|

市場調查報告書

商品編碼

1404508

NaaS(網路即服務):市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Network as a Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

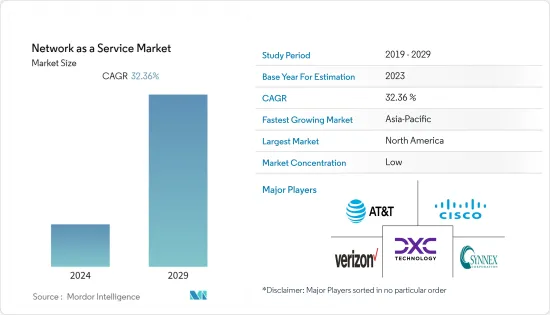

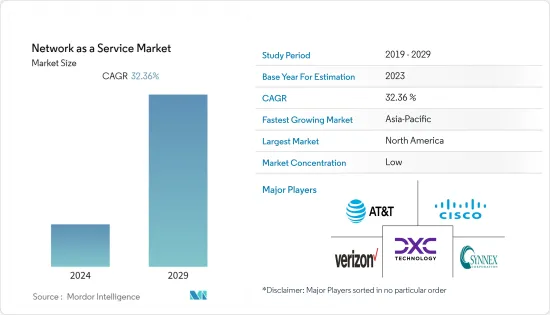

NaaS(網路即服務)市場去年估值為144.6億美元,預計未來五年將以32.36%的複合年成長率成長,達到783.8億美元。

NaaS 為組織和企業提供彈性並提高其網路基礎設施的效能。按需購買使企業變得更加重視成本,只為他們需要的網路服務付費。 NaaS 對於需要更靈活配置而無需重建網路或重新制定合約的組織也很有用。

主要亮點

- 全球新資料中心基礎設施的廣泛建設正在推動NaaS市場的成長。推動這一擴張的幾個關鍵促進因素包括更多地使用雲端運算進行資料儲存、採用巨量資料分析以及提高工作負載移動性的中心虛擬。這些進步可以提高關鍵企業應用程式的資源利用率、提高可用性、降低總成本以及提高可靠性和安全性。

- 此外,網路虛擬、雲端運算和軟體定義網路 (SDN) 領域對基於訂閱和按使用付費的業務模式的需求不斷成長,對市場軌跡產生了重大影響。擴大使用雲端服務來滿足大型和小型企業的需求,這在塑造產業形勢發揮著重要作用。

- NaaS 為企業提供了彈性和提高網路效能的機會。組織可以透過按需購買來支付他們所要求的確切網路服務的費用,從而實現成本效益。 NaaS 還支援需要更靈活配置的企業,而無需重做網路或合約。

- 諾基亞對 100 位 IT 領導者進行了調查,了解他們在整個大流行期間對 NaaS 的期望。這項研究旨在確定主要好處、採用的潛在障礙以及預計未來推出的頂級服務。 47% 的企業技術領導者希望在其組織內實施 NaaS。值得注意的是,雖然 10% 的受訪者已經購買了 NaaS 服務,但只有 14% 的受訪者表示沒有計劃從事 NaaS 服務。當談到 Naas 產品時,這些高階主管專注於特定標準:62% 的人專注於提高安全性,58% 的人專注於最佳效能,48% 的人專注於保證服務水準和市場成長。

- 然而,NaaS 具有顯著的優勢。然而,重要的是要意識到某些障礙和潛在的可靠性問題可能會阻礙其在可預見的未來的成長。選擇第三方網路基礎設施供應商來託管公司的關鍵基礎設施需要信任供應商的長期穩定性。如果供應商無法保持競爭力,企業可能會面臨更換關鍵基礎設施的挑戰。

- 自COVID-19爆發以來,由於企業採用遠距工作模式,對基於雲端基礎的解決方案的需求顯著成長,但零售、製造和BFSI等各行業的收益卻出現了大幅下滑。隨著遠端工作模式的擴展,隨著公司增加對雲端基礎的分析和保證、邊緣運算以及人工智慧驅動的網路技術的投資,NaaS 市場預計也會擴大。

