|

市場調查報告書

商品編碼

1404499

資料中心的液浸冷卻 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Immersion Cooling in Data Centers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

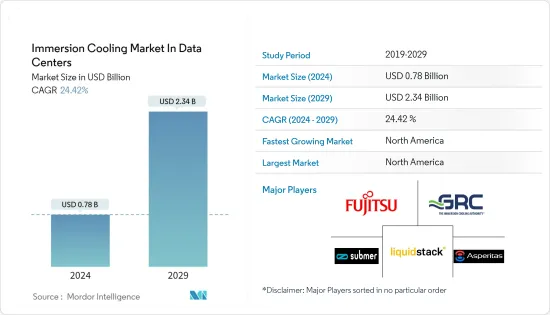

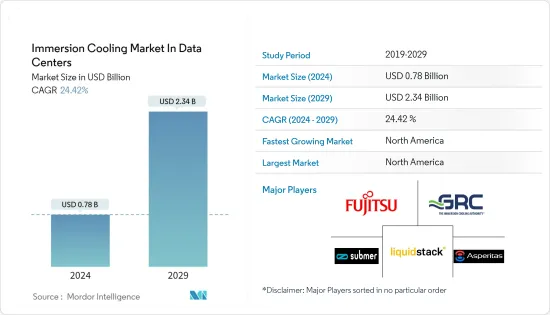

資料中心液浸冷卻市場預計將從2024年的7.8億美元成長到2029年的23.4億美元,預測期間(2024-2029年)複合年成長率為24.42%。

根據許多行業估計,冷卻成本約佔資料中心能耗的 40%,因此解決高密度電力消耗將推動市場發展。浸沒式冷卻可以將資料中心的能源使用量減少 60% 以上,一些系統稱它可以減少多達 95%。對於許多資料中心來說,這每年可以節省數百萬美元。

最近資料中心建設的激增主要集中在以最小的延遲向高流量區域提供服務,而資料中心營運商正在尋求從合適的環境擴展到複雜的城市設施。我被迫這樣做。因此,對克服傳統空氣和液體冷卻的環境和空間限制的伺服器冷卻技術的需求不斷成長。對顯著減少資料中心實體佔地面積同時支援高密度操作的解決方案的需求正在推動對液浸冷卻的需求。

印度和中國等新興經濟體擁有先進的IT基礎設施發展,可能會積極推動資料中心需求。隨著雲端模型的採用,對資料中心的需求可能會增加,這為 IT 產業帶來成本和營運優勢。 NTT Ltd. 的一項調查顯示,超過一半 (52%) 的受訪者表示雲端將為他們組織的業務運作帶來最重大的變化。因此,資料中心冷卻的需求預計會增加,從而導致根據最終用戶的喜好採用液體冷卻方法。

隨著巨量資料和人工智慧的使用越來越多,組織面臨資料處理的挑戰。例如,在美國,由於認知能力需求不斷成長,IBM公司新建了四個資料資料中心。這可能會增加這些資料中心冷卻技術的使用率。

浸入式冷卻是透過介電液體冷卻資料中心最有效的方法之一。高投資和更高的技術資本支出是限制市場成長的唯一因素。

COVID-19 大流行的爆發給多個經濟體的各個部門帶來了進一步的壓力。這已將焦點轉移到數位經濟。資料中心面臨的新壓力是巨大的。隨著越來越多的員工在家工作,視訊通話和 VPN 的使用正在增加。醫療保健相關人員擴大使用遠端醫療應用程式來治療患者。中國最大的雲端處理供應商阿里雲正在投資數十億美元建設下一代資料中心,以支援「疫情後世界」的數位轉型需求。

資料中心液浸冷卻市場趨勢

對高密度功耗的反應正在推動市場

- 富含 GPU 的系統基於 2U ThinkSystem SR670 機架伺服器,每台伺服器最多具有四個雙寬 GPU。緊湊型半機架 24U 系統可容納多達四台聯想伺服器,功耗不到 5kW。同時,中型版本在全尺寸46kW機架中最多可容納16台伺服器,並且可以根據需要添加任意數量的機架進行擴充。兩個系統均由Schneider的 EcoStruxure IT 進行監控。

- 向資料中心銷售即插即用浸入式冷卻模組的荷蘭新興企業Asperitas 表示,在能量吸收方面,浸入式冷卻將所有電氣元件浸入辯證液體中,因此僅IT 一項就可以將您的能源足跡減少10 % 45%。它還強調,在相同體積和溫度下,合適的介電液體吸收的熱能比空氣多約 1,500 倍。

