|

市場調查報告書

商品編碼

1404062

AGV:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測AGV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

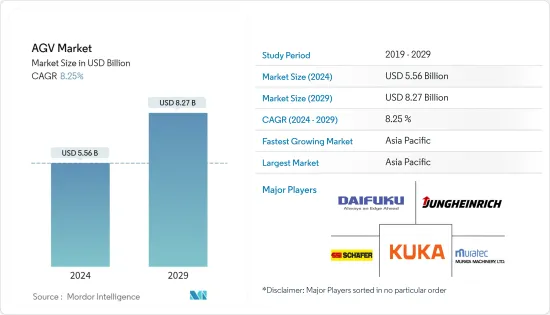

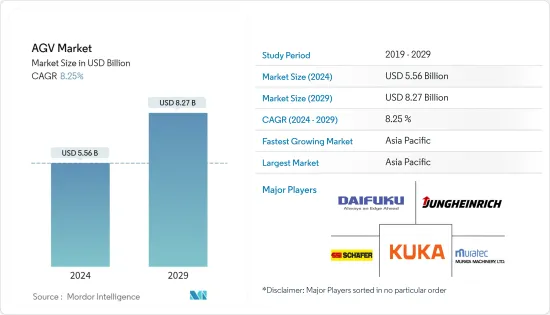

AGV市場規模預計到2024年為55.6億美元,預計到2029年將達到82.7億美元,在預測期內(2024-2029年)複合年成長率為8.25%。

主要亮點

- 技術進步的不斷進步、工業自動化需求的增加、製造和倉儲設施中機器人需求的增加以及新興市場的成長只是推動自動導引運輸車成長的一些關鍵因素。

- 在汽車產業,製造現場的自動化和 AGV 的引入正在取得進展。例如,西雅特位於西班牙馬爾托雷爾的工廠正在轉型為數位化、智慧工廠。該公司推出了具有 SLAM 導航、4G 連接和感應電池充電功能的 AGV。該工廠擁有 8 輛用於戶外作業的 AGV,以及 200 多輛 AGV,用於在 Martorell 和巴塞隆納工廠的組裝車間內運輸零件。

- 市場上的幾家主要企業正在整合他們的硬體設備和導航軟體,以提供更高的效率。例如,除了雷射AGV 之外,還提供電線、RFIS 和膠帶AGV 的豐田汽車公司與Bastian Solutions 合作,使用BlueBotics 的自主導航技術軟體,該軟體的作用類似於自主移動機器人和自動導引車的作業系統。我們將使用兩台 AGV。

- 此外,提供系統介面和 AGV 系統組件的公司正在合作推進該技術。例如,2022年4月,Gideon Robotics推出了自動堆高機Trey,它可以從卡車拖車上裝載和卸載托盤。 Gideon Robotics 聲稱它可以為工人節省 80% 的時間,在動態環境中持續、安全、可靠地運行,並且可以與人一起工作。

- 此外,2022 年 10 月,總部位於威斯康辛州的物料搬運設備公司 Big Joe Forklift推出了一個自主設備部門,專注於提供簡單、低成本的機器人 AGV 堆高機解決方案。

- 不斷增加的研發支出和全球生產基地數量的增加正在推動中程產業對自動化的需求,特別是全球醫療保健和製藥業。

- 此外,隨著世界各地的工人被隔離,工廠和倉庫等手工搬運重型貨物的大型工業設施陷入停頓,嚴重影響了全球供應鏈。根據 DHL 的報告,美國祇有 5-10% 的配送中心已經實現了自動揀選。 COVID-19 危機是促進倉庫自動化的另一個原因,並可能鼓勵未來幾年更快採用。

