|

市場調查報告書

商品編碼

1404442

物流自動化:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Logistics Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

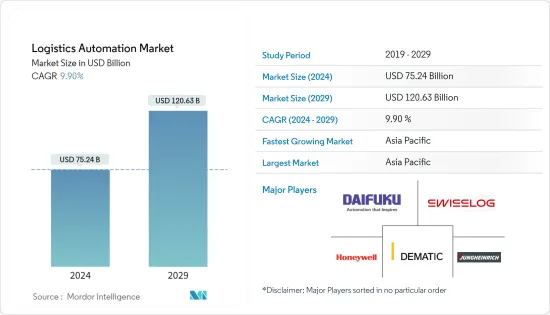

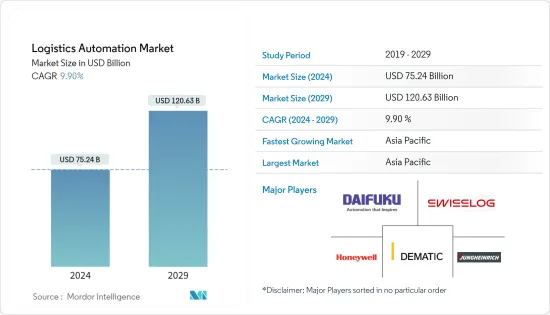

物流自動化市場規模預計到2024年為752.4億美元,預計到2029年將達到1,206.3億美元,在預測期內(2024-2029年)複合年成長率為9.90%。

使用機器、控制系統和軟體來提高工作效率稱為物流自動化。它通常適用於需要在倉庫或配送中心執行並且需要最少人工干預的流程。自動化物流的好處包括改善客戶服務、可擴展性和速度、組織控制以及減少錯誤。

主要亮點

- 電子商務行業的成長以及全球對高效倉儲和庫存管理的需求正在推動市場發展。例如,根據美國商務部和人口普查局的數據,2022年第二季美國零售電商銷售額為2,573億美元,較2022年第一季成長2.7%。此外,據 IBEF 稱,印度電子商務市場預計將從 2017 年的 385 億美元成長到 2026 年的 2,000 億美元。

- 倉庫自動化為企業在節省成本方面提供了更大的便利,並有助於最大限度地減少產品交付中的錯誤。著名 3PL 公司和物流自動化解決方案的重要最終用戶 Dalsey、Hillblom、Lynn 表示,儘管有這些好處,但大約 80% 的倉庫「仍然在不支援自動化的情況下手動操作。」它正在運作。

- 此外,工業物聯網 (IIoT) 的出現,以及用於執行各種任務(例如物料配料、揀選、訂購、包裝、倉庫安全、檢查等)的連接系統網路的出現,能夠顯著改善營運效率。

- 然而,高昂的初期成本和較長的投資回報時間限制了物流自動化解決方案的大規模採用。印度和中國等新興經濟體代表密集型經濟體。單一自動化系統的單一投資和額外的員工培訓會阻礙相同自動化系統的採用。

- COVID-19 促使倉庫業者考慮加快採用自動化和機器人技術的時間表。實施該解決方案的企業還透過減少員工互動和提高生產力來滿足日益成長的電子商務需求,展示了更安全的職場。

物流自動化市場趨勢

移動機器人(AGV 和 AMR)預計將顯著成長

- 物流機器人的主要應用是倉庫和儲存設施中的自動導引車 (AGV)。這些機器人在預先定義的途徑上工作,移動產品進行出貨或儲存。 AGV不僅在簡化供應鏈方面發揮重要作用,而且在降低物流成本方面也發揮重要作用。

- AGV 也用於入境庫處理的補貨和揀選。例如,AGV 將庫存從接收地點運送到儲存地點,或從長期儲存地點運送到遠期揀貨地點以補充庫存。將庫存從長期存放地點轉移到遠期揀貨地點可確保揀貨員能夠獲得足夠的庫存,並使揀貨流程更有效率。

