|

市場調查報告書

商品編碼

1404090

玻璃瓶與容器:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Glass Bottles and Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

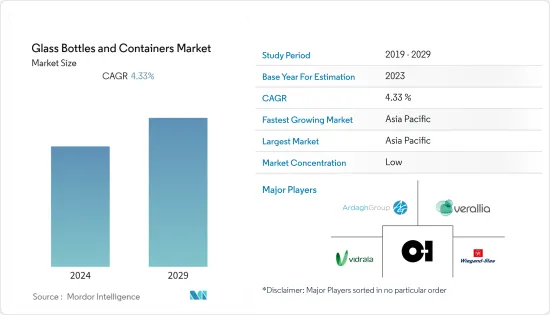

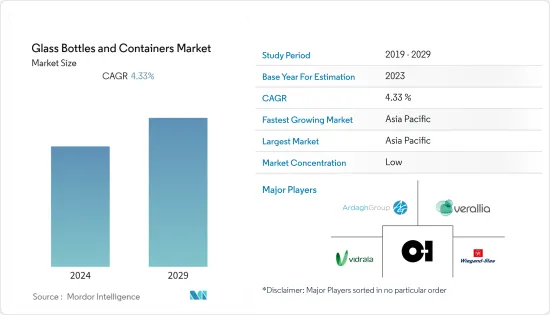

玻璃瓶及容器市場規模預計將從2024年的8,306.2億個擴大到2029年的1.3兆個,預測期內(2024-2029年)複合年成長率為4.33%。

主要亮點

- 消費者對安全健康包裝的需求不斷成長,推動了各類別玻璃包裝的成長。此外,玻璃壓花、成型和添加藝術飾面的創新技術使玻璃包裝更受最終用戶歡迎。此外,對環保產品的需求增加以及食品和飲料市場需求的增加等因素也推動了市場的成長。

- 近年來,食品包裝的透明化趨勢日益明顯。消費者希望在購買前看到實際的產品,而不僅僅是列出的成分。許多公司,尤其是乳製品公司,已經開始在透明玻璃容器中提供產品,以抓住這一趨勢。

- 玻璃瓶和透明容器具有永恆而優雅的設計,吸引消費者。玻璃的透明度也賦予產品奢華精緻的外觀,使它們在貨架和陳列架上更具吸引力。這些因素可能會在預測期內推動該產業的成長。

- 推動市場成長的另一個因素是醫療產業對玻璃瓶的需求不斷增加。此外,人們可支配收入的增加也是推動市場開拓的主要因素,因為消費者往往要求更有效和美觀的包裝設計。

- 此外,糖尿病患者數量的增加是注射用玻璃瓶成長的主要驅動力。根據世界衛生組織 (WHO) 統計,近年來全球約有 4.22 億人患有糖尿病。數量的增加推動了對胰島素的需求並促進了市場成長。

- 然而,玻璃瓶和容器是易碎的,需要適當的處理以及操作和後勤預防措施。這已成為部署玻璃包裝解決方案的公司面臨的關鍵挑戰。由於其重量和體積,玻璃包裝不適合遠距運輸。作為傳統產業的限制,這也是玻璃包裝產業主要面向本土的主要原因。此外,玻璃製造的碳排放也預計將阻礙市場成長。

- 隨著消費者和產業對永續包裝的認知不斷增強,永續包裝似乎還有很大的成長空間,特別是在目睹了這場流行病之後。隔離後,消費者開始專注於更健康的生活方式,並開始尋找永續的解決方案,特別是與食品和飲料產業相關的產品。

- 需求激增很大程度上得益於購買力的增強、現代零售、都市化以及消費者健康衛生意識的增強,預計後疫情時代將為玻璃包裝行業創造重大成長機會。

玻璃瓶及容器的市場趨勢

葡萄酒和烈酒引領非酒精飲料領域

- 玻璃瓶是酒類包裝的首選,尤其是彩色玻璃瓶。否則,它將變得腐敗。預計葡萄酒消費量的成長將在預測期內推動玻璃包裝的需求。釀酒師變得越來越創新,開發新的概念和設計,以透過包裝吸引顧客。例如,Vinebox 每年向客戶運送四次裝在 100 毫升圓柱形玻璃容器中的九種單份葡萄酒。

- 玻璃瓶裝葡萄酒透過設計、優雅的感覺和傳統提供優質的體驗。獨特的設計提供了其他包裝材料無法找到的奢華感。在已開發國家,葡萄酒也被用作禮物。因此,用獨特的玻璃瓶包裝的葡萄酒比其他包裝解決方案具有優勢。

