|

市場調查報告書

商品編碼

1405733

金屬清洗劑-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Metal Cleaning Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

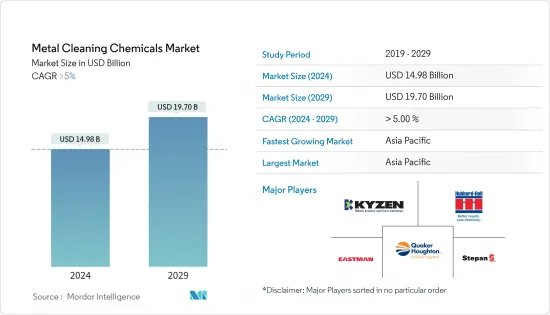

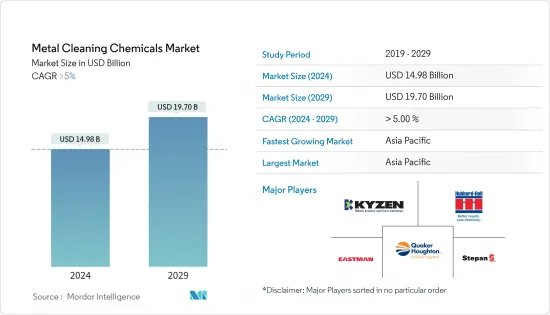

預計2024年金屬清洗劑市場規模為149.8億美元,預計2029年將達到197億美元,在預測期內(2024-2029年)複合年成長率超過5%。

由於對消毒劑、通用清潔劑、表面清潔劑、清潔劑、肥皂和其他衛生產品的需求增加,COVID-19 大流行對金屬清洗化學品市場產生了積極影響。這幫助製藥和化學公司增加了衛生和清潔領域的銷售。

製造業對工業清洗和維護的需求不斷成長正在推動市場成長。

大多數清洗化學品與氧氣混合時具有腐蝕性且危險。廢棄物管理和清洗化學品的毒性是阻礙市場成長的主要課題。

此外,由於其有效性、安全性和永續性,對綠色和生物基金屬清洗劑的需求不斷成長。這些可能為全球市場的快速和盈利擴張創造機會。

亞太地區主導了金屬清洗產品市場,其中印度、中國和日本是主要消費量國。

金屬清洗劑的市場趨勢

鋼鐵業需求增加

- 由於需要保持金屬表面清潔,鋼鐵業是金屬清洗劑的最大用戶。工業金屬清洗是應對這項課題的一個有價值的解決方案,因為它們可以在不拆卸或組裝設備的情況下進行清洗,它們還可以防止清洗後的腐蝕。

- 由於都市化、技術進步、政府支持、工業應用對鋼材的強勁需求、製造需求的增加以及對工業清潔和維護的日益關注,該行業正在不斷成長。

- 世界鋼鐵協會預測,繼 2022 年下降 2.3% 後,2023 年成品鋼用量將成長 1.0%。中國經濟對2022年鋼鐵產量影響較大,下降4%。由於COVID-19控制措施的延長以及房地產和建築計劃需求的減少,預計2023年中國鋼鐵產量將保持穩定。

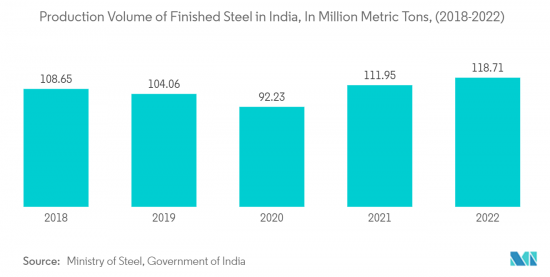

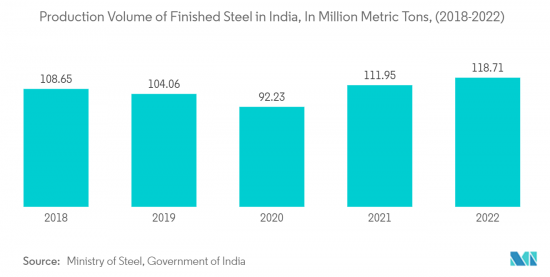

- 受基礎設施支出、強勁的消費需求以及汽車行業成長的推動,印度成品鋼產量預計將在2022年增加,從而提振預測期內與鋼鐵生產相關的金屬清洗化學品市場。

- 根據國家鋼鐵政策,印度2022-23會計年度的鋼鐵產量將超過1.25億噸。新德里的目標是到 2030 年將產量增加到 3 億噸。

- 鋼材是金屬清洗劑市場中最重要的金屬類型之一,預計在預測期內將進一步推動該市場的發展。

亞太地區主導金屬清洗劑市場

- 由於鋼鐵和鋁等金屬的高產量和消費量,亞太市場預計將以最快的速度成長。這些金屬廣泛用於製造各種零件、汽車車架、工業控制面板等,需要金屬清洗液清洗。

- 該地區經濟的快速成長,加上可支配收入的增加,為國際公司進入當地市場、提高知名度和收益潛力創造了機會。

- 根據世界鋼鐵協會預測,2022-23年印度粗鋼產量為12532萬噸,成品鋼產量為12129萬噸,成為全球第二大粗鋼產量國家。

- 根據 OICA 的數據,2022 年全球汽車產業將成長 6%。 2022 年,中國、德國、韓國、英國和義大利等全球已開發國家和開發中國家的汽車產量均增加。 2022年,汽車產量超過8,500萬輛。