- 為了應對 COVID-19,Aruba 對 2,400 名 IT 決策者進行的調查發現,38% 的 IT 領導者增加了對雲端基礎的網路的投資,35% 增加了對基於AI 的網路的投資。並且正在尋求更敏捷和自動化的混合工作基礎架構環境。此外,隨著企業適應 COVID-19,NaaS 的採用率將在未來兩年內加速 38%。

NaaS 市場趨勢

企業越來越多採用雲端服務來推動市場

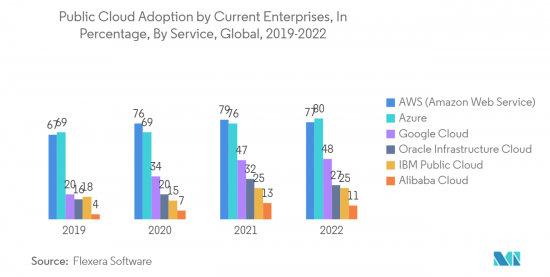

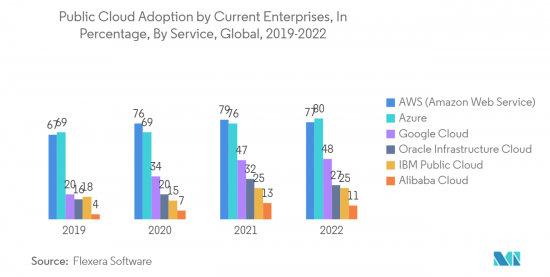

- 技術的不斷使用以及客戶對遠端資料存取的偏好正在推動對雲端基礎的解決方案的需求。企業逐漸意識到,與維護本地基礎設施相比,遷移到雲端可以節省資金和資源,從而提高大型和小型企業的採用率。未來五年,雲端運算和虛擬可能會降低軟體設定成本和硬體使用率。

- 據泰雷茲集團稱,去年超過 60% 的企業資料儲存在雲端,高於 30%。隨著越來越多的公司採用雲端運算,這些趨勢為製造商進入這個市場創造了重要的機會。

- 例如,據印度Druva Inc.稱,許多公司正在轉向企業資料,尤其是大量非結構化資料。據該公司稱,這種資料類型是在企業儲存系統上維護的。此外,根據最新的思科世界指數,雲端資料中心目前管理所有運算工作負載的 94%,而傳統資料中心僅管理 6%。這一數字突顯了雲端基礎的客服中心未來在全球部署的潛力。

- 銀行和其他主要企業預計將迅速接受雲端基礎的服務部署。這是由 IT 行業持續推動基礎設施簡化以及解決方案開發人員透過從不同提供者採購應用程式和基礎設施元件來建立混合雲端解決方案的能力所推動的。這些趨勢正在推動 NaaS 市場的發展。

北美佔據主要市場佔有率

- 美國正在發展成為一個擁抱先進技術的經濟體,推動網路自動化、雲端基礎的服務和 NaaS 市場的擴張。未來五年,IT 團隊計劃採用供應商提供的 NaaS 解決方案,這些解決方案提供混合解決方案,包括軟體、雲端智慧和管理本地硬體的自主權。

- 在科技採用的先驅美國,首選行動裝置數量的顯著增加正在推動對增強網路服務的需求。隨著雲端軟體定義網路 (SDN) 和虛擬網路功能 (VNF) 等虛擬設定的成長,該地區的各種網路服務供應商(NSP) 正在支援按需基礎架構。然而,為組織規劃和獲取網路連接需要時間和精力,這對於希望跟上數位趨勢並以軟體主導的速度運行的企業來說充滿挑戰。