- 品牌和包裝製造商正在專注於開發輕質玻璃瓶,以減少碳足跡。此外,品牌和公司也在進行實驗和研究,開發用於香檳氣泡酒的輕量瓶子。法國玻璃製造商Velaria Group和Champagne Termont宣布,他們在2023年使用800克香檳玻璃瓶的最新實驗取得了成功。新型輕質玻璃瓶每瓶可減少約 4% 的二氧化碳排放量。

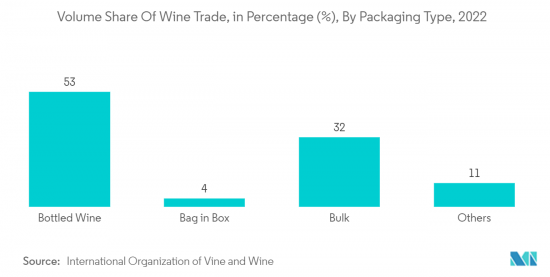

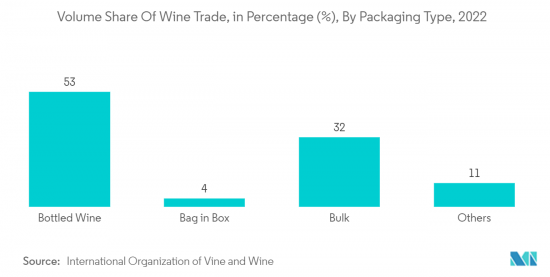

- 美國、法國、義大利、德國、英國是葡萄酒消費量排名前五的國家。根據國際葡萄與葡萄酒組織的數據,2022年美國葡萄酒消費量較2021年成長2.8%。此外,瓶裝葡萄酒佔全球貿易量的大部分,到2022年將佔全球貿易量的53%和貿易額的68%。 2022年瓶裝葡萄酒貿易額較2021年成長7%。大多數國家瓶裝葡萄酒的出口量高於其他包裝類型。例如,義大利57%、法國72%、智利58%、德國73%、葡萄牙76%、美國52%、阿根廷76%、澳洲35%、西班牙34%。

- 全球烈酒消費和貿易的成長正在推動烈酒玻璃瓶的需求。根據美國蒸餾酒協會統計,美國是世界第二大蒸餾酒市場。過去 20 年,美國烈酒出口額幾乎翻了兩番,到 2022 年將達到約 21 億美元,高於 5.51 億美元。 2023年1月至6月美國威士忌出口量約2,330萬加侖。瓶裝威士忌約佔威士忌出口總量的55.44%。這顯示對市場的影響重大。

亞太地區佔最大市場佔有率佔有率

- 由於國家經濟的擴張和具有購買力的中階的不斷壯大,中國的包裝產業正在快速穩定地成長。近年來,中國飲料市場成長顯著,因此對飲料包裝的需求不斷增加。

- 雖然每個飲料類別都有其挑戰和機遇,但中國消費者生活方式的新趨勢正在塑造對玻璃包裝的需求。在中國,大城市中心各行業的酒精和非酒精飲料消費量都在增加。中國百萬富翁最喜歡的飲料包括紅酒、威士忌和香檳。

- 印度酒精飲料消費量的增加預計將支持玻璃瓶和容器的成長。玻璃瓶是酒精飲料的首選,而葡萄酒則使用野生彩色玻璃瓶,因為葡萄酒暴露在陽光下會變質。此外,葡萄酒消費量的成長預計將在預測期內帶動玻璃包裝需求。例如,根據加拿大農業和農業食品部的數據,到 2025 年,印度的葡萄酒消費量預計將達到 5,220 萬公升。

- 此外,市場需求也受到非酒精飲料成長的影響。無酒精飲品是支撐非酒精飲料業務最重要的支柱。玻璃瓶裝在印度可樂銷售中佔 35% 的佔有率。 2022 年 5 月,Coca-Cola India Pvt. Ltd 再次開始在部分邦促銷可口可樂、Thums Up 和 Sprite 等最暢銷品牌的可回收玻璃瓶。在某些市場,到 2022 年,玻璃瓶將佔飲料銷售量的 30%。

- 過去幾年國內啤酒的成長預計將支持玻璃包裝的成長。 2022 年,韓國啤酒零售額達 192.7 億美元,高於 2018 年的 159.8 億美元。該市場在過去幾年中經歷了成長,預計未來幾年將出現類似變化的跡象(加拿大農業和農業食品)。

- 除了本研究中已列為亞太地區的國家外,澳洲、台灣、泰國、馬來西亞、新加坡和越南等國家也可能在調查市場中佔有重要佔有率。酒精飲料銷量的成長、收購和合併正在推動該地區的玻璃包裝市場。

