|

市場調查報告書

商品編碼

1404511

管理列印服務 (MPS):市場佔有率分析、產業趨勢/統計、成長預測,2024-2029 年Managed Print Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

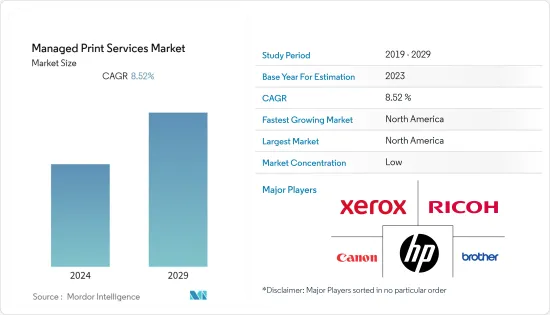

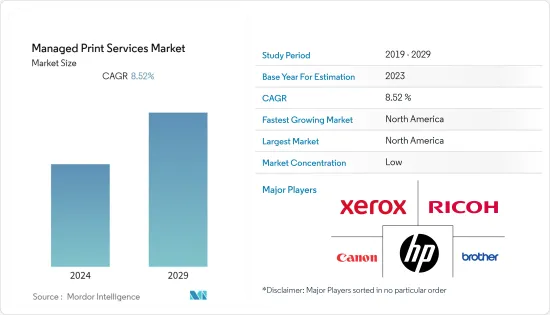

管理列印服務 (MPS) 市場規模預計將從今年的 420.9 億美元成長到預測期內的 633.5 億美元,複合年成長率為 8.52%。

大多數中小型企業 (SMB) 都在尋找提高生產力和降低成本的方法,仔細研究他們處理文件的方式是一個很好的起點。

主要亮點

- 託管列印服務 (MPS) 是由外部列印供應商提供的服務,用於管理業務文件的輸出。透過支援數位技術和列印服務,管理列印服務 (MPS) 可以安全地管理家庭和企業的列印和掃描基礎設施。全球市場受到各種最終用戶擴大採用管理列印服務 (MPS) 的推動,透過文件工作流程的可視化有助於提高時間生產力和成本效率。列印管理服務 (MPS) 透過實現高品質列印和掃描來幫助改善您的客戶體驗。

- 組織減少紙張浪費的努力對市場的成長做出了重大貢獻。公司正在努力限制紙張的使用。管理列印服務 (MPS) 預計將在不久的將來獲得市場成長動力,因為它有助於減少浪費。

- 公司可以透過實施列印管理服務 (MPS) 來降低成本。這些成本節省有助於公司擴大報酬率。公司現在發現與列印相關的成本,這些成本以前被忽視,現在卻成為一個沉重的負擔。

- 資料正在演變為關鍵的智慧財產權 (IP)。公司概念、計劃、財務報表等的資料外洩可能會嚴重損害公司在市場上的聲譽並導致重大財務損失。因此,資料安全近年來備受關注。隨著網路攻擊風險的增加,保護敏感資料變得至關重要。因此,網路威脅是管理列印服務組織必須處理的主要問題之一。

- 管理列印服務 (MPS) 市場只是受 COVID-19大流行負面影響的眾多行業之一。 COVID-19的爆發導致了印刷業的延誤,包括自我隔離標準的影響、製造商供應鏈從中國等製造地轉移以及用於基本商品的包裝材料的變化等。然而,由於這兩個行業在大流行期間提供了必需品,對必需品的需求激增。因此,管理列印服務 (MPS) 的使用有所增加。

管理列印服務 (MPS) 市場趨勢

零售業預計將佔據主要市場佔有率

- 不受管理的輸出要求使零售商擁有大量具有多個供應商、型號、消耗品和服務合約的設備。過時設備頻繁發生故障和服務台負擔過重可能會對商店營運產生負面影響並增加費用。產出策略對於提高生產力和降低成本非常重要。

- 特別是,我們日常依賴的核心應用程式始終需要可靠性,例如列印和發布標誌、貨架標籤和標籤。零售業要求高效率。必須實現這一目標,才能簡化流程並節省所產生的成本。因此,零售商選擇管理列印服務(MPS)而不是擁有生產線更容易且更具成本效益。

- 零售業的 MPS 策略需要根據特定任務、實體位置和冗餘需求來確定適當數量的網路印表機。簡單地向最終用戶強加常見的印表機比率或要求盡可能低的採購成本可能會導致令人失望的結果。您需要一個能夠完美平衡成本節省和生產力提高的計劃。您需要一種與現有幫助台系統無縫協作並支援多種服務模式的 MPS 方法。

- 電子商務的發展以及從傳統實體店到網路商店的轉變迫使零售商重新思考他們的商業實踐。小型企業和家庭企業需要小批量生產和客製化印刷設計和尺寸。相比之下,零售巨頭要求以高產量和低價格獲得美觀、一流的列印品質。因此,列印管理服務 (MPS) 及其網路是最佳選擇,因為它們可以提供列印件和數量以滿足各種需求。

