|

市場調查報告書

商品編碼

1404416

自助倉儲:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Self Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

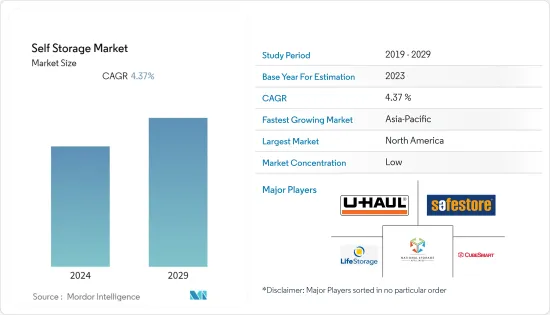

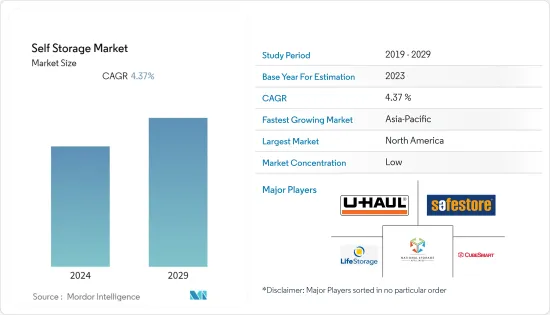

本會計年度自助倉儲市場規模預計為 582.6 億美元,預計到預測期末將達到 721.5 億美元,預測期內複合年成長率為 4.37%。

主要亮點

- 由於都市化的加速和各地區經濟前景的改善,預計該行業在預測期內將出現正成長。這些因素正在導致新業務的成長。

- 自助倉儲產業是商業不動產市場的子部門。由於都市化的加速和經濟前景的改善,新業務數量不斷增加,預計該行業在預測期內將出現積極成長。雖然自助倉儲設施在美國和西歐等成熟市場普及普遍,但在中國和印度等亞洲市場仍然是一個相對較新的概念。

- 都市化的提高是積極推動市場成長的關鍵因素之一。由於城市人口的增加,都市區的居住空間變得越來越小,並且變得越來越昂貴。倫敦就是這一趨勢的典型例子,其人口在 2021 年達到 880 萬的歷史新高。預計到2030年人口將超過1000萬人。

- 除了個人用戶使用量的增加之外,企業對自助倉儲的興趣也在增加。企業意識到並擔心儲存成本。與傳統倉儲業不同,自助倉儲模式提供多種儲存空間大小和費率方案。

- 政府法規正在阻礙市場成長。儲存業者繼續收到國防安全保障部的非具體警告,稱其設施可用於儲存可能在恐怖攻擊中爆炸的材料。

自助倉儲市場趨勢

個人儲存領域預計將佔據大部分市場佔有率

- 隨著越來越多的家庭變得更加足智多謀,自助倉儲物業的性能主要是由對更多儲存空間的需求所驅動的。此外,隨著嬰兒潮世代縮小規模,對儲存單元的需求預計會增加。

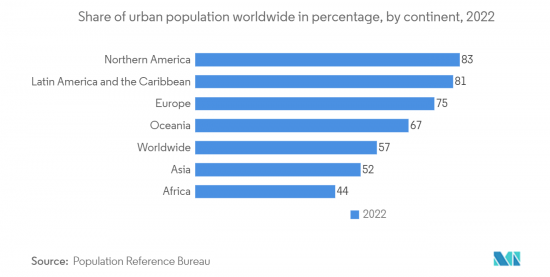

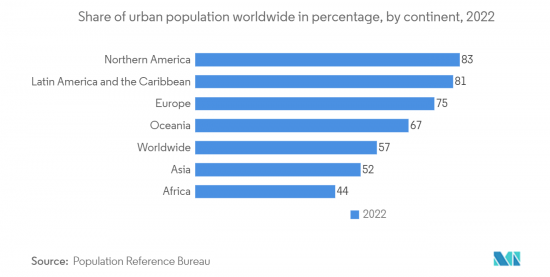

- 由於城市人口不斷成長,隨著越來越多的租屋者頻繁搬家,都市區的居住空間變得越來越小,而且越來越昂貴。預計2022年全球都市化將達57%。北美洲有超過五分之四的人口居住在城鎮,是世界上人口最稠密的地區。

- 如果冠狀冠狀病毒引發的經濟衰退即將來臨(部分原因是都市化),個人儲存將會蓬勃發展。居住在出租住宅的人們需要一個地方來存放不再適合的物品,無論是因為他們的出租房空間縮小、他們與家人一起搬回家,還是他們選擇了更游牧的生活方式。為了應對這些趨勢,個人儲存設施正在蓬勃發展。

