|

市場調查報告書

商品編碼

1404510

異常偵測:市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Anomaly Detection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

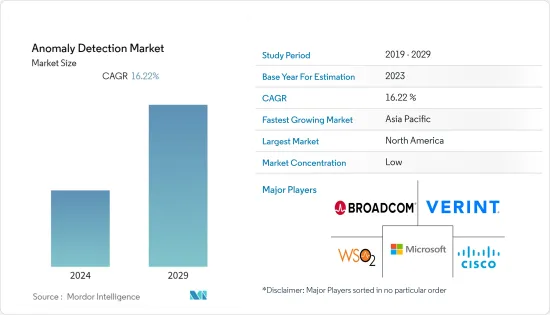

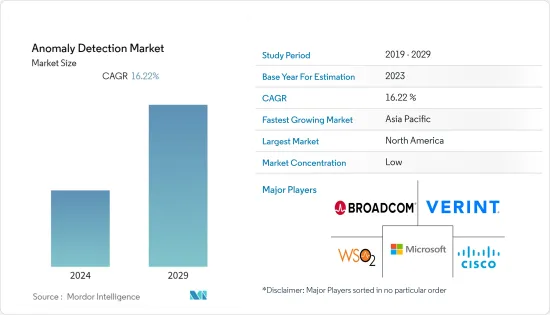

上年度異常偵測市場價值為 57.8 億美元,預計將達到 137.5 億美元,在預測期內的未來五年複合年成長率為 16.22%。

傳統的統計方法正在被 GAN、VAE 和 RNN 等現代技術所取代,這些技術增強了對各種系統中異常情況的識別。此外,大規模資料儲存設備和即時分析的需求不斷成長,導致異常偵測系統的採用增加。

主要亮點

- 異常偵測是識別指示業務或流程中的異常變化的異常,而不是遵循可預測的資料或模式。除了詐欺偵測、系統健康監控和入侵偵測之外,異常偵測還可用於其他目的。

- 隨著連接設備數量的迅速增加,這些設備產生的資料量變得巨大,使得管理這些資訊成為一項重大挑戰。異常偵測可能會克服這一差距並在預測期內促進市場成長。

- 資料外洩通常意味著消費者的個人資訊被盜。詐騙可以進行詐欺購買、修改清單資訊、建立虛假評論、更改帳戶資料等,並將付款發送到受損的銀行帳戶。

- 由於這種成長,異常偵測市場預計將在預測期內成長,銀行、金融服務、醫療保健、製造、IT 和通訊、國防和政府等行業將使用多種連網設備。

- 預測期內異常偵測成長的主要挑戰將是成本上升和來自開放原始碼替代品的競爭,這將使組織難以採用工具和解決方案,同時也使組織難以在其他領域採用工具和解決方案。預計開放原始碼模式將出現人才短缺和非對稱故障等問題。

- COVID-19 的出現、封鎖和強加的限制迫使許多組織將傳統的工作方法轉向遠端工作。安全和風險經理必須進一步保護其組織,以確保線上服務和數位平台抵禦網路犯罪的能力。組織擴大採用基於異常的入侵偵測系統。

異常偵測市場趨勢

BFSI 預計將佔據大部分市場佔有率

- 由於其廣泛的網路框架和重要的客戶資訊,BFSI 部門面臨多次資料外洩和網路攻擊。因此,該行業的公司正在探索替代解決方案,異常偵測市場可能會在預測期內加強。

- 銀行業務包括銀行員工、客戶和外國代理人進行的各種活動和交易。鑑於這些活動的複雜性,需要持續監控,以確保銀行及其最終客戶不會受到此類惡意活動的嚴重打擊。由於這些原因,組織正在開發解決方案和服務來偵測異常。

- 銀行業務包括銀行員工、客戶和獨立機構定期和臨時的一系列活動和交易。解釋這些活動的本質是非常困難的。需要持續監控,以避免各種對銀行及其客戶產生不利影響的不當和違規活動。因此,在該領域提供解決方案和服務的公司有巨大的機會來緩解這些異常情況。

- 此外,數位化的進步使銀行和金融機構能夠透過線上入口網站更有效地提供銀行服務,從而能夠提供更好的客戶服務。因此,大量資料正在積累,因此安全可靠地處理重要資訊至關重要。