- 研究市場中的供應商不斷創新,為包括物流的倉儲產業推出新的 AGV 和 AMR。例如,2021 年 4 月,JBT 推出了一款倉庫冷凍AGV,可在 -10oF 至 110oF 的不同溫度下運行,並提供 2,500 磅的提升能力。自動導引車 (AGV) 配備具有整合側移和傾斜功能的三級液壓桅杆。此外,它還提供從 357 英寸(或更小)到 422 英寸到貨叉頂部的各種提升高度。

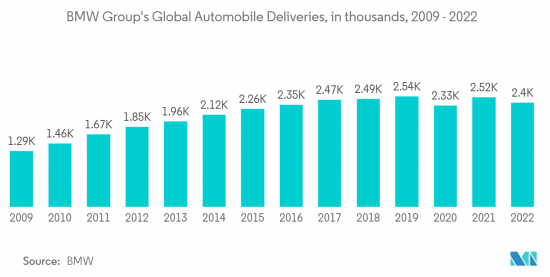

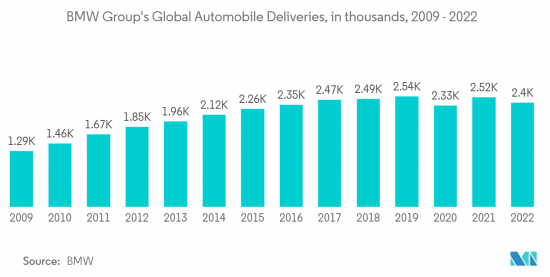

- 此外,汽車製造商正在增加產量和出貨,展示 AGV 和 AMR 的使用。例如,根據寶馬公司的數據,2022年,巴伐利亞汽車製造公司(BMW)向全球客戶出貨了超過250萬輛汽車,其中包括寶馬、MINI和勞斯萊斯品牌汽車。這是所有行業都面臨逆風的一年,包括供應瓶頸和中國的大流行封鎖。

- 2022 年 3 月,自主移動機器人 (AMR) 供應商 Locus Robotics 透過 Locus Vector 和 Locus Max 擴展了其倉庫 AMR 產品線。 Locus Vector是一款緊湊型AMR,可向各個方向移動並具有強大的運輸能力。 Locus Max 是一款 AMR,具有改進的重載能力和彈性,適用於物料搬運應用。 LocusBot 可以添加到現有工作流程以及新工作流程中,使您能夠擴展業務並回應不斷變化的市場需求。

亞太地區預計將創最大市場規模

- 由於該地區工業數量的不斷增加以及這些工業與自動化的融合以提高投資回報率,亞太地區的物流自動化市場正在迅速擴大。機器人的日益普及、電子商務的擴張以及新倉庫的建設預計將主導亞太物流自動化市場。

- 中國是世界上最大的經濟體之一,也是亞太地區倉儲機器人的主要供應商之一,特別是在汽車、製造和電子商務領域。結果,市場正在擴大。根據IFR最新統計年鑑《世界機器人》顯示,2021年中國製造業機器人密度達到每萬名工人322台機器人,位居全球第五。

- 在日本,新機器人策略旨在將日本打造成機器人創新的主要中心。日本政府已在 2022 年捐款超過 9.305 億美元(根據 IFR)。製造和服務行動計劃包括創建整合技術等舉措,這些技術有望成為自動駕駛、先進空中運輸以及下一代機器人和人工智慧的基礎。此外,據IFR稱,2020年至2025年為期五年的Moonshot研發計畫為機器人相關計劃提供了4.4億美元的預算。

- 印度強勁的電子商務產業也是市場成長的主要動力。根據IBEF預測,印度電商市場預計到2024年將達到1,110億美元,到2026年將達到2,000億美元。繼中國和美國之後,印度擁有第三大網購群體,到 2020 年將達到 1.4 億人。智慧型手機和網路使用的增加是產業成長的主要推動力。由於數位印度計劃,2021 年網路連線數量大幅增加,達到 8.3 億。多項政府政策加速了這一成長。印度政府允許 B2B 電子商務 100% FDI(外國直接投資)。此外,在市場模式下的電子商務自動路徑下允許100% FDI。