- 資料中心在添加更多刀片伺服器和儲存設備以提高效能時,需要更多的電力並產生更多的熱量。平均散熱量超過30-50kW/伺服器機架。因此,全球範圍內對用於高效熱量和設備管理的冷卻和溫度控管解決方案的投資正在增加。去年 3 月,AMAX 的 HPC 和 AI 解決方案集團發布了 ServMaxAE-2484L,這是一款具有單相浸沒式冷卻功能的新型 2U 4 節點密度最佳化伺服器。

- 此伺服器經過認證,可將伺服器功耗降低高達 20%,同時在此外形尺寸中提供最高的 CPU 運算密度,從而提高電源使用效率 (PUE)。 2U 4節點密度最佳化伺服器專注於解決位置、電力可得性和成本等限制,滿足HPC和AI工作負載等日益嚴苛的運算需求。

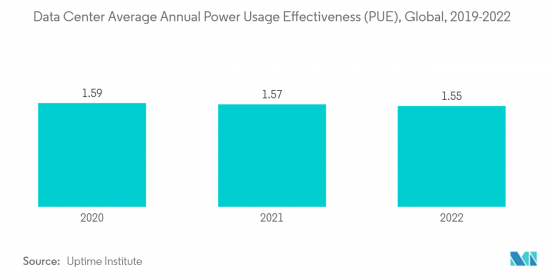

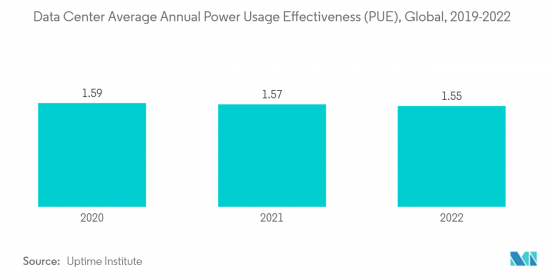

- 根據 Uptime Institute 進行的一項研究,最大的資料中心 IT 和資料中心經理的年度電力使用效率 (PUE) 比率為 1.55。資料中心營運商努力使 PUE 比率盡可能接近 1,許多來自超大規模和主機代管供應商的現代資料中心比使用舊技術的資料中心更有效率。

北美可望創最大市場規模

- 北美是一個快速採用新技術的國家。資料中心投資者擴大投資於浸入式和片下冷卻解決方案。全球 5G 網路的出現推動了邊緣資料中心的重要性,美國是最早採用該技術的國家之一。許多美國業者已開始投資這些中心,包括 EdgePresence、EdgeMicro 和 American Towers。

- 此外,思科系統公司報告稱,美國的行動資料流量逐年顯著成長,從 2028 年的每月 21.49Exabyte(EB) 成長到 2017 年的每月 2028 艾字節。這導致了 6.7EB資料Exabyte。據愛立信稱,到 2030 年,資料流量預計將增加兩倍。因此,分散式雲端正在實用化,因為它們可以確保輕鬆連接這種規模所需的低延遲和寬頻寬度。

- 根據能源技術領域的數據,由於多種因素的影響,美國資料中心的能源使用量預計將小幅成長,從 2014 年到去年成長超過 4%。根據目前趨勢估計,美國資料中心預計 2022 年將消耗約 1.9 吉瓦。

- 在美國,個人和企業的網路使用量正在迅速增加。該國是最大的資料中心營運市場,並且由於最終用戶資料消耗的增加而持續成長。物聯網的日益普及是美國超大型資料中心市場的關鍵驅動力,導致設施擴展以支援企業用戶和消費者產生的Exabyte資料。

- 包括微軟在內的幾家美國公司正在研究在其資料中心實施浸入式冷卻。兩相液浸冷卻的生產引入正值風冷資料晶片技術的可靠進展大幅放緩之際,這是我們長期計劃的下一步。微軟已經研究了液浸作為一些高效能運算應用(包括人工智慧)的冷卻解決方案。研究表明,兩相浸入式冷卻可以將任何給定伺服器的功耗降低 5% 到 15%。

資料中心浸入式冷卻產業概述

研究市場的競爭程度很高,預計在預測期內將進一步加劇。市場上的競爭正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。 Fujitsu Limited、Green Revolution Cooling Inc.、Submer Technologies SL、Liquid Stack Inc.和Asperitas Company是主要的市場參與企業。

2022 年 9 月,陶氏推出 DOWSIL 浸入式冷卻技術。 DOWSIL 浸入式冷卻技術是一種永續解決方案,針對超大規模雲端和企業資料中心冷卻進行了最佳化。 DOWSIL 浸入式冷卻技術為高速、大容量通訊時代快速成長的資料中心提供了突破性的溫度控管和永續性方法。

2022 年 2 月,InfraPrime 和 Iceotope Technology Ltd. 建立了合作夥伴關係,以消除和減少淨零 Powershell 站點在資料中心生命週期中的消費量。這將最大限度地發揮和支持循環業務的潛力,永續的經濟成長和有彈性的未來。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭程度

