|

市場調查報告書

商品編碼

1406057

感測器 -市場佔有率分析、行業趨勢和統計、2024 年至 2029 年成長預測Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

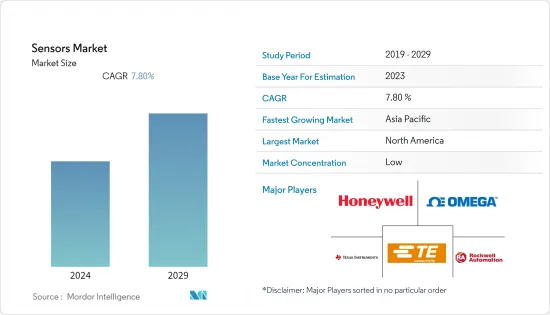

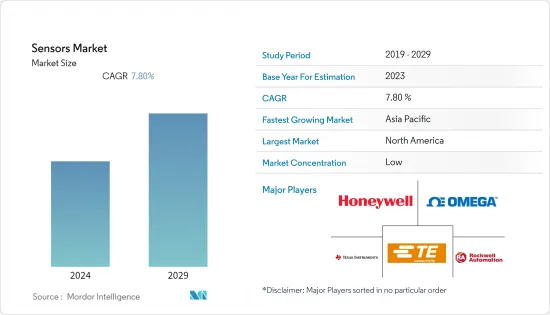

上年度全球感測器市場價值為1,058.9億美元,預計預測期內複合年成長率為7.8%,到預測期結束時將達到1,662億美元。

感測器檢測並響應來自物理環境的輸入。典型的輸入包括壓力、熱量、光、運動和濕度。輸出是一個訊號,該訊號要么轉換為感測器位置的人類可讀顯示器,要么透過網路以電子方式傳輸以供讀取或進一步處理。感測器與物聯網 (IoT) 平台的兼容性日益增強,並成為實現遠端監控和控制的先決條件。

主要亮點

- 物聯網連接設備為感測器在醫療、工業、消費性電子和汽車等眾多應用中帶來了巨大的可能性。根據思科年度網際網路報告,到年終,連網裝置和連線數量將達到約 300 億,高於 2018 年的約 184 億。到 2023 年,物聯網設備預計將佔所有連網裝置的 50%(147 億),高於 2018 年的 33%(61 億)。物聯網設備的增加可能會推動所研究市場的成長。

- 自動化的興起將增加對感測器的需求,這些感測器在檢測、測量、分析和處理工業生產現場發生的眾多變形(例如長度、位置、外裝、高度和錯位的變化)方面發揮關鍵作用。看來。此外,工業 4.0 革命使機器變得更加直覺和智慧型,這增加了對感測器工業應用的需求。新機器的設計更加安全、靈活、高效,能夠自動監控效能、使用情況和故障。因此,這些應用正在推動對高靈敏度感測器的需求。

- 此外,根據IFR的預測,到2024年,全球工廠中運作的工業普及數量預計將大幅增加至約518,000台。工業機器人市場的這種積極成長軌跡預計將推動同期感測器的需求。

- 此外,內建人工智慧(AI)的感測器使它們能夠像人類一樣思考和互動。人工智慧實現即時控制和自動軌跡校正,以保持高精度、系統完整性和穩健性。人工智慧使機器可以輕鬆地主動控制任何偏差。人工智慧也為自動化系統、預測控制、CRM系統、高解析度成像應用等提供智慧型解決方案。

- 一些專注於提高效率、準確性和解決限制的生物感測器研究預計將引領生物感測器的採用。例如,2022年8月,芝加哥大學普利茲克分子工程學院的一項新研究發現,直接佩戴在皮膚上的靈活、可拉伸的電腦晶片可以利用人工智慧即時收集和分析健康資料。 。該設備是神經型態電腦晶片,使用半導體和電化學電晶體從與皮膚接觸的生物感測器收集資料。與其他穿戴式產品(例如智慧型手錶)在設備和用戶皮膚之間留下很小的間隙不同,該晶片設計為直接佩戴在皮膚上,從而提高了感測器的準確性和資料收集。

- 儘管感測器整合提高了工業自動化水平,但它會產生額外的成本,這限制了其在成本敏感型應用中的使用。此外,與生產新產品的研發活動相關的高開發成本構成了重大挑戰,尤其是對於缺乏現金的中小型感測器製造商而言。

