|

市場調查報告書

商品編碼

1404475

LED 照明:市場佔有率分析、行業趨勢和統計、成長預測,2024-2029 年LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

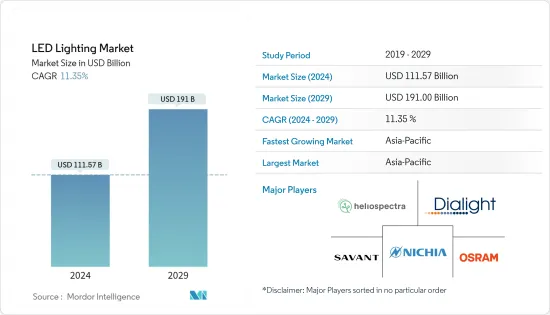

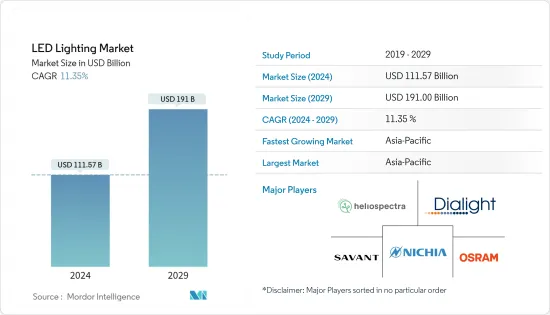

LED照明市場規模預計到2024年為1,115.7億美元,預計到2029年將達到1,910億美元,在預測期內(2024-2029年)複合年成長率為11.35%。

主要亮點

- 可透過智慧型手機和其他智慧型裝置控制的智慧照明系統的趨勢也促進了 LED 照明需求的增加。這意味著,與螢光照明技術相比,LED 照明系統更容易與智慧控制設備整合,在家庭、辦公室和城市中創造智慧型且響應靈敏的生活環境,因為它可以讓光線到達需要的地方。

- 製造商開始在不影響品質的情況下降低成本。這使得住宅成為 LED 照明的不錯選擇。由於LED燈使用壽命長且消費量低,住宅還可以透過使用 LED 燈來節省金錢。許多住宅一直在尋找更環保的方法。 LED 不含汞且可回收,因此非常環保。

- 除了住宅之外,辦公空間也正成為 LED 照明的熱門用途。在當今的商業世界中,管理者和所有者非常關注員工的社會福利。透過改用 LED 照明,辦公室可以為員工提供更明亮的照明。看得更清楚,減少眼睛疲勞,淺色有助於照亮您的心情和舒適感。

- 市場面臨的主要挑戰之一是所需的高額初始投資。製造LED燈的初期投資高的原因是原料成本。 LED照明需要砷化鎵、氮化鎵、磷化銦等優質半導體材料,價格昂貴。此外,LED照明還需要其他材料,例如電子元件和磷光體,這些材料也相對昂貴。

- 此外,貿易戰具有重大的經濟和政治影響力。例如,2018年4月,美國政府在301調查後提案了1,300種中國出口產品清單,並宣布對這些產品加徵25%的關稅。隨後,同年7月,美國政府宣布計畫對包括LED產品在內的價值2,000億美元的中國產品加徵關稅。值得注意的是,列入第一批清單的LED產品主要是晶圓、背光產品等半成品。這些關稅影響了在美國設有工廠、從中國購買和生產中間產品的美國公司。

LED照明市場趨勢

住宅領域預計將佔據很大佔有率

- 許多業主為永續性做出重大努力的關鍵方法之一是在整個住宅社區安裝 LED 照明。這些房產擁有廣泛的照明網路,並且運作在一天中的大部分時間運作。升級到 LED 照明可以顯著節省能源。這就是為什麼許多租戶和住宅也主動使用各種 LED 選項來升級他們的室內照明。

- LED 照明的主要優點是能源效率和耐用性。 LED 照明還提供其他燈類型無法實現的設計彈性。由於尺寸較小,LED 可以適應鹵素燈泡或螢光燈泡無法實現的燈形。還有一些產品可以讓您設計您想要的室內燈光顏色並調整顏色輸出。

- LED 的這些優點正在加速普及在住宅領域的普及。根據IEA於2022年發布的2020-2021年最新住宅能源消耗調查(RECS)顯示,47%的美國住宅現在使用LED產品來滿足大部分或全部照明需求。此外,住宅LED照明的市場佔有率大於鹵素燈、白熾燈和螢光。

