|

市場調查報告書

商品編碼

1404445

電腦輔助編碼 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Computer-assisted Coding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

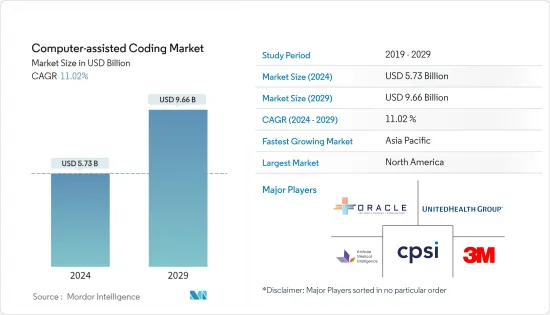

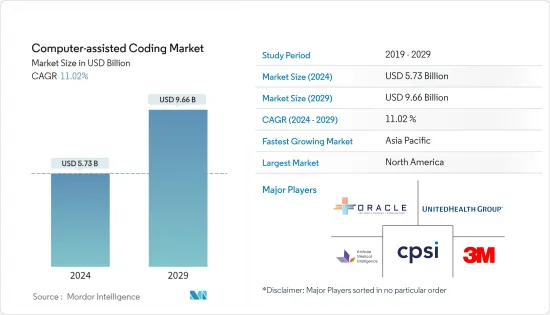

預計 2024 年電腦輔助編碼市場規模為 57.3 億美元,預計到 2029 年將達到 96.6 億美元,在預測期內(2024-2029 年)複合年成長率為 11.02%。

主要亮點

- COVID-19大流行對電腦輔助編碼 (CAC) 市場產生了重大影響。許多醫療機構已經實施了 CAC,使他們能夠在大流行期間更準確地翻譯患者資訊。

- 例如,2022 年 10 月在 PubMed 上發表的一項研究討論了疾病管制與預防中心 (CDC) 於 2021 年 10 月引入新的診斷代碼 (U09.9)。該代碼可在國際疾病分類第 10 版臨床修訂版 (ICD-10-CM) 中找到,旨在識別 COVID-19 後的病理。在後 COVID-19 情況下,由於醫院擴大採用編碼系統以及醫療保健系統中數位健康解決方案的普及不斷提高,預計市場將實現穩定成長。

- 推動市場成長的因素包括擴大採用電子健康記錄(EHR) 系統、擴大使用電腦輔助編碼 (CAC) 解決方案來控制急劇上升的醫療保健成本,以及不斷提高的患者資料管理監管要求。

- 例如,根據歐盟委員會 2022 年 6 月的報告,歐盟委員會發布了關於歐洲電子健康記錄交換標準的建議,該標準將實現醫療資料的跨境傳輸。這將透過支持歐盟 (EU) 國家的努力來實現,使居民能夠從歐盟任何地方安全地存取和交換其健康資料。因此,此類與醫療進步相關的舉措預計將在預測期內推動市場成長。

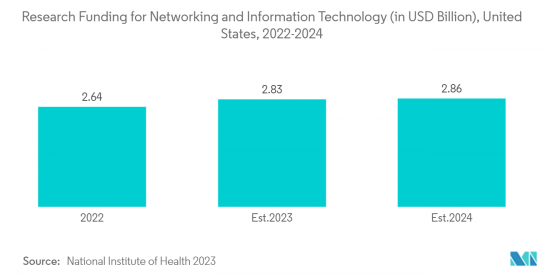

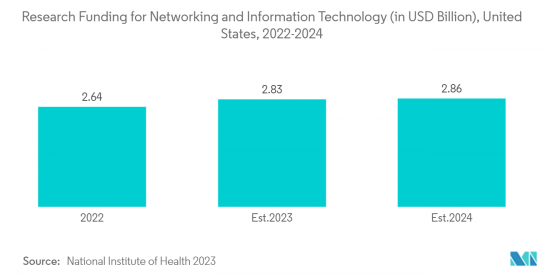

- 此外,不斷增加的軟體發布和醫療編碼的相關進步預計將在研究期間推動市場成長。例如,2022年10月,Nym為美國各地的放射科推出了放射編碼解決方案。此次擴張將公司的自主醫療編碼技術引入了第三個門診專科,擴大了對公司領先業界的收益週期管理 (RCM) 解決方案的訪問範圍。此外,增加編碼平台開發的研究經費預計將在預測期內推動市場成長。

- 例如,2022 年 11 月,主導的人工智慧醫療編碼自動化平台 Fathom。在 B 輪資金籌措中籌集了 4,600 萬美元,參與方包括他們利用資金來解決提供者面臨的挑戰並推進自動化醫療編碼的標準。因此,透過此類研究,開發和推廣編碼平台的資金預計將在預測期內增加市場成長。

