|

市場調查報告書

商品編碼

1404460

InGaAs 相機 -市場佔有率分析、產業趨勢與統計、2024 年至 2029 年成長預測InGaAs Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

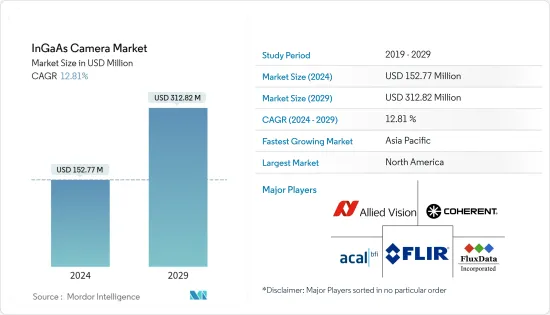

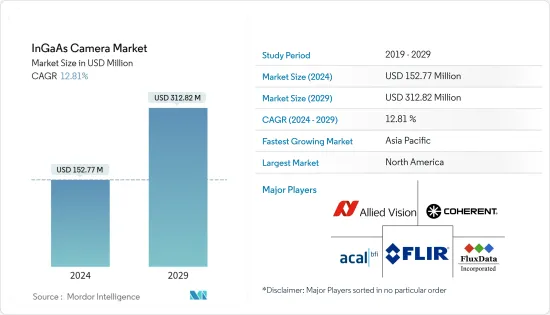

InGaAs相機市場規模預計到2024年為1.5277億美元,預計到2029年將達到3.1282億美元,在預測期內(2024-2029年)複合年成長率為12.81%。

擴大採用視覺引導機器人系統等自動化解決方案,擴大使用這些相機進行污染和缺陷檢測,是推動研究市場成長的關鍵因素之一。

主要亮點

- InGaAs是一種III-V族化合物半導體,在近紅外線(NIR)和短波紅外線(SWIR)區域具有高光敏感性。 InGaAs 相機在多種應用中利用了這一特性,包括即時線上無損檢測。機器視覺應用對線掃描 InGaAs 相機的需求不斷成長是 InGaAs 相機市場的關鍵促進因素。

- InGaAs是一種冷凍相機,應用於航太、軍事、通訊、工業偵測、光譜學等領域。它具有紅外線 (IR) 技術,可實現夜視和透過大氣霧霾的可見度,主要由軍隊和國防部隊使用。尺寸小、非製冷、輕量化設計、高品質夜視功能、附帶的隱蔽人眼安全雷射、目標識別和對夜光的敏感性等性能特徵使這些攝影機在國防部門中得到了許多應用。

- InGaAs 相機彌補了近紅外線波長 950-1,700 nm(矽檢測器不再工作)和 950-1,700 nm(矽檢測器不再敏感)之間的差距。由於其較低的能隙,InGaAs 在更全面的近紅外線區域提供靈敏度。與 Si-CCD 相比,由於能隙較低,暗電流(由熱量產生的訊號)也高得多。因此,科學 InGaAs FPA 相機需要強烈冷卻(至 -85°C)以減少不必要的雜訊源。

- 此外,InGaAs 已成為一種經濟實惠的替代品,可作為近紅外線(NIR) 工業應用(例如濕度測量、表面薄膜分佈以及聚合物和天然材料分離等分選操作)的檢測器材料。因此,技術在工業生產和自動化的應用不斷增加。

- 工業4.0加速了機器人等技術的發展,機器人在工業自動化中發揮重要作用,機器人可以管理工業中的許多核心業務。 InGaAs 相機的新應用包括視覺引導機器人和自動屠宰。這些視覺引導機器人由一個紅外線成像器和一個攝影機組成,紅外線成像儀可以從垃圾箱中找到並拾取隨機零件,相機可以分析每個零件的方向並將其放置在傳送帶上。

- 此外,機器視覺的使用也逐年增加。在某些地區,機器視覺銷售量創下歷史新高。據自動化推進協會稱,2022年上半年,用於自動化檢測和引導的機器視覺將在北美繼續出現正成長,預計全年市場將出現良好成長。因此,在預測期內,此類應用程式對 InGaAs 相機的需求預計將會增加。

