|

市場調查報告書

商品編碼

1405682

模塑纖維包裝:市場佔有率分析、行業趨勢/統計、成長預測,2024-2029 年Molded Fiber Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

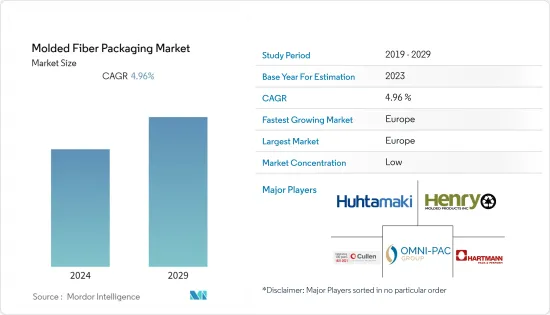

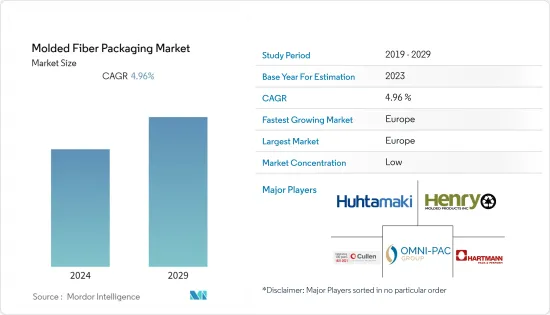

模塑纖維包裝上年度的價值為133.1億美元,預計未來五年將達到179.6億美元,預測期內複合年成長率為4.96%。

對由可再生和可回收材料製成的永續包裝的需求不斷成長,導致人們對模塑纖維包裝市場的潛力持續感興趣。最終用戶行業需求不斷成長以及環保防護包裝解決方案的應用等因素正在對市場進行排序。小麥和甘蔗渣等非木材廢棄物常用於製造紙漿。

主要亮點

- 在花錢的地點和方式方面,現代消費者在購買時非常謹慎。在環境問題日益受到關注的時代,這種意識集中在包裝的永續性。

- 紙漿包裝由回收紙板和紙張等纖維材料或竹子、小麥和甘蔗等天然纖維製成,具有高度可回收性,在完成其初始功能後最多可再使用七次。此外,與常見的塑膠包裝不同,模塑紙漿是生物分解性的,從而減少了用於製造包裝物品的原料數量。

- 儘管疫情在短期內給模塑纖維包裝市場帶來了挑戰,但長期前景是積極的,因為它凸顯了對衛生、永續性和必需產品的需求增加。製造商正在適應不斷變化的市場條件並管理供應鏈中斷,以滿足對紙漿模塑包裝解決方案不斷成長的需求。

- 然而,自 COVID-19 以來,消費者行為發生了顯著變化。買家比以往任何時候都更加關注產品的衛生、安全和永續性。在這場危機中,不斷變化的消費者需求和以消費者為中心的方法可能仍然至關重要。隨著市場更加適應當前情況,消費行為在預測期內肯定會改變。因此,後疫情時代模塑纖維包裝的未來可能對需求面有利。

模塑纖維包裝市場趨勢

食品和飲料成為最大的終端用戶產業

- 模塑纖維產品擴大用於食品相關領域,以取代塑膠,滿足對環保和永續產品不斷成長的需求。食品市場應用有必須滿足的嚴格標準。除了拉伸強度和耐熱性等基本強度規格外,改善阻隔性能對於食品市場使用的材料也至關重要。

- 由模塑紙漿製成的食品包裝產品包括翻蓋和外帶餐盒、蛋托盤和紙盒,以及水果、蔬菜、漿果和蘑菇托盤。市面上大多數食品包裝都採用托盤。

- 此外,為了延緩食品中的化學、物理和微生物變化,包裝必須具有阻隔性能,以減少食品與環境之間的氣體和水蒸氣的交換。因此,對水蒸氣和氧氣的滲透性已成為用於包裝食品相關產品的材料中需要考慮的重要特性。

- 規模相對較大的電商、酒類等飲料產業預計防護包裝產業的銷售成長最為強勁。客製化模具的成本正在下降,模塑纖維的環境和性能優勢也越來越被認可。

- 軟性飲料製造商正在努力減少包裝材料產生的污染和廢棄物量。儘管人們對塑膠越來越持負面態度,但它仍然是世界各地軟性飲料包裝最常用的材料。然而,模塑纖維包裝市場的許多公司正在擴大其足跡並推動該市場的研究領域。

