|

市場調查報告書

商品編碼

1404380

高效資料分析:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測High-Performance Data Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

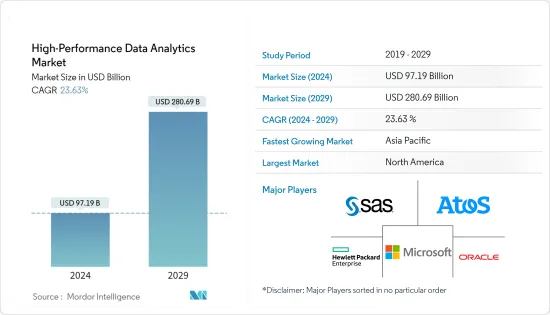

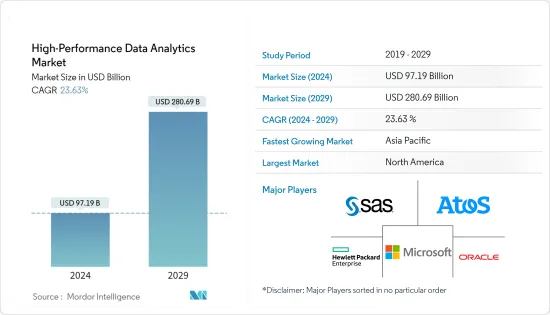

高效能資料分析市場規模預計到 2024 年為 971.9 億美元,預計到 2029 年將達到 2,806.9 億美元,在預測期內(2024-2029 年)複合年成長率為 23.63%。

在快速發展的科技世界中,創新推動產業向前發展。高性能資料分析(HPDA)是加速這項創新的主要催化劑。隨著數位世界以前所未有的速度擴展,準確、快速地分析和處理大量資料的能力已成為技術進步的關鍵推動力。

主要亮點

- 由於最終用戶級資料整合的激增,高效能資料分析市場正在蓬勃發展。為高效能資料分析市場創造巨大成長機會的最重要因素之一是技術創新和可近性。鑑於包括硬體和軟體市場在內的各個層面技術的成長,高階市場分析資料最佳化的前景更加光明。非結構化、結構化和非結構化類別在規模和機會上看起來相似。金融業的技術導向正在取得令人矚目的成長。

- 在日益互聯和電腦化的世界中,正在產生更多資料。然而,資料成長不是線性的,而是指數級的。依賴高效能運算 (HPC) 的公司正在為這一激增做好準備。企業越來越認知到採用支援開發分析和人工智慧操作的 HPC 功能的好處。為了幫助企業走在這場技術革命的最前沿,英特爾和惠普等公司正在提供將 HPC、人工智慧和其他工作負載結合的方法。

- 許多經濟部門利用天氣和氣候預測來做出重要的商業決策。例如,農業部門利用這些預測來決定何時種植、灌溉和減少霜凍損失。能源部門根據地區估算能源需求高峰並平衡負載。這樣,高效能運算 (HPC)主導的分析將透過更快、更準確地分析資料來幫助推進氣候研究。

- 高效能資料分析結合了資料分析和 HPC。該技術利用 HPC 的平行處理能力,以超過兆次浮點運算(每秒 1 兆次浮點運算)的速度運行強大的分析軟體。 HPC 營運和實施需要高昂的投資和資本成本,預計這將阻礙市場成長。

- 資料和分析可以闡明並支持您業務中的臨床和營運決策。例如,治療 COVID-19 患者所需藥物的評估和檢驗依賴研究人員共用的真實臨床資料。許多 HPDA 服務提供者正在為衛生系統提供軟體解決方案,可以免費存取用於學術計劃的 COVID-19資料科學工作區,以幫助臨床研究人員對抗這一流行病。這促進了大流行期間的市場成長。

高性能資料分析市場的趨勢

按需驅動成長

- 高效能資料分析是 HPC、資料分析和巨量資料的組合。 HPDA 利用 HPC 的速度和處理能力來快速洞察複雜的資料集。

- 按需運算,也稱為雲端處理,近年來成長顯著。它使個人和企業可以透過網際網路以訂閱方式使用儲存設備、處理能力和應用程式等運算資源。

- 此外,企業的目標是透過在這個新時代整合新技術來變得敏捷。遷移到雲端環境是實現這一目標最有效的方法。成為雲端的一部分意味著獲得內建連接和智慧,使智慧型操作能夠協同工作,以及與雲端保持一致的數位服務,這意味著建立堅實的基礎。

