|

市場調查報告書

商品編碼

1404084

基礎設施產業無損檢測產業-市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測NDT For Infrastructure Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

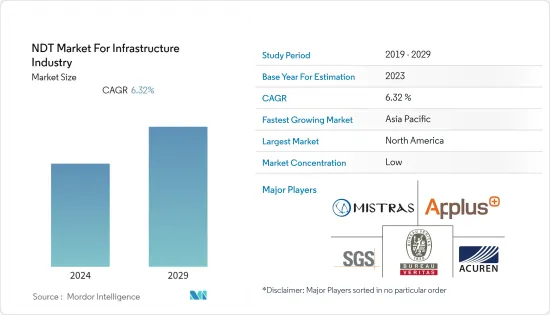

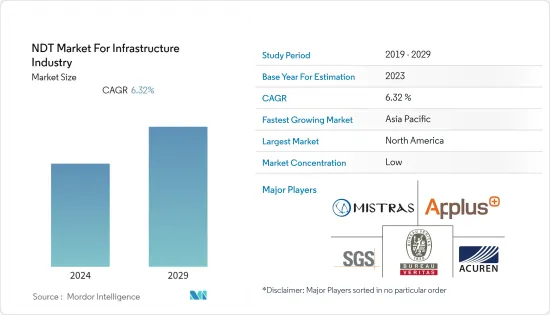

基礎設施產業無損檢測市場上年度規模為405.3億美元,預計未來5年將達588.3億美元,複合年成長率為6.32%。

推動市場的關鍵因素之一是基礎設施現代化投資的增加以及各領域新建築和其他商業基礎設施的建設。此外,基礎設施現代化投資正在為所研究的市場創造商機。

主要亮點

- 無損檢測是對零件、材料和組裝的檢查、測試和評估。在不影響產品可用性或組件的情況下研究屬性的差異和不連續性。由於基礎設施發展的進步、老化建築物和橋樑數量的增加以及政府對公共日益關注,基礎設施領域的無損檢測市場正在迅速擴大。

- 自然災害使房地產和基礎設施資產面臨最終考驗,威脅其完整性並造成嚴重後果。技術性非侵入性和半侵入性測試越來越受歡迎,因為它可以幫助行業相關人員了解有關結構材質和預期用於新建築的材料特性的重要資訊。這是因為基礎建設領域投資較大,攸關人身安全。

- 此外,不斷擴大的建設計劃在基礎設施領域的無損檢測市場中發揮關鍵作用。這是因為現場和實驗室測試是在材料和建築構件的施工階段進行的。該市場的開拓預計將得益於技術發展,使尖端變體變得容易獲得。

- 合格無損檢測專業人員的短缺預計在預測期內將持續存在。因此,無損檢測市場需要更多訓練有素的人力資源和培訓設施,預計將影響預測期內的市場擴張。除此之外,大多數零件的檢查深度通常限制在最大100-150mm,這意味著檢查深度遠小於光的波長。

- 此外,COVID-19大流行對無損檢測(無損檢測)行業產生了重大影響,因為進入基礎設施場所受到限制,使得無損檢測人員難以進行現場檢查。 。這導致了檢查過程的延誤並降低了效率。行動限制增加了對遠端無損檢測技術的需求,例如用於基礎設施檢查的遠端目視檢查(RVI)和無人機(UAV)。儘管有效,但這些技術並不適合所有類型的基礎設施,並且可能受到天氣等因素的限制。

無損檢測市場趨勢

建築業投資增加推動市場成長

- 無損檢測在建設產業的應用十分廣泛。無損檢測被設計師、承包、建築工程師和建築商用來檢驗建築結構和各種建築材料的品質和完整性,並識別和量化潛在的缺陷。

- 近幾十年來,建設產業投資大幅成長,尤其是在新興國家。不斷發展的都市化、工業化以及政府為經濟弱勢群體提供住宅的各種舉措是推動建設產業投資的關鍵因素。

- 影響市場的關鍵因素之一是眾多政府對各類基礎設施開發計劃的持續投資。例如,土耳其政府計劃在2021年投資3,250億美元用於基礎建設計劃,包括對該國交通系統的投資以及對土木工程和道路施工機械的需求增加。