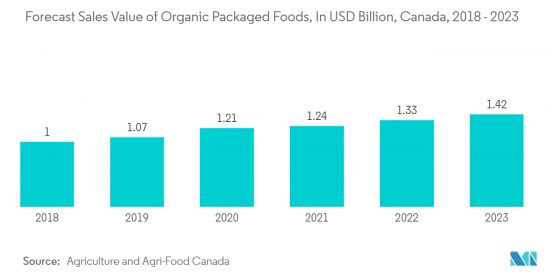

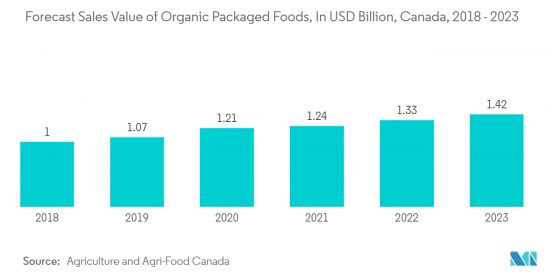

- 此外,根據加拿大農業和農業食品部的數據,2018 年包裝食品銷售額為 10 億美元,預計 2023 年將達到 14.2 億美元。食品業的成長預計將進一步推動模塑纖維包裝市場。

預計歐洲將主導市場

- 西歐已成為模塑纖維包裝最重要的市場之一,英國等已開發國家擁有大量城市人口和較高的可支配收入。根據英國包裝聯合會統計,英國包裝製造業務年營業額為110億英鎊(139.9億美元)。它擁有超過 85,000 名員工,佔英國製造業的 3%。它也為英國經濟做出了重大貢獻,是包裝供應鏈中的關鍵環節。

- 德國包裝業以其在食品業的廣泛應用而聞名。消費者正在尋找能夠提供便利、保護和易於運輸的產品,這推動了對各種包裝中塑膠替代品的需求,特別是乳製品、肉類和家常小菜食品食品。此外,對一次性塑膠的嚴格限制和對永續包裝的高需求正在推動市場擴張。

- 在義大利,對碗、托盤和其他產品的環保保護性包裝的需求不斷成長,預計將推動市場成長。模塑纖維包裝是一種由植物纖維製成的 100% 可回收且環保的包裝解決方案。模塑纖維包裝生產所使用的原料是紙漿、天然纖維和水。模塑溶解漿產品主要用作食品產業的包裝解決方案,推動了當前市場的發展。

- 西班牙的都市化、旅遊業和電子商務市場擴張預計將為模塑纖維包裝產業創造需求。西班牙等新興歐洲經濟體不斷壯大的中階正在創造需求並推動對防護性包裝解決方案(例如堅固的模塑纖維包裝)的市場發展。

- 東歐國家的外食正在蓬勃發展,預計東歐市場在預測期內將以最快的速度成長。東歐國家對用於雞蛋、肉類和水果包裝的模塑紙漿材料的需求可能會促進市場成長。

模塑纖維包裝產業概述

模塑纖維包裝市場高度分散,主要參與者包括 Huhtamaki OYJ、Henry Molded Products Inc.、Omni-Pac Group UK、Cullen Packaging Ltd. 和 Brodrene Hartmann A/S。市場參與者正在採取合作夥伴關係和收購等策略來增強其產品供應並獲得永續的競爭優勢。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

- 模塑纖維進出口分析

第5章市場動態

- 市場促進因素

- 改變消費者對可回收和環保材料的偏好

- 可支配所得增加

- 最終用戶對可重複使用和永續包裝的需求不斷成長

- 市場挑戰

- 嚴格的政府法規

- 原料成本波動

第6章市場區隔

- 按類型

- 厚壁

- 轉移

- 熱成型

- 加工

- 按格式

- 濕的

- 乾燥

- 按最終用戶產業

- 食品與飲品

- 電子產品

- 衛生保健

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- Huhtamaki OYJ

- Henry Moulded Products Inc.

- Omni-Pac Group UK

- Cullen Packaging Ltd.

- Brodrene Hartmann A/S

- EnviroPAK Corporation

- Heracles Packaging Company SA

- Sabert Corporation

- Keiding Inc.

- Berkley International

第8章投資分析

第9章 市場的未來

Molded Fiber Packaging was valued at USD 13.31 billion in the previous year and is expected to reach USD 17.96 billion by the next five years, registering a CAGR of 4.96% during the forecast period.