- 據 IBEF(印度品牌股權基金會)稱,30 家公司已核准了67 份特種鋼生產連結獎勵(PLI) 計劃的申請。這些核准預計將吸引4,250兆印度盧比(51.9億美元)的投資,並增加下游鋼鐵產能2,600萬噸。

- 印度投資局預測,到 2026 年,印度將成為電子系統設計和製造 (ESDM) 領域價值 1 兆美元的數位經濟體。印度電子市場目前價值1,550億美元,其中國內生產佔65%。此外,還啟動了獎勵100 億美元的 Semicon India 計劃,旨在在該國發展永續的半導體和顯示生態系統。

- 普華永道表示,印度化學工業是全球成長最快的產業之一,預計到 2025 年將達到 3,040 億美元。

- 根據IBEF統計,印度是全球第六大化學品生產國、亞洲第三大化學品生產國,佔印度GDP的7%。政府在 2023-24 年聯邦預算中向化學和石化部撥款 17345 萬印度盧比(2093 萬美元)。

- 亞太地區正在經歷政府和企業的快速成長和投資。亞太地區有望成為全球主要化學品市場,其中中國、印度和日本在生產和消費方面處於領先地位。

金屬清洗劑產業概況

金屬清洗劑市場本質上是分散的。主要公司(排名不分先後)包括Quaker Houghton、Stepan Company、Hubbard Hall、KYZEN CORPORATION 和酵母 Chemical Company。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 製造業需求增加

- 水基金屬清洗解決方案市場的成長

- 航太需求不斷成長

- 抑制因素

- 使用金屬清洗的健康和安全問題

- 高級金屬清洗劑高成本

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 類型

- 酸性的

- 基本的

- 中性的

- 型態

- 水性的

- 溶劑

- 最終用戶產業

- 航太

- 汽車/交通

- 電力/電子

- 化學/製藥

- 油和氣

- 其他最終用戶產業(醫療保健、食品和飲料)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arrow Solutions

- Avudai Surface Treatments Pvt Ltd

- BASF SE

- CLARIANT

- Chautauqua Chemical Company

- Crest Chemicals.

- Delstar Metal Finishing, Inc.

- Dow

- DST-CHEMICALS

- Eastman Chemical Company

- Ecolab

- Elmer Wallace Ltd.

- Hubbard-Hall

- Henkel AG & Co. KGaA

- ICL

- KYZEN CORPORATION

- Lincoln Chemical Corporation

- Luster-On Products, Inc.

- Modern Chemical, Inc.

- PARKER HANNIFIN CORP

- PCC Group

- Quaker Houghton

- Rochester Midland Corp

- Solugen

- Spartan Chemical Company, Inc.

- Stepan Company

- The Chemours Company

- Zavenir Daubert

第7章 市場機會及未來趨勢

- 生物基清洗劑的開發

- 醫療保健產業的需求不斷成長

The Metal Cleaning Chemicals Market size is estimated at USD 14.98 billion in 2024, and is expected to reach USD 19.70 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic had a positive impact on the metal cleaning chemicals market, as demand for disinfectants, all-purpose cleaners, surface cleaners, detergents, soaps, and other hygiene products increased. This positively affected the pharmaceutical and chemical companies to boost their sales in the hygiene and cleaning sector.

The increasing demand for industrial cleaning and maintenance in the manufacturing sector is driving the market growth.

Most cleaning chemicals are corrosive and dangerous to mix with oxygen. Waste management and the harmful effects of cleaning chemicals are major challenges hindering market growth.

Further, green and bio-based metal cleaning chemicals are growing in demand due to their effectiveness, safety, and sustainability. They are likely to create opportunities for rapid and profitable expansion in the global market.

Asia-Pacific region dominated the market for metal cleaning chemicals, with India, China, and Japan representing major countries in terms of consumption.

Metal Cleaning Chemicals Market Trends

Increasing Demand in the Steel Sector

- The steel industry is the largest user of metal cleaning chemicals because it needs to keep its metallic surfaces clean. Industrial metal cleaners are a valuable solution for this challenge because they can clean equipment without having to disassemble and reassemble it, and they also prevent corrosion after cleaning.

- This segment is growing due to urbanization, technological advancements, government support, strong demand for steel in industrial applications, increasing manufacturing needs, and a growing focus on industrial cleaning and maintenance.

- The World Steel Association predicts that finished steel usage will increase by 1.0% in 2023, following a 2.3% decline in 2022. China's economy had a significant impact on steel production in 2022, which fell by 4%. Due to prolonged COVID-19 containment measures, which reduced demand for real estate and construction projects, steel production is expected to remain stable in China in 2023.