- 根據人口研究所 (PRB) 的預測,到 2022 年,世界上大約 57% 的人口將居住在都市區。按地區分類,北美地區的比例最高(83%),其次是拉丁美洲和加勒比海地區(81%)。這些趨勢正在推動對新建築和配套基礎設施的需求,為所研究的市場創造成長機會。

- 此外,根據沙烏地阿拉伯的 2030 年願景,公共和私營部門關注的建築和基礎設施發展的需求預計將繼續成長。這項大規模舉措旨在擴大就業機會、實現經濟多元化並為低收入群體提供住宅。

亞太地區佔主要市場佔有率佔有率

- 亞太地區工業領域的強大影響力和基礎設施計劃的快速發展預計將為無損檢測服務提供重大成長機會。具體而言,中國、日本、韓國、印度、新加坡和澳洲預計將在未來幾年為基礎設施產業解決方案不間斷的需求創造巨大潛力。

- 例如,根據澳洲基礎設施合作夥伴組織2022年的研究報告,大約88%的投資者表示他們「可能投資澳洲的基礎設施領域」。 84% 的投資者認為,澳洲在市場參與企業知識、基礎設施和經濟穩定性方面的記錄是使澳洲成為有吸引力的投資目的地的最重要因素。

- 同樣,印度對基礎設施發展的日益重視正在吸引國內和國際參與企業。在該國,私營部門在電力、機場、通訊和道路等各種基礎設施領域中發揮越來越重要的作用。

- 此外,到2022年,印度預計將超過中國,成為全球第三大建築市場(根據IBEF)。 (根據 IBEF)。為確保該地區永續發展,印度擬透過國家基礎設施管道(NIP)在2019年至2023年期間投資1.4兆美元用於基礎建設計劃。

- 此外,2021年2月,印度政府宣布未來五年將投資7.5兆印度盧比(1,024.9億美元)用於石油和天然氣基礎設施,無損檢測設備的需求預計將增加。到2023年,580億美元將用於石油和天然氣探勘和生產,其餘金額將在2024年用於運輸和發行天然氣所需的基礎設施,包括管道、進口碼頭和城市燃氣發行網路。用於建築。

無損檢測產業概況

基礎設施產業的無損檢測市場本質上是分散的。在這個市場上,不同企業之間的競爭由價格、產品、市場佔有率和競爭強度決定。透過創新可以獲得永續的競爭優勢。市場現有企業正在採取基於產品差異化、市場擴張和併購的強力的競爭策略。市場上主要企業包括 SGS SA、Acuren Group Inc. 和 Mistras Group。

2023年6月,TCR Engineering宣布計劃擴大在印度的材料測試和無損檢測業務,目標是2025年首次股票公開發行(IPO)。該公司的無損檢測服務包括超音波檢測、X光透視和磁粉檢測。

2023年5月,SGS Gulf Limited宣布推出新的無損檢測(無損檢測)解決方案,能夠對鐵路軌道上運行的鋼軌全長進行測試。這項新功能補充了 SGS 針對中東地區鐵路基礎設施的功能安全評估服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

- 市場促進因素與市場抑制因素簡介

- 市場促進因素

- 嚴格規定基礎建設產業的安全標準

- 基礎設施維護服務的成長

- 市場抑制因素

- 其他行業的無損檢測服務抑制市場成長

第5章市場區隔

- 類型

- 設施

- 服務

- 科技

- X光檢查

- 超音波探傷檢驗

- 磁粉檢測

- 液體液體滲透探傷

- 目視測試

- 聲波發射測試

- 熱成像測試

- 雷射掃描測試

- 其他技術

- 最終用戶產業

- 建設產業

- 工業領域

- 房地產行業

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章競爭形勢

- 公司簡介

- SGS SA

- Acuren Group Inc.