- 除此之外,數位化轉型等幾個因素正在迅速擴大按需部署。企業擴大採用雲端服務來簡化IT基礎設施並加速數位轉型。雲端處理提供敏捷性、擴充性和成本效率,使其成為各種規模企業的有吸引力的選擇。

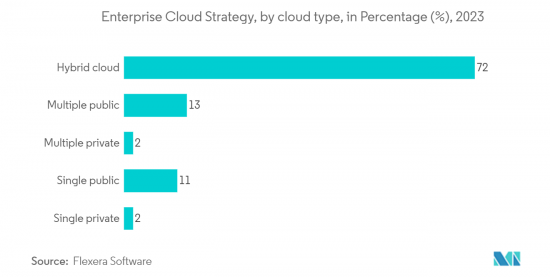

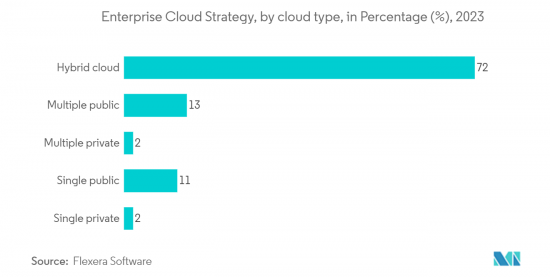

- Flexera 表示,72% 的企業受訪者表示他們將在 2023 年部署混合雲。混合雲幫助企業更好地控制資料,將敏感資料儲存在私有雲中,並在公有雲上運行企業應用程式。

- 總體而言,數位轉型正在透過雲端運算進入新階段。雲端運算將數位轉型從簡單地採用新技術轉變為在遠端虛擬環境中徹底重新設計流程、工具和體驗。雲端處理增強安全性、改善使用者體驗並保護文件免遭劣化。因此,企業現在正在將雲端處理涵蓋其生態系統,從而促進市場成長。

北美佔據主要市場佔有率

- 美國是採用高性能資料分析的主要創新者和先驅。預計該國將佔據很大的市場佔有率。高效能資料分析供應商的強大立足點也推動了市場的成長。

- 供應商包括 IBM 公司、SAS Institute Inc.、英特爾公司和 Hewlett Packard Enterprise。新業務洞察的成長正在促進美國高性能資料分析市場的擴張。資料分析正在幫助該地區的許多企業實現績效提升,例如改善客戶體驗和識別詐欺。

- 此外,能源創新高效能運算投資的增加將產生大量數據,需要先進的資料分析解決方案來獲取洞察、最佳化業務並推動能源領域的創新。預計將產生大量資料,從而創造對能源領域的需求。該國的高效能資料分析解決方案。

- 加拿大專注於醫療保健、人工智慧和可再生能源等領域的研究和創新,需要高效能資料分析解決方案來分析複雜的資料集並獲得研究見解,為市場提供支援。

- 加拿大政府已將各省和地區確定為衛生優先事項,以改善其人口的綜合衛生保健,包括擴大家庭衛生服務的覆蓋範圍,並利用標準化的衛生資料和數位工具實現衛生系統現代化。我們正在與之合作。此類與醫療數位化相關的舉措將導致該行業資料量的增加,需要先進的資料分析解決方案進行處理以獲得見解。

- 此外,與高效能運算相關的合作夥伴預計將結合各自的專業知識、技術和資源,開發更先進、更有效率的資料分析解決方案。這些合作有可能帶來創新並推動加拿大高效能資料分析市場的成長和需求。

高效能資料分析產業概述

由於眾多參與者的存在,高性能資料分析市場的競爭形勢變得碎片化。由於這個市場提供的廣闊前景,SAS Institute Inc、Hewlett Packard Enterprise Company、Oracle Corporation、ATOS SE 和 Microsoft Corporation 等主要供應商不斷創新。公司正在進行併購,並在研發活動上投入大量資金。

2023 年 6 月,Applied Digital 宣布與惠普企業建立合作夥伴關係,Applied Digital 是一家建置、設計和營運主要為高效能運算應用程式設計的下一代數位基礎設施的公司。作為合作的一部分,慧與將提供功能強大、節能的超級電腦,經證明可透過 Applied Digital 的人工智慧雲端服務支援大規模人工智慧。

2023 年 2 月,SAS 將加入 CESMII,進一步加速並加強先進分析在整體製造領域的使用。越來越多的頂級製造商正在利用 SAS 人工智慧、機器學習和流程分析來轉變其營運方式並更好地服務客戶等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 網格計算

- 資料庫庫內分析

- 記憶體內分析

第5章市場動態

- 市場促進因素

- 全球 IT 和資料庫產業的成長

- 資料量增加

- 高效能運算的進步

- 市場抑制因素

- 投資成本高

- 嚴格的政府法規

第6章市場區隔

- 按成分

- 硬體

- 軟體

- 按服務

- 按配置

- 本地

- 一經請求

- 按組織規模

- 中小企業

- 主要企業

- 按最終用戶產業

- BFSI

- 政府/國防

- 能源/公共產業

- 零售/電子商務

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- SAS Institute Inc.