玻璃瓶及容器產業概況

玻璃瓶和容器市場主要由少數幾家大公司主導,包括 Gerresheimer AG、Owens-Illinois (OI)、Ardagh Packaging Group PLC 和 Piramal Glass Ltd。這些行業巨頭在不同地區開展業務,並擁有多樣化的產品系列。然而,該行業面臨激烈的競爭,因為許多其他公司也生產類似的產品。

強大且信譽良好的品牌預計將保持競爭優勢,因為它們可以在市場上佔有一席之地並提供先進的產品。此外,大規模的資本注入將增加現有企業的退出壁壘,進一步加劇產業內的競爭。

2023 年 9 月,Ardagh Glass Packaging 宣布一項計劃,在其奧本基興工廠建造一座環境永續的熔爐,旨在減少溫室氣體排放。 NextGen 反應器計畫於年終年底開始生產商用玻璃容器,玻璃瓶日產量將高達 350 噸 (t)。

2023年7月,飲料業玻璃包裝的技術創新迅速增多,為了追求飲用的便利性,推出了廣口產品「Drinktainer」。 FX Matt Beverage Co. 和 OI Glass 合作將這項創新推向市場。 Drinktainer 是兩家公司成功建立新合作關係的成果。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 新冠疫情後對玻璃瓶和容器市場的影響

- 烏克蘭與俄羅斯衝突對玻璃瓶及容器市場的影響

- 使用關鍵促進因素(組件和能源消費量)進行成本分析 - 玻璃容器的組件

第5章市場動態

- 市場促進因素

- 食品和飲料行業的需求不斷成長

- 永續性和回收性努力推動包裝商和消費品牌轉向玻璃包裝

- 市場抑制因素

- 玻璃製造造成的高碳足跡

- 營運和物流問題

第6章市場區隔

- 按最終用戶產業

- 飲料

- 有酒精的飲品

- 啤酒和蘋果酒

- 葡萄酒/烈酒

- 其他酒精飲料

- 非酒精性

- 碳酸飲料

- 牛奶

- 水和其他非酒精飲料

- 食品

- 化妝品

- 藥品

- 其他行業

- 飲料

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 波蘭

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 中東和非洲其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 北美洲

第7章競爭形勢

- 公司簡介

- OI Glass, Inc.

- Vidrala SA

- Ardagh Group SA

- Wiegand-glas GmbH

- Verallia Packaging

- Vetropack Holding Ltd

- Stoelzle Oberglas GmbH(CAG-holding GmbH)

- Gaasch Packaging

- Beatson Clark

- Vitro SAB de CV

- Schott AG

- Glassworks International Limited

- Gerresheimer AG

- Middle East Glass Manufacturing Co SAE

- Berlin Packaging LLC

- BA VIDRO SA(BA Glass BV)

- PGP Glass Private Limited

- VERESCENCE FRANCE

- SGD SA(SGD Pharma)

- Saver Glass SAS(The Carlyle Group Inc.)

第8章投資分析

第9章 市場的未來

The glass bottles and containers market size is expected to grow from 830.62 billion units in 2024 to 1.03 trillion units by 2029, at a CAGR of 4.33% during the forecast period (2024-2029).

Key Highlights

- Increasing consumer demand for safe and healthier packaging is helping glass packaging grow in different categories. Also, innovative technologies for embossing, shaping, and adding artistic finishes to glass make glass packaging more desirable among end users. Furthermore, factors such as the increasing demand for eco-friendly products and the rising demand from the food and beverage market are stimulating the market's growth.

- There has been an increasing transparency trend in food packaging over the past few years. Beyond the labeled listed ingredients, consumers also want to see the physical product before purchasing. Many companies, especially dairy products, have started offering them in transparent glass containers to capture this trend.

- Glass bottles and transparent containers have a timeless, elegant design that appeals to consumers. The transparency of glass also adds a premium and refined look to products, making them more appealing on shelves or displays. These factors would drive segment growth over the forecast period.

- Another factor driving the market's growth is the increasing demand for glass bottles from the healthcare industry. The rise in the disposable income of people is also a significant factor propelling the development of the market, as consumers tend to demand more effective and aesthetic packaging design.

- Moreover, the increasing number of people with diabetes significantly supports the growth of glass bottles for injectable pharmaceuticals. According to the World Health Organization (WHO), around 422 million people worldwide have had diabetes in recent years. The increase in this number drives the demand for insulin, thereby contributing to the market's growth.