- 替代品的威脅

- 評估 COVID-19 對產業的影響

- 產業供應鏈分析

- 氟化液體供應商/製造商

- 浸入式冷卻浴設備供應商

- 資料中心供應商

第5章市場動態

- 市場促進因素

- 超大規模資料中心的增加

- 應對高密度功耗

- 市場抑制因素

- 資金投入大

第 6 章 技術概覽

- 資料中心冷卻的演變

- 能耗和計算密度指標以及關鍵考慮因素

- 流體、處理器、GPU、機架和基礎設施供應商的細分

第7章市場區隔

- 按類型

- 單相浸沒式冷卻系統

- 兩相浸沒式冷卻系統

- 透過冷卻劑

- 礦物油

- 去離子水

- 氟碳液

- 合成液

- 按用途

- 高效能運算

- 邊緣運算

- 人工智慧

- 加密貨幣挖礦

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第8章競爭形勢

- 公司簡介

- Fujitsu Limited

- Green Revolution Cooling Inc.

- Submer Technologies SL

- Liquid Stack Inc.

- Asperitas Company

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- DUG Technology

第9章投資分析

第10章市場的未來

The Immersion Cooling Market in Data Centers Industry is expected to grow from USD 0.78 billion in 2024 to USD 2.34 billion by 2029, at a CAGR of 24.42% during the forecast period (2024-2029).

Dealing with high-density power consumption drives the market, as many industry estimates put cooling costs at around 40% of the data center's energy consumption. The immersion cooling is able to reduce the data center's energy usage by over 60%, with some systems stating it could be as much as a 95% reduction. For many data centers, this provides millions of dollars in savings annually.

The recent surge in data center construction activities, majorly targeted toward serving high-traffic zones with minimum latency, forced data center operators to expand beyond a suitable environment into complex urban facilities. This increased the demand for server cooling technology that involves the environmental and space constraints that traditional air and liquid cooling practices pose. The increasing need for solutions may significantly reduce the data center's physical footprint and simultaneously accommodate high-density operations, bolstering the demand for immersion cooling.

Growing developments in IT infrastructure in emerging economies, such as India, China, and other countries, is likely to boost the demand for data centers positively. The demand for data centers is likely to increase due to the adoption of the cloud model, which has cost and operational benefits for the IT industry. According to a study by NTT Ltd, over half of the respondents (52%) mentioned that the cloud would have the most transformational impact on their organization's business operations. Hence, the demand for the cooling of data centers is expected to increase, leading to the implementation of liquid cooling methods based on end-user preferences.

The growing use of Big Data, AI, to name a few, has led organizations to face a data-crunch challenge. For instance, the rising demand for cognitive capabilities in the United States led IBM Corporation to build four new cloud data centers. This is likely to encourage the utilization of cooling technologies in these data centers.

Immersion cooling is one of the most effective ways to cool data centers through dielectric liquids. High investment with more significant technological CAPEX has been the only restraint hindering the market's growth.

The outbreak of the COVID-19 pandemic posed additional stress on multiple economies across various sectors. This shifted the focus toward a digital economy. The new load on data centers is serious. More employees are working from home, increasing video calls and VPN usage. Allied health professionals have ramped up the use of telehealth applications to treat patients. China's top cloud computing provider, Alibaba Cloud, invests billions in building next-generation data centers to support digital transformation needs in a "post-pandemic world."

Data Center Immersion Cooling Market Trends

Dealing with High-density Power Consumption Driving the Market

- The GPU-rich system is based on a 2U ThinkSystem SR670 rack server, which includes up to four double-width GPUs per server. A small half-rack 24U system includes up to four Lenovo servers and uses less than 5 kW. At the same time, the medium-sized version includes up to 16 of the servers in full-sized 46 kW racks and can be scaled up by including as many of those racks as needed. Both systems are monitored with Schneider's EcoStruxure IT.

- On the energy absorption front, liquid immersion cooling submerges all electrical components in a dialectic liquid, thus reducing the energy footprint of IT alone by between 10% and 45%, as per Asperitas, a Dutch startup selling plug-and-play liquid immersion cooling modules to data centers. It further highlighted that suitable dielectric liquids absorb approximately 1,500 times more heat energy than air with the same volumes and temperatures.

- As organizations are observed to be adding blade servers and storage devices to improve their performance, data centers are demanding more electricity and producing high heat. On average, the heat dissipation exceeds the 30 kW-50 kW/server rack. Thus, allied investments in cooling and heat management solutions for efficient heat and equipment management are increasing globally. In March last year, AMAX's HPC and AI Solutions Group announced a new 2U 4-Node density optimized server, ServMaxAE-2484L, for single-phase liquid immersion cooling.

- The server is recognized to improve Power Usage Effectiveness (PUE) by reducing server power usage by up to 20% amid the highest CPU compute density in its form factor. The 2U 4-Node density optimized server focuses on solving constraints such as location, the availability and cost of power, and the handling of increasingly demanding computing requirements, such as HPC and AI workloads.