- Hewlett Packard Enterprise Company

- Oracle Corporation

- ATOS SE

- Microsoft Corporation

- Dell Technologies Inc.

- IBM Corporation(Red Hat Inc.)

- Fujitsu Limited

- Intel Corporation

- Amazon Web Services Inc.(Amazon.com Inc.)

- Google LLC(Alphabet Inc.)

- Juniper Networks Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The High-Performance Data Analytics Market size is estimated at USD 97.19 billion in 2024, and is expected to reach USD 280.69 billion by 2029, growing at a CAGR of 23.63% during the forecast period (2024-2029).

In a rapidly growing world of technology, innovation drives the industry forward. High-performance data analytics (HPDA) is a major catalyst for accelerating this innovation. As the digital world is expanding at an unprecedented rate, the capability to analyze and process large amounts of data accurately and quickly has become a key enabler of technological progress.

Key Highlights

- High-performance data analytics market growth is at boom due to the surge in data integration at the end-user level. One of the most crucial factors that have given rise to dramatic growth opportunities in the High-Performance Data Analytics market is technological innovation and accessibility. The prospect of advanced market analytics data optimization is even more promising given the growing state of technology at all levels, including hardware and software markets. Unstructured, structured, and less structured categories seem the same in size and opportunity. An impressive range of growth in the financial industry's technological orientation is visible.

- More data are being generated in an increasingly linked and computerized world. However, the growth of data is not linear; it is exponential. High-performance computing (HPC)-reliant businesses are creating plans for this upsurge. Organizations are gradually aware of the advantages of employing HPC capabilities to enable development analytics and AI operations. For businesses to be at the forefront of this technological revolution, companies such as Intel, HP, and others offer a way to combine HPC, AI, and other workloads.

- Many economic sectors use weather and climate predictions to make crucial business decisions. For instance, the agricultural sector uses these forecasts to determine when to plant, irrigate, and mitigate frost damage. The energy sector estimated that peak energy demands based on geography would balance the load. Thus, HPC (high-performance computing)-driven analytics helps fuel progress in climate research by analyzing data even more quickly and accurately.

- High-performance data analytics combines data analytics and HPC. This technology leverages the parallel processing abilities of HPC to run robust analytics software at speeds in excess of teraflops, or one trillion floating point operations per second. High investment and capital costs for operating and installing HPC are expected to hinder market growth.

- Data and analytics can offer clarity and support for clinical and operational decision-making in businesses. For instance, evaluating and validating the medicines required to treat patients with COVID-19 depends on real-world clinical data that researchers may share. Many HPDA service providers have offered software solutions for health systems with free access to a COVID-19 data science workspace for academic projects to aid clinical researchers in their fight against the pandemic, which fueled the market growth during the pandemic.

High Performance Data Analytics Market Trends

On-Demand to Witness the Growth

- High-performance data analytics combine HPC, Data Analytics, and Big Data. In order to provide quick insight into complex data sets, HPDA uses the speed and processing power of HPC.

- In recent years, there has been strong growth in on-demand computing, also known as cloud computing. This will allow individuals and businesses to make use of computing resources on a subscription basis via the Internet, e.g., storage devices, processing power, or applications.

- Moreover, companies are aiming to become agile with the integration of new technologies in this new era. Moving to a cloud environment is the most effective way of doing this. Being a part of the cloud means obtaining an embedded connection and intelligence, enabling intelligent operations to work in cooperation with each other, as well as building solid foundations for digital services linked to the cloud.

- In addition to this, on-demand deployment has been growing rapidly owing to several factors like digital transformation. Organizations are progressively adopting cloud services to streamline their IT infrastructure and speed up digital transformation initiatives. Cloud computing offers agility, scalability, and cost-efficiency, making it an attractive option for businesses of all sizes.