- 例如,電商巨頭亞馬遜已在印度市場投資50億美元,正在印度各地投資興建自動化倉庫。亞馬遜是印度最早在倉庫中試驗機器人技術的公司之一。該公司的 Kiva 機器人用於大型倉庫的揀選和包裝任務。此外,2022 年 6 月,亞馬遜宣布推出首款自主移動機器人,旨在減輕倉庫工人的負擔。這款名為 Porteus 的自主機器人使用亞馬遜開發的先進安全、感知和導航技術來導航亞馬遜設施。此外,印度對快速消費品產業的投資不斷增加,增加了對物流自動化市場的需求。

物流自動化行業概況

物流自動化市場分散。該市場由Honeywell、瑞仕格、大福和謝弗等歷史悠久的參與企業組成。這些參與企業在產品和製造工廠上投入了大量資金。新的市場參與企業也需要適度的投資,但只有透過強力的競爭策略才能生存。

2023 年 3 月,德馬泰克為凱傲的新物流設施提供了最新的自動化技術。凱傲集團可能會利用該設施在整個歐洲出貨更換零件。其目的是提高向客戶交付的效率。德馬泰克計劃部署一支高度動態的 Dematic Multi-Shuttle 車隊,擁有 110,000 個儲存位置和 150 輛用於自動儲存和搜尋的接駁車。

2023年3月,瑞仕格發表了CarryPickmobile機器人產品儲存與搜尋系統。新的 CarryPickmobile 機器人平台現在工作速度更快。這款移動機器人還具有創新的升降轉盤,使其可以旋轉貨架或在旋轉時保持貨架靜止,提供更快、適應性更強的貨到人解決方案,實現高品質的儲存和選擇過程。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 電子商務行業的快速成長和客戶期望

- 增加製造複雜性和技術可用性

- 提高效率和職業安全

- 市場挑戰

- 高資金投入

第6章市場區隔

- 物流自動化市場

- 按成分

- 硬體

- 移動機器人(AGV、AMR)

- 自動搜尋系統(AS/RS)

- 自動分類系統

- 卸垛/碼垛系統

- 輸送機系統

- 自動識別和資料收集(AIDC)

- 揀貨

- 軟體

- 服務

- 按最終用戶產業

- 食品和飲料

- 小包裹

- 雜貨

- 通用產品

- 服飾

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

- 按成分

- 全球交通自動化市場情景

- 其他全球運輸自動化市場場景

第7章競爭形勢

- 公司簡介

- Dematic Corp.(Kion Group AG)

- Daifuku Co. Limited

- Swisslog Holding AG(KUKA AG)

- Honeywell International Inc.

- Jungheinrich AG

- Murata Machinery Ltd

- Knapp AG

- TGW Logistics Group GmbH

- Kardex Group

- Mecalux SA

- Beumer Group GmbH & Co. KG

- SSI Schaefer AG

- Vanderlande Industries BV

- WITRON Logistik

- Oracle Corporation

- One Network Enterprises Inc.

- SAP SE

- 供應商市場佔有率分析

第8章投資分析

第9章市場機會與未來成長

The Logistics Automation Market size is estimated at USD 75.24 billion in 2024, and is expected to reach USD 120.63 billion by 2029, growing at a CAGR of 9.90% during the forecast period (2024-2029).

The use of machinery, control systems, and software to enhance the efficiency of operations is called automation in logistics. It usually applies to the processes that need to be performed in a warehouse or distribution center, requiring minimal human intervention. Some benefits of automation logistics comprise improved customer service, scalability and speed, organizational control, and reduction of errors.

Key Highlights

- The growth in the e-commerce industry, along with the need for efficient warehousing as well as inventory management across the world, are driving the market. For instance, the retail e-commerce sales in the United States for the second quarter of 2022 was USD 257.3 billion, up 2.7% from the first quarter of 2022, as per the Census Bureau of the Department of Commerce. Also, as per IBEF, the Indian e-commerce market was expected to grow from USD 38.5 billion in 2017 to USD 200 billion by 2026.

- Automation for warehouses provides superior convenience regarding cost-cutting for businesses and helps minimize errors in product deliveries. As per Dalsey, Hillblom, and Lynn, a prominent 3PL company and a significant end-user of warehouse automation solutions, about 80% of warehouses "still operate manually with no supporting automation" despite the advantages.

