|

市場調查報告書

商品編碼

1404099

活性碳:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Activated Carbon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

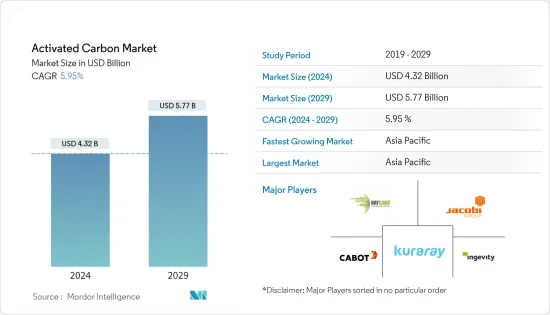

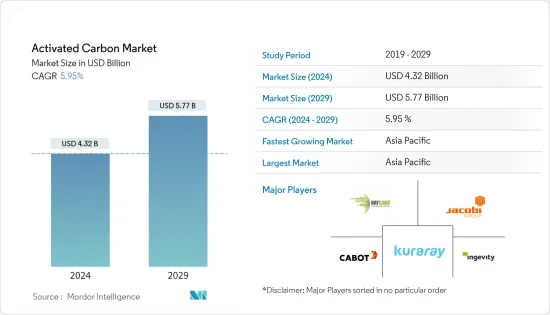

活性碳市場規模預計到2024年為43.2億美元,預計到2029年將達到57.7億美元,在預測期內(2024-2029年)複合年成長率為5.95%。

由於COVID-19大流行,金屬採礦等各種最終用戶行業的活動暫時停止,需求下降,市場受到負面影響。然而,自疫情結束以來,所研究市場的需求已恢復成長,預計未來幾年將大幅成長。

主要亮點

- 中期推動市場的關鍵因素是美國水處理應用嚴格的環境法規的遵守以及空氣污染預防(尤其是除汞)的重要性日益增加。

- 某些等級活性碳的成本上升、矽膠等替代品的威脅以及由於開拓更好的替代品而導致的新興市場萎縮預計將阻礙市場成長。

- 醫療製藥領域的新應用可能會成為市場的機會。

- 亞太地區佔據最高的市場佔有率,該地區很可能在預測期內主導市場。

活性碳市場趨勢

水處理產業主導市場

- 水處理是活性碳的常見用途。大多數水處理過濾器由顆粒活性碳製成。活性碳用於去除有機化學物質和著色劑,減少化學物質等微量物質。活性碳通常以顆粒形式用於去除各種污染物,包括非生物分解的有機化合物、可吸收的有機鹵素、著色化合物和染料以及殺蟲劑。

- 污水和壓艙水水處理、地下水淨化、地表水庫、地下水和意外洩漏淨化是活性碳的其他活動。活性碳也有助於去除廢水處理廠產生的氣味,污水廠的生物活性會產生硫化氫 (H2S)、氨 (NH3)、VOC 等。

- 此外,由環境保護局 (EPA) 協調的《安全飲用水法》和《清潔水法》等聯邦政策計劃運行創新的水和污水排放技術。應用。因此,水處理領域對活性碳的需求預計將進一步增加。

- 中國有10113座水處理廠,處理來自95%城市和30%農村地區的污水。此外,在2021年3月公佈的「十四五」規劃中,中國公佈了新的污水回用指南,到2025年將必須處理達到回用標準的污水比例提高到25%,強制提高到%。

- 水處理是活性碳的常見用途。大多數水處理過濾器由顆粒活性碳製成。用於去除有機化學物質和色素,減少化學物質等微量物質。使用活性碳是處理城市/工業污水最有效的方法之一。活性碳通常以顆粒形式用於去除各種污染物,非生物分解的有機化合物、可吸收的有機鹵素、著色化合物和染料以及殺蟲劑。

