|

市場調查報告書

商品編碼

1404468

隔熱塗料:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Thermal Barrier Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

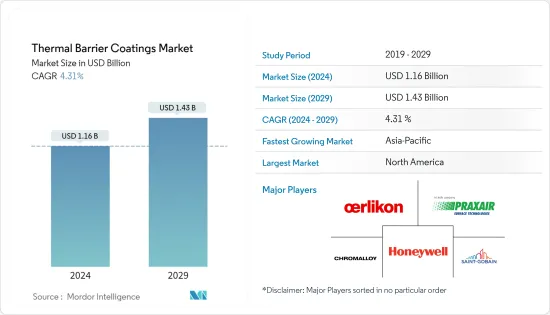

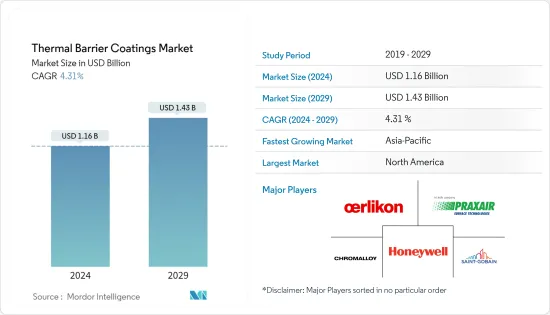

預計 2024 年隔熱障塗料市場規模為 11.6 億美元,預計 2029 年將達到 14.3 億美元,在預測期內(2024-2029 年)複合年成長率為 4.31%。

由於不利的宏觀經濟和這些塗料主要最終用戶的營運限制,COVID-19 對 2020 年市場產生了負面影響,壓低了這段時期的需求。不過,目前預計市場將達到疫情前水平,並有望穩定成長。

主要亮點

- 從燃煤發電向天然氣發電的轉變以及航太領域不斷成長的需求預計將推動隔熱障塗料市場的需求。

- 另一方面,原物料價格波動預計將抑制市場需求。

- 在預測期內,各種最終用戶市場的技術進步可能會為所研究的市場帶來新的成長途徑。

- 北美主導著世界市場。然而,預計亞太地區在預測期內將呈現最高成長率。

隔熱障塗層市場趨勢

航太領域佔市場主導地位

- 隔熱障塗層通常用於保護鎳基高溫合金免受熔化以及航空渦輪機與冷氣流結合的熱循環的影響。

- 隔熱障塗層將允許的氣體溫度提高到高溫合金的熔點以上。它可以降低葉片合金的溫度,並保護其免受熱氣體引起的氧化和熱腐蝕,從而提高渦輪機的性能、壽命和效率。

- 不斷成長的機持有和不斷增加的國防支出導致世界各地的飛機產量增加,從而對 TBC 等用於保護引擎和渦輪機的被覆劑產生了巨大的需求。

- 根據航空維修店協會發布的資料,全球飛機持有預計在未來十年將快速成長。預計這一數字將從 2023 年的 28,000 人增加到 2032 年的 38,100 人。

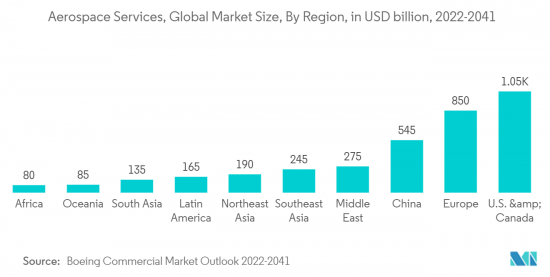

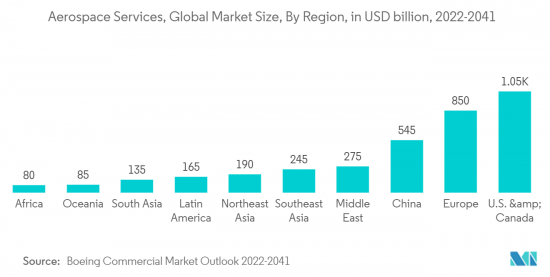

- 根據波音《2022-2041年商業展望》,全球航太服務業預計將達到3.6兆美元以上,其中美國和加拿大佔近30%的市場佔有率。歐洲緊隨其後,佔 23.5%,這可能會推動未來幾年研究市場的需求。