- 加拿大的 NaaS 市場正在不斷擴大,新產品的發布、收購、併購、合作和協作正在改變北美市場。針對 IT服務供應商的網路攻擊大幅增加,導致資料外洩。因此,加拿大網路安全中心發布了建議,要求各組織在選擇網路服務供應商時更加謹慎。

- 隨著自動化和協作設備的部署擴大,市場需求正在顯著增加。 NaaS 模式對於小型企業尤其有利。鑑於加拿大有大量小型企業,NaaS 的使用預計在短期內將獲得巨大的吸引力。

NaaS行業概況

NaaS市場由幾家大公司組成,競爭非常激烈。市場分散,有大大小小的參與者。擁有壓倒性市場佔有率的主要企業正致力於將基本客群擴展到區域之外。這些公司正在利用策略合作措施來提高市場盈利和佔有率。該市場的主要企業包括 AT&T Intellectual Property、Verizon 和 Cisco System Inc.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 企業越來越多採用雲端服務

- 擴展 SDN 與現有網路基礎設施的整合

- 市場抑制因素

- 隱私和資料安全問題

第6章市場區隔

- 按類型

- LANaaS

- WANaaS

- 按申請

- vCPE

- BoD

- 整合網路SECaaS

- WAN

- VPN

- 按行業分類

- 衛生保健

- BFSI

- 零售/電子商務

- 資訊科技/通訊

- 製造業

- 運輸/物流

- 公共部門

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- AT&T Intellectual Property

- Verizon

- DXC Technology Company

- TD SYNNEX Corporation

- Cisco Systems, Inc.

- NEC Corporation

- Hewlett Packard Enterprise Development LP

- IBM

- Oracle

- GTT Communications, Inc.

- VMware, Inc.

- Telstra Group Limited

- CenturyLink

- Meta Networks Ltd(Proofpoint)

- Masergy Communications, Inc.

- Juniper Networks, Inc.

- Nokia(Alcatel Lucent)

- Akamai Technologie

- Broadcom

第8章投資分析

第9章 市場機會及未來趨勢

The network as a service market was valued at USD 14.46 billion the previous year and is expected to grow at a CAGR of 32.36%, reaching USD 78.38 billion by the next five years. Network-as-a-Service (NaaS) offers organizations and companies greater flexibility and even performance gains in their network infrastructure. With on-demand purchasing, firms can be more cost-conscious and pay only for the necessary networking services. Network-as-a-Service (NaaS) can also enable organizations that need greater flexibility in provisioning without having to rearchitect networks or redo contracts from the ground up.

Key Highlights

- The broad construction of new data center infrastructures worldwide drives the growth of the network as a service (NaaS) market. Several main drivers drive this expansion, including the increasing use of cloud computing for data storage, the incorporation of Big Data analytics, and virtualization within that center to improve workload mobility. These advancements have resulted in better resource utilization, higher availability, lower total costs, and increased reliability and security for critical corporate applications.

- Furthermore, the increasing need for subscription-based and pay-per-use business models in network virtualization, cloud computing, and software-defined networking (SDN) is significantly impacting the market trajectory. The growing use of cloud services, which cater to the demands of large and small organizations, plays a significant role in shaping the industry landscape.

- NaaS gives businesses more flexibility and the opportunity for improved network performance. Organizations can emphasize cost-effectiveness by paying for the precise networking services requested via on-demand purchases. NaaS also enables businesses that need more provisioning flexibility without redoing their network or contract.

- Throughout the pandemic, Nokia studied with 100 IT leaders to learn about their expectations of their network as a service (NaaS). The study sought to identify the significant benefits, potential barriers to adoption, and the top services they will likely acquire. Forty-seven percent of the enterprise technology leaders wanted to implement NaaS within their organizations. Notably, ten percent of respondents had already purchased NaaS services, while only 14 percent said their businesses had yet to make plans to engage in NaaS service. Regarding Naas products, these executives emphasized specific criteria, with sixty-two percent emphasizing improved security, 58 percent wanting optimum performance, and forty-eight percent valuing guaranteed service levels and driving the market's growth.

