|

市場調查報告書

商品編碼

1404104

聲學感測器:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Sound Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

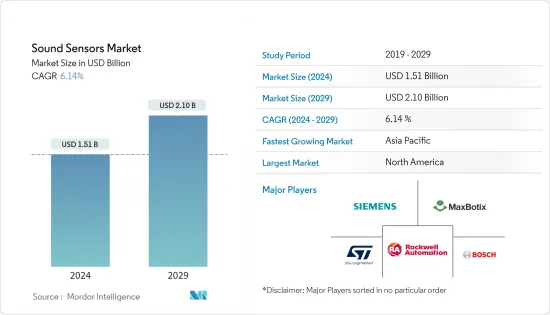

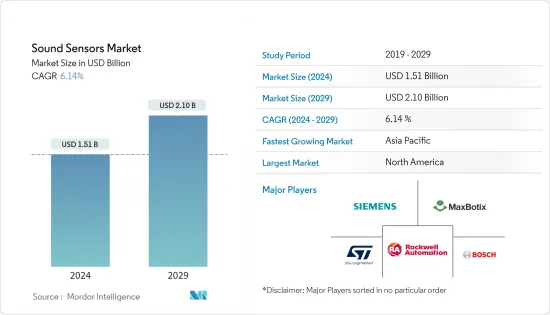

聲學感測器市場規模預計到2024年為15.1億美元,預計到2029年將達到21億美元,在市場估計和預測期間(2024-2029年)複合年成長率為6.14%。

由於新興應用是聲學感測器的潛在市場,例如自動駕駛和半自動車輛以及自動自動導引運輸車,預計未來對聲學感測器的需求將成長。

主要亮點

- 聲音感測器的核心是偵測聲波的感測模組。聲波通常以移動空氣或水分子的機械震動的形式出現,然後轉換為電訊號。聲音感測器的主要部件包括偵測聲音來源的麥克風、峰值檢測器和音訊放大器。聲音感測器主要用於安全、開關和監控應用。

- 推動該市場成長的因素是聲學感測器應用基礎的擴展和技術的快速進步。智慧家庭設備對可靠、高性能感測器的需求不斷成長也是推動聲音感測器市場高速成長的主要因素。此外,大公司在開發具有成本效益和高效的感測器方面的投資導致感測器變得更小,並在家用電子電器產業中找到了重要的應用。

- 聲音感測器,包括超音波和音訊感測器,具有成本低、靈敏度高、能夠在許多行業工作等優點。因此,各領域的採用正在取得進展。例如,這些感測器整合到太陽能城市污染監測 (SPCPM) 系統中,在聲音污染成為人們關注的問題時,有助於監測城市的聲音品質。

- 此外,近年來,智慧家居設備變得越來越普及。這些感測器擴大被涵蓋安全系統、帶有語音命令的家用電器以及父母和看護者的嬰兒監控系統中。由於該領域不斷的技術創新,越來越多的新使用案例被識別出來,為所研究的市場帶來了機會。例如,正在研究開發嬰兒監視器,該監視器可以阻擋其他噪音,同時在嬰兒需要關注時提醒父母。

- 然而,該領域的一個重大限制是擔心表面聲波感測器將被質量靈敏度較低的其他感測器替代。此外,隨著新技術的不斷出現,預計會出現新的挑戰並挑戰所研究市場的成長。

- 另一個技術限制是聲學感測器在真空中使用時的性能有限,因為聲波的傳輸需要空氣。此外,特定聲學感測器的功能也會受到任何表面或軟邊緣的影響,因為某些溫度水平可能會阻礙市場成長。

聲學感測器市場趨勢

醫療保健預計將佔據很大的市場佔有率

- 聲音或聲學感測器是醫療業務的一個組成部分。涉及感測器的醫療業務是高度敏感的功能,需要適當的品質和可靠性。使用超音波換能器進行超音波檢查也是聲學感測器在醫學領域的一個非常重要的特點。

- 連網型醫療服務的發展以及對用於監測關鍵人體生命徵象的低功耗聲學感測器的持續研究正在擴大這些解決方案的應用領域,並將繼續推動這一領域的發展。預計將成為推動需求的關鍵因素之一。

- 近年來,低成本、穿戴式醫療保健設備的採用顯著增加。壓電心音感測器非常適合長期動態監測心臟功能,並為心臟病的初步診斷提供技術支持,從而增加具有健康監測普及的穿戴式設備的採用,將推動所研究市場的機會。