- 此外,俄羅斯和烏克蘭戰爭影響了半導體和電子元件的供應鏈,並對全球感測器市場產生嚴重影響。衝突可能會擾亂供應鏈並導致這些材料的短缺和價格上漲,從而影響工業 4.0 製造商並導致最終用戶的成本更高。這些因素可能會抑制所研究市場的成長。

感測器市場趨勢

消費性電子產業可望推動市場區隔成長

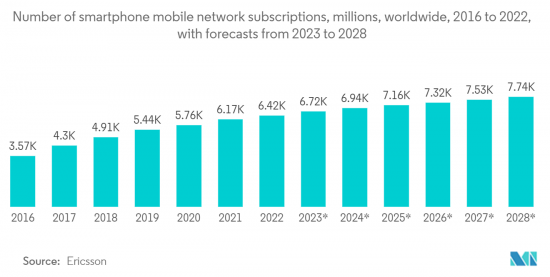

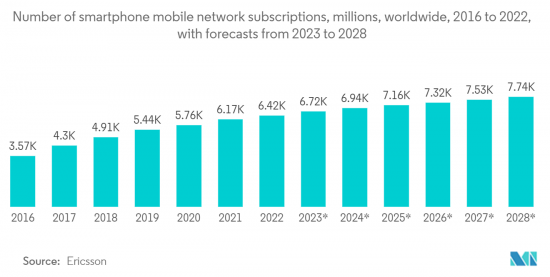

- 受多種因素影響,全球對智慧型手機的需求不斷成長,包括 5G 的出現、可支配收入的增加以及通訊基礎設施的改善。根據愛立信報告,預計2021年全球智慧型手機用戶數將達到62.59億部,2027年將達到76.9億支。

- 智慧型手機中的感測器用於檢測環境的各個方面。智慧型手機中使用了多種類型的感測器,包括運動感測器、環境感測器、位置感測器、環境光感測器、接近感測器、加速感應器、陀螺儀感測器和氣壓感測器。因此,智慧型手機的日益普及為推動研究目標市場提供了巨大的機會。智慧型手機影像感測器的使用正在增加,SONY和三星等公司成為這些市場的領導者。 2022 年 7 月,SONY宣布開發出新型 100MP CMOS 感測器。

- 生物識別感測器已成為市場成長的重要因素。各種公告和協議證明,個人電腦生物辨識認證的需求存在一定的正面成長趨勢。例如,2022年3月,Fingerprint Cards AB宣布其生物識別PC解決方案將整合到聯想ThinkBook 14和ThinkBook 15 G4筆記型電腦的電源按鈕中。鑑於聯想是個人電腦製造領域的主要企業之一,這樣的交易將對發展研究市場大有幫助。

- 此外,健身追蹤器、智慧型手錶、智慧手環、 VR頭戴裝置、運動手錶、活動追蹤器等智慧穿戴裝置與人工智慧(AR)、物聯網(IoT)等先進技術相結合,應用數量龐大。感測器。例如,Fitbit、智慧型手錶和脈動式血氧監測儀系統等穿戴式系統採用光學感測器提供即時患者健康追蹤解決方案。因此,隨著這些設備的使用不斷增加,整個感測器市場受到了積極的影響,並呈現出穩定的成長。

- 2023年4月,三星Galaxy發表了Watch5系列。 Watch5系列配備了先進的感應器,可以追蹤您的身體活動(步數、燃燒的卡路里)、心率、SpO2(血氧飽和度),甚至月經週期。它還具有獨特的生物活性感測器。您可以測量您的骨肌比和脂肪量。這可以幫助您了解您身體的健康程度。

- 此外,使用感測器進行健康監測對於感測器市場的崛起至關重要。收購和開發是這方面的重要因素。 2022 年 6 月,AliveCor 宣布將加入資料感測器雲端網路,以促進和擴大各種嚴重的臨床試驗。 資料和 AliveCor 正在透過智慧型使用感測器雲端網路提供可靠的方式來遠端擷取和共用關鍵心臟健康資料,從而實現臨床研究的民主化。

- 2022 年 6 月,嵌入式系統公司 SolidRun 宣布與瑞薩電子建立合作關係,並推出了首款基於瑞薩電子 RZ/G2LC系統晶片的模組系統 (SoM)。該 SoM 針對人工智慧增強型人機介面 (HMI) 應用、工業和建築自動化、智慧視訊監控和物聯網解決方案。符合條件的設備包括對講機、視訊門鈴、網路攝影機和手持 POS 系統。這些新興市場對於感測器市場的全球整體成長至關重要。