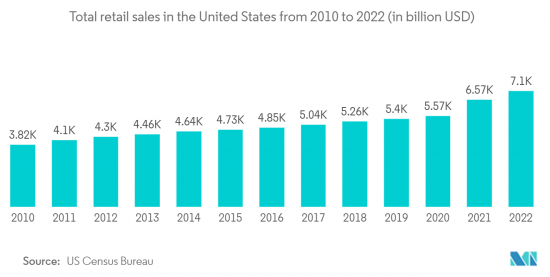

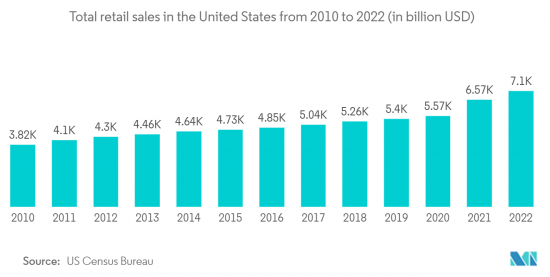

- 所分析的市場是由全球零售業及其收益的不斷擴張所推動的。例如,美國人口普查局預測,與前一年同期比較零售總額將達到6.6兆美元,年增約10億美元。

預計北美將佔據較大市場佔有率

- 北美的成長主要歸功於該地區新興企業活動的活性化、有利的政府法規以及主要印表機和影印機製造商的存在。由於美國政府和醫療保健部門採用率的提高,管理列印服務 (MPS) 市場也在成長。

- 由於政府面臨如此多的挑戰,很容易忽略紙張密集型業務流程中的商機。為美國聯邦政府提供的 Xerox 託管列印服務使用經過 FedRAMP(聯邦風險和特權管理計劃)認證的安全雲端來簡化流程並提高員工效率。更好地管理風險和成本,改善服務交付和生產力。

- 隨著美國醫療保健產業產生更多收益,它正在開放各種與提高效率相關的技術。醫療保健領域的託管列印服務 (MPS) 透過階段引入設備標準來直接解決這些問題。

- 例如,NHE情況說明書預測,2019年至2028年,國家衛生支出將以每年平均5.4%的速度成長,屆時將達到6.2兆美元。這為該地區的市場提供了巨大的機會。

- 北美保險業過去經歷了顯著成長。隨著保險業應對日益成長的市場和成本壓力,最佳化列印環境對於節省可用於服務客戶和發展業務的時間和金錢至關重要。

管理列印服務 (MPS) 產業概述

列印管理服務 (MPS) 市場競爭非常激烈,許多大公司都進入了該市場。從市場佔有率來看,市場正走向分散化,目前尚無廠商壟斷市場。提供者正在努力創新其服務產品以獲得競爭優勢。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進與市場抑制因素介紹

- 市場促進因素

- 減少紙張浪費的組織努力

- 降低成本

- 市場抑制因素

- 持續經常支出

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章競爭形勢

- 公司簡介

- Xerox Corporation

- Ricoh Company Ltd.

- HP Development Company, LP

- Canon, Inc.

- Brother UK Ltd

- Lexmark International, Inc.

- Konica Minolta, Inc.

- Samsung Electronics Co. Ltd.

- Kyocera Corporation

- Toshiba Corporation

- Sharp Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Managed Print Services Market size is expected to grow from USD 42.09 billion in the current year to USD 63.35 billion during the forecast period, registering a CAGR of 8.52% during the forecast period. Most small and medium businesses (SMBs) are looking for ways to improve their productivity and cut costs, and taking a closer look at how they handle documents is a good place to start.

Key Highlights

- Managed print services (MPS) are services provided by outside print vendors to control the output of business documents. By enabling digital technologies and printing services, managed print services (MPS) safely manage households and companies' print and scan infrastructure. The global market is driven by the growing adoption of managed print services (MPS) among various end users, which helps increase time productivity and cost efficiency by providing visibility into document workflows. Managed print services (MPS) help improve the customer experience because they allow for high-quality printing and scanning.

- Organizational initiatives to reduce paper waste have significantly contributed to the market's growth. Companies are trying to restrict the use of paper. As managed print services help control wastage, their growth is going to get a boost in the near future.

- Reductions in the cost involved are noticed when companies adapt managed print services. These cost reductions help the firms expand their profit margins. The companies are apprehending the costs associated with printing that were neglected before and cost a major chunk.

- Data has evolved into a crucial kind of intellectual property (IP). Data leaks, including corporate concepts, plans, or financial statements, could seriously harm a company's reputation in the marketplace or result in significant financial loss. As a result, data security has received the greatest attention in recent years. Protecting sensitive data is crucial in light of the growing dangers posed by cyberattacks. Cyberthreats are thus one of the main issues that Managed Printing Service organizations must deal with.

- The managed print services market was just one of the numerous industries that the COVID-19 pandemic outbreak negatively impacted. The COVID-19 outbreak caused a delay in the printing industry, including effects brought on by self-isolation standards, manufacturers shifting their supply chains away from manufacturing centers like China, and changes to the packaging materials used for basic goods. However, as both sectors provided necessary commodities during the pandemic, the demand for essential products skyrocketed. This, in turn, raised the usage of managed print services.