- 環境照明為房間提供一般照明。 LED環境照明有多種形式,包括吸頂式LED嵌燈、LED 條燈、LED 燈泡,甚至帶有 LED 燈具的水晶燈。使用 LED 的環境照明主要用於照亮房間。然而,LED 還可以提供有吸引力的照明,因為它們發出高品質的光。當今最受歡迎的環境照明方法之一是間接照明,它隱藏 LED 燈具,同時在整個房間中傳播柔和、均勻的光線。

- 2022年6月,Sisca集團推出Sisca Growling LED嵌入式下照燈與明裝下照燈。燈體的大部分主要零件均採用熱塑性樹脂製成,重量輕、安全且散熱效果好。有兩種不同的瓦數和尺寸:6W 型,尺寸為 87.5 x 42 mm,12W 型,尺寸為 114.5 x 44.5 mm。該燈還具有雙色和 3 路切換功能,可滿足任何美學需求。

亞太地區預計將佔據主要市場佔有率

- 預計亞太地區對 LED 照明的需求將增加,這主要是由於對節能照明解決方案的需求不斷成長以及政府採取的各種舉措促進其在市場上多個行業的應用。 LED 照明因其功耗低、使用壽命長和顏色選擇範圍廣等許多優點而在該地區越來越受歡迎。

- 亞太地區LED照明市場的成長是由該地區的逐步成長所推動的,例如擴大採用節能照明解決方案、照明基礎設施、智慧照明解決方案,以及人們對節能重要性的認知不斷增強照明解決方案,這也是由於穩定的遷移趨勢所致。

- 將調光技術、運動感應器和藍牙連接等創新功能融入 LED 照明系統,進一步推動了 LED 照明市場的成長。聲控燈、運動感應器和定時器等智慧照明產品由於其便利性和節能性,在住宅和商業環境中越來越普及。眾多最終用戶對節能照明的需求不斷成長,預計將推動亞太地區的市場成長。許多專業人士正在使用 LED 照明,這使其比傳統緊湊型螢光燈泡和其他照明具有競爭優勢。

- LED 照明有效提高工人生產力,實現更好的品管和更輕鬆的操作。它還安全且具有成本效益。 LED 照明提高了光強度和質量,並顯著降低了光能耗。所有這些因素都將在預測期內刺激節能照明的採用。

- 許多西方國家正在經歷研究市場飽和,而中國LED照明市場參與者的價格競爭正在升溫。許多製造商正在該地區其他地方尋找商機。印度和越南等新興國家對 LED 照明(包括智慧 LED)的需求不斷增加,這可能是推動該地區 LED 照明國內需求的重大機會。

LED照明產業概況

由於Heliospectra AB、Dialight PLC、伊頓公司、通用電氣公司和歐司朗有限公司等許多地區和國際公司的存在,LED 照明市場呈現碎片化。這些擁有壓倒性市場佔有率的大公司正致力於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。然而,隨著技術進步和產品創新的出現,中小企業(SME)正在透過獲取新契約和開拓新市場來增加其在市場中的影響力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 技術簡介

- LED照明價值鏈分析(上游、中游、下游)

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- LED貿易分析及美國貿易戰對LED的影響

- 宏觀經濟趨勢對LED照明市場的影響

- LED照明產品價格趨勢

- LED 模組和照明產業的關鍵案例和客戶見解

第5章市場動態

- 市場促進因素

- 對節能照明系統和有利的政府法規的需求不斷增加

- LED產品價格更低

- 市場抑制因素

- 初始投資高

- 替代技術的開發

第6章市場區隔

- 按用途

- 商業辦公室

- 零售

- 款待

- 產業

- 高速公路

- 架構

- 公共設施

- 醫院

- 住宅

- 車

- 其他

- 依產品類型

- 燈

- 照明設備

- 按銷售管道

- 直銷

- 批發零售

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- Heliospectra AB

- Dialight PLC

- Nichia Corporation

- Savant Systems Inc.

- OSRAM Licht AG(AMS OSRAM AG)

- Signify NV

- Zumtobel Group AG

- Panasonic Corporation

- Acuity Brands Inc.

- Hubbell Incorporated

第8章投資分析

第9章市場的未來

The LED Lighting Market size is estimated at USD 111.57 billion in 2024, and is expected to reach USD 191 billion by 2029, growing at a CAGR of 11.35% during the forecast period (2024-2029).