- 然而,InGaAs相機的高成本是阻礙調查市場成長的主要因素之一。此外,各國日益嚴格的進出口法規也限制了研究市場的開拓。

- 在 COVID-19 爆發之初,半導體、自動化和安全等各個製造業對 InGaAs 相機的需求有所下降。然而,疫情提高了人們的認知並加速了自動化解決方案的採用。

InGaAs相機市場趨勢

工業自動化預計將佔據最大的市場佔有率

- 推動市場成長的關鍵因素之一是各種應用中對 InGaAs 相機的需求不斷增加。此外,InGaAs相機在工業自動化領域的使用不斷增加也是推動市場成長的因素之一。 InGaAs相機比其他類型的相機具有更高的性能,用於熱感成像、機器視覺和品管等工業自動化應用。

- 由於機器視覺系統的日益普及,預計工業自動化領域對 InGaAs 相機的需求將持續增加。在機器視覺環境中,相機系統用於掃描生產線上的產品。相機捕捉影像並將其與預先定義的標準進行比較。

- 此外,機器視覺擴大與機器人結合使用,以提高其效率和整體業務價值。這些機器人的手部位置安裝有攝影機,以引導機器人完成手邊的任務。例如,根據IFR的2023年報告,預計2022年全球商務用機器人庫存將達到約350萬台的歷史新高。同時,裝機價值預計為157億美元。

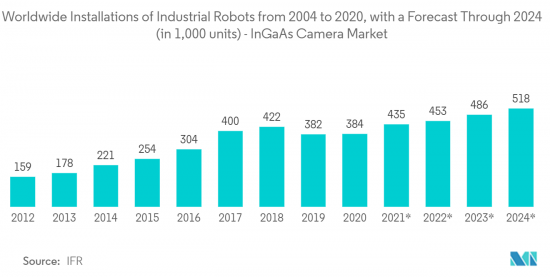

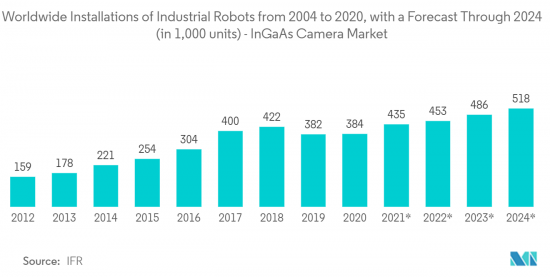

- 此外,由於工業機器人的採用預計在預測期內增加,因此受調查市場的工業領域需求預計將轉為正值。根據IFR預測,到2024年,工業機器人年安裝量預計將達到51.8萬台。

- 各個行業都在使用該技術來實現生產自動化並提高產品品質和速度。各行業對高品質檢測和自動化的需求不斷成長,將推動機器視覺需求,並最終推動 InGaAs 相機市場的發展。此外,InGaAs相機市場參與企業不斷增加的研發和新產品的推出也顯著推動了InGaAs相機市場的發展。

- 例如,2023 年 1 月,Lucid Vision Labs 宣布推出新型 1.3MP 和 0.3MP Triton SWIR IP67 工業視覺相機。 Triton SWIR 是一款 GigE PoE 相機,配備寬頻高靈敏度索尼 SenSWIR 1.3MP IMX990 和 0.3MP IMX991 InGaAs 感測器,能夠捕捉可見光和不可見頻譜中的影像,像素大小為 5m。

預計北美將佔據最大的市場佔有率

- 由於無人機和無人地面車輛等機器人在軍事和國防應用中的使用不斷增加,北美對 InGaAs 相機的需求預計將增加。此外,工業領域擴大普及自動化和先進技術也支持了該地區研究市場的成長。

- 由於先進製造合作夥伴計劃等旨在鼓勵企業、學術機構和聯邦政府投資尖端自動化技術的政府計劃,機器視覺系統的產量將會增加。預計這將為市場成長創造光明的前景。

- InGaAs相機廣泛應用於軍事和國防領域,可透視煙、霧、霾和水蒸氣等不利條件,導致美國等國家增加國防預算和先進設備的支出。例如,美國要求2023會計年度國防預算為8,133億美元。此類國防支出預計將推動市場需求。