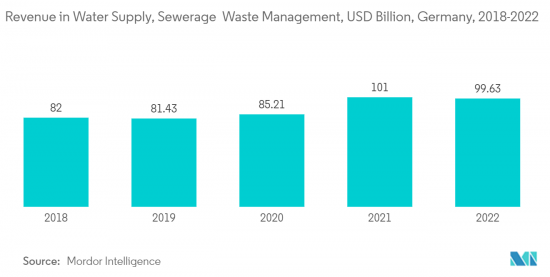

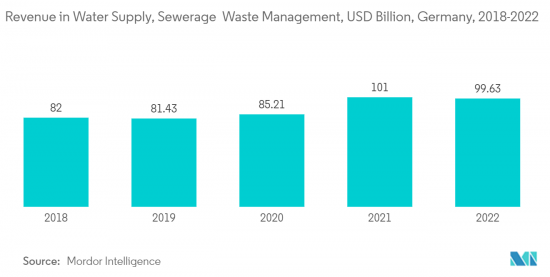

- 德國的水處理技術市場是歐洲最大的,並且正在顯著成長。根據歐盟統計局和德國聯邦統計局的數據,2022年德國用水和污水、廢水和廢棄物管理產業的收益達到996.3億美元。

- 因此,考慮到世界不同地區水處理的成長趨勢和各種計劃,水處理行業很可能佔據市場主導地位,因此預計將在預測期內推動活性碳的需求。 。

亞太地區主導市場

- 2022 年,亞太地區在活性碳市場上佔據主導地位,擁有巨大的銷售佔有率,預計在預測期內將保持其主導地位。

- 近年來,中國增加了處理水的使用,以減少對淡水的依賴。隨著中國五年計畫 (FYP) 中嚴格的法律規範以及中水回用的重要性日益提高,中國正在迅速加強水處理產業,以實現永續的未來。

- 據國際貿易管理局稱,中國計劃從2021年到2025年建造或維修8萬公里污水收集管網,增加污水處理能力2,000萬立方公尺/日。

- 中國是公認的醫藥市場,也是活性碳發展最快的新興市場。該國國內製藥業規模龐大且多元化,擁有約 5,000 家製造商,其中許多是中小型製造商。

- 在印度,班加羅爾市用水和污水部門選擇蘇伊士來支持該城市並改善其污水基礎設施。集團計劃新建一座15萬立方米/天的污水處理廠,其中包括對一座15萬立方米/天的現有污水處理廠維修,以及這兩座工廠產生的污泥的污水處理。規劃建設污泥資源化利用廠。因此,印度對水處理的興趣正在增加,活性碳市場預計將會成長。

- 根據印度品牌股權基金會(IBEF)統計,2022年該國汽車年產量約2,293萬輛。汽車產量佔該國GDP的49%,該產業的成長可能會增加印度對活性碳的需求。

- 印度的食品工業是該國最大的食品工業之一。人口成長也是推動食品產業需求的因素,預計這反過來又會推動印度活性碳市場的發展。在印度,食品加工工業部批准了24個邦的42個大型食品園區,每個邦都處於實施階段。

- 因此,上述原因預計將在預測期內推動亞太地區活性碳市場的成長。

活性碳產業概況

活性碳市場已部分整合,多家公司在全球和區域層面運作。市場上的主要企業(排名不分先後)包括 Kuraray、Cabot Corporation、Ingevity、Jacobi Carbons Group 和 Haycarb (Pvt.) Ltd。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 遵守美國嚴格的水處理應用環境法規

- 日益關注空氣污染預防(特別是汞去除)

- 抑制因素

- 由於某些等級的活性碳成本上漲導致市場萎縮

- 矽膠等替代品的威脅以及更好替代品的開發

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 依產品類型

- 粉狀活性碳(PAC)

- 顆粒活性碳(GAC)

- 擠壓或粒狀活性碳

- 按用途

- 氣體淨化

- 淨水

- 金屬提取

- 藥品

- 其他用途

- 按最終用戶產業

- 水處理

- 食品和飲料

- 醫療保健

- 車

- 工業加工

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 亞太地區

第6章競爭形勢

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Advanced Emissions Solutions Inc.