Key Highlights

- The rising trend of smart lighting systems, which smartphones and other smart devices can control, has also contributed to the rising demand for LED lights. This is because LED lighting systems are much easier to integrate with smart controls to create intelligent and responsive living environments in homes, offices, and cities, delivering light when and where needed, compared with fluorescent lighting technologies.

- Manufacturers have started to lower the cost without compromising quality. This makes residences a suitable option for LED lighting applications. Residential owners can also get the advantage of monetary savings when using LED lamps as it last a long time and use a fraction of the energy. Many homeowners are constantly looking for ways to be more eco-friendly. LEDs provide that as they contain no mercury and are recyclable.

- Apart from houses, office spaces are also becoming one of the common LED lighting applications. In current business world, managers and owners are placing more focus on the overall well-being of their employees. By switching to LED lighting, offices can facilitate bright light for their employees. This aids them see better and experience less eye fatigue and the color of the light can help brighten moods and comfort.

- One of the main challenge with the market is the requirement of high initial investment. The reasons why the initial investment for LED light manufacturing is high is the cost of raw materials. LED lights require high-quality semiconductor materials, such as gallium arsenide, gallium nitride, and indium phosphide, which are expensive. In addition, LED lights require other materials, such as electronic components and phosphors, which are also relatively expensive.

- Furthermore, the Trade war has had significant economic and political consequences. For instance, in April 2018, the U.S. government proposed a list of 1300 Chinese exports and announced 25 percent tariffs on these products following the Section 301 investigation. Later in July of the same year, the U.S. administration released the plan of additional tariffs enforcement on USD 200 billion worth of Chinese goods that included LED products. Notably, the LED products included in the first list were primarily intermediate goods such as wafers and backlight products. The tariff influenced U.S.-based companies with factories in the U.S. and used to buy intermediate products from China for manufacturing.

LED Lighting Market Trends

Residential Sector is expected to share major market share

- One important way many property owners are making significant efforts towards sustainability is by implementing LED lighting throughout their residential communities. These properties contain large lighting networks that operate most hours of the day and are required to remain operational. Upgrading to LED lighting results in significant energy savings. Thus, many renters and homeowners are also taking the initiative to upgrade their interior lighting with a wide array of LED options.

- The primary benefits of LED lighting are energy efficiency and durability. LED lighting also provides a design flexibility that cannot be achieved with other lamp types. Owing to their small size, LEDs can be used in lamp shapes that are not possible with halogen and fluorescent bulbs. LEDs can also be designed to produce any light color needed for an interior design, and some products have an adjustable color output.

- Such benefits offered by LEDs have accelerated their uptake in the residential segment. As per the latest Residential Energy Consumption Survey (RECS) completed in 2020-2021 by IEA and published in 2022, 47 percent of US homes now use LED products for most or all of their lighting needs. Residential LED lighting also has a larger market share than halogen, incandescent and fluorescent lighting.

- Ambient lighting provides the general illumination of a room. LED-based ambient light can come in different forms, such as ceiling-mounted LED downlights, LED strip lights, LED bulbs, or even chandeliers that use LED luminaries to produce light. Ambient lighting with LEDs serves the first and foremost purpose of illuminating the room. However, due to the high-quality light emitted, LEDs also deliver attractive lighting. One of the most popular ways to create ambient lighting nowadays is with indirect installation, where the LED fixtures are hidden but still spread a gentle, even light over the room.

- In June 2022, Syska Group launched Syska Glowring LED Recessed Downlight and Surface Downlight. Thermo plastic body forms the majority of the lamp's main component, adding to its light weight, high safety factor, and effective heat dissipation. The lights come with two wattage and size options that are 6W having the size 87.5 x 42 mm which can be both recessed and surface mounted and an additional option of 12W which has the size as 114.5 x 44.5 mm. The lights also feature dual colors and three way switching that helps match with every aesthetic.

Asia-Pacific Expected to Hold Significant Market Share

- The Asia-Pacific region is expected to experience an increase in demand for LED lighting, mainly due to the rising demand for energy-efficient lighting solutions and the various government initiatives promoting their applications across multiple industries in the market. LED lights are turning more popular in the region due to their numerous benefits, such as low power consumption, longer life, and a wide range of color options.

- The growth of the Asia-Pacific LED lighting market is also driven by the robust development of the region's gradual transition toward energy-efficient lighting solutions, lighting infrastructure, and the increased adoption of smart lighting solutions, coupled with increasing awareness among people about the importance of energy-efficient lighting solutions.