- 因此,由於政府實施數位醫療保健的措施以及主要企業增加的策略活動,預計所研究的市場在預測期內將出現顯著的市場成長。然而,高昂的維護成本和缺乏熟練的系統支援專業人員正在限制市場的成長。

電腦輔助編碼市場趨勢

預計在預測期內,網路和雲端基礎的細分市場將佔據主要市場佔有率

- 基於 Web 的交付可以使用超文本傳輸協定 (HTTP)、傳輸控制協定 (TCP)、網際網路通訊協定 (IP) 或其他協定在不同的伺服器電腦上進行,並且可以透過網際網路、虛擬專用網路或無線方式進行交付。透過網路通訊的網路。基於網路的電腦輔助編碼系統完全透過網路瀏覽器訪問,不需要或在您的裝置上安裝任何軟體。所有資料和軟體均遠端託管並透過網路存取。這是基於網路的電腦輔助編碼系統的主要優點之一。

- 政府越來越多舉措實施電腦輔助編碼、技術進步和開拓的醫療保健組織等因素正在推動這一市場的發展。例如,2023年3月,富士通宣布了一個新的雲端基礎的平台,允許用戶安全地收集和利用健康相關資料,以推動醫療保健產業的數位轉型。作為 Fujitsu Uvance 建立永續發展世界的「健康生活」目標的一部分,富士通持續推動健康社會的發展。

- 同樣,2022 年 11 月,Google Cloud 宣布與 Hackensack Meridian Health、Lifepoint Health 等公司合作開發的三款新的健康資料引擎 (HDE) 加速器,以支持健康股權、患者流動、基於價值的幫助解決常見護理用例。

- 此外,各國政府正在採取措施支持醫療保健領域資訊科技的發展。例如,2021 年 2 月,作為英國主導採用完全連接、雲端驅動的醫療保健服務計劃的一部分,超過 200 萬個 NHSmail 郵箱被遷移到 Microsoft Azure 雲端的一部分 Exchange Online。這使得 NHS 組織和部門的工作人員之間的溝通更加順暢和高效,並改善了資訊的獲取。預計這將增加英國健康資訊科技 (HCIT) 變革管理服務的採用,從而推動該產業在研究期間的成長。

- 此外,該地區政府機構和市場參與企業的聯合舉措也促進了市場成長。例如,2021 年 9 月,德國電信的 T-Systems 與 Google Cloud 合作,為德國企業、醫療保健公司和公眾建置和提供主權雲端服務。兩家公司共同開發了下一代主權雲端解決方案和基礎設施。該公司計劃在奧地利和瑞士建立類似的主權雲。

- 因此,由於擴大採用基於雲端/網路的醫療軟體以及主要企業的策略活動增加,預計所研究的細分市場將在研究期間顯著成長。

預計北美在預測期內將出現強勁成長

- 由於醫院擴大採用數位醫療服務、主要企業增加策略活動以及北美醫療保健數位化投資的增加,預計北美電腦輔助編碼市場將顯著成長。

- 例如,Canada Health Infoway 於 2022 年 11 月進行的一項調查發現,94% 的加拿大人對訪問數位醫療服務感興趣。加拿大人還可以線上訪問個人健康資訊,包括測試和診斷結果、免疫史和記錄、當前用藥清單和歷史以及專家筆記和記錄。因此,由於人們採用數位醫療服務,所研究的市場預計在預測期內將顯著成長。

- 此外,北美地區主要企業電腦輔助編碼的興起預計將推動研究期間的市場成長。例如,2022年7月,醫療資訊科技服務供應商Greenway Health推出了Greenway醫療編碼服務,這是一種針對門診診所的最先進的醫療解決方案。 Greenway Medical Coding 透過個體化編碼團隊的知識和準確性,幫助診所實現成本效率、提高盈利並有效收集索賠。

- 同樣,2022 年 9 月,即時臨床文件、醫療編碼和中期收益週期交付虛擬解決方案提供商 AQuity Solutions 收購了位於佛羅裡達州坦帕的 Coding Services Group CSG 的所有資產。因此,主要企業的此類策略活動預計將增加對電腦輔助編碼的需求並刺激整個北美市場的成長。

- 因此,由於醫療保健環境中數位醫療服務的日益採用以及北美主要企業的策略活動的增加,預計市場在預測期內將呈現顯著成長。

電腦輔助編碼產業概述

電腦輔助編碼市場是一個適度分散且競爭激烈的市場。市場參與企業正專注於產品發布、合作夥伴關係和收購等策略活動,以增強其在全球的產品組合和影響力。市場參與企業包括Oracle、Computer Programs and Systems, Inc. (TruCode LLC)、United Health Group (Optum Inc.)、Artificial Medical Intelligence Inc. 和 3M。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 更多採用電子健康記錄(EHR) 系統