- 隨著千禧世代在自助倉儲用戶中所佔的比例越來越大,他們希望使用科技(尤其是智慧型手機、應用程式和響應式行動網站)與營運商互動。虛擬旅遊、線上預訂和支付、自助服務亭和自動訪問是與該領域技術發展相對應的新趨勢。隨著實體位置的競爭優勢減弱,這些線上管道為新興儲存創新者提供了顛覆產業的新機會。

北美有望成為最大市場

- 北美(主要包括美國和加拿大)預計將引領自助倉儲市場。對儲存解決方案和工業自動化的需求正在推動市場。北美市場的促進因素包括越來越注重減少基礎設施支出、不斷增加對業務洞察力的需求以及即時資料的可用性。

- 自36年前出現以來,自助倉儲產業一直是商業房地產市場成長最快的領域之一。根據 SpareFoot.com 統計,截至 2023 年 1 月,儲存產業年銷售額為 290 億美元,估計目前美國有 51,206 個儲存設施在運作。

- 該地區的公司也在規劃並持續建造自助倉儲。例如,2021 年 3 月,Life Storage 計劃在 Transit Road 擁有的土地上建造一座三層、216 個單元的氣候控制建築,以擴大其在西塞內卡的業務。

- 強勁的就業創造和薪資上漲正在鼓勵家庭組建和個人消費,從而促進了對自助倉儲的積極需求。此外,年輕一代和老一代人更快的生活方式以及相對較多的紀念品收藏也增加了未來對自助倉儲空間的需求。

- 2021 年 7 月,全球投資公司 KKR 收購了德克薩斯州奧斯汀和田納西州納什維爾的三處自助倉儲物業,以滿足基本供需,並解決經濟週期彈性等長期動態。我很有吸引力。

自助倉儲產業競爭形勢

自助倉儲市場競爭激烈,主要企業包括 U-Haul International Inc.、Life Storage Inc.、CubeSmart LP、National Storage Affiliates Trust 和 Safestore Holdings PLC。市場主要企業也透過聯盟、併購、收購、投資、業務擴張和技術創新來維持其市場地位。

2023 年 6 月,SecureSpace 宣布收購了西雅圖林伍德附近的 Northlynn Mini Storage。租賃的辦公室將升級為 SecureSpace 標誌性的現代風格,並配備由該公司國家安全團隊管理的專有高安全平台。

2022 年 10 月,位於阿默斯特街 476 號的北納舒厄 U-Haul Moving and Storage 宣布竣工 600 個具有高科技安全功能的室內空調自助自助倉儲單元。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 市場主要基本面指標分析

- 平均居住面積

- 自助倉儲設施運轉率

- 辦公室租金價格

第5章市場動態

- 市場促進因素

- 都市化進程推進,生活空間縮小

- 商業實踐與 COVID-19消費行為變化

- 市場抑制因素

- 政府有關儲存的法規阻礙因素了市場成長

第6章市場區隔

- 依使用者類型

- 個人

- 商業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟

- 北歐的

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 台灣

- 韓國

- 馬來西亞

- 香港

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- U-Haul International Inc.

- Life Storage Inc.

- CubeSmart LP

- National Storage Affiliates

- Safestore Holdings PLC

- Simply Self Storage Management LLC

- StorageMart

- Prime Storage Group

- WP Carey Inc.

- Metro Storage LLC

- SmartStop Asset Management LLC

- (Great Value Storage)World Class Capital Group LLC

- All Storage

- Amsdell Cos./Compass Self Storage

- Urban Self Storage Inc.

- Global Self Storage Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Self-storage Market size is estimated at USD 58.26 billion in the current year and is expected to reach USD 72.15 billion by the end of the forecast period, registering a CAGR of 4.37% during the forecast period.

Key Highlights

- The growth in this industry is expected to be positive during the forecast period, owing to increased urbanization and improved economic outlook across the regions. These factors have led to the growth of new businesses.

- The self-storage industry is a sub-sector of the commercial real estate market. The growth in this industry is expected to be positive during the forecast period due to increased urbanization and improved economic outlook, which have led to new business growth. Although self-storage facilities are widely available in mature markets, such as the United States and Western Europe, they remain a relatively new concept in Asian markets, such as China and India.

- The increasing rate of urbanization is one of the significant factors positively driving market growth. The rising urban population means smaller and increasingly expensive living spaces in cities with more renters who move around frequently. London was a prime example of this trend, with its population hitting a new all-time high of 8.8 million in 2021. The population is projected to be more than 10 million by 2030.

- On top of increased use by personal users, businesses have increasingly shown an interest in self-storage. Businesses are aware and concerned about their storage costs. Unlike traditional warehousing, the self-storage model offers an increased diversity of options for storage space size and pricing plans.

- Government regulations hinder the market's growth. The storage operators have continued to receive nonspecific warnings from the Department of Homeland Security that their facilities can be used to store materials that could be unleashed in a terrorist attack.