- Mistras Group Inc.

- Applus Services SA

- Bureau Veritas SA

- Teledyne FLIR LLC

- Infraspect(TFIC)

- Intertek Group PLC

- Olympus Corporation

- ROSEN Group

- Tech4Imaging LLC

第7章 投資分析

第8章 市場機會及未來趨勢

The Non-Destructive Testing Market for the Infrastructure Industry was valued at USD 40.53 billion in the previous year and is expected to register a CAGR of 6.32%, reaching USD 58.83 billion by the next five years. One of the main factors propelling the market is an increase in investment in the modernization of infrastructures in various sectors and the building of new structures and other commercial infrastructures. Additionally, opportunities in the market under study are being created by investments in infrastructure modernization.

Key Highlights

- Non-destructive testing (NDT) is the inspection, testing, or evaluation of components, materials, or assemblies. It entails examining differences in characteristics or discontinuities without impairing the product's usability or a component. The market for non-destructive testing in the infrastructure sector is expanding quickly as a result of rising infrastructure development, an increase in the number of aging buildings and bridges, and growing government attention to public safety.

- Natural disasters put real estate and infrastructure assets to the ultimate test, threatening their integrity and posing severe consequences. Technical non-invasive and semi-invasive tests are gaining popularity because they help industry stakeholders learn crucial information about the properties of the materials the structures are made of or are anticipated to be used in new construction. This is because the infrastructure sector involves a significant investment, and human safety is on the line.

- In addition, expanding construction projects have a significant role in the infrastructure sector's non-destructive testing market. This is due to on-site or laboratory testing during the construction stage of materials and building components. The development of this market is anticipated to be aided by technological developments that make cutting-edge variants readily available.

- Over the forecast period, it is expected that the shortage of qualified NDT professionals will persist because there is yet to be an obvious solution. Therefore, the need for more trained personnel and training facilities in the NDT market is expected to impact the market's expansion over the forecast period. In addition to this, the depth of inspection for most components has been usually limited to a maximum depth of 100-150mm, which means that the inspection depth is much less than the wavelength of light.

- Furthermore, the COVID-19 pandemic had a significant impact on the non-destructive testing (NDT) industry owing to limited access to infrastructure sites, making it difficult for NDT inspectors to conduct on-site inspections. This led to delays and reduced efficiency in the inspection process. With travel restrictions in place, there was an increased demand for remote NDT inspection techniques such as remote visual inspection (RVI) and unmanned aerial vehicles (UAVs) for infrastructure inspection. While these techniques can be effective, they may not be suitable for all types of infrastructure and can be limited by factors such as weather conditions.

NDT Market Trends

Growing Investment in Construction Sector to Drive the Market's Growth

- The application of nondestructive testing in the construction industry is broad. NDT testing helps designers, contractors, construction engineers, and contractors verify the quality and integrity of built structures and various building materials and identify and quantify potential defects.

- Construction industry investments have grown significantly in the last few decades, especially across emerging countries. Increasing urbanization, industrialization, and various government initiatives to provide homes to economically weak people are among the primary factors driving investment in the construction industry.

- One of the key factors influencing the market is the ongoing investment by numerous governments in various infrastructure development projects. For instance, the Turkish government spent USD 325 billion on infrastructure projects in 2021, including investments in the country's transportation system and a rise in the need for earthmoving and road construction equipment.

- According to the Population Reference Bureau (PRB), in 2022, about 57 percent of people stayed in urban areas worldwide. In terms of region, North America has the highest (83) percentage of the population remaining in urban areas, followed by the Latin America and Caribean region (81 percent). Such trends drive the demand for new buildings and other supporting infrastructures, creating growth opportunities in the studied market.

- The need for construction and infrastructure development will also continue to rise in line with Saudi Arabia's Vision 2030 as the public and private sectors increase focus. Large-scale initiatives seek to expand employment opportunities, diversify the economy, and give lower-income groups housing options.