自動導引車市場趨勢

電子商務的快速發展需要更高的效率

- 儘管製造業成長,但倉儲和物流行業的需求主要集中在電子商務。此外,加拿大的倉儲業務主要由電子商務組成,估計佔該國倉儲業務的50%以上。

- AGV的引入為電子商務的各個領域提供了機會。具體來說,AGV 非常適合涉及大量、小批量訂單、大 SKU 範圍分佈在大型倉庫區域的履行業務。使用自主機器人進行水平移動可以提高訂單處理效率。

- 始終線上的電子商務的引入、對更快響應時間的需求以及以更少錯誤管理更多庫存單位的需求,迫使倉庫擴大規模,並為智慧型、高效、自動化倉庫設定標準。 。全球化的進步以及線上零售和大眾零售的興起正在增加零售業對 AGV 的需求。

- 由於已開發國家和新興國家對電子商務公司滿足日益增加的一日達訂單的需求不斷成長,此類計劃的商業性可行性顯著提高了效率。電商倉庫借助AGV實現一日達。 IBEF表示,印度電子商務產業潛力巨大。印度電子商務產業的市場價值正在呈指數級成長,預計到2030年將達到3,500億美元。

- 美國人口普查局數據顯示,2023年4月至6月美國電商零售額約2,695億美元,較上季成長6.6%。快速變化的零售市場迫使物流中心探索和實施創新、靈活和自動化的電子商務訂單處理方法。電子商務購買量的增加可能會鼓勵企業將自動化物料搬運設備引入其營運流程,以增強工作流程的流暢性。

- 此外,為了滿足日益成長的電子商務需求,供應鏈已開始在物流中心使用 AGV,從而使各行業能夠高效運作。 AGV 的使用正在擴大在製藥等領域,以滿足需求並保持衛生。 AGV 在醫院和其他醫療機構中用於食品、垃圾、床單和無菌消耗品的非接觸式運輸。

亞太地區預計將出現顯著成長

- 亞太地區是全球最大的 AGV 消費地區。由於市場分散,因此很容易找到負擔得起的自動化服務。汽車產業產量的增加也推動了該地區 AGV 的需求。

- 在中國,市場主要受到國家製造業激增的推動。中國擁有世界上最大的製造業,製造業對國家經濟成長也做出了巨大貢獻。根據中國國務院資訊局預測,2022年中國製造業產值佔全球的比重為27.7%,較2012年的22.5%大幅提升,製造業近期做大做強的動能越來越明顯。

- 此外,中國是工業4.0的領先採用者,擁有世界上最先進的製造設施,領先歐盟、美國和日本等地區。例如,根據世界經濟論壇的數據,目前全球有 69 家工廠被認為是使用工業 4.0 技術的領先者,中國目前有 20 家工廠,其次是歐盟 19 家、美國7 家和日本。後面跟著5。除了作為全工廠自動化的基礎之外,自動儲存和搜尋系統也是工業 4.0 的基礎。

- 此外,隨著印度、中國及週邊國家等新興國家對電子商務的需求不斷增加,電子商務公司正在其倉庫中大量部署AGV。根據IBEF預測,到2030年,印度電子商務市場規模預計將達到3,500億美元。此外,到 2025 年,印度電子商務市場的商品總價值 (GMV) 預計將達到 2,200 億美元,並吸引約 5.3 億消費者。

- 此外,泰國大學正在與製造工廠合作提供自動導引車(AGV)。例如,Shillington 國際泰德工程學院 (TGGS) 最近與泰國羅勇府的寶馬製造廠合作。該計劃始於寶馬的想法,即使用 AGV 在生產線上自動運輸重型零件。大學研究團隊開發了一種量身定做的自動導引運輸車精確匹配生產過程的要求,同時與進口解決方案相比,投資成本相當經濟。

自動導引運輸車產業概況

由於自動導引運輸車(AGV)市場參與者眾多,全球自動導引運輸車市場適度分散。數位轉型以及與物聯網結合的工業4.0的出現等因素為自動導引車產業提供了可觀的成長前景。主要參與者包括 Amerden Inc.、Swisslog Holding 和 SSI Schaefer Systems International DWC LLC。