- 此外,半導體產業在美國為中心的北美地區日益受到關注,其中矽晶圓圖案檢測等應用對 InGaAs 相機的需求不斷增加。美國《晶片法案》等有利的政府投資以及供應商對晶片產業的投資預計將在預測期內推動 InGaAs 相機需求。

- InGaAs 相機在光同調斷層掃瞄(OCT) 和光譜等醫學成像應用中提供高靈敏度和低雜訊。美國、加拿大等國家不斷投資醫療產業的發展,預計將為InGaAs相機在醫療影像應用中的使用增加創造成長機會。

- 由於該地區各最終用戶對先進有效成像系統的需求穩定成長,預計北美 InGaAs 相機市場在預測期內將出現良好的成長。此外,隨著機器人的普及以及政府在國防和軍事工業方面的支出,工業自動化的進步預計將在未來幾年推動市場發展。

InGaAs相機產業概況

InGaAs 相機市場競爭非常激烈,因為它由許多大公司和新參與企業組成。公司正努力創新現有產品,以滿足日益成長的消費者需求,加劇市場競爭。此外,不斷成長的需求正在吸引新參與企業並分割市場。主要參與企業包括 Allied Vision Technologies GmbH、Acal BFI Limited Company、Coherent Inc. 和 Flir Systems Inc.。

2022 年 12 月,JAI 將採用由多個 CMOS 感測器和一個基於砷化鎵 (InGaAs) 技術的感測器組成的四感測器線掃描技術,用於從短波長紅外線(SWIR)頻譜收集影像資料。我們宣布發布SW -4010Q-MCL,一款新型工業棱鏡基線掃描相機。

2022 年 11 月,Allied Vision 宣布推出四款配備 InGaAs 感光元件的 Goldeye SWIR 相機,可偵測高達 1.9μm 或 2.2μm 的波長,並具有高量子效率。整合雙級感測器冷卻和多種板載影像校正功能是以出色的影像品質可視化特定頻譜特徵的關鍵因素。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 技術簡介

- 未冷卻的

- 冷卻

- 市場促進因素

- 機器視覺應用的採用率提高

- 軍事和國防活動的需求不斷增加

- 市場挑戰

- InGaAS相機採購成本高

- 嚴格的進出口規定

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 按用途

- 軍事/國防

- 工業自動化

- 監控和安全

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 東南亞

- 其他亞太地區

- 其他

- 北美洲

第6章競爭形勢

- 公司簡介

- Allied Vision Technologies GmbH(TKH group)

- Acal BFI Limited Company(Discoverie Group PLC)

- Coherent Inc.

- Flir Systems Inc.

- FluxData Inc.

- Hamamatsu Photonics KK

- Lambda Photometrics Ltd.

- New Imaging Technologies

- Specim Spectral Imaging Ltd.

- Raptor Photonics Ltd.

- Sensors Unlimited(Collins Aerospace Company)

- Teledyne Dalsa Inc.(Teledyne Technologies Incorporated)

- Xenics Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The InGaAs Camera Market size is estimated at USD 152.77 million in 2024, and is expected to reach USD 312.82 million by 2029, growing at a CAGR of 12.81% during the forecast period (2024-2029).

The increasing adoption of automation solutions, such as vision-guided robotic systems, and the increasing use of these cameras for contamination and defect detection are among the significant factors driving the growth of the studied market.

Key Highlights

- InGaAs is an III-V compound semiconductor with high photosensitivity in the near-infrared (NIR) and short-wave infrared (SWIR). The InGaAs camera uses this feature in various applications, including real-time in-line non-destructive inspection. The rise in demand for line scan InGaAs cameras for machine vision applications is a crucial driver of the InGaAs camera market.

- InGaAs are cooling-based cameras used in aerospace, military, telecommunications, industrial inspection, and spectroscopy. It has infrared (IR) technology, which allows for night vision or visibility through atmospheric haze and is primarily used by military and defense forces. Because of their performance characteristics, such as small, uncooled, lightweight design, high-quality night vision, attached covert eye-safe lasers, target recognition, and sensitivity to nightglows, these cameras find many applications in defense.