Managed Print Services Market Trends

Retail is Expected to Hold Major Market Share

- An unmanaged output condition leaves retailers with huge fleets of devices with multiple vendors, models, supplies, and service contracts. Frequent failures of outdated equipment and an overburdened help desk can adversely affect store operations and shoot up expenses. An output strategy is crucial for improving productivity and decreasing costs.

- Reliability is always outstanding, especially for core applications that you depend on daily, such as the printing and publishing of signs, shelf strips, and labels. A high level of efficiency is required in the retail sector. It must be achieved to streamline the process and save on the costs incurred. Therefore, it is easier and more cost-effective for retailers to choose managed print services instead of having their production lines.

- MPS strategies for retail should identify the right number of networked printers based on specific tasks, physical location, and the need for redundancy. Simply imposing generic printer ratios on end users or looking for the lowest possible acquisition cost can generate disappointing results. A plan is needed that perfectly balances cost savings and productivity enhancements. An MPS approach is needed that works seamlessly with existing help desk systems and allows for a variety of service models.

- Retailers have been compelled to reevaluate their business practices as a result of the growth of e-commerce and the migration from traditional brick-and-mortar sites to online storefronts. Smaller and home-based businesses seek out small quantities and bespoke print designs and sizes. In contrast, retail behemoths demand aesthetically pleasing and top-notch print quality with vast quantities and lower price ranges. As a result, managed print services and their network are the best options because they can supply prints and quantities in line with various requests.

- The analyzed market is driven by the ongoing expansion of global retail and its revenues. For example, the US Census Bureau predicts that total retail sales will reach USD 6.6 trillion by the end of last year, an increase of around USD 1 billion over the previous year.

North America is Expected to Hold a Major Market Share

- The growth in the North American region is primarily attributable to the region's increased start-up activity, favorable government regulations, and the presence of major printer and copier manufacturers. The market for managed print services is also expanding due to the greater adoption rates in the U.S. government and healthcare sectors.

- With so many challenges putting the government under pressure, it's easy to overlook the opportunities in paper-intensive work processes. Xerox Managed Print Services for the U.S. Federal Government uses a secure FedRAMP (Federal Risk and Authorization Management Program) authorized cloud to streamline processes and improve employee efficiency. Risk and cost are better managed, and service delivery and productivity improve.

- With the increased revenue generated by the healthcare sector in the United States, doors are getting opened for the various technologies associated with increased efficiency. Managed Print Services (MPS) in healthcare directly address these problems by putting in place device standards in stages.

- The USA is also one of the largest spenders on its healthcare and healthcare infrastructure; for instance, the NHE fact sheet projects that national health spending will increase at an average annual rate of 5.4% from 2019 to 2028 and reach USD 6.2 trillion at that time. This poses a huge opportunity for the market in the region.

- The insurance industry in North America has seen substantial growth in the past. As the insurance industry responds to increasing market and cost pressures, optimizing the print environment is essential to saving time and money that could be better spent working with customers and growing the business.

Managed Print Services Industry Overview

The managed print services market is highly competitive and consists of a significant number of major players. In terms of market share, none of the players currently dominate the market; thus, the market is moving towards fragmentation. The providers are innovating their offerings in order to gain a competitive advantage.

In March 2022, in order to increase the comfort level of small businesses employing managed print services, Brother introduced a test subscription service (MPS). Over the previous year, managed print has had significant demand from the vendor. The final piece of the puzzle is its PrintSmart Essential offering, which includes a small company option that allows users to become familiar with managed print without restrictions or significant commitments. Customers can pay monthly for support, device installation, supply recycling, and maintenance services with a three-month notice period. Prices vary depending on page volumes and the hardware selected, from USD 17 to USD 62 per month.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Initiatives by the Organizations to Reduce the Paper Wastage

- 4.3.2 Reduction in the Cost Involved

- 4.4 Market Restraints

- 4.4.1 Continuous Recurring Expenditure

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.1.1 US

- 5.1.1.2 Canada

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 UK

- 5.1.2.3 France

- 5.1.2.4 Rest of Europe

- 5.1.3 Asia-Pacific

- 5.1.3.1 China

- 5.1.3.2 Japan

- 5.1.3.3 India

- 5.1.3.4 Rest of Asia-Pacific

- 5.1.4 Latin America

- 5.1.5 Middle East and Africa

- 5.1.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Xerox Corporation

- 6.1.2 Ricoh Company Ltd.

- 6.1.3 HP Development Company, L.P.

- 6.1.4 Canon, Inc.

- 6.1.5 Brother UK Ltd

- 6.1.6 Lexmark International, Inc.

- 6.1.7 Konica Minolta, Inc.

- 6.1.8 Samsung Electronics Co. Ltd.

- 6.1.9 Kyocera Corporation

- 6.1.10 Toshiba Corporation

- 6.1.11 Sharp Corporation