|

市場調查報告書

商品編碼

1404401

聚氨酯添加劑(PU添加劑):市場佔有率分析、產業趨勢/統計、成長預測,2024-2029Polyurethane Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

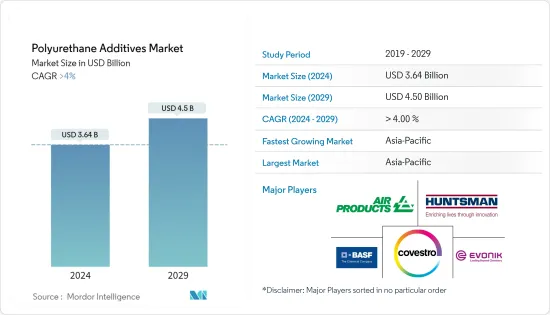

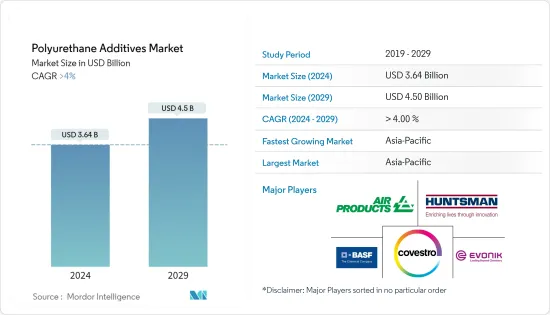

聚氨酯添加劑(PU添加劑)市場規模預計2024年為36.4億美元,預計到2029年將達到45億美元,在預測期內(2024-2029年)複合年成長率為4%,預計將進一步成長。

市場受到 COVID-19大流行的負面影響。由於遏制措施和經濟混亂迫使該行業推遲生產,生產和流動性放緩。目前市場正從疫情中恢復。預計2022年市場將達到疫情前水準並持續穩定成長。

主要亮點

- 建設產業對聚氨酯的需求不斷成長可能會推動添加劑的消費。最大的應用之一是使用硬質 PU 泡棉作為牆壁和屋頂隔熱材料、隔熱板以及門窗周圍的間隙填充材。這將推動市場成長。

- 另一方面,替代添加劑也可用於與 PU 添加劑相同的應用。例如,有機矽添加劑和丙烯酸類添加劑都是PU泡棉的有效添加劑。

- 對更具創新性和成本效益的添加劑的需求不斷成長預計將成為未來幾年市場的機會。

- 亞太地區佔比重最大,預計在預測期內成長率最高。

聚氨酯添加劑市場趨勢

汽車產業需求增加

- 汽車產業是PU材料多樣化應用的最佳例子之一。幾乎所有類型的 PU 產品都用於汽車最終用戶產業。

- 軟質PU發泡體用於座椅、頭枕、扶手、暖通空調和其他汽車內裝系統、客機、火車、巴士等。 PU 塗層為您的汽車外裝提供高光澤度、耐用性、防刮擦性和耐腐蝕性。 PU 塗層也用於擋風玻璃和窗戶嵌裝玻璃,以增加強度並提供防霧保護。

- PU合成橡膠可防止輪胎刺穿,也可用於避震器等模製部件。熱塑性 PU 材料用於製造許多汽車零件,例如外裝外飾板、行李箱襯裡、防鎖死煞車系統、正時皮帶和燃油管路。 PU合成橡膠的獨特性能專門用於墊圈、O 形環和其他密封件。

- 座椅是PU在汽車產業最大的應用領域。許多汽車座椅製造商正在尋求使用生物基多元醇的產品。然而,在全球大部分聚氨酯市場,「綠色」聚氨酯的市場滲透率仍處於起步階段。

- 在全球整體,超過 90% 的汽車是使用單組份 PU 密封膠將擋風玻璃和後玻璃黏合在一起生產的。汽車產業是反應射出成型(RIM) PU 零件最大的最終用戶產業。 RIM 用於最大限度地吸收車輛擋泥板、保險桿和擾流板的衝擊力,而不會增加重量或體積。

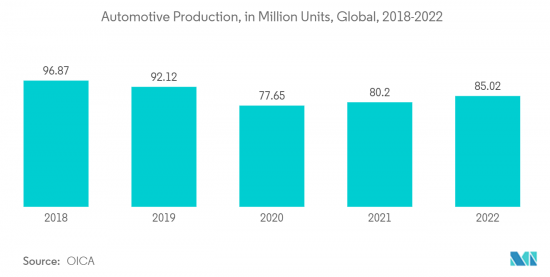

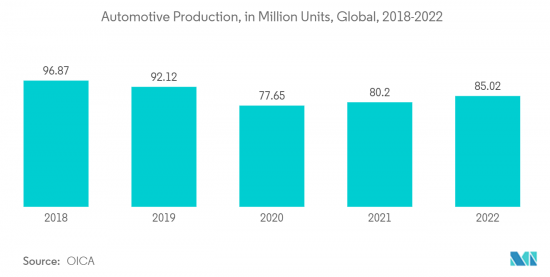

- 根據國際汽車製造商組織 (OICA) 的數據,2022 年全球汽車產量約為 8,502 萬輛。這個數字比去年增加了約6%。到2022年,中國、日本和德國將成為最大的汽車和商用車生產國,推動PU添加劑市場的發展。