亞太地區預計將推動市場成長

- 分析師預測,由於亞太地區擁有許多消費性電子產品製造商,該地區將主導感測器市場。預計該市場將受到智慧型手機普及的提高、5G普及以及眾多最終用戶行業的進步的推動。中國、韓國、日本、印度是亞太地區主要國家。

- 此外,智慧城市的前景正在吸引亞太地區的科技業。 Equinix最新報告《智慧城市:根據瑞銀預測,到2025年,亞太地區將佔全球智慧城市計劃市場發展的約40%,即8,000億美元。這種快速的都市化將促進IT建設和互聯的擴展頻寬來維持亞太地區不斷擴大的數位市場,從而導致智慧建築和電網、空氣和水監測、智慧廢棄物收集、智慧交通、災難應變等智慧城市應用可能會擴大感測器市場的機會領域。

- 隨著ADAS(高級駕駛輔助系統)在汽車市場的進步,其目標是透過結合來自雷達、攝影機和雷射雷達等多個感測器的資料來提供對車輛周圍環境的精確感知,對汽車感測器的需求不斷成長以及。隨著汽車中 ADAS 系統需求的增加,感測器的採用預計將加速。

- 2022 年 8 月,先進半導體解決方案領先供應商瑞薩電子收購了 Steradian Semiconductors Private Limited,這是一家位於印度班加羅爾的無晶圓廠半導體公司,提供 4D 成像雷達解決方案。此次收購將使瑞薩電子能夠擴大在雷達市場的影響力,並加強其工業和汽車感測解決方案組合。此外,我們的目標是擴大我們在汽車領域的領導地位。瑞薩電子也將利用 Stelladian 的工業應用技術,支援汽車感測和工業領域的中長期業務成長。

- 此外,智慧型手機市場中各種感測器的廣泛使用預計將進一步增加該市場對感測器的需求。 2022年6月,SONY集團宣布計劃加強其影像感測器技術,旨在鞏固其市場地位並擴大產品系列。該公司投資於研發能力,為客戶提供在使用智慧型手機拍照時專注於多個目標的解決方案。這些公司的努力預計將增加智慧型手機中感測器的需求,從而刺激亞太地區感測器需求的成長。

感測器產業概況

隨著感測器行業知名製造商的不斷增加,競爭對手之間的敵對關係預計在預測期內將會加劇。德州儀器 (TI)、TE Connectivity Inc 和 Omega Engineering Inc 等市場老牌企業正在對整個市場產生重大影響。這些公司透過專注於市場擴張和收購來不斷擴大業務。持續的產品推出和技術升級有效滾打了感測器行業整體市場的成長。

2023 年 1 月,恩智浦半導體宣布推出業界首款 28nm RF CMOS 雷達單單晶片IC 系列,用於下一代 ADAS 和自動駕駛系統。全新單晶片SAF85xx 系列將恩智浦強大的雷達偵測和處理技術整合到單一裝置中,為一級層級商和OEM彈性。

2022年4月,奇石樂發表了最新的4017-A壓阻式絕對壓力感知器,用於冷熱環境下的引擎開發以及液壓和氣壓應用。 PR 壓力感測器也可用於動態壓力測量,因為即使在低壓區域,它們也可以捕捉快速變化的壓力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 技術趨勢/進展

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 評估 COVID-19 和宏觀經濟趨勢對產業的影響

- 產業價值鏈/供應鏈分析

- 軟性印刷感測器產業動態(現況、市場估計與預測、發展、動態)

第5章市場動態

- 市場促進因素

- 感測器技術進步和成本下降

- 自動化和工業 4.0 的出現

- 市場抑制因素

- 初始成本高

第6章市場區隔

- 按測量參數

- 溫度

- 壓力

- 等級

- 流量

- 接近

- 環境

- 化學

- 慣性

- 磁的

- 振動

- 其他測量參數

- 按運轉模式

- 光學

- 電阻

- 生物感測器

- 壓電電阻

- 影像

- 電容式

- 壓電

- LiDAR

- 雷達

- 其他操作模式

- 按最終用戶產業

- 車

- 家用電器

- 智慧型手機

- 平板電腦、筆記型電腦、電腦

- 穿戴式裝置

- 智慧家電

- 其他家電

- 能源

- 工業/其他

- 醫療/福利

- 建築、農業、採礦

- 航太

- 防禦

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- Texas Instruments Incorporated