- 此外,根據波音《2022-2041年商業展望》,到2041年,中國將交付約8,485架新飛機,市場服務價值將達到5,450億美元。因此,它正在推動市場的成長。

- 總體而言,航太工業隔熱障塗料市場預計將逐步復甦,並在整個預測期內實現穩定成長。

北美市場佔據主導地位

- 由於航太、汽車、電力、石油和天然氣等各個最終用戶產業的強勁需求,北美地區在隔熱塗料市場佔據主導地位。

- 此外,美國在市場研究中佔最大佔有率。除美國外,加拿大和墨西哥在隔熱障塗料市場中佔有很大佔有率。

- 向法國、中國和德國等國家的航太零件出口強勁,加上美國強勁的消費支出,推動了航太業的製造業活動。這可能會給市場帶來正面的動力。

- 在北美,波音《2022-2041年商業展望》預計,到2041年,新飛機交付總量將達到9,310架,市場服務價值將達到1.45兆美元。

- 根據OICA的數據,2022年北美汽車產量將為17,756,263輛,比2021年產量16,190,835輛增加10%。此外,在北美,2022年美國產量超過1,006萬台。

- 北美地區主要國家繼續受到半導體微晶片短缺和供應鏈進一步中斷的影響。例如,根據美國汽車經銷商協會 (NADA) 的數據,2022 年年輕型汽車銷量是自 2011 年以來最低的一年。與2021年輕型汽車銷量相比,年減8.2%。

- 因此,預計所有上述因素都將在預測期內對該地區隔熱障塗料市場的需求產生重大影響。

隔熱障塗層產業概況

隔熱障塗層市場分散。該市場的主要企業包括(排名不分先後)霍尼韋爾國際公司、OC Oerlikon Management AG、Praxair ST Technology, Inc.、Chromalloy Gas Turbine LLC 和 Saint-Gobain。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 航太領域需求增加

- 發電對燃氣渦輪機的依賴日益增加

- 其他司機

- 抑制因素

- 原物料價格不穩定

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 產品

- 金屬(黏合層)

- 陶瓷(面漆)

- 金屬間化合物

- 其他產品(金屬玻璃複合材料)

- 最終用戶產業

- 車

- 航太

- 發電廠

- 油和氣

- 其他最終用戶產業(船舶、鐵路)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率分析(%)**/市場排名分析

- 主要企業策略

- 公司簡介

- A&A Thermal Spray Coatings

- Chromalloy Gas Turbine LLC

- CTS, Inc.

- Hayden Corp.

- Honeywell International Inc.

- KECO Coatings

- Metallic Bonds, Ltd.

- Northwest Mettech Corp.

- OC Oerlikon Management AG

- Praxair ST Technology, Inc.

- Saint-Gobain

- Tech Line Coatings LLC

- ZIRCOTEC

第7章 市場機會及未來趨勢

- 最終用戶市場的技術進步

- 其他機會

The Thermal Barrier Coatings Market size is estimated at USD 1.16 billion in 2024, and is expected to reach USD 1.43 billion by 2029, growing at a CAGR of 4.31% during the forecast period (2024-2029).

COVID-19 negatively impacted the market in 2020 due to the unfavorable macroeconomics and operational restrictions across major end users of these coatings pushed back the demand during this period. However, the market is now estimated to reach pre-pandemic levels and is expected to grow steadily.

Key Highlights

- The shift from coal to natural gas-fired power generation and increasing demand from the aerospace sector is expected to drive demand for the thermal barrier coatings market.

- On the flip side, volatile raw material prices are expected to restrain demand in the market studied.

- The technological advancements in various end-user markets will likely provide new growth avenues for the market studied during the forecast period.

- North America dominated the global market. However, Asia-Pacific will likely witness the highest growth rate during the forecast period.