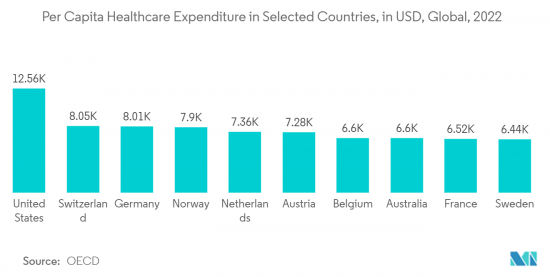

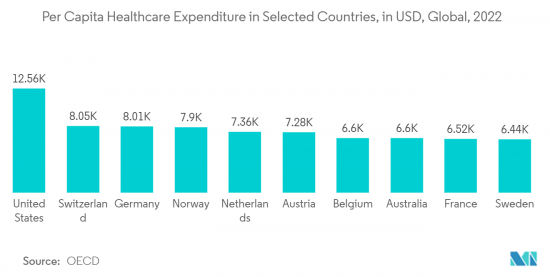

- 世界各地的人均醫療支出不斷增加,對先進醫療設備和技術以幫助改善醫療基礎設施的需求也在增加。例如,根據經合組織的數據,美國在人均醫療支出方面領先全球(12,555.3美元),其次是瑞士(8,049.1美元)和德國(8,010.9美元)。

- 此外,聲音感測器製造和感測能力的進步將使醫療設備製造商受益,考慮到它們的微調和提供清晰明確結果的能力,利用在醫療領域不同領域整合感測器的需求。創造機會。在不久的將來可能會快速滲透到醫療領域,這反過來將為聲學感測器市場的成長做出重大貢獻。

預計北美將佔據較大市場佔有率

- 由於其發達的工業部門以及與其他地區相比安全支出的天文數字差異,預計北美將佔據大部分市場佔有率。高支出表明感測器已經在各個方面開發和有效部署,相對於其他感測器建立了顯著的技術和資訊優勢。

- 美國在醫療保健、國防、工業、消費性電子和通訊方面的支出仍然位居世界前列。例如,根據消費者技術協會 (CTA) 的數據,2023 年美國智慧家庭設備銷售額預計將達到 235 億美元。同樣,該國穿戴式設備的銷售額預計將大幅成長,到 2023 年將達到 138 億美元,而 2018 年為 77 億美元。

- 此外,該市場還得到強大生態系統的支持,支持該地區新技術的快速採用。例如,該地區正在迅速採用工業物聯網(IIOT),因為隨著無線通訊、連網型設備和工廠自動化的採用,已經存在了最大限度地效用聲學感測器的必要基礎設施,它為市場提供了支援。此外,「美國製造」等政府舉措預計將進一步推動工業領域先進技術的採用,並在預測期內為調查市場創造機會。

- 此外,美國也是汽車、國防車輛/設備和飛機的領先製造商之一。例如,該國是波音、洛克希德火星公司和諾斯羅普格魯曼公司等主要飛機製造商的所在地。 2022年,波音在全球交付了約480架飛機。隨著聲學感測器廣泛應用於汽車和飛機系統,這些趨勢正在支持北美市場的成長。

聲學感測器產業概況

聲學感測器市場競爭適度,由幾家主要企業組成。儘管就市場佔有率,但不斷成長的需求正在吸引新參與者進入市場,並加劇供應商之間的競爭。製造商尋求透過提高產品專業知識來獲得競爭優勢。主要市場參與者包括羅克韋爾自動化、西門子、義法半導體和羅伯特博世有限公司。

2023年3月,凸版印刷開發了一種感測系統,可以遠端監測工廠和設施正常運作期間不會出現的摩擦噪音和金屬對金屬碰撞聲音等異常聲音。

2023 年 2 月,PolySense 推出了適用於工業環境和智慧城市的室內外聲學和噪音感測器集群,支援健康監測和城市管理。新型聲學/噪音感測器由新的 iEdge 4.0 OS 模組化和可配置 WxS 產品平台提供支持,可為用戶提供更強大的功能來監控噪音污染並採取行動。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 由於市場技術進步,採用率增加

- 製造成本低

- 市場抑制因素

- 替代技術的出現

第 6 章 技術概覽

- 水聽器

- 定向

- 定向的

- 麥克風

- 駐極體麥克風

- 壓電麥克風

- 電容麥克風

- 動圈/磁力麥克風

- 其他麥克風

第7章市場區隔

- 按最終用戶產業

- 消費性電子產品

- 通訊

- 產業

- 防禦

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第8章競爭形勢

- 公司簡介

- CTS Corporation

- General Electric

- Maxbotix, Inc.