Self Storage Market Trends

Personal Storage Segment is Expected to Hold Major Market Share

- The performance of self-storage properties is primarily driven by the demand for growing space for additional storage as families are growing with more material possessions. Moreover, the need for storage units is predicted to increase as baby boomers downsize.

- The increasing urban population causes smaller and increasingly expensive living spaces in cities with more renters who move around more frequently. The degree of urbanization worldwide was supposed to reach 57 percent by 2022. With over four-fifths of its people living in towns and cities, North America is the world's most densely populated.

- In the event of an impending recession triggered by coronavirus that would be partially driven by urbanization, personal storage is booming. Renters need a place to store their belongings that no longer fit when their rental space is reduced; they move home with their families or choose a more nomadic lifestyle. In view of the trend, personal-storage facilities are prospering.

- As the millennial population occupies a more significant percentage of those using self-storage, they expect to interact with operators using technology, specifically smartphones, apps, or responsive mobile websites. Virtual tours, online booking and payment, self-service kiosks, and automated access are emerging trends in response to the technological development in the sector. With the decreasing competitive advantage of physical location, these online channels provide new opportunities for emerging storage innovators to build upon and disrupt the industry.

North America is Expected to be the Largest Market

- North America, which primarily includes the United States and Canada, is expected to lead the self-storage market. The demand for storage solutions and industrial automation drives the market. Some of North America's market drivers include an increased focus on reducing infrastructure expenditure, a growing need for business insights, and real-time data availability.

- The self-storage industry has been one of the fastest-growing segments of the commercial real estate market since its debut 36 years ago. According to SpareFoot.com, the storage industry records USD 29 billion in annual industry revenue as of January 2023, and the United States has an estimated 51,206 storage facilities in service currently.

- The companies in the region are also planning and continuously building self-storage. For instance, in March 2021, Life Storage planned to build a three-story, 216-unit, climate-controlled building on the property the company owned on Transit Road to expand its business in West Seneca.

- Demand for self-storage units is positive due to steady job creation and wage growth, bolstering household formation and consumer spending. The faster lifestyles and relatively more memorabilia collected by younger and older generations also fortify the future need for self-storage space.

- In July 2021, the global investment firm KKR acquired three self-storage properties in Austin, Texas, and Nashville, Tennessee, to meet the supply-demand fundamental and appealing long-term dynamics, including resiliency through economic cycles.

Self Storage Industry Competitive Landscape

The self-storage market is highly competitive, with significant players like U-Haul International Inc., Life Storage Inc., CubeSmart LP, National Storage Affiliates Trust, and Safestore Holdings PLC. The key players in the market are also making partnerships, mergers, acquisitions, investments, expansions, and innovations to retain their market position.

In June 2023, SecureSpace announced that Northlynn Mini Storage in the Lynnwood area of Seattle was acquired. The leasing office is to be upgraded with SecureSpace's signature modern style, while the proprietary high-security platform managed by their national security team shall be installed.

In October 2022, U-Haul Moving and Storage of North Nashua, located at 476 Amherst St., announced the completion of 600 indoor climate-controlled self-storage units with high-tech security features available for rent.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

- 4.5 Analysis of Key Base Indicators of the Market

- 4.5.1 Average Living Spaces

- 4.5.2 Occupancy Rates of Self-storage Facilities

- 4.5.3 Office Rental Prices

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Urbanization Coupled with Smaller Living Spaces

- 5.1.2 Changing Business Practices and COVID-19 Consumer Behavior

- 5.2 Market Restraints

- 5.2.1 Government Regulations on Storage are Hindering the Market Growth

6 MARKET SEGMENTATION

- 6.1 By User Type

- 6.1.1 Personal

- 6.1.2 Business

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Spain

- 6.2.2.5 Italy

- 6.2.2.6 Benelux

- 6.2.2.7 Nordics

- 6.2.2.8 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Taiwan

- 6.2.3.4 South Korea

- 6.2.3.5 Malaysia

- 6.2.3.6 Hong Kong

- 6.2.3.7 Australia

- 6.2.3.8 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 U-Haul International Inc.

- 7.1.2 Life Storage Inc.

- 7.1.3 CubeSmart LP

- 7.1.4 National Storage Affiliates

- 7.1.5 Safestore Holdings PLC

- 7.1.6 Simply Self Storage Management LLC

- 7.1.7 StorageMart

- 7.1.8 Prime Storage Group

- 7.1.9 WP Carey Inc.

- 7.1.10 Metro Storage LLC

- 7.1.11 SmartStop Asset Management LLC

- 7.1.12 (Great Value Storage) World Class Capital Group LLC

- 7.1.13 All Storage

- 7.1.14 Amsdell Cos./Compass Self Storage

- 7.1.15 Urban Self Storage Inc.

- 7.1.16 Global Self Storage Inc.