Thermal Barrier Coatings Market Trends

Aerospace Sector to Dominate the Market

- Thermal barrier coatings are commonly used to protect nickel-based superalloys from melting and thermal cycling in aviation turbines combined with cool airflow.

- Thermal barrier coatings increase the allowable gas temperature above the superalloy melting point. They reduce the temperature of the blade alloy and protect against oxidation and hot corrosion from high-temperature gas, thus, increasing turbine performance, life expectancy, and efficiency.

- The increasing aircraft fleet and the rising defense expenditure increased aircraft production worldwide, creating immense demand for coatings like TBCs to protect engines and turbines.

- According to the data released by the Aeronautical repair station association, the global aircraft fleet is expected to expand rapidly in the coming decade. It is expected to reach 38,100 aircraft by 2032 from 28,000 in 2023.

- According to the Boeing Commercial Outlook 2022-2041, the worldwide aerospace services industry is predicted to reach over USD 3.6 trillion, with the United States and Canada accounting for almost 30% of the market. Europe follows it with 23.5%, which will likely boost the demand for the studied market in the coming years.

- Furthermore, according to the Boeing Commercial Outlook 2022-2041, in China, around 8,485 new deliveries will be made by 2041 with a market service value of USD 545 billion. Thus, boosting the market growth.

- Overall, the market for thermal barrier coatings in the aerospace industry is expected to recover gradually through the forecast period and grow consistently.

North American Region to Dominate the Market

- The North American region is dominating the thermal barrier coatings market, owing to the significant demand from various end-user industries such as aerospace, automotive, power, and oil and gas.

- Moreover, the United States includes the largest share of the market studied. Besides the United States, Canada and Mexico contain a sizeable share of the market for thermal barrier coatings.

- Strong exports of aerospace components to countries such as France, China, and Germany, along with robust consumer spending in the United States, are driving the manufacturing activities in the aerospace industry. It can induce positive momentum for the market.

- In North America, according to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes will account for 9,310 units by 2041, with a market service value of USD 1,045 billion.

- According to the OICA, automotive production in North America in 2022 accounted for 17,756,263 units, an increase of 10% compared to the production in 2021, which was reported to be 16,190,835 units. Additionally, in North America, Over 10.06 million vehicles manufactured in 2022 were produced in the United States.

- Major countries in the North American region continued to get affected by the semiconductor microchip shortage and additional supply chain disruptions. For instance, According to the National Automobile Dealers Association (NADA), Light vehicle sales in 2022 recorded the lowest full-year sales in 2022 since 2011. They experienced an 8.2% annual decline compared to light vehicle sales in 2021.

- Hence, all the factors above are expected to significantly impact the demand for the thermal barrier coatings market in the region over the forecast period.

Thermal Barrier Coatings Industry Overview

The thermal barrier coatings market is fragmented in nature. Some of the major players in the market include Honeywell International Inc., OC Oerlikon Management AG, Praxair ST Technology, Inc., Chromalloy Gas Turbine LLC, and Saint-Gobain, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Aerospace Sector

- 4.1.2 Growing Dependence on Gas-Fired Turbines for Power Generation

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatile Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product

- 5.1.1 Metal (Bond Coat)

- 5.1.2 Ceramic (Top Coat)

- 5.1.3 Intermetallic

- 5.1.4 Other Products (Metal Glass Composites)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace

- 5.2.3 Power Plants

- 5.2.4 Oil and Gas

- 5.2.5 Other End-user Industries (Marine and Railways)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A&A Thermal Spray Coatings

- 6.4.2 Chromalloy Gas Turbine LLC

- 6.4.3 CTS, Inc.

- 6.4.4 Hayden Corp.

- 6.4.5 Honeywell International Inc.

- 6.4.6 KECO Coatings

- 6.4.7 Metallic Bonds, Ltd.

- 6.4.8 Northwest Mettech Corp.

- 6.4.9 OC Oerlikon Management AG

- 6.4.10 Praxair S.T. Technology, Inc.

- 6.4.11 Saint-Gobain

- 6.4.12 Tech Line Coatings LLC

- 6.4.13 ZIRCOTEC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancements in the End-user Market

- 7.2 Other Opportunities