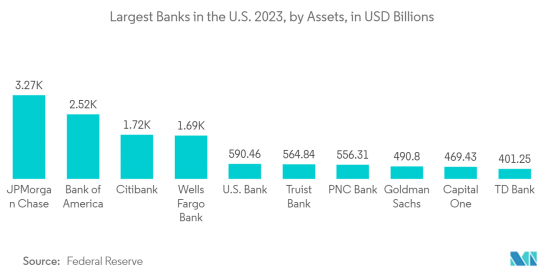

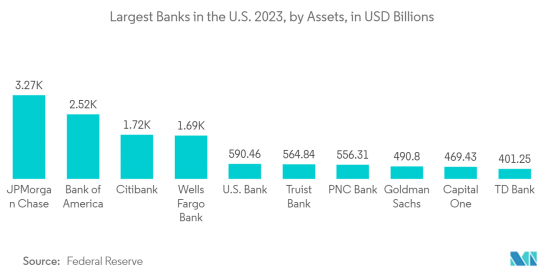

北美市場佔最大佔有率

- 美國聯邦貿易委員會 (FTC) 指出,美國與付款和銀行服務相關的資訊盜竊現象普遍存在,可能會導致更多地採用異常偵測解決方案和服務。

- 北美地區率先倡導了自帶設備 (BYOD) 文化,並廣泛採用。因此,企業開始尋找能夠確保業務相關資訊安全的解決方案和服務,這可能會導致該地區異常偵測市場的擴大。

- 區域公司為客戶提供異常偵測領域的廣泛解決方案,提供更先進的功能和特性。

- 由於全部區域互聯設備數量不斷增加以及詐騙和網路攻擊發生率不斷增加,對異常偵測的需求也很強勁,從而加速了該領域的市場成長。

- 採用線上演算法、學習增量方法和滑動技術等異常偵測系統是最新的基於批處理窗口的異常偵測技術之一,用於各個領域以有效地傳輸資料,並且它受到對電容資料存儲單元和數據存儲單元的需求的刺激。即時資料分析。

異常偵測產業概述

Cisco、WSO2 和 Microsoft 等主要企業在異常偵測市場的競爭中佔據主導地位。整體而言,產業內競爭企業之間的敵意相對較高。透過策略聯盟、併購和收購,市場參與者可以在向客戶提供更好的解決方案和產品方面保持立足點。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 網路犯罪增加

- 在軟體測試中更多採用異常偵測解決方案

- 市場抑制因素

- 開放原始碼替代品構成威脅

第6章市場區隔

- 按類型

- 解決方案

- 服務

- 按最終用戶產業

- BFSI

- 製造業

- 衛生保健

- 資訊科技/通訊

- 其他

- 按發展

- 本地

- 雲

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 澳洲

- 日本

- 印度

- 其他亞太地區

- 其他地區

- 北美洲

第7章競爭形勢

- 公司簡介

- Verint Systems Inc.

- Broadcom Inc.(Symantec Corporation)

- WSO2 Inc.

- Microsoft Corporation

- Cisco Systems Inc.

- IBM Corporation

- Wipro Limited

- Trend Micro Incorporated

- SAS Institute Inc.

- Happiest Minds Technologies Pvt. Ltd

- Guardian Analytics Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The anomaly detection market was valued at USD 5.78 billion in the previous year and is expected to register a CAGR of 16.22%, reaching USD 13.75 billion by the next five years during the forecast period. The traditional statistical approaches are being replaced with modern methods, such as Generative Adversarial Networks (GAN), variational autoencoders (Vaes), and Recurrent Neural Networks (RNNs), thereby enhancing the identification of anomalies across various systems. In addition, the adoption of anomaly detection systems has been increased by a growing demand for significant data storage devices and real-time analysis.

Key Highlights

- Anomaly detection is the identification of anomalies that indicate unusual shifts in operations and processes rather than following predictable data or patterns. In addition to fraud detection, system health monitoring, and intrusion detection, anomaly detection can be used for other purposes.

- As the number of connected devices increases rapidly, the amount of data generated by these devices is enormous, making it a critical task to manage this information, which could lead to the loss of valuable information. Anomaly detection could overcome this gap, increasing market growth during the forecast period.

- The breach of data usually means identity theft to the consumer. Fraudsters can make fraudulent purchases, modify listing information, create false reviews, or change account data to take payments into their bank accounts once compromised.

- The market for anomaly detection As a result of this increase, it is expected to grow during the forecast period, and several connected devices are in sectors such as banking, financial services, health care, manufacturing, information technology, telecommunications, defense, and government.

- The main challenges to the growth of anomaly detection during that period are expected to be rising costs and competition from opensource alternatives, which would make it more difficult for organizations to adopt tools and solutions while there is also a lack of qualified workers in areas such as solution development and incidence of asymmetrical faults within Open Source models.

- The emergence of COVID-19, the lockdown, and the restrictions imposed forced many organizations to shift their traditional working methodologies to remote working. Security and risk managers must safeguard their organizations even more to ensure the resilience of online services and digital platforms against cybercrime. Organizations are increasingly adopting anomaly-based intrusion detection systems.