- Rockwell Automation, Inc.

- Siemens AG

- ST Microelectronics, Inc.

- Robert Bosch Gmbh

- Panasonic Corporation

- Bruel & Kjar GmbH

- Teledyne Technologies Incorporated

第9章投資分析

第10章市場機會與未來趨勢

The Sound Sensors Market size is estimated at USD 1.51 billion in 2024, and is expected to reach USD 2.10 billion by 2029, growing at a CAGR of 6.14% during the forecast period (2024-2029).

With emerging applications that have become potential markets for sound sensors, such as autonomous and semi-autonomous self-driving cars and AGVs, the demand for sound sensors is expected to gain momentum in the future.

Key Highlights

- A sound sensor at its core is a sensing module that detects sound waves, usually produced as mechanical vibration of moving air or water molecules, and converts them into electrical signals. A sound sensor's key components include a microphone that detects the sound source, a peak detector, and an audio power amplifier. Sound sensors are primarily adopted in security, switching, and monitoring applications.

- Essential drivers for the growth of this market are the expanding application base for sound sensors and rapid technological advancements. The rising demand for reliable and high-performance sensors in smart home devices is another primary driver that is responsible for the high growth rate of the sound sensors market. Furthermore, investments by major players in developing cost-effective and efficient sensors have also led to miniaturized sensors, which find significant applications in the consumer electronics industry.

- Sound sensors, including acoustic, ultrasound, and audio sensors, have several advantages, like low cost, high sensitivity, and ability to function across many industries. As a result, their adoption has been growing across various sectors. For instance, these sensors are being incorporated into Solar Powered City Pollution Monitor (SPCPM) systems, which can help monitor sound quality in the city, as sound pollution is a growing concern nowadays.

- Furthermore, in recent years, the penetration of smart home devices has also grown significantly. These sensors are increasingly being incorporated into security systems, appliances with voice command features, baby monitoring systems for parents or caretakers, etc. With innovations being a constant in this domain, new use cases are increasingly being identified, driving opportunities in the studied market. For instance, research works are being undertaken to develop a baby monitor that alerts parents when their baby needs attention while filtering out the noise from other sources.

- However, a significant limitation of this sector is the concern with respect to surface acoustic wave sensors being substituted with other sensors with a low mass sensitivity. Furthermore, with new technologies continuously emerging, new challenges are also anticipated to appear and challenge the growth of the studied market.

- Other technical limitations include the performance limitation of sound sensors when used in a vacuum, as sound waves require air for transmission. Additionally, the capabilities of specific sound sensors are also affected by any surface or soft edges, as a certain temperature level is likely to hamper the growth of the studied market.

Sound Sensors Market Trends

Healthcare is Expected to Hold a Significant Market Share

- Sound or acoustic sensors form an integral part of medical operations. Medical operations, including the sensors, are extremely sensitive functions that require proper quality and reliability. Using ultrasonic transducers for sonography is another very important function of sound sensors in the medical sector.

- The evolution of connected medical services and the continued research in low-power sound-based sensors used in monitoring the critical vitals of the human body have broadened the application area for these solutions, and this is expected to remain one of the significant factors driving the demand for this segment.

- In recent years, the adoption of low-cost and wearable healthcare devices has grown significantly. As piezoelectric heart sound sensors are highly suitable for long-term dynamic monitoring of the heart's functioning and provide technical support for preliminary diagnosis of heart disease, the growing penetration of wearables with health monitoring facilities will drive opportunities in the studied market.

- With per capita healthcare expenditure growing across the globe, the demand for advanced medical devices and technologies to help improve the healthcare infrastructure is also growing, which in turn is creating a favorable outlook for the growth of the studied market. For instance, according to the OECD, the United States leads the world in terms of per capita healthcare expenditure (USD 12,555.3), followed by Switzerland (USD 8,049.1) and Germany (USD 8,010.9)

- Furthermore, advancements in the fabrication and sensing capabilities of sound sensors have also created an opportunity for medical device manufacturers to capitalize on the need for the integration of sensors in different fields of the healthcare sector, considering its ability to fine-tune and provide definite and clear results. A rapid penetration in the medical sector is plausible and can be observed in the near future, which, in turn, will contribute significantly to the growth of the sound sensors market.