- TE Connectivity Ltd

- Omega Engineering Inc.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Siemens AG

- STMicroelectronics NV

- ams OSRAM AG

- NXP Semiconductors NV

- Infineon Technologies AG

- Bosch Sensortec Gmbh(Robert Bosch Stiftung GMBH)

- Sick AG

- ABB Limited

- Omron Corporation

第8章投資分析

第9章市場的未來

The global sensors market was valued at USD 105.89 billion in the previous year and is anticipated to reach USD 166.2 billion by the end of the forecast period, registering a CAGR of 7.8% during the forecast period. A sensor detects and responds to the inputs from the physical environment. A typical input can be pressure, heat, light, motion, and moisture, among many others. The output is a signal that is transformed into a human-readable display at the sensor's location or is electronically transmitted over a network for reading or further processing. The rising sensor compatibility with the Internet of Things (IoT) platform is slowly becoming a prerequisite for enabling remote monitoring and control.

Key Highlights

- The IoT-connected devices have unfurled enormous opportunities for sensors in numerous applications like medical, industrial, consumer electronics, automotive, etc. According to Cisco's Annual Internet Report, by the end of 2023, there will be approximately 30 billion network-connected devices and connections, up from about 18.4 billion in 2018. In 2023, IoT devices are estimated to make up 50 percent (14.7 billion) of all networked devices, up from 33 percent (6.1 billion) in 2018. Such an increase in IoT devices would drive the growth of the studied market.

- The emergence of automation would augment the demand for sensors as they play an important part in detecting, measuring, analyzing, and processing numerous transformations like alteration in length, position, exterior, height, and dislocation that occur in industrial manufacturing sites. Further, the Industry 4.0 revolution, in which machines are becoming more intuitive and intelligent, is increasing the necessity for the industrial applications of sensors. The new machines are designed to be safer, flexible, and efficient, with the ability to autonomously monitor their performance, usage, and failure. These applications, therefore, spur the demand for highly sensitive sensors.

- Also, according to the IFR forecasts, the global adoption is anticipated to increase significantly to approximately 518,000 industrial robots operational across factories all around the globe by 2024. Such a positive growth trajectory of the industrial robots market is likely to drive the demand for sensors during the same period.

- Moreover, sensors embedded with AI (artificial intelligence) have enabled them to think and interact like humans. AI allows real-time control and auto-course correction to maintain high precision, system integrity, and robustness. It facilitates machines to control any deviations proactively. AI also delivers intelligent solutions in automation systems, predictive controls, CRM systems, high-resolution imaging applications, etc.

- Several researches regarding biosensors focusing on increasing efficiency, accuracy, and tackling limitations are anticipated to spearhead the adoption of biosensors. For instance, in August 2022, new research conducted by the University of Chicago's Pritzker School of Molecular Engineering showed that a flexible, stretchable computer chip worn directly on the skin can use artificial intelligence to collect and analyze health data in real-time. The device is a neuromorphic computer chip that uses semiconductors and electrochemical transistors to collect data from biosensors in contact with the skin. Unlike other wearable products, such as smartwatches that leave a small gap between the device and the user's skin, this chip is designed to be worn directly on the skin, improving sensor accuracy and data collection.

- Although integrating sensors boosts the industrial automation level, it incurs an additional cost, limiting the use in cost-sensitive applications. Additionally, high development costs involved in the research and development activities to manufacture new products act as a critical challenge, mainly for the cash-deficient small and medium-sized sensor manufacturers.

- Also, the Russia-Ukraine war is impacting the supply chain of semiconductors and electronic components, thereby severely impacting the global sensors market. The dispute has disrupted the supply chain, causing shortages and price increases for these materials, impacting industry 4.0 manufacturers and potentially leading to higher costs for end-users. Such factors might restrain the growth of the studied market.

Sensor Market Trends

The Consumer Electronics Segment is Anticipated to Drive the Growth of the Studied Market

- The global demand for smartphones has been witnessing an uptick due to several factors, like the advent of 5G, increasing disposable income, and the development of telecom infrastructure. As per the Ericsson report, the number of smartphone subscriptions globally amounted to 6,259 million in 2021 and is expected to reach 7,690 million in 2027.