- 更多地使用電腦輔助編碼解決方案來遏制不斷上漲的醫療成本

- 病患資料管理的監管要求提高

- 市場抑制因素

- 安裝和維護成本高

- 缺乏現場支援和內部領域知識

- 波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-美元)

- 依產品

- 軟體

- 獨立軟體

- 整合軟體

- 按服務

- 軟體

- 按規定型態

- 雲端基礎

- 本地

- 按用途

- 自動編碼

- 管理報告和分析

- 臨床編碼審核

- 按最終用戶

- 醫院

- 臨床檢測/診斷中心

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- 海灣合作理事會國家

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章競爭形勢

- 公司簡介

- 3M

- UnitedHealth Group(Optum Inc.)

- Nuance Communications Inc.

- Oracle

- Computer Programs and Systems, Inc.(TruCode LLC)

- Artificial Medical Intelligence Inc.

- Athenahealth Inc.

- Streamline Health Solutions Inc.

- Epic Systems Corporation

- ZyDoc Corporation

- Alpha II LLC

- AGS Health

第7章 市場機會及未來趨勢

The Computer-assisted Coding Market size is estimated at USD 5.73 billion in 2024, and is expected to reach USD 9.66 billion by 2029, growing at a CAGR of 11.02% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic significantly impacted the computer-assisted coding (CAC) market since many healthcare organizations implemented CAC, which enabled the translation of patient information more accurately during the pandemic.

- For instance, a study published in October 2022 in PubMed discusses the introduction of a new diagnosis code (U09.9) by the Centers for Disease Control and Prevention (CDC) in October 2021. This code, found in the International Classification of Diseases, Tenth Revision, Clinical Modification (ICD-10-CM), is designed for identifying cases of post-COVID-19 conditions. In the context of the post-COVID-19 situation, the market is anticipated to experience steady growth due to the heightened adoption of coding systems in hospitals and the increased prevalence of digital health solutions in healthcare systems.

- Some factors driving the market growth include increasing implementation of electronic health record (EHR) systems, increasing utilization of computer-assisted coding (CAC) solutions to curtail the rising healthcare costs, and increasing regulatory requirements for patient data management.

- For instance, according to the European Commission's June 2022 report, the European Commission issued a recommendation on a European electronic health record exchange standard to enable the transfer of health data across borders. It accomplishes this by supporting European Union (EU) nations in their initiatives to ensure that residents can safely access and exchange their health data from any location within the EU. Hence, such initiatives associated with the advancements in healthcare are anticipated to boost market growth over the forecast period.

- Furthermore, an increase in software launches and related advancements in medical coding is expected to fuel the market growth over the study period. For instance, in October 2022, Nym launched radiology coding solutions for radiology departments across the United States. This expansion offers the company's autonomous medical coding technology to a third outpatient specialty area, expanding access to the company's industry-leading solution for revenue cycle management (RCM). Moreover, an increase in research funding for the development of coding platforms is expected to drive market growth over the forecast period.

- For instance, in November 2022, Fathom, an AI-powered medical coding automation platform, raised USD 46 million in Series B funding co-led by Alkeon Capital and Lightspeed Venture Partners with participation from Vituity's Inflect Health, Cedars-Sinai, ApolloMD, Jonathan Bush, and other healthcare executives. They utilized the funding to advance the standard in automated medical coding in response to the challenges faced by the providers. Hence, owing to such research, funding to develop and promote coding platforms is expected to augment the market growth over the forecast period.

- Thus, owing to the government initiatives to implement digital health care and the rise in strategic activities by the key players, the studied market is expected to witness significant market growth over the forecast period. However, the high maintenance cost and lack of skilled professionals for system support have restrained market growth.

Computer-assisted Coding Market Trends

Web and Cloud Based Segment is Expected to Hold Significant Market Share Over the Forecast Period.

- Web-based delivery is a network that runs on different server computers and communicates by Internet, virtual private network, and the wireless network, using hypertext transfer protocol (HTTP), transmission control protocol (TCP), and internet protocol (IP) or other protocols. A web-based computer-assisted coding system is entirely accessed through a web browser, and no software is installed or required on the device at all. All data and software are hosted remotely and accessed through the Internet. This is one of the main advantages of the web-based computer-assisted coding system.

- The factors, such as increasing initiatives taken by the government for the adoption of computer-assisted coding, coupled with advancements in technology and developments in healthcare organizations, drive the market segment. For instance, in March 2023, Fujitsu launched a new cloud-based platform that allows users to securely collect and leverage health-related data to promote digital transformation in the medical field. As part of its goal for "Healthy Living" under Fujitsu Uvance to build a sustainable world, Fujitsu continues to promote the development of a healthy society.