- Incorporating innovative features into LED lighting systems, such as dimming technology, motion sensors, and Bluetooth connectivity, further propels the LED lights market's growth. The increasing popularity of smart lighting products, such as voice-activated lights, motion sensors, and timers, is becoming increasingly popular in residential and commercial settings due to their convenience and energy savings. The rising demand for energy-efficient lighting by numerous end users is expected to boost the market growth in the Asia-Pacific region. Many professionals use LED lighting to provide competitive advantages over conventional compact fluorescent lamps or other lights.

- LED lighting efficiently boosts workers' productivity, enabling better quality control and easier operations. These lights are also safe and cost-effective. LED lighting enhances light levels and quality and significantly reduces light energy consumption. All these factors stimulate the adoption of energy-efficient lighting over the forecast period.

- Many western countries are experiencing saturation in the studied market, and the price war among Chinese LED lighting market players has heated up. Numerous manufacturers are looking for opportunities in other parts of the region. The growing need for LED lighting (including smart LED) in developing countries like India and Vietnam can provide a great opportunity, thus boosting the domestic demand for LED lighting in the region.

LED Lighting Industry Overview

The LED lighting market is fragmented due to the presence of many regional and international players like Heliospectra AB, Dialight PLC, Eaton Corporation, General Electric Company, and OSRAM GmbH. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are expanding their market presence by securing new contracts and tapping new markets.

- February 2023 - Heliospectra introduced MITRA Flex, a revolutionary flexible far-red light for application-based growing. The new solutions provide customers with three spectra in one without sacrificing power, making it ideal for specialized and application-based growing, such as far-red light treatments at the end of the day or the end of production, or to guarantee a healthy crop all year long, even during low light seasons.

- January 2023 - Nichia Corporation and Infineon Technologies AG announced the launch of the industry's first fully integrated micro-LED (µPLS light engine) light engine for high-definition (HD) adaptive driving beam applications. The µPLS light engine uses Nichia's unique in-house LED chip, micro-LED technology, and an integrated LED driver IC from Infineon that can drive all 16,384 micro-LEDs individually using pulse-width modulation (PWM) control.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.3 LED Lighting Value Chain Analysis (Upstream, Midstream, Downstream)

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Intensity of Competitive Rivalry

- 4.4.5 Threat of Substitutes

- 4.5 LED Trade Analysis and Impact of US-China Trade War on the LED

- 4.6 Impact of Macro Economic trends on the LED Lighting Market

- 4.7 LED Lighting Product Pricing Trends

- 4.8 Key Case Studies and Customer Insights Pertaining to LED Modules and Lighting Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

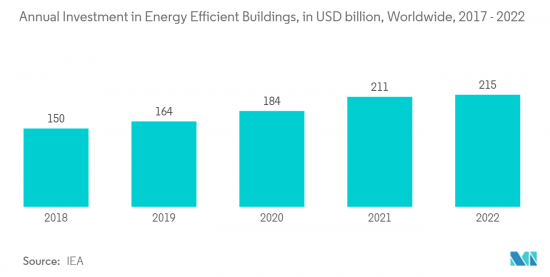

- 5.1.1 Increase in Need for Energy-efficient Lighting Systems and Favorable Government Regulations

- 5.1.2 Declining Prices of LED Products

- 5.2 Market Restraints

- 5.2.1 High Initial Investment

- 5.2.2 Development of Alternative Technologies

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Commercial Offices

- 6.1.2 Retail

- 6.1.3 Hospitality

- 6.1.4 Industrial

- 6.1.5 Highway and Roadway

- 6.1.6 Architectural

- 6.1.7 Public Places

- 6.1.8 Hospitals

- 6.1.9 Residential

- 6.1.10 Automotive

- 6.1.11 Other Applications

- 6.2 By Product Type

- 6.2.1 Lamps

- 6.2.2 Luminaires

- 6.3 By Distribution Channel

- 6.3.1 Direct Sales

- 6.3.2 Wholesale/Retail

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 France

- 6.4.2.3 Germany

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Heliospectra AB

- 7.1.2 Dialight PLC

- 7.1.3 Nichia Corporation

- 7.1.4 Savant Systems Inc.

- 7.1.5 OSRAM Licht AG (AMS OSRAM AG)

- 7.1.6 Signify NV

- 7.1.7 Zumtobel Group AG

- 7.1.8 Panasonic Corporation

- 7.1.9 Acuity Brands Inc.

- 7.1.10 Hubbell Incorporated