- However, network as a service (NaaS) offers significant advantages; it's important to acknowledge certain obstacles and potential reliability issues that could hinder its growth in the foreseeable future. Opting for a third-party network infrastructure provider to host critical corporate infrastructure requires faith in the supplier's long-term stability. Businesses may face the challenge of replacing essential infrastructure if the provider fails to remain competitive.

- Since the outbreak of COVID-19, the demand for cloud-based solutions has seen significant growth owing to remote working models being adopted by enterprises; however, various industries such as retail, manufacturing, BFSI, and others have seen a considerable revenue slump. With the growing remote working model, companies are increasing investments in cloud-based analytics and assurance, edge computing, and AI-powered networking technologies, which are expected to boost the NaaS market.

- According to a survey by Aruba of 2400 IT decision-makers, in response to COVID-19, 38 percent of IT leaders plan to increase their investment in cloud-based networking and 35 percent in AI-based networking as they seek more agile, automated infrastructures for hybrid work environments. Also, Network-as-a-Service adoption will accelerate by 38 percent within the next two years as businesses adapt to COVID-19.

Network as a Service Market Trends

Increased Adoption of Cloud Services among Enterprises to Drive the Market

- The growing use of technology and customer preference for remote data access drives the increased need for cloud-based solutions. Companies understand the cost and resource savings benefits of migrating to the cloud rather than maintaining on-premise infrastructure, leading to increased adoption among large corporations and SMEs. During the next five years, cloud computing and virtualization will lower software setup costs and hardware utilization.

- According to the Thales Group, more than 60 percent of corporate data was kept in the cloud last year, a massive increase from 30 percent. These trends create considerable potential prospects for manufacturers in this market, with the increasing adoption of cloud computing among organizations broadening the market's scope.

- For instance, according to Druva Inc., a company located in India, numerous companies focus on enterprise data, particularly because of its substantial volume of unstructured data. According to the company, this data type is held in enterprise storage systems. Furthermore, according to the most recent Cisco Global Index, cloud data centers currently manage 94 percent of all computing workloads, while traditional data centers handle only 6 percent. This figure emphasizes the global potential for cloud-based contact center deployment in the future.

- Banking and other key businesses are expected to embrace cloud-based service rollout rapidly. This is due to the IT industry's continued quest for simplified infrastructure and solution developers' ability to create hybrid cloud solutions by obtaining application and infrastructure components from different providers. This tendency is helping to drive the Network as a service (NaaS) market forward.

North America to Occupy Significant Market Share

- The United States has developed an economy that embraces advanced technology, propelling the expansion of network automation, cloud-based services, and the Network as a service (NaaS) market. IT teams are set to adopt NaaS solutions from suppliers that offer hybrid solutions, including software, cloud intelligence, and the autonomy to manage on-premise hardware in the next five years.

- As a pioneer in technology adoption, the United States is experiencing a rise in demand for enhanced network services, driven by significant growth in liked mobile devices. With the growth of virtualized settings such as Cloud Software Defined Networks (SDN) and Virtual Network Functions (VNF), various Network Service Providers (NSPs) in the region have enabled on-demand infrastructure. However, planning and acquiring network connectivity for organizations may take time and effort, posting difficulties for businesses attempting to stay up with digital trends and function at software-driven speeds.

- The Canadian NaaS market is expanding due to new product releases, acquisitions, mergers, partnerships, and collaborations that are transforming the North American market. There has been a noteworthy increase in cyberattacks on IT service providers, resulting in data breaches. As a result, the Canadian Center for Cybersecurity has issued recommendations to organizations, allowing them to be more selective when picking network service providers.

- Market demand is increasing significantly as automation and linked device deployment expand. The NaaS model is especially beneficial for small firms since it allows them to delegate day-to-day equipment upkeep and focus on their key capabilities, such as customer service. Given the prevalence of small enterprises in Canada, using NaaS is projected to grow considerable traction soon.