- India's increased production of finished steel products in 2022, driven by infrastructure spending, strong consumer demand, and automotive industry growth, is expected to boost the metal cleaning chemicals market associated with steel production during the forecast period.

- India produced over 125 million metric tons of steel in the fiscal year 2022-23, according to the National Steel Policy. New Delhi aims to increase this production to 300 million metric tons by 2030.

- Steel is one of the most significant metal types in the metal cleaning chemicals market and is expected to drive this market further during the forecast period.

Asia-Pacific to Dominate the Metal Cleaning Chemicals Market

- The Asia-Pacific market is expected to grow at the fastest rate due to the high production and consumption of metals such as steel and aluminum. These metals are widely used in the manufacturing of various components, vehicle frames, and industrial control panels, among others, and require metal cleaning solutions to be cleaned.

- The rapid economic growth in the region, coupled with rising disposable incomes, is creating opportunities for international companies to enter the local market and increase their visibility and revenue potential.

- India produced 125.32 million metric tons of crude steel and 121.29 million metric tons of finished steel in fiscal year 2022-23, making it the world's second-largest producer of crude steel, according to the World Steel Association.

- The global automotive industry grew by 6% in 2022, according to OICA. In developed and developing countries across the world, including China, Germany, South Korea, Canada, the United Kingdom, and Italy, automotive production increased in 2022. Over 85 million motor vehicles were manufactured in 2022.

- According to IBEF (India Brand Equity Foundation), 30 companies have had 67 applications approved for the Production Linked Incentive (PLI) Scheme for Specialty Steel. These approvals are expected to attract an investment of INR 4,250 trillion (USD 5.19 billion) and increase downstream iron and steel capacity by 26 million tonnes.

- Invest India predicts that India will become a USD 1 trillion digital economy in the Electronics System Design and Manufacturing (ESDM) sector by fiscal year 2026. The Indian electronics market is currently worth USD 155 billion, with domestic production accounting for 65%. Additionally, the Semicon India Program, a USD 10 billion incentive program, was launched to develop a sustainable semiconductor and display ecosystem in the country.

- According to PwC, India's chemical industry is one of the world's fastest-growing sectors, projected to reach a value of USD 304 billion by 2025.

- India is the world's 6th and Asia's 3rd largest producer of chemicals, contributing 7% to India's GDP, according to IBEF. The government allocated INR 173.45 crore (USD 20.93 million) to the Department of Chemicals and Petrochemicals in the Union Budget for 2023-24.

- Asia-Pacific is experiencing rapid growth and investment from governments and businesses in the region. It is poised to become the world's dominant chemical market, with China, India, and Japan leading production and consumption.

Metal Cleaning Chemicals Industry Overview

The metal cleaning chemicals market is fragmented in nature. The major players (not in any particular order) include Quaker Houghton, Stepan Company, Hubbard-Hall, KYZEN CORPORATION, and Eastman Chemical Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Manufacturing Industries

- 4.1.2 Growing Market for Aqueous-Based Metal Cleaning Solutions

- 4.1.3 Rising Demand in the Aerospace Industry

- 4.2 Restraints

- 4.2.1 Health and Safety Concerns Related to the Use of Metal Cleaning Chemicals

- 4.2.2 High Cost of Advanced Metal Cleaning Chemicals

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Type

- 5.1.1 Acidic

- 5.1.2 Basic

- 5.1.3 Neutral

- 5.2 Form

- 5.2.1 Aqueous

- 5.2.2 Solvent

- 5.3 End-user Industry

- 5.3.1 Aerpospace

- 5.3.2 Automotive and Transportation

- 5.3.3 Electrical and Electronics

- 5.3.4 Chemical and Pharmaceutical

- 5.3.5 Oil and Gas

- 5.3.6 Other End-user Industries (Healthcare, and Food and Beverage)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arrow Solutions

- 6.4.2 Avudai Surface Treatments Pvt Ltd

- 6.4.3 BASF SE

- 6.4.4 CLARIANT

- 6.4.5 Chautauqua Chemical Company

- 6.4.6 Crest Chemicals.

- 6.4.7 Delstar Metal Finishing, Inc.

- 6.4.8 Dow

- 6.4.9 DST-CHEMICALS

- 6.4.10 Eastman Chemical Company

- 6.4.11 Ecolab

- 6.4.12 Elmer Wallace Ltd.

- 6.4.13 Hubbard-Hall

- 6.4.14 Henkel AG & Co. KGaA

- 6.4.15 ICL

- 6.4.16 KYZEN CORPORATION

- 6.4.17 Lincoln Chemical Corporation

- 6.4.18 Luster-On Products, Inc.

- 6.4.19 Modern Chemical, Inc.

- 6.4.20 PARKER HANNIFIN CORP

- 6.4.21 PCC Group

- 6.4.22 Quaker Houghton

- 6.4.23 Rochester Midland Corp

- 6.4.24 Solugen

- 6.4.25 Spartan Chemical Company, Inc.

- 6.4.26 Stepan Company

- 6.4.27 The Chemours Company

- 6.4.28 Zavenir Daubert

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Cleaning Chemicals

- 7.2 Growing Demand in the Healthcare Industry