- Also, the emergence of the Industrial Internet of Things (IIoT) along with the advent of a network of connected systems have enabled industries to perform different tasks, like material batching, picking, ordering, packaging, warehouse security, and inspection, and have helped improve the operational efficiency by huge margins.

- However, with upfront costs being high, the long duration to achieve ROI has been limiting the mass adoption of logistic automation solutions. Developing economies like India and China have been representative of labor-intensive formats. Single investments for a single automation system with additional staff training have been restraining the adoption of the same.

- COVID-19 led warehouse operators to consider accelerating their timelines for adopting automation and robotics. Those who deployed the solutions also demonstrated safer workplaces through the reduction of interactions among workers and enhancing productivity to meet increasing demands for e-commerce.

Logistics Automation Market Trends

Mobile Robots (AGV and AMR) are Expected to Witness Significant Growth

- The main usage of logistics robots is in the form of automated guided vehicles (AGVs) in warehouses and storage facilities for transporting goods. These robots operate in predefined pathways by moving products for shipping and storage. AGVs play a vital role in reducing the cost of logistics as well as streamlining the supply chain.

- AGVs are also used for replenishment and picking for inbound and outbound handling. For example, AGVs transport inventory from receiving to storage locations or long-term storage locations to forward-picking locations to replenish stock. Moving inventory from long-term storage to forward-picking locations ensures adequate inventory is accessible to pickers, making the order-picking process more efficient.

- The vendors in the studied market are constantly innovating and launching new AGVs and AMRs for the warehouse segment of operations, including logistics. For instance, in April 2021, JBT unveiled its warehouse freezer AGV, which may operate at various temperatures, from -10 oF to 110 oF, offering operations a lift capacity of 2,500 pounds. The automatic guided vehicle (AGV) features a triple-stage hydraulic mast with an integrated side shift and tilt. In addition, it provides a variety of lift heights, from 357 inches (or less) to the top of its forks to 422 inches.

- Further, the automakers are increasing their production and shipment units, indicating the usage of AGVs and AMRs. For instance, according to BMW, in 2022, the Bayerische Motoren Werke AG (BMW) shipped over 2.5 million autos worldwide, including brands BMW, MINI, and Rolls-Royce vehicles, to customers, a year in which all industries faced headwinds from supply bottlenecks, China's pandemic lockdowns, and others.

- In March 2022, autonomous mobile robot (AMR) provider Locus Robotics extended its line of warehouse AMRs with the Locus Vector and Locus Max. Locus Vector is a compact AMR with omnidirectional mobility and robust payload capacity. The Locus Max AMR has a heavyweight load capacity and improved flexibility for material handling applications. The LocusBots can be added to existing as well as new workflows, enabling operations to scale and adapt to changing market demands.

Asia-Pacific is Expected to Register the Largest Market

- The Asia-Pacific warehouse automation market is rapidly expanding due to the region's growing number of industries and their integration with automation to increase ROI. With the increasing adoption of robots, the expansion of e-commerce, and the construction of new warehouses, the Asia-Pacific warehouse automation market is expected to dominate.

- China, one of the largest economies in the world, is one of the significant suppliers of warehouse robots in the Asia-Pacific region, particularly in the automotive, manufacturing, and e-commerce sectors. The market is growing as a result of this. China achieved a robot density of 322 units per 10,000 workers in the manufacturing industry, as per the most recent statistical yearbook, "World Robotics," by IFR, and the nation was ranked 5th globally in 2021.

- In Japan, the "New Robot Strategy" aims to establish the country as the leading hub for robotic innovation. The Japanese government already contributed more than USD 930.5 million in 2022 (according to IFR). The manufacturing and service action plan includes initiatives like autonomous driving, advanced air mobility, and the creation of integrated technologies that are anticipated to form the basis of the next generation of robots and artificial intelligence. Additionally, according to IFR, a budget of USD 440 million was given to robotics-related projects in the "Moonshot Research and Development Program" for five years from 2020 to 2025.

- The robust e-commerce sector in India is also significantly boosting the market's growth. According to IBEF, India's e-commerce market is expected to reach USD 111 billion by 2024 and USD 200 billion by 2026. After China and the United States, India had the third-largest online shopper base of 140 million in 2020. An increase in smartphone and internet usage is a major factor in the industry's growth. The Digital India program significantly increased the number of internet connections in 2021, reaching 830 million. Several government policies helped accelerate this growth. The Indian Government allowed 100% FDI (foreign direct investment) in B2B e-commerce. Moreover, 100% FDI is permitted under the automatic route in the marketplace model of e-commerce.

