|

市場調查報告書

商品編碼

1404440

醫療保健供應鏈管理 -市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Healthcare Supply Chain Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

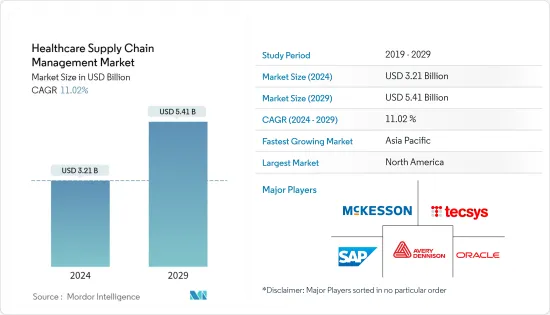

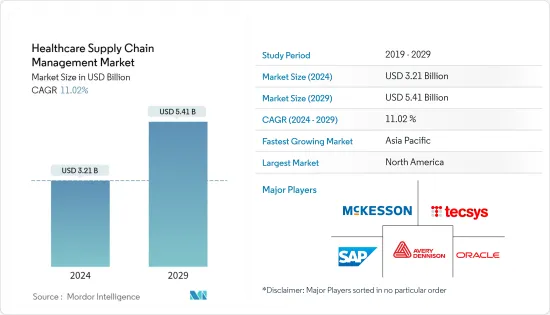

醫療保健供應鏈管理市場規模預計到 2024 年將達到 32.1 億美元,到 2029 年將達到 54.1 億美元,在預測期內(2024-2029 年)複合年成長率為 11.02%。

COVID-19 對醫療保健供應鏈管理產生了重大影響,因為世界上多個國家報告在大流行早期階段藥品和手術器械的原料藥短缺。然而,COVID-19 大流行產生了對藥品無縫追蹤和追溯的需求,從而促進了大流行後期的市場成長。

例如,根據 2022 年 3 月發表在愛思唯爾公共衛生緊急事件集上的報導,COVID-19 大流行以前所未有的速度和規模影響了全球供應鏈。報導稱,疫情過後,供需缺口進一步擴大。目前,多家公司正在醫療保健領域開發創新的供應鏈管理解決方案,用於追蹤藥品,因此,調查市場預計在預測期內將成長。

推動市場成長的關鍵因素是醫療保健提供者加強降低成本和提高供應鏈質量,以及對高品質庫存管理系統的需求不斷成長。

各種醫療保健供應鏈管理軟體應用程式提供的優勢導致需求不斷成長,預計將推動市場成長。例如,根據 2022 年 11 月《沙烏地阿拉伯製藥雜誌》發表的報導,庫存和供應鏈管理主要專注於提高生產力、降低成本和管理所需的供應品,以便提供更好的患者照護。我們專注於接收和分配準時。

有效的供應鏈管理依賴於組織和追蹤庫存、採購、訂購和付款工作流程。最近,供應鏈管理在醫療保健機構中的使用增加。醫療保健組織計劃、購買、管理、處理、追蹤和運輸庫存,例如藥品、醫療保健設備和用品。因此,庫存管理至關重要,預計將在預測期內推動供應鏈管理市場的成長。

此外,市場參與企業之間擴大推出和結盟,以擴大醫療保健供應鏈管理解決方案,預計這將在預測期內推動市場成長。例如,2022 年 2 月,艾利丹尼森 Smartrac 推出了適用於製藥應用的 AD Minidose U9 RAIN RFID嵌體,為醫療保健、製藥和實驗室資產管理釋放了龐大的 RFID 價值。同樣在 2021 年 8 月,法國 Tageos 推出了適用於醫療保健和製藥應用的 EOS~202 U9 RAIN RFID嵌體。

此外,據報道,最近各政府機構擴大採用供應鏈管理解決方案,預計這也將在預測期內對市場成長做出重大貢獻。例如,2022年1月,阿拉伯聯合大公國衛生署推出了一款配備AR的藥物包,帶有2D碼,可以無紙化地獲取藥物相關資訊。患者只需掃描藥盒上的2D碼即可讀取藥品資訊。

因此,由於庫存管理解決方案的優勢、市場參與企業不斷推出產品以及政府組織擴大採用供應鏈管理,預計所研究的市場將在分析期間呈現成長。然而,由於供應鏈管理軟體的實施成本較高,預計市場成長將受到限制。

