|

市場調查報告書

商品編碼

1404076

汽車繼電器市場佔有率分析、產業趨勢及統計、2024年至2029年成長預測Automotive Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

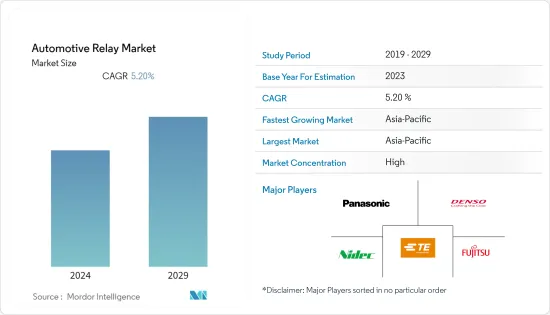

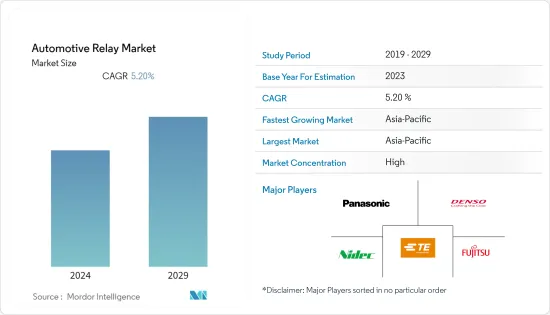

汽車繼電器市場規模預計將從2024年的102.3億美元成長到2029年的131.8億美元,預測期間(2024-2029年)複合年成長率為5.2%。

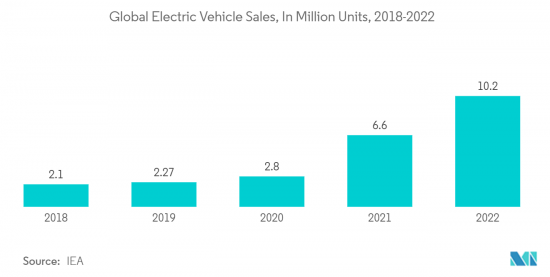

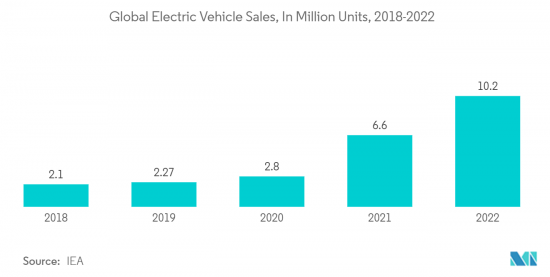

隨著混合汽車和電動車等汽車電動的進展,對控制和管理各種電氣系統的繼電器的需求不斷增加。此外,主動式車距維持定速系統和車道偏離警告系統等 ADAS 功能的發展依賴繼電器來控制感測器和致動器。

對具有輕量化和高性能特性的先進繼電器的需求正迫使製造商投資生產比傳統重型電子機械繼電器更多的固態繼電器。這是由於該地區對混合和電動車的需求不斷成長。

按地區分類,亞太地區預計將主導汽車繼電器市場。亞太繼電器市場主要受到汽車產量和銷售增加、汽車快速電動、更嚴格的排放法規以及消費者可支配收入增加的推動。因此,隨著人們越來越追求安全和舒適,對汽車的需求也增加。

汽車繼電器市場趨勢

自動化系統的普及正在推動電子設備的採用。

汽車產業正在從硬體車輛轉向軟體車輛,每輛車的軟體和電子產品的平均數量正在迅速增加。電子產品通常允許將新功能和特性整合到汽車中。因此,電子產品日益滲透到動力傳動系統、安全管理、車身、便利性和資訊娛樂等關鍵應用領域。

政府的參與和消費者對系統自動控制的需求導致汽車中電子產品的使用增加。電子產品為提高能源效率和減少排放氣體提供了新的機會。汽車電子在所有車型中的高普及受到三個主要方面的影響:生產力、品質和創新。

