|

市場調查報告書

商品編碼

1404370

空氣壓縮機 -市場佔有率分析、產業趨勢/統計、2024-2029 年成長預測Air Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

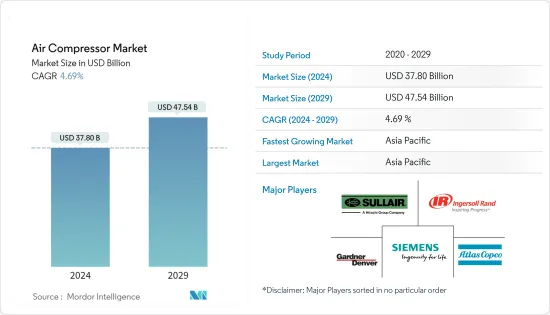

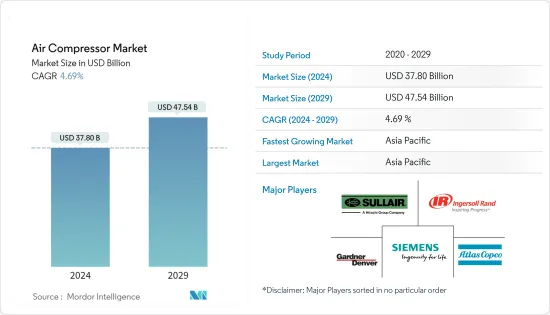

預計2024年空氣壓縮機市場規模為378億美元,預計2029年將達475.4億美元,在預測期內(2024-2029年)複合年成長率為4.69%。

截至年終,空氣壓縮機市場規模預計為361.1億美元,預計未來五年將達到454.1億美元,預測期內複合年成長率超過4.69%。

主要亮點

- 從中期來看,天然氣產業需求的急劇上升以及煉油和石化產業需求的成長可能會在預測期內支持空氣壓縮機市場的成長。

- 另一方面,與傳統內燃機相比,較高的資本成本可能會阻礙研究期間的市場成長。

- 然而,空氣壓縮機行業的技術進步導致了需要較少運行和維護投資的產品的開發。例如,無油系統有望在降低定期維護成本的行業中找到機會。

- 由於印度、中國和日本石油和天然氣行業的持續成長,預計亞太地區空氣壓縮機市場將顯著成長。中國和台灣廣泛的半導體和電子製造工業基礎預計將進一步推動市場。

空氣壓縮機市場趨勢

正排量壓縮機預計將佔據主要市場佔有率

- 在容積式壓縮機中,氣體通過活塞的吸氣衝程被吸入,通過活塞向相反方向移動而被壓縮以減少氣體的體積,當氣體的壓力超過作用於出口的壓力時被排出閥門。往復式壓縮機可用於供應少量高壓氣體。

- 儘管旋轉式容積式壓縮機的排出壓力範圍有限,但由於食品和飲料行業的成長,其需求預計將成長。由於採用內部冷卻系統,這些空氣壓縮機設計用於連續使用,輸出範圍從 5 馬力到 350 馬力。

- 由於技術進步和汽車行業需求的快速成長,空氣壓縮機的市場佔有率預計將大幅成長。在這個領域,借助空氣壓縮機,可以快速、準確地組裝零件。

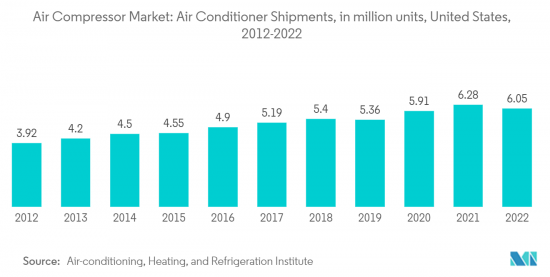

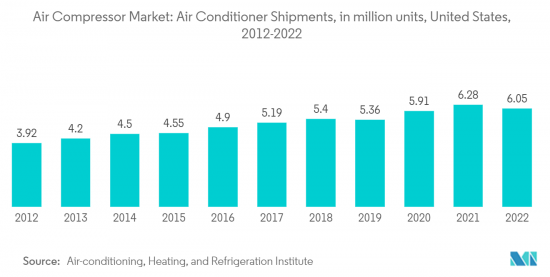

- 空調是空氣壓縮機的重要用途之一。隨著世界各地生活水準的提高,空調銷售正在推動空氣壓縮機市場。根據空調、暖氣和冷氣研究所預計,美國空調進口數量將從2012年的392萬台增加到2022年的605萬台,空調消費量的增加將直接帶動空調消費量的成長。壓縮機市場,我支持你。

- 基於使用容積式空氣壓縮機的多個不斷成長的行業,容積式空氣壓縮機預計將在預測期內佔據重要的市場佔有率。

亞太地區主導市場

- 亞太地區各產業的工業化正在經歷從小規模到大規模的顯著成長。製造業對該地區的 GDP 貢獻顯著。

- 印度和中國等國家不斷成長的精製和天然氣市場必將擴大空氣壓縮機的市場。天然氣管道產業的大規模投資正在推動空氣壓縮機市場的發展。

- 定置型空氣壓縮機,包括用於冰箱和空調的小型壓縮機,在壓縮機市場中佔據主要佔有率,而不斷成長的餐飲業預計將提振空氣壓縮機市場。

- 由於中國和印度等開發中國家對發電廠的大量投資,該地區的能源和電力產業預計將成長。預計這將促進工業成長並增加對工業壓縮機的需求。

空壓機產業概況

空氣壓縮機市場較為分散。市場的主要企業(排名不分先後)包括阿特拉斯·科普柯集團、英格索蘭公司、西門子股份公司、格南登福公司和壽力有限責任公司(日立集團)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2028年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 天然氣產業需求激增

- 精製和石化產業需求增加

- 抑制因素

- 與傳統內燃機相比,資本成本更高

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 正位移

- 往復運動

- 旋轉式

- 動態的

- 軸型

- 離心式

- 正位移

- 最終用戶

- 油和氣

- 電力部門

- 製造業

- 化工/石化

- 其他最終用戶

- 按地區分類的市場分析(到 2028 年的市場規模和需求預測(僅按地區))

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 中東和非洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章競爭形勢

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Atlas Copco Group

- Ingersoll Rand Inc.