醫療保健供應鏈管理市場趨勢

預計雲端基礎的細分市場將在預測期內實現強勁成長

雲端基礎的供應鏈解決方案提供網路、儲存和容量,以彈性的基於使用的模型運行,允許快速更新和適應。擴大規模(或縮小規模)、適應新的市場環境、與新的合作夥伴建立聯繫以及添加新的供應商都是潛在的用途。

由於活性化和雲端基礎的解決方案的進步,預計該行業將在預測期內成長。例如,根據國家生物技術資訊中心2022年8月發表的報導,在香港和美國進行的研究表明,雲端基礎的區塊鏈的技術永續性可以提高醫療保健供應鏈的效率。它可以與人工智慧(AI)結合進行管理。因此,此類研究將推動雲端基礎的醫療保健供應鏈管理業務的發展。

此外,各種醫療保健組織擴大採用雲端基礎的供應鏈解決方案,預計也將在預測期內推動該細分市場的成長。例如,2022年10月,總部位於印第安納州的衛理公會醫院與雲端解決方案公司Infor合作開發了一款雲端基礎的醫療保健應用程式,該應用程式可以標準化財務、人力資源、供應鏈和營運等各領域的關鍵流程。 。預計此類合作夥伴關係將在預測期內擴大雲端基礎的解決方案市場。

此外,先進的雲端基礎的供應鏈管理軟體的推出預計將推動市場成長。例如,2022 年 5 月,Jump Technologies 與電子健康記錄(EMR)、企業資源規劃 (ERP) 或調度系統整合,記錄醫院使用的產品的批號、序號和有效期。推出了雲端基礎的名為JumpStock 的軟體解決方案可增強移動掃描解決方案以提高合規性,從而使醫院能夠節省物資囤積、醫生偏好差異和缺貨成本Ta。

因此,由於雲端基礎的供應鏈管理的高採用率以及市場參與企業的推出和合作夥伴關係的增加,預計該行業將在預測期內擴大。

預計北美將在預測期內佔據主要市場佔有率

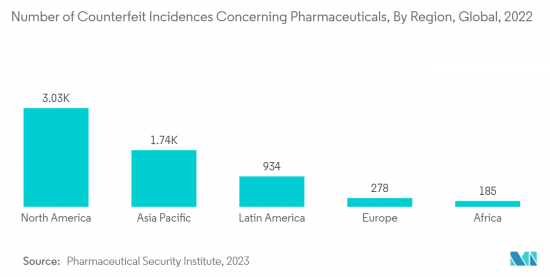

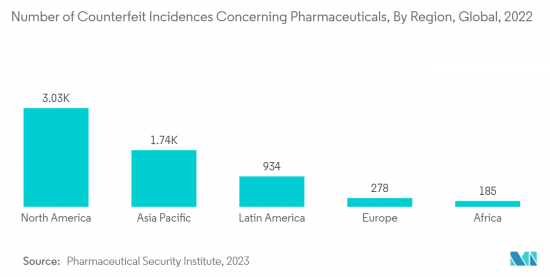

北美面臨不合格藥品和假藥、嚴格的法律規範、藥品和醫療保健器械的 GS1 和唯一器械標識 (UDI) 的引入,再加上大型製造地。預計將佔主要因素預測期內的市佔率。例如,2022年7月,美國食品藥物管理局(FDA)發布了獨特設備識別系統的最終指南,以正確識別在美國銷售的醫療設備的製造、分銷和患者使用等方面的指導方針和政策。因此,此類國家政府指南和建議的可用性預計將在預測期內推動該地區對供應鏈管理的需求。

此外,市場參與企業擴大採用各種業務策略,例如在該地區建立聯盟、合作夥伴關係和產品發布,也有助於市場擴張。例如,2022年10月,總部位於魁北克的供應鏈管理軟體公司Tecsys Inc.宣布推出其端到端Elite醫療保健供應鏈執行平台的新功能「Elite Healthcare Receiving」。這項新功能是醫院住院應用程式,它將住院和交付流程無縫整合到醫療保健系統的供應鏈業務中。因此,增加簡化醫療機構供應鏈業務的新功能預計將在預測期內促進市場成長。

醫療保健供應鏈管理產業概覽

醫療保健供應鏈管理市場是一個快速成長的市場,本質上競爭適度。目前的市場佔有率主要由少數專門提供醫療保健領域服務解決方案的醫療科技公司主導。主要市場參與企業包括 SAP AG Group、Oracle Corporation、McKesson Corporation、Avery Dennison Corporation、Tecsys Inc.、Ochsner Health System 和 Providence Health & Services。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 醫療保健提供者加大力度降低成本並提高供應鏈質量