Anomaly Detection Market Trends

BFSI is Expected to Hold a Significant Part of the Market Share

- It faces several data breaches and cyber attacks due to its extensive network framework and essential customer information in the BFSI sector. Consequently, companies within the industry have been looking for alternate solutions that will likely strengthen the anomaly detection market during the forecast period.

- The banking operation includes various activities and transactions carried out by staff, customers, and foreign agents. Given the complexities of these activities, continuous monitoring is required to ensure that a bank or its end customers are hit significantly by any such malicious activity. For these reasons, solutions and services for detecting anomalies are being developed by organizations.

- Several periodic and occasional activities and transactions carried out by staff, clients, and independent agencies shall be included in banking operations. It is very difficult to describe the nature of these activities. It calls for continuous monitoring to avoid an adverse effect on the bank or its customers due to various inappropriate and random actions. Therefore, firms offering solutions and services in this area have a huge opportunity to mitigate these anomalies.

- In addition, the increase in digitization has enabled banks and financial institutions to offer banking services more efficiently through online portals, allowing them to provide better customer service. This has led to the development of large quantities of data, making it vital that critical information be handled safely and securely.

North America Holds the Largest Share in the Market

- The Federal Trade Commission pointed out that identity theft related to payment and banking services in the United States is widespread, which could lead to increased adoption of Anomaly Detection Solutions and Services.

- North America is a pioneer in the bring-your-own-device (BYOD) culture, which has resulted in its wide-scale adoption. In doing so, the companies have started searching for solutions and services that enable them to guarantee the security of information relating to business, which could lead to an increase in the area's Anomaly Detection Market.

- Regional enterprises provide their clients with an extensive range of solutions in the area of anomaly detection and are providing more advanced features and functionalities.

- In addition, there is also a strong demand for anomaly detection and an acceleration of market growth in this area due to the increasing number of interconnected devices and rising incidences of fraud and cyber-attacks throughout the region.

- Adopting anomaly detection systems as online algorithms, learning incremental approaches, and sliding techniques are among the modern batch window-based anomaly detection techniques used by different sectors to stream data efficiently has been stimulated by the need for large data storage units and real-time data analysis.

Anomaly Detection Industry Overview

Some key players, such as Cisco Systems Inc., WSO2 Inc., Microsoft Corporation, etc., govern the anomaly detection market competition. Overall, the competitive rivalry within the industry is relatively high. Through strategic partnerships, mergers, and acquisitions, the companies in the market can maintain their foothold to provide better solutions and products to their customers.

Cisco announced its vision for Cisco Networking Cloud, an integrated management platform experience for both on-premise and cloud operating models, in June this year. These innovations include SSO, API key exchange/repository, sustainable data center networking solutions, and expanded network assurance with Cisco ThousandEyes.Cisco Networking Cloud will dramatically simplify IT with a more flexible Cisco Catalyst switch stack, improved visibility into data center power and energy consumption, and new AI data center blueprints to enhance performance and visibility for network operators.

Through Google Cloud Contact Center AI integration with Verint's customer engagement Platform, the two companies have announced an enhanced partnership to help improve contact center performance in March this year. Combining its customer experience automation solutions with Google Cloud's Contact Center AICCAI platform is as seamless as the Verint Platform's unique open architecture. Through this collaboration, organizations can use Verint's solutions to close the Engagement capacity gap with CX automation. This robust platform-to-platform approach offers essential capabilities for organizations seeking best-of-breed solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Cyber Crimes

- 5.1.2 Increasing Adoption of Anomaly Detection Solutions in Software Testing

- 5.2 Market Restraints

- 5.2.1 Open Source Alternatives Pose as a Threat

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Service

- 6.2 By End-user Industry

- 6.2.1 BFSI

- 6.2.2 Manufacturing

- 6.2.3 Healthcare

- 6.2.4 IT and Telecommunications

- 6.2.5 Other End-user Industries

- 6.3 By Deployment

- 6.3.1 On-premise

- 6.3.2 Cloud

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 Australia

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Rest of the World

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Verint Systems Inc.

- 7.1.2 Broadcom Inc. (Symantec Corporation)

- 7.1.3 WSO2 Inc.

- 7.1.4 Microsoft Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 IBM Corporation

- 7.1.7 Wipro Limited

- 7.1.8 Trend Micro Incorporated

- 7.1.9 SAS Institute Inc.

- 7.1.10 Happiest Minds Technologies Pvt. Ltd

- 7.1.11 Guardian Analytics Inc.