- Sensors in smartphones are employed to detect various aspects of the environment. Several types of sensors include motion sensors, environmental sensors, position sensors, ambient light sensors, proximity sensors, accelerometer sensors, gyroscope sensors, and barometer sensors. etc., are utilized in smartphones. As a result, the increasing penetration of smartphones would offer robust opportunities for boosting the studied market. The use of image sensors for smartphones has increased, and companies such as Sony and Samsung are the front runners in these markets. In July 2022, Sony announced the development of a new 100 MP CMOS sensor that will be seen on upcoming mid-range smartphones.

- Biometric sensors have been an integral factor contributing to the market's growth. There is a solid positive growth trend in demand for biometric authentication in PCs, which various launches and agreements can illustrate. For example, in March 2022, Fingerprint Cards AB announced that the company's biometric PC solution would be integrated into the power button of the Lenovo ThinkBook 14 and ThinkBook 15 G4 laptops. Considering Lenovo is one of the prominent players in PC making, such agreements would hugely aid in the growth of the studied market.

- Further, Smart wearable devices like fitness trackers, smartwatches, smart wristbands, VR headsets, sports watches, and activity trackers are integrated with advanced technologies such as artificial intelligence (AR) and IoT (IoT), which employ a huge number of sensors. For example, fit bits, smartwatches, and pulse oximeters are among the wearable systems incorporated with optical sensors to provide real-time patient health tracking solutions. Therefore, with increased use of these devices, the overall sensors market is impacted positively, exhibiting a steady growth.

- To that extent, in April 2023, Samsung's Galaxy launched the Watch5 series, which comes with advanced sensors that can track physical activities (in terms of steps walked and calories burned), monitor heart rate, SpO2 (blood-oxygen saturation), and even menstrual cycle. It also has a unique BioActive Sensor. It can measure the skeleton-muscle ratio and fat mass of the body. This helps in getting a better understanding of the body's fitness level.

- Moreover, the use of sensors for health monitoring has been imperative for the rise of the sensors market. Acquisitions and developments in this regard have been an essential factor. In June 2022, AliveCor announced joining the Medidata Sensor Cloud Network to facilitate and expand access to clinical trials for a diverse range of severe conditions. Medidata and AliveCor are democratizing clinical research by offering a reliable way to remotely capture and share important heart health data through the intelligent use of Sensor Cloud Network.

- In June 2022, embedded systems company SolidRun announced a partnership with Renesas and launched the first system-on-module (SoM) based on Renesas' RZ/G2LC system-on-a-chip. The SoMs are aimed at AI-enhanced human-machine interface (HMI) applications, industrial and building automation, smart video surveillance, and IoT solutions. Targeted devices include intercoms, video doorbells, network cameras, handheld POS systems, and more. Such developments are crucial for the growth of the overall sensor market globally.

Asia-Pacific is Expected to Drive the Growth of the Market Studied

- Due to significant consumer electronics manufacturers in this region, analysts predict that Asia-Pacific will dominate the sensors market. The market is anticipated to be driven by increasing smartphone penetration, 5G penetration, and advancements across numerous end-user industries. China, South Korea, Japan, and India, among others, are major Asia-Pacific countries.

- Moreover, the promise of smart cities has captivated the APAC region's technology industry. As per the recent report by Equinix, "Smart Cities: Shifting Asia," UBS projects that APAC is likely to account for about 40 percent of the global addressable market evolution for smart city projects, or USD 800 billion, by 2025. This prompt urbanization drives IT buildout and interconnection bandwidth growth to sustain APAC's expanding digital market. As a result, smart city applications like smart buildings and grids, air and water monitoring, smart waste collection, smart transportation, and disaster response are likely to expand the opportunity areas for the sensor market.

- With the growing advancements of Advanced Driver Assistance Systems in the automotive market, automotive sensor demand has been growing similarly with an aim to offer precise and accurate detection of vehicles' surroundings by combining data from several sensors like radar, cameras, and LiDAR. In line with the growing demand for ADAS systems in vehicles, it is expected to promote the adoption of sensors.

- In August 2022, Renesas Electronics, a premier supplier of advanced semiconductor solutions, acquired Steradian Semiconductors Private Limited, a fabless semiconductor company that offers 4D imaging radar solutions based in Bengaluru, India. The acquisition would enable Renesas to expand its market presence in the radar market and augment its industrial and automotive sensing solution portfolio. Moreover, the company also aims to expand its leadership in the automotive segments. Renesas would also leverage Steradian's technology for industrial applications to support its mid-term and long-term business growth in the automotive sensing and industrial segments.