- General Electric

- Siemens AG

- Gardner Denver Inc.

- Sullair LLC(Hitachi Group)

- Sulzer Ltd

- ELGI Equipments Ltd

第7章 市場機會及未來趨勢

- 空壓機產業的技術進步

The Air Compressor Market size is estimated at USD 37.80 billion in 2024, and is expected to reach USD 47.54 billion by 2029, growing at a CAGR of 4.69% during the forecast period (2024-2029).

The Air compressor market is estimated to be at USD 36.11 billion by the end of this year and is projected to reach USD 45.41 billion in the next five years, registering a CAGR of over 4.69% during the forecast period.

Key Highlights

- Over the medium term, soaring demand from natural gas sector and increasing demand from the refinery and petrochemical sector, are likely to support the air compressor market growth during the forecast period

- On the other hand, higher capital cost compared to traditional internal combustion engines is likely to hinder the market growth during the study period.

- Nevertheless, the technical advancement in the air compressor industry is leading to the development of products that requires less operational and maintenance investment. such as, oil-free systems are expected to get the opportunity in the industries which would reduce expenses related to maintenance during certain intervals.

- Asia-Pacific is estimated to witness a significant growth in the air compressor market due to the ongoing growth of the oil and gas industry in India, China, and Japan. A broad industrial base for semiconductor and electronics manufacturing in China and Taiwan is projected to drive the market further.

Air Compressor Market Trends

Positive Displacement Compressors Expected to Hold Significant Market Share

- In a positive displacement air compressor, the gas is drawn in during the suction stroke of the piston, compressed by decreasing the volume of the gas by moving the piston in the opposite direction, and discharged when the gas pressure exceeds the pressure acting on the outlet valve. Reciprocating compressors are useful for supplying small amounts of gas at high pressures.

- Although the discharge pressure range of rotary-type positive displacement compressors is limited, their demand is expected to grow due to the growing food and beverage industry. Because of the internal cooling system, these air compressors are designed for continuous use and range in power from 5 horsepower up to 350 horsepower.

- With technical advancements and rapidly growing demand in the automobile industry, the market share of air compressors is expected to grow significantly. With the help of air compressors, parts can be assembled rapidly and precisely in this sector.

- Air conditioners are one of the significant applicants for air compressors. With the advancement in living standards globally, air conditioner sales have driven the air compressor market. According to the Air-conditioning, Heating, and Refrigeration Institute, the number of air-conditioners imported by the United States increased from 3.92 million in 2012 to 6.05 million units in 2022, representing an increase in the consumption of air conditioners directly aiding the air compressor market.

- Based on multiple growing industries using the positive displacement air compressor, positive displacement air compressors will likely hold a significant market share during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is witnessing tremendous growth in industrialization in different industries, including small-scale to large-scale. The manufacturing sector significantly contributes to the region's GDP.

- With the growing refining and gas market in countries such as India and China, an increase in the market for air compressors is adamant. Considerable investments in the gas pipeline industry are set to boost the air compressor market.

- Stationary air compressors, including small-size compressors in refrigerators and air conditioners, hold a significant share of the compressor market, and the growing F&B industry is expected to boost the air compressor market.

- The energy and power industry is set to grow in the region due to high investment in power plants from developing nations, such as China and India. It is set to drive industrial growth, which is expected to boost the demand for industrial compressors.

Air Compressor Industry Overview

The air compressor market is fragmented. Some of the key players in this market (not in particular order) include Atlas Copco Group, Ingersoll Rand Inc., Siemens AG, Gardner Denver Inc., and Sullair LLC (Hitachi Group).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Soaring Demand From Natural Gas Sector

- 4.5.1.2 Increasing Demand From The Refinery And Petrochemical Sector

- 4.5.2 Restraints

- 4.5.2.1 Higher Capital Cost Compared To Traditional Internal Combustion Engines

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Positive Displacement

- 5.1.1.1 Reciprocating

- 5.1.1.2 Rotary

- 5.1.2 Dynamic

- 5.1.2.1 Axial

- 5.1.2.2 Centrifugal

- 5.1.1 Positive Displacement

- 5.2 End User

- 5.2.1 Oil and Gas

- 5.2.2 Power Sector

- 5.2.3 Manufacturing Industry

- 5.2.4 Chemicals and Petrochemicals

- 5.2.5 Other End Users

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco Group

- 6.3.2 Ingersoll Rand Inc.

- 6.3.3 General Electric

- 6.3.4 Siemens AG

- 6.3.5 Gardner Denver Inc.

- 6.3.6 Sullair LLC (Hitachi Group)

- 6.3.7 Sulzer Ltd

- 6.3.8 ELGI Equipments Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technical Advancement in the Air Compressor Industry