- However, glass bottles and containers are fragile and need proper handling and care of operation and logistics. This stands as a significant challenge for companies deploying glass packaging solutions. Due to its weight and bulkiness, glass packaging is unsuitable for long-distance transportation. As a traditional industry constraint, this is the main reason that the glass packaging industry is primarily locally oriented. In addition, the carbon footprint due to glass manufacturing is also expected to hinder the market's growth.

- With the increase in the awareness of sustainable packaging among consumers and industries, especially after witnessing the pandemic, there will be huge scope for growth in sustainable packaging. After the lockdown, consumers are more focused on adopting a healthier lifestyle and have started looking for sustainable solutions, especially for products related to the food and beverage sector.

- The surge in demand, owing largely to the growing purchasing power, modern retail, urbanization, and increasing awareness about health and hygiene among consumers, is expected to create significant growth opportunities for the glass packaging industry in the post-COVID world.

Glass Bottle and Container Market Trends

Wine and Spirits to Lead the Non-alcoholic Beverages Segment

- The glass bottle is most favored in wine packaging, especially colored glass, the reason being that wine should not be exposed to sunlight. Otherwise, it gets spoiled. The increasing consumption of wine is expected to spearhead the glass packaging demand during the forecasted period. Wine manufacturers are becoming increasingly innovative to attract customers with the packaging and are developing new concepts and designs. For example, Vinebox ships customers a box of nine single-serve wines packaged in cylindrical 100 ml glass containers four times a year.

- The wine packed in glass bottles offers a premium experience through the design, elegant feel, and heritage. The unique design provides the feeling of luxury that other packaging materials could not offer. Wine is also used for gifting purposes on occasions in the developed country. Therefore, the wine packed in unique glass bottles gains an advantage over the other packaging solutions.

- The brands and packaging manufacturers focus on developing lightweight glass bottles to reduce carbon footprints. In addition, the brands and companies are also carrying out experiments and studies to develop lightweight bottles for sparkling wine called champagne. French glassmaker Verallia Group and Champagne Telmont announced the success of their most recent experiment of using an 800-gram champagne glass bottle in 2023. The new lighter glass bottles will generate around 4% less carbon dioxide per bottle produced.

- The United States, France, Italy, Germany, and the United Kingdom are the top five countries in terms of wine consumption. According to the International Organization of Vine and Wine, wine consumption in the United States increased by 2.8% in 2022 compared to 2021. Furthermore, bottled wine represented the major portion of the trade volume globally, accounting for 53% in terms of trade volume and 68% in terms of trade value for the year 2022. The bottled wine trade value increased by 7% in 2022 compared to 2021. Bottled wine exports were high in most countries compared to other packaging types. For instance, Italy exported 57% of wine in bottles, France 72%, Chile 58%, Germany 73%, Portugal 76%, the United States 52%, Argentina 76%, Australia 35%, and Spain 34%.

- The increasing consumption and trade of spirits worldwide are driving the demand for glass bottles for spirits. The United States is the second-largest market for spirits in the world, according to the Distilled Spirits Council of the United States. The spirits export in the United States nearly quadrupled over the past two decades, reaching around USD 2.1 billion in 2022 from USD 551 million in 2022. The export of whiskey in the United States stood at around 23.3 million gallons from January to June 2023. Out of the total whiskey exports, bottled whiskey accounts for around 55.44% of the total. This showcases a fair impact on the market.

Asia-Pacific to Hold the Largest Market Share

- The packaging industry in China is growing at a fast and steady rate due to the country's expanding economy and growing middle class with more purchasing power. The need for beverage packaging is increasing because China's beverage market has grown significantly recently.

- Each beverage category will have challenges and opportunities, but new trends in the Chinese consumer lifestyle are shaping the demand for glass packaging. China has seen a rise in the consumption of alcoholic and non-alcoholic drinks across all industries in its large urban centers. Some of the most preferred beverages by millionaires in China are Red Wine, Whiskey, and Champagne.

- The increase in the consumption of alcoholic beverages in India is expected to support the growth of glass bottles and containers. The glass bottle is most favored in alcoholic beverages, wildly colored glass for wine because wine gets spoiled if exposed to the sunlight. Also, the increasing consumption of wine is expected to spearhead the glass packaging demand during the forecasted period. For Example, according to Agriculture and Agri-Food Canada, the volume of wine consumption across India is projected to reach 52.2 million liters in 2025.

- Moreover, the demand for the market will also be impacted by the growth in non-alcoholic beverages. Soft drinks are the most significant pillar on which the business of non-alcoholic drinks rests. Glass bottles retain a 35% share of sales for Coke in India. In May 2022, Coca-Cola India Pvt. Ltd started promoting returnable glass bottles again in select states across the company's top-selling brands, such as Coca-Cola, Thums Up, and Sprite. In some markets, glass bottles comprise 30% of beverage sales in 2022.