- InGaAs cameras bridge the gap between NIR wavelengths 950-1700 nm, where silicon detectors no longer work, and 950 - 1700 nm, where silicon detectors are no longer sensitive. Because of its lower bandgap, InGaAs provide sensitivity over a more comprehensive NIR range. When compared to Si-CCDs, the lower bandgap is also responsible for a much higher dark current (thermally generated signal). As a result, scientific InGaAs FPA cameras require intense cooling (down to -85°C) to reduce some unwanted noise sources.

- Moreover, as a detector material, InGaAs provided an affordable alternative for near-infrared (NIR) industrial applications such as humidity measurement, surface film distributions, and sorting tasks such as separating polymers from natural materials. As a result, the use of technology in industrial manufacturing and automation is increasing.

- Industry 4.0 accelerated the development of technologies such as robots, which now play a critical role in industrial automation, with robots managing many core operations in industries. New applications for InGaAs cameras include vision-guided robotics and automated butchering. These vision-guided robots are made up of IR imagers that find and pick random parts from a bin, followed by a camera that analyzes the orientation of each part and places it on a conveyor belt.

- Furthermore, the use of machine vision is increasing year after year. Machine vision sales are at an all-time high in some regions. According to the Association for Advancing Automation, machine vision for automated inspection and guidance continued its positive growth trajectory in North America in the first half of 2022, with favorable market growth predicted throughout the year. This is expected to drive demand for InGaAs cameras in such applications during the forecast period.

- However, the higher cost of InGaAs cameras is one of the major factors impeding the growth of the studied market. Furthermore, a rise in stringent import and export regulations across various countries restrains the development of the studied market.

- During the initial COVID-19 outbreak, InGaAs cameras saw a drop in demand from various manufacturing industries, such as semiconductors, automation, and security, as the global lockdown significantly impacted the industrial sector. However, the pandemic increased awareness and drove the adoption of automation solutions, which was expected to have a long-term positive impact on the growth of the studied market.

InGaAs Camera Market Trends

Industrial Automation Expected to Occupy the Largest Market Share

- One of the key factors driving market growth is the increasing demand for InGaAs cameras in various applications. Another factor driving market growth is the increasing use of InGaAs cameras in the industrial automation sector. InGaAs cameras are used in industrial automation applications like thermal imaging, machine vision, and quality control because they outperform other types of cameras.

- The increasing adoption of machine vision systems is expected to drive demand for InGaAs cameras in the industrial automation segment. In a machine vision environment, a camera system is used to scan products on a production line. The camera captures the image and compares it to pre-defined criteria.

- Moreover, machine vision is increasingly being used in conjunction with robots to improve their effectiveness and overall value to the business. These robots have a camera mounted at the hand position that guides them through the task at hand. For example, according to IFR's 2023 report, the global stock of operational robots was to reach a new high of approximately 3.5 million units in 2022. In the meantime, the value of installations reached an estimated USD 15.7 billion.

- Furthermore, with the adoption of industrial robots expected to increase over the forecast period, the studied market is expected to see a positive increase in demand from the industrial segment. The annual installation of industrial robots is expected to reach 518 thousand units by 2024, according to IFR.

- Different industries use this technology to automate production and improve product quality and speed. The growing need for high-quality inspection and automation in various industries drives the demand for machine vision, eventually boosting the InGaAs camera market. Furthermore, increased R&D and the launch of new products by InGaAs camera market players are propelling the InGaAs camera market significantly.

- For instance, in January 2023, Lucid Vision Labs unveiled its brand-new 1.3MP and 0.3MP Triton SWIR IP67-rated industrial vision cameras. The Triton SWIR is a GigE PoE camera with wide-band and high-sensitivity Sony SenSWIR 1.3MP IMX990 and 0.3MP IMX991 InGaAs sensors capable of capturing images in visible and invisible light spectrums and a pixel size of 5m.