汽車產業正在製定措施來改變消費者的駕駛體驗。汽車變得越來越聰明並且能夠進行自我診斷。未來幾年,汽車將能夠高效連接。

此外,乘客安全也是推動自動駕駛系統在汽車上採用的因素之一。過去幾十年來,汽車中安全功能和系統的安裝極大地減少了道路事故和死亡人數。

隨著確保消費者安全和便利的自動駕駛汽車和智慧汽車(能夠透過車對車(V2V)和車對車基礎設施(V2I)通訊進行連接)越來越受到關注,智慧汽車正在安裝在新車。對電子系統的需求正在迅速增加。

促進因素 改善體驗的新一代汽車電子產品正在中檔和入門級汽車領域大量採用,並且可以透過售後市場輕鬆獲得。

目前和即將推出的車輛中電氣元件的使用正在迅速增加,並且對製造可靠、標準化元件以高效、安全和可靠地切換電氣負載的需求持續成長。這些因素正在推動當前市場的成長。

亞太地區主導汽車繼電器市場

亞太地區是全球最大的汽車生產中心,也是中國、日本、韓國、印度等主要汽車製造商的所在地。收入水準的提高、都市化和生活水準的提高也推動了亞太地區汽車持有的成長。汽車持有的快速成長直接影響了各種車輛系統中使用的汽車繼電器的需求。

亞太地區許多國家實施了嚴格的排放法規,以減少污染和溫室氣體排放。這些法規正在推動先進引擎管理和排放控制系統的採用,這些系統使用繼電器來實現高效運作。

向電動車和混合的轉變是汽車產業的重要趨勢。電動車和混合比傳統內燃機汽車使用更多的繼電器,有助於市場成長。繼電器的整合度越來越緊湊,佔用的空間越來越小,車內的重量也越來越輕。這一趨勢符合汽車產業對減重和空間最佳化的關注。

亞太地區由於其作為汽車生產主要中心的地位、汽車持有的增加、汽車電動、嚴格的法規以及先進汽車技術的採用,在汽車繼電器市場上處於領先地位。

汽車繼電器產業概況

汽車繼電器市場由Denso、Panasonic Corporation、TE Connectivity 和 Nidec Corporation 等公司主導。

汽車繼電器市場競爭激烈,該地區既有國際、國內的繼電器製造商。本公司大力投資研發計劃並推出新產品。例如

- 2022 年 4 月,LG Magna e- 動力傳動系統在墨西哥拉莫斯阿里斯佩揭幕了最新的製造工廠。新工廠將專門生產逆變器、馬達和汽車充電器,主要目的是加強通用汽車的電動車(EV)製造業務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車電動進展

- 市場抑制因素

- 精確的測試和檢驗

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場金額單位:美元)

- 按類型

- 印刷電路板繼電器

- 插入式繼電器

- 按使用類型

- 鎖系統

- 引擎管理模組

- 燈/燈

- 其他應用類型(電動車窗、天窗、ABS 控制等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 南非

- 其他國家

- 北美洲

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Robert Bosch GmbH

- DENSO Corporation

- Fujitsu Ltd

- Panasonic Corporation

- MITSUBA Corporation

- TE Connectivity

- Omron Corporation

- Hella KGaA Hueck & Co.

- Nidec Corporation

第7章 市場機會及未來趨勢

The Automotive Relay Market size is expected to grow from USD 10.23 billion in 2024 to USD 13.18 billion by 2029, registering a CAGR of 5.2% during the forecast period (2024-2029).

The increasing electrification of vehicles, including hybrid and electric vehicles, drives the demand for relays to control and manage various electrical systems. Also, the growth of ADAS features such as adaptive cruise control and lane departure warning systems relies on relays to control sensors and actuators.

The demand for advanced relays with lightweight and high-performance characteristics is compelling manufacturers to invest in producing more solid-state relays compared to traditional heavy electromechanical relays. It is owing to the growing demand for hybrid and electric vehicles in the region.

Among regions, Asia-Pacific is anticipated to dominate the automotive relay market. The Asia-Pacific relay market is primarily driven by growing vehicle production and sales, rapid electrification of vehicles, rising stringency of emission norms, and increasing disposable income of consumers. It, in turn, is increasing the demand for vehicles, owing to the growing preference for safety and comfort.

Automotive Relay Market Trends

Increasing Penetration of Automated Systems Driving the Adoption of Electronics.