2023 年 5 月,ResGreen International Inc. 發布了新的互動式 BigBuddy。這款 AGV 是業界最堅固的 AGV 之一,使用磁帶移動重達 5,000 磅的負載。該新產品具有完全反轉功能、高負載能力和模組化設計,擴展了該公司的 AMR 和 AGV 產品組合。

2023 年 3 月,芬蘭 Rocla AGV 推出了新型敏捷 AGV,這是一款自動緊湊型卡車,旨在在狹小空間內提升重物。 ACT 對於在倉庫和生產現場或裝卸區域之間運作非常有用。

2022 年 10 月,DAIFUKU CO. LTD.宣布開設一家新製造工廠,該工廠將整合 Harbour Springs、佩爾斯頓和博因市現有工廠的營運。新廠將生產韋伯的所有行李處理設備,包括行李輸送帶、行動安檢台和自動安檢區域。此外,還將生產Webb的全系列AGV和智慧推車。 65,000平方公尺的空間包括AGV測試區和會議室,為未來的製造擴張提供空間。

2022年9月,Adverb Technologies宣佈在加州成立新的先進機器人研發中心。該中心將專注於開發用於自主移動機器人和自動引導車輛平台、人機協作和生物醫學機器人的先進演算法。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估主要宏觀經濟趨勢的市場影響

第5章市場動態

- 市場促進因素

- 電子商務的快速發展需要更高的效率

- 加大技術和機器人投資

- 市場抑制因素

- 由於通訊延遲而導致即時無線控制的局限性

第6章市場區隔

- 依產品類型

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單位負荷

- 組裝

- 特殊用途

- 按最終用戶產業

- 食品和飲料

- 車

- 零售

- 電子/電力

- 一般製造業

- 製藥

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章競爭形勢

- 公司簡介

- KUKA AG

- Jungheinrich AG

- Murata Machinery Ltd.

- Daifuku Co. Ltd.

- SSI Schaefer Systems International DWC LLC

- Swisslog Holding

- Dematic Corp.

- Toyota Material Handling

- Scott Technology Limited

- John Bean Technologies(JBT)Corporation

- Systems Logistics SPA

- Seegrid Corporation

第8章投資分析

第9章市場的未來

The AGV Market size is estimated at USD 5.56 billion in 2024, and is expected to reach USD 8.27 billion by 2029, growing at a CAGR of 8.25% during the forecast period (2024-2029).

Key Highlights

- Rising technological advancements, increased demand for automation in industries, increased demand for robots in manufacturing and warehousing facilities, and growing emerging markets are just a few of the key factors driving the growth of Automated Guided Vehicle.

- The automotive industry is increasingly incorporating automation and AGVs into its manufacturing floors. For instance, the SEAT plant in Martorell, Spain, is transforming into a digitalized and smart factory. The company implemented AGVs with SLAM navigation, 4G connectivity, and induction battery charging. The facility has eight AGVs for outdoor operation and over 200 AGVs that deliver parts inside the assembly workshops at the Martorell and Barcelona factories.

- Several key players in the market are integrating their hardware equipment with navigational software to offer high efficiency. For instance, Toyota, a company offering Wire, RFIS, and Tape AGVs alongside Laser AGVs, introduced two AGVs in partnership with Bastian Solutions that use Autonomous Navigation Technology software from BlueBotics, which acts like an operating system for autonomous mobile robots or automated guided vehicles.

- Moreover, companies providing system interfaces and AGV system components are collaborating for advancement in technology. For instance, in April 2022, Gideon Robotics announced Trey, an autonomous forklift that can load and unload pallets from truck trailers. Gideon Robotics claimed that it could save 80% of a worker's time and operate consistently, safely, and reliably in dynamic environments, working side by side with people.