- Similarly, in November 2022, Google Cloud launched three new Healthcare Data Engine (HDE) accelerators, developed in collaboration with Hackensack Meridian Health, Lifepoint Health, and others, that help organizations address common use cases around health equity, patient flow, and value-based care.

- Furthermore, governments in various countries are taking initiatives to support the growth of information technology in healthcare. For instance, in February 2021, as part of the UK government's program to adopt a fully connected cloud-driven health service, more than two million NHSmail mailboxes were moved to Exchange Online, a part of Microsoft's Azure Cloud. This enabled smoother and more efficient communication between staff across NHS organizations and departments and provided improved access to information. This is likely to increase the usage of health information technology (HCIT) change management services in the United Kingdom and is expected to boost the growth of the segment over the study period.

- Additionally, the joint initiatives taken by government bodies and market players in the region are also driving the growth of the market. For instance, in September 2021, Deutsche Telekom's T-Systems partnered with Google Cloud to build and deliver sovereign cloud services to German enterprises, healthcare firms, and the public. The companies jointly developed a large spectrum of next-generation sovereign cloud solutions and infrastructure. The company planned to build a similar sovereign cloud for Austria and Switzerland.

- Thus, owing to the rise in the adoption of cloud/web-based healthcare software and the rise in strategic activities by the key players, the studied segment is expected to witness significant growth over the study period.

North America is Expected to Witness a Significant Growth Over the Forecast Period

- North America is expected to witness significant growth in the computer-assisted coding market owing to the increase in the adoption of digital healthcare services across the hospitals, the rise in strategic activities by the key players, and the increase in investment towards digitalization of healthcare in North America.

- For instance, in a survey conducted by Canada Health Infoway in November 2022, 94% of Canadians were interested in accessing digital health services. Canadians could also access their personal health information online, including lab tests and diagnostic results, immunization history/records, a list of current medications and medication history, and specialist consultation notes/records. Thus, owing to people's adoption of digital health services, the studied market is expected to witness significant growth over the forecast period.

- Furthermore, an increase in computer-assisted coding by the key players in the North American region is expected to bolster the market growth over the study period. For instance, in July 2022, Greenway Health, a health information technology services provider, launched Greenway Medical Coding services, its newest healthcare solution for ambulatory practices. Greenway Medical Coding offers practices to capture cost efficiencies, improve practice earning potential, and collect insurance payments efficiently with the knowledge and precision of a personalized coding team.

- Similarly, in September 2022, AQuity Solutions, a provider of virtual solutions for real-time clinical documentation, medical coding, and mid-revenue cycle offerings, acquired all the assets of Tampa, FL-based Coding Services Group CSG. Thus, owing to such strategic activities by the key players, the demand for computer-assisted coding will likely increase, fueling market growth across North America.

- Therefore, due to the rise in the adoption of digital health services in healthcare settings and the increase in strategic activities by the key players in North America, the market is anticipated to witness notable growth over the forecast period.

Computer-assisted Coding Industry Overview

The computer-assisted coding market is moderately fragmented and competitive in nature. Market players are focused on strategic activities such as product launches, collaborations, and acquisitions to advance their portfolio and presence across the globe. Some market players include Oracle, Computer Programs and Systems, Inc. (TruCode LLC), United Health Group (Optum Inc.), Artificial Medical Intelligence Inc., and 3M, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Implementation of Electronic Health Record (EHR) Systems

- 4.2.2 Rising Utilization of Computer Assisted Coding Solutions to Curtail the Rising Healthcare Costs

- 4.2.3 Increasing Regulatory Requirements for Patient Data Management

- 4.3 Market Restraints

- 4.3.1 High Implementation and Maintenance Costs

- 4.3.2 Lack of On-site Support and In-house Domain Knowledge

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product

- 5.1.1 Software

- 5.1.1.1 Standalone Software

- 5.1.1.2 Integrated Software

- 5.1.2 Services

- 5.1.1 Software

- 5.2 By Mode of Delivery

- 5.2.1 Web and Cloud Based

- 5.2.2 On-premise

- 5.3 By Application

- 5.3.1 Automated Computer-assisted Encoding

- 5.3.2 Management Reporting and Analytics

- 5.3.3 Clinical Coding Auditing

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Clinical Laboratories and Diagnostic Centers

- 5.4.3 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 UnitedHealth Group (Optum Inc.)

- 6.1.3 Nuance Communications Inc.

- 6.1.4 Oracle

- 6.1.5 Computer Programs and Systems, Inc. (TruCode LLC)

- 6.1.6 Artificial Medical Intelligence Inc.

- 6.1.7 Athenahealth Inc.

- 6.1.8 Streamline Health Solutions Inc.

- 6.1.9 Epic Systems Corporation

- 6.1.10 ZyDoc Corporation

- 6.1.11 Alpha II LLC

- 6.1.12 AGS Health