The automotive industry is transitioning from hardware to software-enabled vehicles, and the average software and electronics content per vehicle is increasing rapidly. Electronics often enable the integration of new functions and features into the car. Thus, there is increasing penetration of electronics into major application fields, including powertrain, safety management, body, and convenience or infotainment.

Both government involvement and consumers' demand for greater automatic control of systems resulted in the increased usage of electronics in vehicles. Electronics are offering new opportunities to improve energy efficiency and emission reduction as several functions can be consolidated into fewer and smaller electronic control super units, thereby reducing the weight. The high penetration rate of automobile electronics across all vehicle classes is being influenced by three major aspects, namely, productivity, quality, and innovation.

Efforts are being deployed in the automobile industry to transform consumers driving experience. Cars are becoming smarter and capable of conducting self-diagnostics. In the coming years, cars can connect effectively.

In addition, passenger safety is another factor driving the adoption of automated systems in automobiles. The installation of safety features and systems in vehicles greatly aided in reducing the number of accidents and fatalities on the road over the past few decades.

With the increasing focus on autonomous vehicles and smart cars (with the ability to connect with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications) that can ensure safety and convenience to consumers, the demand for electronic systems in new cars is increasing rapidly.

Newer generation automotive electronics that enhance the driver experience are witnessing mass adoption in mid-range and entry-level car segments and ease of availability through the aftermarket.

The rapidly growing use of electric components in current and upcoming vehicles is consistently propelling the need for manufacturing reliable and standardized components for efficient, safe, and secure switching of electric loads. These factors are currently driving the market growth.

Asia-Pacific Dominating The Automotive Relay Market

Asia-Pacific is the world's largest automotive production hub, with several countries in the region, including China, Japan, South Korea, and India being major automobile manufacturers. Also, rising income levels, urbanization, and improved living standards led to an increase in vehicle ownership across Asia-Pacific. This surge in vehicle ownership directly impacts the demand for automotive relays used in various vehicle systems.

Many countries in Asia-Pacific implemented strict emission regulations to reduce pollution and greenhouse gas emissions. These regulations drive the adoption of advanced engine management and emission control systems that use relays for efficient operation.

The shift towards EVs and hybrid vehicles is a significant trend in the automotive industry. EVs and hybrids use more relays compared to traditional internal combustion engine vehicles, contributing to the market growth. Relays are becoming more compact and integrated, saving space in vehicles and reducing weight. This trend aligns with the automotive industry's focus on lightweighting and space optimization.

Asia-Pacific region leads in the automotive relay market due to its position as a major automotive production hub, growing vehicle ownership, the electrification of vehicles, stringent regulations, and the adoption of advanced automotive technologies.

Automotive Relay Industry Overview

The automotive relay market is dominated by companies such as DENSO Corporation (ANDEN Co. Ltd), Panasonic Corporation, TE Connectivity, and Nidec Corporation.

The market for automotive relays is highly competitive due to the presence of both international and domestic relay suppliers in the region. The companies are investing heavily in R&D projects and launching new products. For instance,

- In April 2022, LG Magna e-Powertrain announced its latest manufacturing facility located in Ramos Arizpe, Mexico. This newly established plant is dedicated to the production of inverters, motors, and onboard chargers with the primary objective of bolstering General Motors Electric Vehicle (EV) manufacturing operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Electrification of Vehicles

- 4.2 Market Restraints

- 4.2.1 Precise Testing and Validation

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market value in (USD))

- 5.1 By Type

- 5.1.1 PCB Relay

- 5.1.2 Plug-in Relay

- 5.2 By Application Type

- 5.2.1 Locking System

- 5.2.2 Engine Management Module

- 5.2.3 Lamps/Lights

- 5.2.4 Other Application Types (Power Window, Sunroof, ABS Control, etc.)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 South Africa

- 5.3.4.3 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 DENSO Corporation

- 6.2.3 Fujitsu Ltd

- 6.2.4 Panasonic Corporation

- 6.2.5 MITSUBA Corporation

- 6.2.6 TE Connectivity

- 6.2.7 Omron Corporation

- 6.2.8 Hella KGaA Hueck & Co.

- 6.2.9 Nidec Corporation