Asia-Pacific to Hold a Significant Market Share

- The Asia-Pacific region's strong presence in the industrial sector and rapid advancements in infrastructure projects are anticipated to provide significant growth opportunities for nondestructive testing services. Specifically, China, Japan, South Korea, India, Singapore, and Australia are expected to create huge potential for the nondestructive demand for infrastructure industry solutions in the coming years.

- For instance, according to a 2022 survey report by Infrastructure Partnerships Australia, about 88% of the investors indicated they are 'highly likely to invest in the Australian infrastructure sector. According to 84 percent of the investors, Australia's track record for knowledge of market participants, infrastructure, and economic stability are among the most important factors making Australia an attractive investment destination.

- Similarly, India's increased emphasis on infrastructure development is drawing domestic and foreign players. In the nation, the private sector is growing to be a significant player in various infrastructure sectors, from power and airports to communications and roads.

- In addition, by 2022, India was anticipated to overtake China as the third-largest construction market worldwide. (as per IBEF). To ensure sustainable development in the area, the nation intends to invest USD 1.4 trillion in infrastructure projects through the National Infrastructure Pipeline (NIP) between 2019 and 2023.

- Additionally, the Indian government announced in February 2021 that it would spend INR 7.5 trillion (USD 102.49 billion) on oil and gas infrastructure over the next five years, which is anticipated to increase demand for NDT equipment. By 2023, USD 58 billion would be spent on oil and gas exploration and production; the remaining sum might be used to build the infrastructure needed to transport and distribute natural gas, including pipelines, import terminals, and city gas distribution networks, by 2024.

NDT Industry Overview

The non-destructive testing market for the infrastructure industry is fragmented in nature. In the market studied the competitive rivalry between various firms depends on price, product, market share, and the intensity with which they compete. Sustainable competitive advantage can be gained through innovation. Market incumbents have adopted powerful competitive strategies based on product differentiation, market expansion, and mergers and acquisitions. Some of the key players in the market include SGS SA, Acuren Group Inc., and Mistras Group.

In June 2023, TCR Engineering announced its plans to expand its materials testing and non-destructive testing operations in India and is eyeing to launch its initial public offering (IPO) by 2025. The company's non-destructive testing services include ultrasonic testing, radiographic testing, and magnetic particle inspection, among others.

In May 2023, SGS Gulf Limited announced the introduction of a new Non-Destructive Testing (NDT) solution enabling the test of the whole running rail length of the railway tracks, with excellent throughput and coverage on a continuous basis. This new capability has complemented the SGS's range of functional safety assessment services for the railway infrastructure in the Middle East region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Industry

- 4.5 Introduction to Market Drivers and Restraints

- 4.6 Market Drivers

- 4.6.1 Stringent Regulations Mandating Safety Standard in the Infrastructure Industry

- 4.6.2 Growth in Infrastructure Maintenance Services

- 4.7 Market Restraints

- 4.7.1 NDT Services In Other Industries Restraining the Growth of the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Equipment

- 5.1.2 Services

- 5.2 Technology

- 5.2.1 Radiographic Testing

- 5.2.2 Ultrasonic Testing

- 5.2.3 Magnetic Particle Testing

- 5.2.4 Liquid Penetrant Testing

- 5.2.5 Visual Testing

- 5.2.6 Acoustic Emission Testing

- 5.2.7 Thermography Testing

- 5.2.8 Laser Scanning Testing

- 5.2.9 Other Technologies

- 5.3 End-user Industry

- 5.3.1 Construction Industry

- 5.3.2 Industrial Sector

- 5.3.3 Real Estate Industry

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SGS SA

- 6.1.2 Acuren Group Inc.

- 6.1.3 Mistras Group Inc.

- 6.1.4 Applus Services SA

- 6.1.5 Bureau Veritas SA

- 6.1.6 Teledyne FLIR LLC

- 6.1.7 Infraspect (TFIC)

- 6.1.8 Intertek Group PLC

- 6.1.9 Olympus Corporation

- 6.1.10 ROSEN Group

- 6.1.11 Tech4Imaging LLC