- Further, in October 2022, Wisconsin-based material handling equipment company Big Joe Forklifts launched an autonomous equipment division focused on providing simple, low-priced robotic AGV forklift solutions.

- The continuously increasing R&D expenditure and the rising number of production establishments worldwide are driving the demand for automation worldwide in mid-range industries, especially in the healthcare and pharmaceutical sectors.

- Furthermore, with workers quarantined worldwide, large industrial buildings, such as factories or warehouses that transport heavy materials manually, have experienced a halt situation, thus severely impacting the global supply chain. DHL reported that only 5-10% of the fulfillment centers in the United States were using automated picking already. The COVID-19 crisis was another reason to automate warehouses, which might drive quicker adoption in the coming years.

Automated Guided Vehicles Market Trends

Rapid Growth of E-commerce Demanding Higher Efficency

- Despite growth in the manufacturing industry, considerable demand from the warehousing and logistics sector is dedicated to e-commerce activity. Furthermore, the Canadian warehouse portfolio majorly comprises e-commerce, which is estimated to make up more than 50% of the warehouse business in the country.

- The deployment of AGVs provides an opportunity for different areas in e-commerce. Specifically, the AGVs are suited for fulfillment operations involving large quantities of small orders for large SKU ranges spread across large warehouse areas. Using autonomous robots to perform horizontal traveling can increase order fulfillment efficiency.

- With the introduction of always-on e-commerce, the demand for faster responses, and the need to manage a more significant number of stock-keeping units with fewer errors, warehouses need to scale up and meet the standards of an intelligent, efficient, and automated warehouse. Such increasing globalization and the rise of online retail and bulk retail have increased demand for AGVs in the retail industry.

- The rising demand for e-commerce companies to cater to the increasing number of single-day delivery orders, both in advanced and emerging economies, has resulted in a significant increase in efficiency owing to the commercial viability of these schemes. E-commerce warehouses carry out the single-day delivery method with the aid of AGVs. According to the IBEF, India has significant potential in the e-commerce industry. The market value of India's e-commerce industry is growing at an exponential rate, and it is expected to reach USD 350 billion by 2030.

- According to the U.S. Census Bureau, retail e-commerce sales in the United States totaled nearly USD 269.5 billion from April to June 2023, representing a 6.6 percent increase over the previous quarter. The rapidly changing retail market compels distribution centers to seek out and implement innovative, flexible, and automated approaches to e-commerce order fulfillment. Such a rise in e-commerce purchases will push companies to deploy automated material handling equipment in their operation process to enhance smooth workflow.

- Moreover, supply chains began using AGVs in distribution centers in response to increased e-commerce demand, allowing industries to function at high productivity. AGVs' use has expanded in sectors like pharmaceuticals to keep up with demand and maintain sanitation. AGVs were utilized by hospitals and other healthcare facilities to undertake the contactless transfer of food, trash bins, linens, and sterile supplies.

Asia-Pacific is expected to Witness a Significant Growth

- Asia-Pacific is the world's largest AGV consumer. Because of the fragmented market, it is easy to find affordable automation services. Also, the increased production in the automobile sector is driving up demand for AGVs in this region.

- In China, the market is primarily driven by the proliferating manufacturing industry of the country. China has the largest manufacturing industry in the world, and the sector is also a key contributor to the country's economic growth. As per the State Council Information Office of China, the country accounted for 27.7% of the global manufacturing output in 2022, marking a significant increase from 22.5% in 2012, with the industry growing bigger and stronger in recent times.

- Moreover, China is a major adopter of Industry 4.0, and the region is home to some of the most advanced manufacturing facilities in the world, ahead of regions like the European Union, the United States, and Japan. For instance, according to the World Economic Forum, of the 69 factories around the world now considered leaders using Industry 4.0 technologies, China is now home to 20, followed by 19 in the European Union, 7 in the United States, and 5 in Japan. Besides being the foundation for plant-wide automation, the automated storage and retrieval system also serves as a foundation for Industry 4.0.