The growing need for sustainable packaging made from renewable and recyclable materials is leading to continued interest in the potential of molded fiber packaging market. Factors such as expanding demand in end-user industries and applying envir onment-friendly protective packaging solutions are sorting the market. Waste non-wood products like wheat and bagasse are used more frequently to make pulp.

Key Highlights

- Consumers are now more aware of the long-term effects of their purchasing decisions than they were a decade ago. In terms of where and how to spend their money, modern consumers give their purchases careful consideration. This awareness is mostly focused on package sustainability in the modern period as environmental concerns increase. Over 83% of younger consumers (aged 44 and under) have indicated a willingness to spend more for items that employ sustainable packaging, according to Trivium Packaging's Global Buying Green recent report.

- PulPac developed and owned Dry Molded Fiber, a fiber-forming technology that can affordably and sustainably replace single-use plastic with fiber-based alternatives. Converters who set up their production can use this unique technique. PulPac created the PulPac Modula standardized machine platform with partners to hasten the transition. This platform is now accessible to licensees and is available at the PulPac Tech Centre for sample and bridge volume production. To align with global sustainability, quality, and productivity Scandicore, a key manufacturer of sustainability packaging, introduced the first paper tube lids ever produced using PulPac's ground-breaking dry molded fiber technology in February 2022. This spring, the first art print supplies with the revised cover will reach customers. PulPac will produce the bridge volumes.

- Also, molded pulp packaging has been a popular option for organizations wanting to reduce their environmental impact as the packaging sector has come under greater scrutiny in recent years. Pulp-based packaging, made from fibrous materials like recycled cardboard and paper or natural fibers like bamboo, wheat, or sugarcane, is highly recyclable and can be used up to seven more times after serving its initial function. Additionally, molded pulp is biodegradable, as opposed to typical plastic-based packaging, allowing for a reduction in the number of raw materials used to make packaging items.

- However, fluctuations in the cost of raw materials might hinder market growth. However, total fiber availability is a concern in the paper industry. Imports have climbed to three million tons, and numerous nations' governments have adopted import laws and restrictions and increased tariffs and excise levies. Due to a container shortage in December, international liners raised their prices.

- The pandemic presented challenges for the molded pulp packaging market in the short term, but its long-term prospects were positive as it emphasized on hygiene, sustainability, along with the growing demand for essential products. Manufacturers are adjusting to the changing market conditions and working to address supply chain disruptions to meet the rising demand for molded pulp packaging solutions.

- However, post-COVID-19, consumer behavior has changed substantially. Buyers are more concerned than ever before about products' hygiene, disability, and sustainability. The shoppers' evolving needs and a consumer-focused approach will remain crucial as this crisis continues. As the market adapts more to the current scenario, consumer behavior will undoubtedly change in the forecast period. Thus, the post-COVID future for molded fiber packaging looks favorable in terms of demand.

Molded Fiber Packaging Market Trends

Food and Beverages to be the Largest End-user Industry

- Molded fiber products are increasingly used in the food-related sector to replace plastics and meet the growing demand for eco-friendly and sustainable products. Applications for the food market are subject to strict standards and must comply with them. In addition to some basic strength specifications, such as tensile and thermal qualities, improved barrier properties are crucial for materials in the food market sector.

- The food packaging products made of molded pulp include clam-shell and takeout meal containers, egg trays and cartons, and fruit, vegetable, berry, and mushroom trays. The majority of the food packaging items on the market utilize trays.

- Further, the packaging must have barrier qualities that reduce the exchanges of gases and water vapor between the food and the environment to slow down food's chemical, physical, and microbiological changes. As a result, for materials intended for food-related product packaging, the permeability to water vapor and oxygen are crucial properties to consider.

- The relatively big e-commerce, wine, and other beverages segments are expected to see the most significant sales increases in the protective packaging industry. Prices for custom tooling are reducing, and people are becoming more conscious of molded fiber's environmental and performance benefits.

- Soft drink companies are still trying to decrease the amount of pollution and waste produced by their packaging materials. Even though people are becoming more negative towards plastic, it is still the most used material for soft drink packaging worldwide. However, many companies in the molded fiber packaging market are expanding their footprints, boosting the studied segment of the market.

- Further, according to Agriculture and Agri-Food Canada, the sales value of packaged foods in 2018 was valued at USD 1 billion and is expected to reach USD 1.42 billion In 2023. Such growth in the food industry would further drive the market for molded fiber packaging.