- According to Flexera, as of 2023, 72% of the enterprise respondents indicated that they had deployed a hybrid cloud in their organization since it can provide businesses more control over their data, help store sensitive data in a private cloud and run enterprise applications on a public cloud.

- Overall, digital transformation has been given an extra dimension by cloud computing, which transforms it from simply adopting new technology to a complete rebuilding of processes, tools, and experiences in a remote, virtual environment. Cloud computing boosts security, enhances user experience, and protects documents from deterioration. Because of this, businesses are now incorporating cloud computing into their ecosystem, fueling the growth of the market.

North America to Hold Major Market Share

- The United States is among the leading innovators and pioneers in adopting high-performance data analytics. The country is expected to hold a prominent share of the market. It has a strong foothold in terms of high-performance data analytics vendors, which adds to the market's growth.

- Some vendors include IBM Corporation, SAS Institute Inc., Intel Corporation, and Hewlett Packard Enterprise, among others. The growth of new business insights contributes to expanding the high-performance data analytics market in the United States. Data analytics is helping many companies in the region to improve customer experience, identify fraud, and achieve other results that directly strengthen business performance.

- Furthermore, increasing investment in high-performance computing for energy innovation is expected to generate a large amount of data that needs sophisticated data analytics solutions to get insights, optimize operations, drive innovation in the energy sector, and create demand for high-performance data analytics solutions in the country.

- The strong focus on research and innovation in Canada in sectors like healthcare, artificial intelligence, and renewable energy is leading to support the market requiring high-performance data analytics solutions to analyze complex data sets and gain research insights.

- The government of Canada is working collaboratively with provinces and territories on health priorities to improve integrated health care for residents, such as expanding access to family health services and modernizing the health care system with standardized health data and digital tools. Such initiatives related to digitalization in healthcare would result in the growth in data volumes in the sector, which needs advanced data analytics solutions for processing to get insights creating the need for high-performance data analytics solutions for better healthcare service offerings in the country.

- Moreover, partnerships related to high-performance computing are expected to bring together their expertise, technology, and resources to develop more advanced and efficient data analytics solutions. These collaborations could lead to innovations, driving growth and demand in the high-performance data analytics market in Canada.

High Performance Data Analytics Industry Overview

The competitive landscape of the high-performance data analytics market is fragmented due to the presence of many players. Key vendors such as SAS Institute Inc, Hewlett Packard Enterprise Company, Oracle Corporation, ATOS SE, and Microsoft Corporation are continuously innovating in the technology due to the vast array of prospects the market projects. The companies are undergoing mergers and acquisitions, spending vast sums of money on R&D activities, etc.

In June 2023, Applied Digital Corporation, a builder, designer, and operator of next-generation digital infrastructure primarily designed for High-Performance Computing applications, declared a collaboration with Hewlett Packard Enterprise. As a part of the collaboration, HPE would provide its powerful, energy-efficient supercomputers that are proven to support large-scale AI through Applied Digital's AI cloud service.

In February 2023, SAS joined CESMII to promote further and enhance the utilization of advanced analytics across the manufacturing sector. More and more top manufacturers utilize artificial intelligence, machine learning, and streaming analytics from SAS, especially to transform operations and better serve its customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Grid Computing

- 4.4.2 In-Database Analytics

- 4.4.3 In-Memory Analytics

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of IT & Database Industry Across the Globe

- 5.1.2 Growing Data Volumes

- 5.1.3 Advancements in High-Performance Computing Activities

- 5.2 Market Restraints

- 5.2.1 High Investment Cost

- 5.2.2 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Deployment

- 6.2.1 On-Premise

- 6.2.2 On-Demand

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Government & Defense

- 6.4.3 Energy & Utilities

- 6.4.4 Retail & E-Commerce

- 6.4.5 Other End-User Industry

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.4.1 Mexico

- 6.5.4.2 Brazil

- 6.5.4.3 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAS Institute Inc.

- 7.1.2 Hewlett Packard Enterprise Company

- 7.1.3 Oracle Corporation

- 7.1.4 ATOS SE

- 7.1.5 Microsoft Corporation

- 7.1.6 Dell Technologies Inc.

- 7.1.7 IBM Corporation (Red Hat Inc.)

- 7.1.8 Fujitsu Limited

- 7.1.9 Intel Corporation

- 7.1.10 Amazon Web Services Inc. (Amazon.com Inc.)

- 7.1.11 Google LLC (Alphabet Inc.)

- 7.1.12 Juniper Networks Inc.