- 然而,隨著對汽油和柴油車環境污染的擔憂加劇,電動車產量預計將在未來五年內恢復。這可能會在預測期內提振受調查市場的需求。

- 2023 年 8 月,總部位於密西根州的全球科技公司 Altair 和汽車研究中心 (CAR) 評選馬瑞利為內裝產品聚氨酯泡沫輕量化未來類別 2023 年 Enlighten 獎得主。

- 此外,全球電動車市場正在顯著擴張,這有利於所研究的市場。例如,2022年,全球銷售了約1,050萬輛純電動車(BEV)和插電式混合電動車(PHEV),與前一年的677萬輛相比成長了55%。

- 所有上述因素預計將在預測期內推動市場。

中國可望主導亞太地區

- 在亞太地區,中國是GDP最大的經濟體。 2022年中國GDP產值將佔世界經濟的7.73%,GDP成長速度與前一年同期比較3%。

- 中國是世界上最大的經濟體之一,其建築業的成長速度幾乎超過了所有其他行業。 2022年,建築業佔中國國內生產總值約6.9%,中國建築業增加付加比與前一年同期比較成長約5.5%。

- 中國家具製造業的快速成長很大程度上得益於國內需求的增加以及海外市場的大量需求。

- 2022年,中國將佔全球家具產量的近53%。國內需求的增加和對歐洲國家的出口進一步增加了產量。

- 根據OICA統計,自2009年以來,中國一直是全球最大的汽車製造國和汽車市場。中國年汽車產量佔全球汽車產量的32%以上,超過歐盟、美國和日本的總和。

- 然而,電動車在該國的普及預計將在未來幾年推動聚氨酯添加劑的需求。中國政府計畫在2025年引進至少5,000輛燃料電池電動車,到2030年引進100萬輛。政府推廣電動車、混合和燃料電池汽車的使用預計將在預測期內推動市場研究。

- 這些因素預計將增加該國對聚氨酯添加劑的需求。

聚氨酯添加劑產業概況

聚氨酯添加劑市場因其性質而部分分散。主要參與者(排名不分先後)包括贏創工業股份公司、空氣產品公司、科思創股份公司、亨斯曼國際有限責任公司和BASF股份公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建設產業對聚氨酯的需求增加

- 汽車產業需求增加

- 對永續聚氨酯產品的需求不斷成長

- 抑制因素

- 替代添加劑的可得性

- 嚴格的政府法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:以金額為準)

- 類型

- 發泡

- 催化劑

- 阻燃劑

- 介面活性劑

- 其他(填料、乳化劑、交聯劑)

- 目的

- 黏劑/密封劑

- 塗層

- 軟質模製泡沫

- 硬質泡沫

- 其他(合成橡膠、纖維、複合材料、醫療設備)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Air Products Inc.

- Covestro AG

- BASF SE

- Dow

- GEO Specialty Chemicals Inc.

- Huntsman International LLC

- Eastman Chemical Company

- Evonik Industries AG

- Momentive Performance Materials Inc.

- KAO Corporation

- Specialty Products Inc.

- Tosoh Corporation

第7章 市場機會及未來趨勢

- 對創新且具有成本效益的添加劑的需求不斷成長

- 其他機會

The Polyurethane Additives Market size is estimated at USD 3.64 billion in 2024, and is expected to reach USD 4.5 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries were forced to delay their production due to containment measures and economic disruptions. Currently, the market has recovered from the pandemic. The market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The rising demand for polyurethane in the construction industry will likely propel additives' consumption. One of the largest applications is the use of rigid PU foam as wall and roof insulation, insulated panels, and gap fillers for the space around doors and windows. Thereby augmenting the market's growth.

- On the flip side, the alternative additives can be used in some of the same applications as PU additives. For example, silicon additives and acrylic additives are both effective additives against PU foams.

- The increasing demand for more innovative and cost-effective additives is projected to act as an opportunity for the market in the future.

- The Asia-Pacific region is expected to account for the largest share and register the highest growth rate over the forecast period.

Polyurethane Additives Market Trends

Increasing Demand from the Automotive Industry

- The automotive industry provides one of the best examples of the diverse applications of PU materials. Nearly every type of PU product is used in the automotive end-user industry.

- Flexible PU foams are used in seating, headrests, armrests, HVAC, and other interior systems for automotive, like in airliners, trains, and buses. PU coatings provide a vehicle's exterior with high gloss, durability, scratch resistance, and corrosion resistance. PU coatings are also used for glazing windshields and windows, increasing strength and providing fog resistance.