- Albemarle Corporation

- Cabot Corporation

- Carbon Activated Corporation

- CARBOTECH

- CPL Activated Carbons

- Donau Carbon GmbH

- Evoqua Water Technologies LLC

- Haycarb(Pvt.)Ltd

- Ingevity

- Jacobi Carbons Group

- Kuraray Co. Ltd

- Kureha Corporation

- Puragen Activated Carbons

- Silcarbon Aktivkohle GmbH

- Veolia(Veolia Water Technologies)

第7章 市場機會及未來趨勢

- 醫療製藥領域新應用

The Activated Carbon Market size is estimated at USD 4.32 billion in 2024, and is expected to reach USD 5.77 billion by 2029, growing at a CAGR of 5.95% during the forecast period (2024-2029).

The market was negatively impacted by the COVID-19 pandemic as the demand was reduced, considering the temporary halt of activities in various end-user industries, such as metal extraction and others. However, since the end of the pandemic, the demand for the market studied has picked up the pace and is likely to grow at a significant rate in the coming years.

Key Highlights

- In the medium term, major factors driving the market are conformance to stringent environmental regulations in water treatment applications in the United States and the increasing prominence of air pollution control (especially mercury removal).

- Narrower markets, due to the increased costs of some grades of activated carbon, the threat of substitutes like silica gel, and the development of better alternatives, are expected to hinder the growth of the market.

- Emerging applications in the medical and pharmaceutical sectors is likely to act as an opportunity for the market.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Activated Carbon Market Trends

Water Treatment Industry to Dominate the Market

- Water treatment is a popular application of activated carbon. Most water treatment filters are made of granular activated carbon. It is used to remove organic-chemical substances and colorants and reduce trace substances, such as chemicals.The usage of activated carbon is one of the most effective methods for the treatment of municipal/industrial wastewater. Activated carbon is normally used in granular form to remove a wide variety of contaminants, such as nonbiodegradable organic compounds, absorbable organic halogens, color compounds and dyestuffs, and pesticides.

- Wastewater and ballast water treatment, groundwater remediation, surface impoundments, and cleanup of groundwater and accidental spills are other applications of activated carbon. Activated carbon also helps in the removal of odors that occur in wastewater plants, where biological activity creates hydrogen sulfide (H2S), ammonia (NH3), VOCs, etc.

- In addition, federal policy programs, including the Safe Drinking Water Act and the Clean Water Act coordinated by the Environmental Protection Agency (EPA), provide treatment and discharge regulations, funding programs, and frameworks for operating and applying innovative water and wastewater treatment technologies. Hence, this is further expected to boost the demand for activated carbons from the water treatment segment.

- China has 10,113 water treatment plants that treat wastewater for 95% of municipalities and 30% of rural areas. Moreover, in the 14th Five-year Plan, released in March 2021, China published new guidelines for wastewater reuse, which mandated raising the proportion of sewage that must be treated to reuse standards to 25% by 2025.

- Water treatment is a popular application of activated carbon. Most water treatment filters are made of granular activated carbon. It is used to remove organic-chemical substances and colorants and reduce trace substances such as chemicals. The usage of activated carbon is one of the most effective methods for the treatment of municipal/industrial wastewater. Activated carbon is normally used in granular form to remove a wide variety of contaminants, such as nonbiodegradable organic compounds, absorbable organic halogens, color compounds and dyestuffs, and pesticides.

- The German water treatment technology market is the largest in Europe and is growing considerably. According to the Eurostat and Statistisches Bundesamt, the revenue of Germany's water supply, sewerage, and waste management industry generated USD 99.63 billion in 2022.

- Therefore, considering the growth trends and various projects of water treatment in different regions worldwide, the water treatment industry is likely to dominate the market, which, in turn, is expected to enhance the demand for activated carbon during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominated the activated carbon market in 2022 with a considerable volume share, and it is expected to maintain its dominance during the forecast period.