North America is Expected to Hold a Major Market Share

- North America is expected to hold most of the market share, owing to its developed industrial segment and the astronomical difference in security spending compared to others. The high spending indicates a developed and efficient implementation of sensors on different fronts to establish a significant technological and intelligence advantage over others.

- The healthcare, defense, industrial, consumer electronics, and telecommunication-related expenses in the United States are still among the highest in the world. For instance, according to the Consumer Technology Association (CTA), the sales of smart home devices in the United States are anticipated to reach USD 23.5 billion in 2023. Similarly, wearable device sales revenue in the country is also anticipated to grow significantly, reaching USD 13.8 billion in 2023, compared to USD 7.7 billion in 2018.

- Furthermore, the market has also been helped by a robust ecosystem supporting the fast adoption of new technology in the region. For instance, IIOT adoption has been fast in the region, as adopters of wireless communication, connected devices, and factory automation have helped the market, as the infrastructure necessary to maximize the utility of acoustic sensors is already there. Additionally, government initiatives such as "Made in America" are anticipated to further drive the adoption of advanced technologies in the industrial domain, creating opportunities in the studied market during the forecast period.

- Moreover, the United States is also among the leading manufacturers of automobiles, defense vehicles/equipment, and aircraft. For instance, the country is home to some of the leading aircraft manufacturers, including Boeing, Lockheed Martien, Northrop Grumman Corp, etc. In 2022, Boeing delivered about 480 aircraft globally. As sound sensors are widely used in automobiles and aircraft systems, such trends support the studied market's growth in North America.

Sound Sensors Industry Overview

The sound sensors market is moderately competitive and consists of several major players. A few of the major players currently dominate the market in terms of market share; however, the growing demand is attracting new players into the market, driving competitive rivalry among the vendors. The manufacturers are trying to gain a competitive advantage by improving their expertise in the product. Some key market players include Rockwell Automation, Siemens, STMicroelectronics, and Robert Bosch Gmbh, among others.

In March 2023, Toppan developed a sensing system for remotely monitoring abnormal sounds, such as friction and metal-on-metal impacts, that do not occur during normal operation at factories and facilities to drive greater efficiency for inspection and maintenance work by promptly identifying abnormalities in equipment, indicating when machinery parts need maintenance or replacement.

In February 2023, Polysense announced indoor and outdoor sound/noise sensor clusters for industrial environments and smart cities, enabling health monitoring and city management. Powered by the new iEdge 4.0 OS modular and configurable WxS product platform, the new sound/noise sensor can equip users with more powerful capabilities to monitor and take action on noise pollution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technology Advancement in the Market, Leading to Increasing Adoption

- 5.1.2 Low Manufacturing Cost

- 5.2 Market Restraints

- 5.2.1 Emergence of Alternative Technologies

6 TECHNOLOGY SNAPSHOT

- 6.1 Hydrophone

- 6.1.1 Omni-directional

- 6.1.2 Directional

- 6.2 Microphone

- 6.2.1 Electret Microphones

- 6.2.2 Piezoelectric Microphones

- 6.2.3 Condenser Microphones

- 6.2.4 Dynamic/Magnetic Microphones

- 6.2.5 Other Microphones

7 MARKET SEGMENTATION

- 7.1 By End-User Industry

- 7.1.1 Consumer Electronics

- 7.1.2 Telecommunications

- 7.1.3 Industrial

- 7.1.4 Defense

- 7.1.5 Healthcare

- 7.1.6 Other End-User Industries

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 CTS Corporation

- 8.1.2 General Electric

- 8.1.3 Maxbotix, Inc.

- 8.1.4 Rockwell Automation, Inc.

- 8.1.5 Siemens AG

- 8.1.6 ST Microelectronics, Inc.

- 8.1.7 Robert Bosch Gmbh

- 8.1.8 Panasonic Corporation

- 8.1.9 Bruel & Kjar GmbH

- 8.1.10 Teledyne Technologies Incorporated