- Furthermore, the increasing applications of a wide range of sensors in the smartphone market are expected further to increase the demand for sensors in the market. In June 2022, Sony Group announced its plan to enhance its image sensor technology with an aim to expand its product portfolio along with strengthening its market position. The company has been investing in its R&D capabilities to provide its customers with a solution for focusing on multiple targets when taking a picture via a smartphone. Such initiatives by the companies in the market are expected to increase the demand for sensors in the smartphone, thereby fueling the demand growth of sensors in the Asia-Pacific region.

Sensor Industry Overview

The increasing presence of prominent manufacturers in the sensor industry is expected to intensify competitive rivalry during the forecast period. Market incumbents, such as Texas Instruments Incorporated, TE Connectivity Inc., Omega Engineering Inc., etc., considerably influence the overall market. These firms have continuously expanded their operations by focusing on market expansions and acquisitions. Continuous product launches and technological upgrades effectively set the ball rolling regarding overall market growth in the sensor sector.

In January 2023, NXP Semiconductors launched a new industry-first 28 nm RF CMOS radar one-chip IC family for next-generation ADAS and autonomous driving systems. The new single-chip SAF85xx family integrates NXP's powerful radar detection and processing technology into a single device, giving Tier 1s and OEMs new flexibility to address short-, medium-, and long-range radar applications.

In April 2022, Kistler released its latest 4017-A piezoresistive absolute pressure sensor for usage in engine development and hydraulic and pneumatic applications in hot and cold environments. The PR pressure sensors can also be employed for dynamic pressure measurements due to their ability to capture rapidly changing pressures, even in low-pressure ranges.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends/Advancements

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Assessment of the Impact of the COVID-19 and Macroeconomic Trends on the Industry

- 4.5 Industry Value Chain/supply Chain Analysis

- 4.6 Flexible and Printed Sensors Industry Dynamics (Current Scenario, Market Estimates, Projections, Developments, and Dynamics)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancement and Decreasing Cost of Sensors

- 5.1.2 Emergence of Automation and Industry 4.0

- 5.2 Market Restraints

- 5.2.1 High Initial Cost Involved

6 MARKET SEGMENTATION

- 6.1 By Parameters Measured

- 6.1.1 Temperature

- 6.1.2 Pressure

- 6.1.3 Level

- 6.1.4 Flow

- 6.1.5 Proximity

- 6.1.6 Environmental

- 6.1.7 Chemical

- 6.1.8 Inertial

- 6.1.9 Magnetic

- 6.1.10 Vibration

- 6.1.11 Other Parameters Measured

- 6.2 By Mode of Operation

- 6.2.1 Optical

- 6.2.2 Electrical Resistance

- 6.2.3 Biosensors

- 6.2.4 Piezoresistive

- 6.2.5 Image

- 6.2.6 Capacitive

- 6.2.7 Piezoelectric

- 6.2.8 LiDAR

- 6.2.9 Radar

- 6.2.10 Other Modes of Operation

- 6.3 By End user Industry

- 6.3.1 Automotive

- 6.3.2 Consumer Electronics

- 6.3.2.1 Smartphones

- 6.3.2.2 Tablets, Laptops, and Computers

- 6.3.2.3 Wearable Devices

- 6.3.2.4 Smart Appliances or Devices

- 6.3.2.5 Other Consumer Electronics

- 6.3.3 Energy

- 6.3.4 Industrial and Other

- 6.3.5 Medical and Wellness

- 6.3.6 Construction, Agriculture, and Mining

- 6.3.7 Aerospace

- 6.3.8 Defense

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 TE Connectivity Ltd

- 7.1.3 Omega Engineering Inc.

- 7.1.4 Honeywell International Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Siemens AG

- 7.1.7 STMicroelectronics NV

- 7.1.8 ams OSRAM AG

- 7.1.9 NXP Semiconductors NV

- 7.1.10 Infineon Technologies AG

- 7.1.11 Bosch Sensortec Gmbh (Robert Bosch Stiftung GMBH)

- 7.1.12 Sick AG

- 7.1.13 ABB Limited

- 7.1.14 Omron Corporation