- For instance, e-commerce giant Amazon, which invested USD 5 billion in the Indian market, is investing in automated warehouses across India. Amazon is among the first few companies in India that have experimented with and adopted robotics in their warehouses. Its Kiva robot engages in the picking and packing process at large warehouses. Further, in June 2022, Amazon announced its first autonomous mobile robot aimed at reducing warehouse workers' workload. The autonomous robot named Porteus moves through the Amazon facilities using advanced safety, perception, and navigation technology developed by Amazon. Furthermore, with the growing investment in the FMCG sector in India, the demand for the warehouse automation market is increasing.

Logistics Automation Industry Overview

The logistics automation market is fragmented. The market comprises long-standing established players, including Honeywell, Swisslog, Daifuku, and Schaefer. These players have made significant investments in products and manufacturing plants. Although the new market players require moderate investments, they can sustain themselves only through strong competitive strategies.

In March 2023, Dematic provided the most recent automation technologies for KION's new logistics facility. The KION Group will likely utilize the facility to ship replacement components around Europe. The aim is to make customer deliveries more effective. Dematic plans to deploy a highly dynamic Dematic Multishuttle with 110,000 storage places and 150 shuttles for automatic storage and retrieval.

In March 2023, Swisslog's CarryPickmobile robotic goods-to-person storage and retrieval system was released. The new, updated CarryPickmobile robotic platform offers a much faster working speed. The mobile robots also employ a revolutionary lifting turntable that allows them to turn a rack or hold the rack stationary as it turns, enabling quicker and more adaptable storage and selection processes for goods-to-person solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Growth of the E-commerce Industry and Customer Expectation

- 5.1.2 Increasing Manufacturing Complexity and Technology Availability

- 5.1.3 Improved Efficiency and Workforce Safety

- 5.2 Market Challenges

- 5.2.1 High Capital Investment

6 MARKET SEGMENTATION

- 6.1 Warehouse Automation Market

- 6.1.1 By Component

- 6.1.1.1 Hardware

- 6.1.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.1.3 Automated Sorting Systems

- 6.1.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.1.5 Conveyor Systems

- 6.1.1.1.6 Automatic Identification and Data Collection (AIDC)

- 6.1.1.1.7 Order Picking

- 6.1.1.2 Software

- 6.1.1.3 Services

- 6.1.2 By End-user Industry

- 6.1.2.1 Food and Beverage

- 6.1.2.2 Post and Parcel

- 6.1.2.3 Groceries

- 6.1.2.4 General Merchandise

- 6.1.2.5 Apparel

- 6.1.2.6 Manufacturing

- 6.1.2.7 Other End-user Industries

- 6.1.3 By Geography

- 6.1.3.1 North America

- 6.1.3.2 Europe

- 6.1.3.3 Asia-Pacific

- 6.1.3.4 Latin America

- 6.1.3.5 Middle East and Africa

- 6.1.1 By Component

- 6.2 Global Transportation Automation Market Scenario

- 6.3 Other Global Transportation Automation Market Scenarios

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dematic Corp. (Kion Group AG)

- 7.1.2 Daifuku Co. Limited

- 7.1.3 Swisslog Holding AG (KUKA AG)

- 7.1.4 Honeywell International Inc.

- 7.1.5 Jungheinrich AG

- 7.1.6 Murata Machinery Ltd

- 7.1.7 Knapp AG

- 7.1.8 TGW Logistics Group GmbH

- 7.1.9 Kardex Group

- 7.1.10 Mecalux SA

- 7.1.11 Beumer Group GmbH & Co. KG

- 7.1.12 SSI Schaefer AG

- 7.1.13 Vanderlande Industries BV

- 7.1.14 WITRON Logistik

- 7.1.15 Oracle Corporation

- 7.1.16 One Network Enterprises Inc.

- 7.1.17 SAP SE

- 7.2 Vendor Market Share Analysis