- PU elastomers protect against tire punctures and are used in other molded components, such as shock absorbers. Thermoplastic PU materials are used to manufacture many automotive parts, including exterior body parts, trunk liners, anti-lock brake systems, timing belts, and fuel lines. The unique properties of PU elastomers contribute to their exclusive usage in gaskets, O-rings, and other seals.

- Seating is the largest application of PU in the automotive industry. Many automotive seating manufacturers demand products made with bio-based polyols. However, the market penetration of "green" PU is still emerging in most global PU markets.

- Globally, more than 90% of automobiles are produced with bonded windshields and rear windows using one-component PU sealants. The automotive industry is the largest end-user industry for reaction injection molding (RIM) PU parts. RIM is used to maximize the shock absorption of vehicle fenders, bumpers, and spoilers without adding weight or bulk.

- In 2022, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), around 85.02 million motor vehicles were produced worldwide. This figure translates into an increase of around 6% compared with the previous year. China, Japan, and Germany were the largest producers of cars and commercial vehicles in 2022, which is driving the PU additive market.

- However, with growing concerns about environmental pollution from petrol- and diesel-based vehicles, the production of electric vehicles is expected to pick up over the next five years. This is likely to drive the demand in the market studied over the forecast period.

- In August 2023, Global technology company Altair and the Center for Automotive Research (CAR), both based in Michigan, named Marelli as the 2023 Enlighten award winner in the Future of Lightweighting category for its polyurethane foam for interior products.

- Further, the global electric vehicle market is expanding significantly, which is benefitting the market studied. For instance, in 2022, around 10.5 million units of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold across the globe, witnessing a growth rate of 55% compared to 6.77 million units sold in the previous year.

- All the factors above are expected to drive the market during the forecast period.

China is Expected to Dominate the Asia-Pacific Region

- In Asia-Pacific, China is the largest economy in terms of GDP. The GDP value of China represents 7.73% of the world economy in 2022 and has a 3% GDP growth compared to the previous year.

- China is one of the largest countries in the world, where the construction sector dominates almost all other sectors in growth. In 2022, the construction industry accounted for around 6.9% of China's gross domestic product, and the value added to the Chinese construction industry increased by about 5.5% compared to the previous year.

- The rapid growth of the furniture manufacturing industry in the country is majorly fueled by the increasing domestic demand, coupled with significant demand from the foreign market.

- China accounted for almost 53% of the global furniture production in 2022. The production was further increased rapidly due to the increase in domestic demand and exports to European countries.

- According to the OICA, China remains the world's largest automotive manufacturing country and automotive market since 2009. Annual vehicle production in China accounted for more than 32% of worldwide vehicle production, which exceeds that of the European Union or that of the United States and Japan combined.

- However, the popularity of electric vehicles in the country is expected to propel the demand for PU additives in the coming years. The Chinese government plans to have a minimum of 5,000 fuel-cell electric vehicles by 2025 and 1 million by 2030. The government promoting the use of electric, hybrid, and fuel-cell electric vehicles is expected to drive the market studied during the forecast period.

- Such factors are expected to increase the demand for polyurethane additives in the country.

Polyurethane Additives Industry Overview

The polyurethane additives market is partially fragmented in nature. The major players (not in any particular order) include Evonik Industries AG, Air Products Inc., Covestro AG, Huntsman International LLC, and BASF SE. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Polyurethane in the Construction Industry

- 4.1.2 Increasing Demand from the Automotive Industry

- 4.1.3 Growing demand for sustainable Polyurethane products

- 4.2 Restraints

- 4.2.1 Availability of Alternative Additives

- 4.2.2 Stringent Government Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Blowing Agents

- 5.1.2 Catalysts

- 5.1.3 Flame Retardants

- 5.1.4 Surfactants

- 5.1.5 Other Additives( Filler, Emulsifiers, and Crosslinking Additives)

- 5.2 Application

- 5.2.1 Adhesives and Sealants

- 5.2.2 Coatings

- 5.2.3 Flexible Molded Foams

- 5.2.4 Rigid Foams

- 5.2.5 Other Applications (Elastomers, Fibers, Composites, and Medical Devices)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products Inc.

- 6.4.2 Covestro AG

- 6.4.3 BASF SE

- 6.4.4 Dow

- 6.4.5 GEO Specialty Chemicals Inc.

- 6.4.6 Huntsman International LLC

- 6.4.7 Eastman Chemical Company

- 6.4.8 Evonik Industries AG

- 6.4.9 Momentive Performance Materials Inc.

- 6.4.10 KAO Corporation

- 6.4.11 Specialty Products Inc.

- 6.4.12 Tosoh Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for More Innovative and Cost-effective Additives

- 7.2 Other Opportunities