- In recent years, China has increased the use of treated water to reduce its dependency on fresh water. With a tough regulatory framework and the increasing importance of water reuse in China's five-year plans (FYPs), the country is rapidly moving toward enhancing its water treatment industry for a sustainable future.

- According to the International Trade Administration, China plans to build or renovate 80,000 km of sewage collection pipeline networks and increase sewage treatment capacity by 20 million cubic meters/day between 2021 and 2025.

- China has a recognized market for pharmaceuticals and is the fastest emerging market for activated carbons. The country has a large and diverse domestic drug industry, comprising around 5,000 manufacturers, of which many are small- or medium-sized.

- In India, the Water Supply and Sewerage Board of Bangalore selected SUEZ to support the city and improve wastewater infrastructures. The group is expected to build a new wastewater treatment plant of 150,000 m3/day capacity, including the rehabilitation of an existing plant, with a capacity of 150,000 m3/day and the building of a sewage sludge recycling and recovery plant, for the sludge coming from these two plants. This increase in focus on water treatment in the country is expected to drive the activated carbon market growth.

- As per the India Brand Equity Foundation (IBEF), the country's annual production of automobiles in FY 2022 was nearly 22.93 million. Automotive production accounts for 49% of the country's GDP, and hence, the growth in this sector is liable to increase the demand for activated carbon in India.

- The Indian food industry is one the prominent industries in the country. The increasing population is another factor boosting the demand for the food industry, which, in turn, is estimated to boost the activated carbon market in India. There are 42 mega food parks located in 24 states in India, sanctioned by the Ministry of Food Processing Industry, which are in different stages of implementation.

- Thus, the reasons mentioned above are likely to fuel the growth of the activated carbon market in Asia-Pacific during the forecast period.

Activated Carbon Industry Overview

The activated carbon market is partially consolidated, with several companies operating on both global and regional levels. Some of the major players in the market (not in any particular order) include Kuraray Co. Ltd, Cabot Corporation, Ingevity, Jacobi Carbons Group, and Haycarb (Pvt.) Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Conformance to Stringent Environmental Regulations in Water Treatment Applications in the United States

- 4.1.2 Augmenting Prominence for Air Pollution Control (Especially Mercury Removal)

- 4.2 Restraints

- 4.2.1 Narrower Markets Due to Increased Costs of Some Grades of Activated Carbon

- 4.2.2 Threat of Substitutes Like Silica Gel and Development of Better Alternatives

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Product Type

- 5.1.1 Powdered Activated Carbons (PAC)

- 5.1.2 Granular Activated Carbons (GAC)

- 5.1.3 Extruded or Pelletized Activated Carbon

- 5.2 By Application

- 5.2.1 Gas Purification

- 5.2.2 Water Purification

- 5.2.3 Metal Extraction

- 5.2.4 Medicine

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Water Treatment

- 5.3.2 Food and Beverage

- 5.3.3 Healthcare

- 5.3.4 Automotive

- 5.3.5 Industrial Processing

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advanced Emissions Solutions Inc.

- 6.4.2 Albemarle Corporation

- 6.4.3 Cabot Corporation

- 6.4.4 Carbon Activated Corporation

- 6.4.5 CARBOTECH

- 6.4.6 CPL Activated Carbons

- 6.4.7 Donau Carbon GmbH

- 6.4.8 Evoqua Water Technologies LLC

- 6.4.9 Haycarb (Pvt.) Ltd

- 6.4.10 Ingevity

- 6.4.11 Jacobi Carbons Group

- 6.4.12 Kuraray Co. Ltd

- 6.4.13 Kureha Corporation

- 6.4.14 Puragen Activated Carbons

- 6.4.15 Silcarbon Aktivkohle GmbH

- 6.4.16 Veolia (Veolia Water Technologies)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications in the Medical and Pharmaceutical Sectors