North America is Expected to Account for the Largest Market Share

- The rising use of robotics like UAVs and UGVs in military and defense applications is expected to increase demand for InGaAs cameras in North America. Moreover, higher penetration of automation and advanced technologies in the industrial domain favors the growth of the studied market in the region.

- The production of machine vision systems will be increased as a result of government programs like the Advanced Manufacturing Partnership, which aims to encourage businesses, academic institutions, and the federal government to invest in cutting-edge automation technologies. This will create a positive outlook for the market's growth.

- As InGaAs cameras are widely used in the military and defense sector to see through unfavorable conditions such as smoke, fog, haze, and water vapor, countries like the United States have increased their defense budgets and expenditure on advanced equipment. For example, a budget request for national defense of USD 813.3 billion in the United States has been made for the fiscal year 2023. Such defense spending is expected to drive market demand.

- Furthermore, the semiconductor industry, where demand for InGaAs cameras in applications such as silicon wafer pattern inspection is increasing, is gaining traction in the North American region, particularly in the United States. Favorable government investments, such as the US CHIPS Act, and vendor investments in the chip industry are thus expected to drive demand for InGaAs cameras during the forecast period.

- InGaAs cameras provide high sensitivity and low noise in medical imaging applications such as optical coherence tomography (OCT) and spectroscopy. Countries such as the United States, Canada, and others are constantly investing in advancing their medical industries, which is expected to drive growth opportunities in the increasing use of InGaAs cameras in medical imaging applications.

- The InGaAs camera market in North America is anticipated to experience favorable growth rates during the anticipated period due to the steadily increasing demand for advanced and effective imaging systems from various end-users operating in the area. Furthermore, advancements in industrial automation with the widespread adoption of robots and government spending in the defense and military industries are expected to drive the market in the coming years.

InGaAs Camera Industry Overview

The InGaAs camera market is competitive due to the market consisting of many large players as well as new players. Companies are trying to innovate their existing products to cater to increasing consumer demand, making the market competitive. Furthermore, the growing demand attracts new players, making the market fragmented. Some of the major players are Allied Vision Technologies GmbH, Acal BFI Limited Company, Coherent Inc., and Flir Systems Inc., among others.

In December 2022, JAI announced the launch of SW-4010Q-MCL, a new industrial prism-based line scan camera featuring 4-sensor line scan technology consisting of multiple CMOS sensors and a sensor based on indium gallium arsenide (InGaAs) technology to collect image data from the short wave infrared (SWIR) spectrum.

In November 2022, Allied Vision announced the launch of four new Goldeye SWIR camera models equipped with an extended range of InGaAs sensors, capable of detecting wavelengths up to 1.9 µm or 2.2 µm at high quantum efficiencies. The integrated dual-stage sensor cooling and several onboard image correction features are among the key factors to make specific spectral features visible with outstanding image quality.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview?

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.4.1 Uncooled

- 4.4.2 Cooled

- 4.5 Market Drivers

- 4.5.1 Increasing Adoption in Machine Vision Applications

- 4.5.2 Rising Demand in Military and Defense Operations

- 4.6 Market Challenges

- 4.6.1 High Procurement Cost of InGaAS Cameras

- 4.6.2 Stringent Regulation on Export and Import

- 4.7 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Military and Defense

- 5.1.2 Industrial Automation

- 5.1.3 Surveillance and Security

- 5.1.4 Other Applications

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 U.S.

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 South East Asia

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Allied Vision Technologies GmbH (TKH group)

- 6.1.2 Acal BFI Limited Company (Discoverie Group PLC)

- 6.1.3 Coherent Inc.

- 6.1.4 Flir Systems Inc.

- 6.1.5 FluxData Inc.

- 6.1.6 Hamamatsu Photonics KK

- 6.1.7 Lambda Photometrics Ltd.

- 6.1.8 New Imaging Technologies

- 6.1.9 Specim Spectral Imaging Ltd.

- 6.1.10 Raptor Photonics Ltd.

- 6.1.11 Sensors Unlimited (Collins Aerospace Company)

- 6.1.12 Teledyne Dalsa Inc. (Teledyne Technologies Incorporated)

- 6.1.13 Xenics Inc.