- 對高品質庫存管理系統的需求不斷成長

- 市場抑制因素

- 引進供應鏈管理軟體成本高

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(以金額為準的市場規模 - 百萬美元)

- 按成分

- 軟體應用

- 供應商管理軟體

- 庫存管理軟體

- 其他軟體應用程式

- 硬體

- 掃碼機

- RFID

- 其他硬體

- 軟體應用

- 按交貨方式

- 本地

- 雲端基礎

- 按最終用戶

- 醫療服務提供方

- 保健品製造商

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東/非洲

- 海灣合作理事會國家

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章競爭形勢

- 公司簡介

- Advocate Healthcare

- Ascension Health

- Avery Dennison Corporation

- Tecsys Inc.

- Mckesson Corporation

- Oracle Corporatipon

- Providence Health & Services

- SAP AG Group

- Spectrum Health

- Ochsner Health System

- Aspen Technology Inc

- Infor

第7章 市場機會及未來趨勢

The Healthcare Supply Chain Management Market size is estimated at USD 3.21 billion in 2024, and is expected to reach USD 5.41 billion by 2029, growing at a CAGR of 11.02% during the forecast period (2024-2029).

COVID-19 significantly impacted healthcare supply chain management as several countries worldwide reported that active pharmaceutical ingredients were in short supply of drugs and surgical equipment during the early phase of the pandemic. However, the COVID-19 pandemic created a need for the seamless tracking and tracing of pharmaceutical items, which boosted the market growth in the later phase of the pandemic.

For instance, according to an article published in Elsevier Public Health Emergency Collection in March 2022, the COVID-19 pandemic has impacted global supply chains at an unprecedented speed and scale. As per the article, gaps between supply and demand increased post-pandemic. Various companies are currently developing innovative supply chain management solutions in the healthcare segment for tracking pharmaceuticals, due to which the studied market is expected to grow during the forecast period.

The major factors driving the market growth are increasing efforts of healthcare providers to reduce cost and improve the quality of the supply chain and rising demand for the quality inventory management system.

The advantages offered by various healthcare supply chain management software applications are leading to their rising demand, which is expected to boost market growth. For instance, according to an article published in Saudi Pharmaceutical Journal in November 2022, in order to deliver better patient care, inventory and supply chain management primarily focuses on increasing productivity, reducing costs, and receiving and distributing the required supplies on time.

Workflow organization and tracking of inventory, purchases, orders, and payments depend on effective supply chain management. The use of supply chain management in healthcare settings has increased recently. Healthcare institutions are responsible for planning, purchasing, managing, handling, tracking, and transporting stock such as medications, medical equipment, and supplies. Therefore, inventory management is crucial and is expected to propel the supply chain management market growth during the forecast period.

Furthermore, the rising launches and partnerships among the market players to expand the healthcare supply chain management solutions are expected to propel the market growth during the forecast period. For instance, in February 2022, Avery Dennison Smartrac launched its AD Minidose U9 RAIN RFID inlay for pharmaceutical applications, unlocking critical RFID value for healthcare, pharmacies, and laboratory asset management. Also, in August 2021, Tageos, a French-headquartered company, launched its EOS-202 U9 RAIN RFID inlay for healthcare and pharmaceutical applications.

Additionally, the growing adoption of supply chain management solutions by various government bodies has been reported in recent times, which is also expected to significantly contribute to the market growth during the forecast period. For instance, in January 2022, the United Arab Emirates' Ministry of Health launched AR-powered drug packs with a QR code for paperless access to drug-related information. It will help patients to read drug information by simply scanning a QR code on the medicine box.

Therefore, owing to the advantages of inventory management solutions, rising launches by market players, and increasing adoption of supply chain management by government organizations, the studied market is anticipated to witness growth over the analysis period. However, the high cost of implementation of supply chain management software is expected to restrain market growth.

Healthcare Supply Chain Management Market Trends

Cloud based Segment is Expected to Register a Significant Growth Over the Forecast Period

The network, storage, and capacity provided by cloud-based supply chain solutions operate on a flexible, usage-based model that allows for faster updates and adaptations. Scaling up (or down), adapting to new market conditions, connecting with new partners, and adding new suppliers are all potential uses.