Europe is Expected to Dominate the Market

- Western Europe has emerged as one of the most important markets for mold fiber packaging, with industrialized countries such as the United Kingdom having a larger urban population and higher disposable income. The package manufacturing business in the United Kingdom generates GBP 11 billion (USD 13.99 billion) in yearly sales, according to the Packaging Federation of the United Kingdom. It employs over 85,000 people, accounting for 3% of the manufacturing workforce in the United Kingdom. It also substantially contributes to the UK economy and is an important link in the packaging supply chain.

- Germany's packaging business is known for its extensive use in the food industry. Consumers seek products that provide convenience, protection, and ease of transportation, which drives demand for various packaging, particularly plastic replacements in food products, particularly dairy food, meat, and prepared meals. Furthermore, strict limits on single-use plastics and high demand for sustainable packaging drive market expansion.

- In Italy, the growing demand for eco-friendly protective packaging in bowls, trays, and other products is anticipated to boost market growth. Molded fiber packaging is a 100% recyclable, environmentally friendly packaging solution made from plant fibers. The raw materials used to manufacture molded fiber packages are pulp, natural fibers, and water. Molded dissolving pulp products are used mainly as packaging solutions in the food industry, which is driving the market currently.

- Spain's growing urbanization, tourism, and e-commerce market are expected to generate demand for the molded fiber packaging industry. The expanding middle class in the emerging economies of Europe, like Spain, is creating demand for protective packaging solutions, such as heavy-duty molded pulp packaging, subsequently driving the market.

- With the rapidly increasing food service business in Eastern European countries, the Eastern European market is expected to grow at the quickest rate over the projection period. Eastern European countries' demand for molded pulp materials for egg, meat, and fruit packaging will likely contribute to market growth.

Molded Fiber Packaging Industry Overview

The molded fiber packaging market is highly fragmented, with the presence of major players like Huhtamaki OYJ, Henry Moulded Products Inc., Omni-Pac Group UK, Cullen Packaging Ltd., and Brodrene Hartmann A/S. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2023, Omni-Pac Group UK, a manufacturer of molded fiber packaging solutions, announced the opening of a new site of EUR 8 Million (USD 8.5 Million) and 60,000 square feet, located in the town of Scunthorpe, which will enable the company to increase its production capacity and create more than 100 new employment opportunities over a period of five years.

In December 2022, Cullen announced a customer acquisition. It will soon be supplying a wide range of its SRPs to CakeDecor, the UK's largest manufacturer and supplier of cake decorations. Cullen also manufactures a wide range of products for factory bakeries, fine food manufacturers, handicraft workshops, and leading UK supermarkets, building a reputation for quality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Market

- 4.5 Import Export Analysis of Molded Fiber For Listed Countries

- 4.5.1 United States - Import and Export Analysis

- 4.5.2 United Kingdom - Import And Export Analysis

- 4.5.3 France - Import and Export Analysis

- 4.5.4 Germany - Import and Export Analysis

- 4.5.5 Italy - Import and Export Analysis

- 4.5.6 Sapin - Import and Export Analysis

- 4.5.7 China - Import and Export Analysis

- 4.5.8 Japan - Import and Export Analysis

- 4.5.9 India - Import and Export Analysis

- 4.5.10 Brazil - Import and Export Analysis

- 4.5.11 Mexico - Import and Export Analysis

- 4.5.12 United Arab Emirates - Import and Export Analysis

- 4.5.13 Saudi Arabia - Import and Export Analysis

- 4.5.14 South Africa - Import and Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Shift in Consumer Preferences Toward Recyclable and Eco-friendly Materials

- 5.1.2 Growing Disposable Income

- 5.1.3 Augmented Demand for Reusable and Sustainable Packaging From End Users

- 5.2 Market Challenges

- 5.2.1 Strict Government Rules and Regulations

- 5.2.2 Fluctuations in the Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Thick wall

- 6.1.2 Transfer

- 6.1.3 Thermoformed

- 6.1.4 Processed

- 6.2 By Formal Type

- 6.2.1 Wet

- 6.2.2 Dry

- 6.3 By End-user Industry

- 6.3.1 Food and Beverages

- 6.3.2 Electronics

- 6.3.3 Healthcare

- 6.3.4 Other End-user Industry

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki OYJ

- 7.1.2 Henry Moulded Products Inc.

- 7.1.3 Omni-Pac Group UK

- 7.1.4 Cullen Packaging Ltd.

- 7.1.5 Brodrene Hartmann A/S

- 7.1.6 EnviroPAK Corporation

- 7.1.7 Heracles Packaging Company SA

- 7.1.8 Sabert Corporation

- 7.1.9 Keiding Inc.

- 7.1.10 Berkley International