆記型電腦內膽包、托特包和文具袋。

- 上述因素加上政府的支持正在推動包裝塗料添加劑市場的成長。

包裝塗料添加劑產業概況

包裝塗料添加劑市場本質上高度分散。主要企業(排名不分先後)包括 Croda International Plc、 BASF SE、Arkema、3M 和 CLARIANT。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 食品和飲料包裝的需求不斷擴大

- 工業包裝需求增加

- 其他司機

- 抑制因素

- 關於塑膠使用的嚴格政府政策

- 原物料價格波動

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 劑型

- 水性的

- 溶劑型

- 粉底

- 功能性

- 滑

- 抗靜電

- 防霧

- 抗菌的

- 防塞

- 目的

- 食品和飲料

- 工業的

- 衛生保健

- 消費品

- 其他用途(營養補充)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Ampacet Corporation

- Arkema

- BASF SE

- BYK Group(ALTANA)

- CLARIANT

- Croda International Plc

- DAIKIN INDUSTRIES, Ltd.

- DIC CORPORATION

- Evonik Industries AG

- Lonza

- PCC Group

- Solvay

第7章 市場機會及未來趨勢

- 對軟性塗料添加劑的需求不斷成長

- 電子商務的擴張趨勢

The Packaging Coating Additives Market size is estimated at USD 0.82 billion in 2024, and is expected to reach USD 1.01 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the packaging coating additives market, causing declines in sales, production, and distribution due to global supply chain disruptions and government restrictions. However, the market is seemingly growing towards its pre-pandemic stages as many economies are returning to normalcy.

Increasing demand in industrial packaging and growing demand for anti-fog and anti-microbial additives in food and beverage packaging applications are expected to fuel the market growth.

On the flip side, strict government policies regarding the use of plastics and fluctuation in raw material prices are hindering the growth of the market.

Rising demand for flexible coating additives and growing trends for e-commerce in developing as well as developed countries are expected to offer ample opportunities for the growth of the market.

Asia-Pacific dominated the global market's most significant enormous consumption from countries such as China, India, and Japan.

Packaging Coating Additives Market Trends

Increasing Demand from Food and Beverages Packaging Segment.

- Packaging Materials are prone to problems such as friction and chemical stability. To improve the performance of packaging coating materials, additives are added, which increase the pH stability, make the surface frictionless, and induce anti-microbial properties to the packaged food items.

- Packaged and processed foods consumption is increasing globally owing to increasing disposable income and the hectic lifestyle of consumers, which will help stimulate the demand for packaging coatings, thus enhancing the market for packaging coating additives.

- Increasing sales of packaged and processed foods will help in increasing the demand for packaging coating additives as they help in preventing food spoiling & leakage and also help in increasing the serviceable life of packaged food items.

- Furthermore, the use of antifog packaging coating additive helps to increase the sales of packaged food items as antifog additives helps to maintain the clarity and transparency of packaged coatings, thus making food items visible to the customer.

- According to Invest India, India's burgeoning food processing sector, with an anticipated output of USD 535 billion by 2025-2026, is driving significant growth in the Indian food and beverage packaging industry, which is projected to reach USD 86 billion in 2029, fueled by an annual growth rate of 14.8%. This growth fuels the demand for packaging and coating adhesives, essential food packaging components.

- Due to the changing consumer habits, the beverage industry in the United States has noticed substantial growth. According to PMMI's Beverage Report, the North American beverage industry is expected to grow by 4.5% from 2018 to 2028. Sellers achieve the major portion of the beverage sales in North America in the United States.

- Owing to the aforementioned factors, the packaging coating additives market is expected to grow rapidly during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for packaging coating additives during the forecast period. In countries like China and India, due to the significant rise in the income of the middle-class population and the increasing demand for packaged foods, the need for packaging coating additives has been increasing in the region.

- Growth in e-commerce is expected to provide lucrative opportunities for the packaging coatings industry and, consequently, for the packaging coating additives market in the region. The food and beverage packaging segment is the fastest-growing among them.

- China holds the largest share in the e-commerce market, accounting for more than 30% of the total e-commerce sales.

- The growing emphasis on sustainability prompts folding carton manufacturers to introduce innovative packaging solutions, particularly in the dairy segment. In March 2022, SIG India launched an aluminum-free folding carton aseptic packaging to cater to the rising demand for carton-packaged milk products in India.

- In a significant step towards sustainable packaging, ITC Limited's Yippee! The brand introduced "Terra By YiPPee!" in February 2023, a waste upcycling initiative that transforms discarded YiPPee! Wrappers into eco-friendly lifestyle products, including laptop sleeves, totes, and stationery pouches.

- The above factors, coupled with government support, have fueled the growth of the packaging coating additives market.

Packaging Coating Additives Industry Overview

The packaging coating additives market is highly fragmented in nature. The major players (not in any particular order) include Croda International Plc, BASF SE, Arkema, 3M, and CLARIANT, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand in Food & Beverages Packaging

- 4.1.2 Increasing Demand in Industrial Packaging

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Government Policies Regarding the Use of Plastics

- 4.2.2 Fluctuation in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Formulation

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Powder-based

- 5.2 Function

- 5.2.1 Slip

- 5.2.2 Anti-static

- 5.2.3 Anti-fog

- 5.2.4 Antimicrobial

- 5.2.5 Anti-block

- 5.3 Application

- 5.3.1 Food and Beverage

- 5.3.2 Industrial

- 5.3.3 Healthcare

- 5.3.4 Consumer Goods

- 5.3.5 Other Applications (Nutraceuticals)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Ampacet Corporation

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 BYK Group (ALTANA)

- 6.4.6 CLARIANT

- 6.4.7 Croda International Plc

- 6.4.8 DAIKIN INDUSTRIES, Ltd.

- 6.4.9 DIC CORPORATION

- 6.4.10 Evonik Industries AG

- 6.4.11 Lonza

- 6.4.12 PCC Group

- 6.4.13 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand For Flexible Coating additives

- 7.2 Growing Trend for E-commerce