The segment is expected to grow during the forecast period owing to the rising research studies and advancements in cloud-based solutions. For instance, according to an article published in August 2022 by the National Center of Biotechnology Information, a study conducted in Hong Kong and the United States mentioned that the technical sustainability of cloud-based blockchain could be combined with artificial intelligence (AI) for efficient healthcare supply chain management. Therefore, such research studies boost the developments in cloud-based healthcare supply chain management operations.

Additionally, the rising adoption of cloud-based supply chain solutions by various healthcare organizations is also expected to boost segment growth during the forecast period. For instance, in October 2022, Indiana-based Methodist Hospitals partnered with cloud solutions company Infor to create a cloud-based healthcare application that will allow the health system to standardize key processes in various areas, such as finance, human resources, supply chain, and operations. Such partnerships are expected to expand the cloud-based solution market during the forecast period.

Furthermore, the launch of advanced cloud-based supply chain management software is expected to propel market growth. For instance, in May 2022, Jump Technologies launched a cloud-based software solution called JumpStock that integrates with the electronic medical record (EMR), enterprise resource planning (ERP), or scheduling systems and enhances its mobile scanning solution to improve compliance for recording lot and serial numbers, as well as expiration dates of product used in hospitals, allowing hospitals to save money on supply hoarding, physician preference variances, and stock-outs.

Therefore, owing to the high adoption of cloud-based supply chain management and rising launches and partnerships by market players, the segment is expected to propel during the forecast period.

North America is Expected to Hold a Significant Market Share Over The Forecast Period

North America is anticipated to hold the major share of the market over the forecast period owing to the increasing risks from substandard and falsified drugs and stringent regulatory frameworks, and mandatory implementation of GS1 and Unique Device Identification (UDI) on pharmaceutical drugs and medical devices, coupled with the presence of large manufacturing hubs. For instance, in July 2022, the Food and Drug Administration (FDA) published the final guidelines and policies regarding the unique device identification system to adequately identify medical devices sold in the United States from manufacturing through distribution to patient use. Therefore, the availability of such national government guidelines and recommendations is expected to propel the demand for supply chain management in the region during the forecast period.

Furthermore, the increasing adoption of various business strategies by the market players, such as collaborations, partnerships, and product launches in the region, is also contributing to the market expansion. For instance, in October 2022, Tecsys Inc., a Quebec-based supply chain management software company, launched a new feature, Elite Healthcare Receiving, in its end-to-end Elite Healthcare supply chain execution platform. The new feature is a hospital receiving application that seamlessly integrates receiving and delivery processes into a health system's supply chain operations. Therefore, the addition of new features to simplify the supply chain operations in healthcare organizations is projected to augment the market growth over the forecast period.

Healthcare Supply Chain Management Industry Overview

The healthcare supply chain management market is a fast-growing market and moderately competitive in nature. The current market share is majorly controlled by a few medical technology companies that have expertise in providing service solutions in the healthcare domain. Some of the key market players are SAP AG Group, Oracle Corporation, McKesson Corporation, Avery Dennison Corporation, Tecsys Inc., Ochsner Health System, and Providence Health & Services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Efforts of Healthcare Providers to Reduce Cost and Improve the Quality of Supply Chain

- 4.2.2 Rising Demand of the Quality Inventory Management System

- 4.3 Market Restraints

- 4.3.1 High Cost of Implementation of Supply Chain Management Software

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Component

- 5.1.1 Software Application

- 5.1.1.1 Supplier Management Software

- 5.1.1.2 Inventory Management Software

- 5.1.1.3 Other Software Applications

- 5.1.2 Hardware Type

- 5.1.2.1 Barcode Scanners

- 5.1.2.2 RFID

- 5.1.2.3 Other Hardware Types

- 5.1.1 Software Application

- 5.2 By Delivery Mode

- 5.2.1 On-premise

- 5.2.2 Cloud based

- 5.3 By End User

- 5.3.1 Healthcare Providers

- 5.3.2 Healthcare Manufacturers

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Advocate Healthcare

- 6.1.2 Ascension Health

- 6.1.3 Avery Dennison Corporation

- 6.1.4 Tecsys Inc.

- 6.1.5 Mckesson Corporation

- 6.1.6 Oracle Corporatipon

- 6.1.7 Providence Health & Services

- 6.1.8 SAP AG Group

- 6.1.9 Spectrum Health

- 6.1.10 Ochsner Health System

- 6.1.11 Aspen Technology Inc

- 6.1.12 Infor