- According to a survey conducted by Uptime Institute, at the largest data center, IT and data center management reported an annual power use effectiveness (PUE) ratio of 1.55. Data center operators strive to achieve a PUE ratio as near to one as feasible, with many of the newest data centers from hyperscale and colocation providers delivering higher efficiency than those using older technology.

North America is Expected to Register the Largest Market

- North America is an early adopter of newer technologies. Datacenter investors are increasingly investing in liquid immersion and direct-to-chip cooling solutions. The importance of edge data centers has been aided by the emergence of 5G networks worldwide, and the United States is among the earliest adopters of the technology. Many operators in the United States, such as EdgePresence, EdgeMicro, and American Towers, started investing in these centers.

- Moreover, the mobile data traffic in the United States increased considerably over the years, from 21.49 exabytes (EB) 2028 of data traffic in 2017 to 6.7 EB exabytes per month of data traffic by this year, as reported by Cisco Systems. According to Ericsson, this data traffic is expected to triple by 2030. Thus, the distributed cloud that may secure the low latency and high bandwidth required to connect such scale easily is coming into action.

- Due to multiple factors, energy use in US data centers is expected to grow slightly, increasing by more than 4% from 2014 to last year, according to the Energy Technology Area. Based on current trend estimates, the US data centers were projected to consume approximately 1.9 gigawatts in 2022.

- The United States is witnessing massive growth in internet usage by people and businesses. The country is the largest market in data center operations, and it continues to grow due to the higher data consumption by end-users. The growing popularity of the IoT is a significant driver for the US hyper-scale data center market, leading to additional facilities supporting exabytes of data generated by business users and consumers.

- Multiple US-based companies, like Microsoft, are researching immersion cooling deployment in data centers. The production environment deployment of two-phase immersion cooling is the next step in Microsoft's long-term plan to keep up with demand for faster, more robust data center computers when reliable advances in air-cooled computer chip technology considerably slowed. Microsoft researched liquid immersion as a cooling solution for several high-performance computing applications, such as AI. The investigation revealed that two-phase immersion cooling reduced power consumption for any given server by 5% to 15%.

Data Center Immersion Cooling Industry Overview

The degree of competition in the market studied is high and is expected to increase over the forecast period. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage. Fujitsu Limited, Green Revolution Cooling Inc., Submer Technologies SL, Liquid Stack Inc., and Asperitas Company are some of the key market players.

In September 2022, Dow announced DOWSIL Immersion Cooling Technology, which is an optimized and sustainable solution for cooling hyperscale cloud and enterprise data centers. DOWSIL Immersion Cooling Technology offers a revolutionary approach to thermal management and sustainability for fast-growing data centers in an era of high-speed, high-volume communications.

In February 2022, InfraPrime and Iceotope Technology Ltd entered a partnership to eliminate and reduce water consumption for Net Zero PowerShell Sites throughout the data center life cycle. It would help leverage and boost the full potential of circular businesses for sustainable economic growth and a resilient future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Supply Chain Analysis

- 4.5 Fluorine-based Liquid Suppliers/Manufacturers

- 4.6 Immersion Cooling Bath Equipment Vendors

- 4.7 Data Center Vendors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Hyper-scale Data Centers

- 5.1.2 Dealing with High-density Power Consumption

- 5.2 Market Restraint

- 5.2.1 High Investment with Greater Capital Expenditure

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Data Center Cooling

- 6.2 Energy Consumption and Computing Density Metrics, and Key Considerations

- 6.3 Teardown of Fluid, Processor, GPUs, Racks, and Infrastructure Providers

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Single-Phase Immersion Cooling System

- 7.1.2 Two-Phase Immersion Cooling System

- 7.2 By Cooling Fluid

- 7.2.1 Mineral Oil

- 7.2.2 Deionized Water

- 7.2.3 Fluorocarbon-Based Fluids

- 7.2.4 Synthetic Fluids

- 7.3 By Application

- 7.3.1 High-performance Computing

- 7.3.2 Edge Computing

- 7.3.3 Artificial Intelligence

- 7.3.4 Cryptocurrency Mining

- 7.3.5 Other Applications

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia Pacific

- 7.4.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Fujitsu Limited

- 8.1.2 Green Revolution Cooling Inc.

- 8.1.3 Submer Technologies SL

- 8.1.4 Liquid Stack Inc.

- 8.1.5 Asperitas Company

- 8.1.6 LiquidCool Solutions

- 8.1.7 Midas Green Technologies

- 8.1.8 Iceotope Technologies Ltd.

- 8.1.9 Wiwynn Corporation

- 8.1.10 DCX Ltd.

- 8.1.11 DUG Technology