- Moreover, with the increasing e-commerce demand in emerging countries, such as India, China, and neighboring countries, e-commerce companies have significantly been deploying AGVs at warehouses. According to the IBEF, India's e-commerce market is anticipated to be worth USD 350 billion by 2030. Furthermore, India's e-commerce market is expected to reach USD 220 billion in gross merchandise value (GMV), and there are expected to be about 530 million shoppers by 2025.

- In addition, universities in Thailand are collaborating with manufacturing plants to deliver Automated Guided Vehicles (AGVs). For instance, the Sirindhorn International Thai-German School of Engineering (TGGS) recently collaborated with the BMW Manufacturing plant in Rayong, Thailand. The project began with a vision from BMW for using AGVs that automatically carry heavy parts in the production line. A tailor-made AGV was developed by the university research team that exactly fits into the production process requirements while keeping the investment cost reasonably economical compared to imported solutions.

Automated Guided Vehicles Industry Overview

The global automated guided vehicle is moderately fragmented due to many automatic guided vehicle (AGV) market players. Factors such as digital transformation and the advent of integrated Industry 4.0 with IoT deliver considerable growth prospects to automated guided vehicle industries. Key players are Amerden Inc., Swisslog Holding, SSI Schaefer Systems International DWC LLC, etc.

In May 2023, ResGreen International Inc. introduced a new bidirectional BigBuddy, one of the most robust AGVs in the industry that uses magnetic tape to move loads up to 5,000 pounds. The new product expands the company's portfolio of AMRs and AGVs with its full-reversing capability, high-load capacity, and modular design.

In March 2023, Rocla AGV, a Finland-based company, launched a new, agile AGV, an automated compact truck designed to lift heavy loads in narrow spaces. ACT is handy to operate between warehouse and production or inbound and outbound areas.

In October 2022, Daifuku announced the opening of a new manufacturing plant where the plant will combine the operation of existing facilities in Harbor Springs, Pellston, and Boyne City. In the new factory, all Webb baggage handling equipment was to be manufactured, such as luggage carousels, mobile inspection tables, and automatic screening areas. Moreover, it would produce Webb's entire line of AGVs and SmartCarts. The building, in order to make room for future manufacturing expansion within 65,000 square meters of space, included an AGV testing area and conference rooms.

In September 2022, Addverb Technologies announced the development of a new Center of Excellence for Advanced Robotics Research and Development in California. The center was to focus on developing platforms for autonomous mobile robotics and automated guided vehicles, as well as advanced algorithms for human-machine collaboration and biomedical robotics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth of E-commerce Demanding Higher Efficiency

- 5.1.2 Increasing Investments in Technology and Robotics

- 5.2 Market Restraints

- 5.2.1 Limitation of Real-Time Wireless Control Due to Communication Delays

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Automated Fork Lift

- 6.1.2 Automated Tow/Tractor/Tugs

- 6.1.3 Unit Load

- 6.1.4 Assembly Line

- 6.1.5 Special Purpose

- 6.2 By End User Industry

- 6.2.1 Food & Beverage

- 6.2.2 Automotive

- 6.2.3 Retail

- 6.2.4 Electronics & Electrical

- 6.2.5 General Manufacturing

- 6.2.6 Pharmaceuticals

- 6.2.7 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 KUKA AG

- 7.1.2 Jungheinrich AG

- 7.1.3 Murata Machinery Ltd.

- 7.1.4 Daifuku Co. Ltd.

- 7.1.5 SSI Schaefer Systems International DWC LLC

- 7.1.6 Swisslog Holding

- 7.1.7 Dematic Corp.

- 7.1.8 Toyota Material Handling

- 7.1.9 Scott Technology Limited

- 7.1.10 John Bean Technologies (JBT) Corporation

- 7.1.11 Systems Logistics SPA

- 7.1.12 Seegrid Corporation