Network as a Service Industry Overview

The Network-as-a-Service Market consists of several major players and is highly competitive. The market is fragmented due to the presence of several small and large players. The key players that hold a prominent market share are focusing on expanding their customer base across regional boundaries. These companies leverage strategic collaborative initiatives to increase their market profitability and share. Some major players in the market are AT&T Intellectual Property, Verizon, and Cisco System Inc., among others.

- January 2022, Fujitsu Network Communications, Inc. introduced software-defined wide area network, or SD-WAN as a Service, for service providers to deliver to their enterprise clients. The solution combines the Silver Peak Unity EdgeConnectSP SD-WAN system with Fujitsu's Managed Network Service and SDN/NFV Consulting Service. The Fujitsu product enables service providers to immediately deliver SD-WAN-as-a-Service to their enterprise customers rather than designing and implementing their solution for months. As a result, service providers can now concentrate on attracting clients and making money by utilizing the advantages of this disruptive technology.

- June 2022 - Kyndryl, a provider of IT infrastructure services, and Cisco announced a technical alliance to assist enterprise customers in accelerating the transformation into data-driven organizations using Cisco technologies and Kyndryl-managed services. By utilizing cloud computing technologies that simplify difficult hybrid IT management with increased visibility, manageability, and flexibility, Kyndryl and Cisco work together to facilitate businesses in transforming their operations. Also, Kyndryl and Cisco are working together to create new private cloud services, network and edge computing solutions, software-defined networking (SDN) solutions, and multi-network vast area network (WAN) options in a setting with high-tech security features.

- September 2022 - Verizon launched a global Network-as-a-Service (NaaS) relationship with Wipro Ltd, a technology services and consulting firm, that speeds enterprises' network modernization and cloud transformation journeys. Wipro's Network-as-a-Service (NaaS) solution, powered by Verizon, comprises a variety of pre-configured and proven service chains on a subscription-based consumption model, allowing network consumption infrastructure to be consumed on demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Cloud Services among Enterprises

- 5.1.2 Augmentation in Software-defined Networking (SDN) Integration with Existing Network Infrastructure

- 5.2 Market Restraints

- 5.2.1 Privacy and Data Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LAN-as-a-Service

- 6.1.2 WAN-as-a-Service

- 6.2 By Application

- 6.2.1 Cloud-based Services (vCPE)

- 6.2.2 Bandwidth on Demand (BoD)

- 6.2.3 Integrated Network Security-as-a-Service

- 6.2.4 Wide Area Network (WAN)

- 6.2.5 Virtual Private Network (VPN)

- 6.3 By Industry Vertical

- 6.3.1 Healthcare

- 6.3.2 BFSI

- 6.3.3 Retail and E-commerce

- 6.3.4 IT and Telecom

- 6.3.5 Manufacturing

- 6.3.6 Transportation and Logistics

- 6.3.7 Public Sector

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.4.4 Rest of Latin America

- 6.4.5 Middle East & Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Rest of Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Intellectual Property

- 7.1.2 Verizon

- 7.1.3 DXC Technology Company

- 7.1.4 TD SYNNEX Corporation

- 7.1.5 Cisco Systems, Inc.

- 7.1.6 NEC Corporation

- 7.1.7 Hewlett Packard Enterprise Development LP

- 7.1.8 IBM

- 7.1.9 Oracle

- 7.1.10 GTT Communications, Inc.

- 7.1.11 VMware, Inc.

- 7.1.12 Telstra Group Limited

- 7.1.13 CenturyLink

- 7.1.14 Meta Networks Ltd (Proofpoint)

- 7.1.15 Masergy Communications, Inc.

- 7.1.16 Juniper Networks, Inc.

- 7.1.17 Nokia (Alcatel Lucent)

- 7.1.18 Akamai Technologie

- 7.1.19 Broadcom