- The growth in domestic beer during the past years is expected to support growth in glass packaging. The retail sales of beer in South Korea reached USD 19.27 billion in 2022 from USD 15.98 billion in 2018. The market has experienced growth in the past years and is anticipated to show similar signs of change in the years ahead (Agriculture and Agri-Food Canada).

- Apart from the countries already discussed in the study under the Asia-Pacific region, other countries like Australia, Taiwan, Thailand, Malaysia, Singapore, Vietnam, etc., also have a high potential scope for gaining a considerable share in the market studied. The growth in the sale of alcoholic beverages, acquisitions, and mergers drives the market for glass packaging in the region.

Glass Bottle and Container Industry Overview

The glass bottles and containers market is primarily dominated by a handful of major companies, including Gerresheimer AG, Owens-Illinois (O-I), Ardagh Packaging Group PLC, and Piramal Glass Ltd. These industry leaders operate across various regions and maintain diversified product portfolios. Nevertheless, the industry faces fierce competition, as numerous other companies also manufacture similar products.

Strong and reputable brands are expected to maintain a competitive edge due to their established market presence and ability to offer advanced product offerings. Additionally, the infusion of significant capital investments raises the barriers to exit for existing players, further intensifying competition within the sector.

In September 2023, Ardagh Glass Packaging unveiled its initiative to construct an environmentally sustainable furnace at its Obernkirchen facility with the aim of reducing greenhouse gas emissions. The NextGen furnace is anticipated to commence the production of commercial glass containers by the end of 2023, boasting the capacity to manufacture up to 350 tonnes (t) of glass bottles daily.

In July 2023, the beverage industry witnessed a surge in glass packaging innovation, resulting in the introduction of the Drinktainer, a wide-mouth product designed to enhance the drinking experience. FX Matt Beverage Co. and O-I Glass collaborated to bring this innovation to market. The Drinktainer represents the successful outcome of a new partnership between the two companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Post-COVID Impact on Glass Bottles and Containers Market

- 4.5 Impact of Ukraine-Russia Conflict on Glass Bottles and Containers Market

- 4.6 Cost Analysis With Key Drivers (Components and Energy Consumption) - Components of Glass Container

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Food and Beverage Industry

- 5.1.2 Sustainability and Recyclability Initiatives Moving Packagers and Consumer Brands to Glass Packaging

- 5.2 Market Restraints

- 5.2.1 High Carbon Footprint due to Glass Manufacturing

- 5.2.2 Operation and Logistical Concerns

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Bevarages

- 6.1.1.1 Alcoholic

- 6.1.1.1.1 Beer and Cider

- 6.1.1.1.2 Wine and Spirits

- 6.1.1.1.3 Other Alcoholic Beverages

- 6.1.1.2 Non-alcoholic

- 6.1.1.2.1 Carbonated Soft Drinks

- 6.1.1.2.2 Milk

- 6.1.1.2.3 Water and Other Non-alcoholic Beverages

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceutical

- 6.1.5 Other End-user Verticals

- 6.1.1 Bevarages

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Poland

- 6.2.2.7 Russia

- 6.2.2.8 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.4.1 United Arab Emirates

- 6.2.4.2 Saudi Arabia

- 6.2.4.3 South Africa

- 6.2.4.4 Rest of Middle East and Africa

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.5.2 Mexico

- 6.2.5.3 Argentina

- 6.2.5.4 Rest of Latin America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 O-I Glass, Inc.

- 7.1.2 Vidrala SA

- 7.1.3 Ardagh Group S.A.

- 7.1.4 Wiegand-glas GmbH

- 7.1.5 Verallia Packaging

- 7.1.6 Vetropack Holding Ltd

- 7.1.7 Stoelzle Oberglas GmbH (CAG-holding GmbH)

- 7.1.8 Gaasch Packaging

- 7.1.9 Beatson Clark

- 7.1.10 Vitro SAB de CV

- 7.1.11 Schott AG

- 7.1.12 Glassworks International Limited

- 7.1.13 Gerresheimer AG

- 7.1.14 Middle East Glass Manufacturing Co SAE

- 7.1.15 Berlin Packaging LLC

- 7.1.16 BA VIDRO SA (BA Glass BV)

- 7.1.17 PGP Glass Private Limited

- 7.1.18 VERESCENCE FRANCE

- 7.1.19 SGD SA (SGD Pharma)

- 7.1.20 Saver Glass SAS (The Carlyle Group Inc.)