|

市場調查報告書

商品編碼

1403973

3D遠距臨場系統-市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測3D Telepresence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

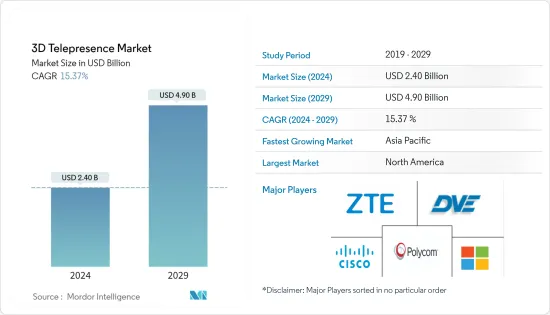

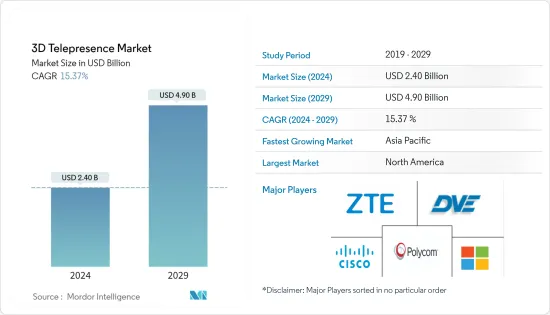

預計 3D遠距臨場系統市場規模到 2024 年將達到 24 億美元,預計到 2029 年將達到 49 億美元,在預測期內(2024-2029 年)複合年成長率為 15.37%。

主要亮點

- AR 和 MR 等先進技術的日益普及預計將為名為 3D遠距臨場系統的新協作平台鋪平道路。 AR 和 MR 等先進技術的日益普及預計將為名為 3D遠距臨場系統的新協作平台鋪平道路。

- 如今,音訊和視訊應用程式(例如 Google Hangouts、Facetime、Skype 和其他辦公室視訊會議平台)可供整個企業使用,以實現遠端通訊。

- 儘管在過去幾年中,音訊和視訊傳輸的體驗品質有了顯著提高,但 2D 視訊技術存在一些固有的缺陷,例如眼神接觸和手勢等非語言線索的損失,這些都是有缺陷的。 3D遠距臨場系統在兩方或多方之間提供 3D 視訊資料的渲染和串流傳輸,有助於普及3D遠距臨場系統世界。

- 思科(Spark Systems)等公司正在開發智慧型會議室,捆綁攝影機、4K螢幕揚聲器和支援設備,但技術的進步將透過遠距臨場系統帶來更真實的體驗。

- 早期進入遠距臨場系統領域的公司包括思科、微軟、Teliris、Huwaei 和SONY。自誕生以來,該技術克服了多項挑戰,包括不同供應商的遠距臨場系統系統之間的互通性以及與不同電信業者提供的網路的兼容性。

- 該技術已在 Musion 3D 等多個娛樂演示中得到應用。然而,迄今為止,此類 3D 系統由於與 2D遠距臨場系統/視訊會議相比高成本,實用化受到限制。

- 透過利用擴增實境(AR) 與 3D 結合的最新進展,例如 Atheer Air Glasses、Google Glass 和 Microsoft Holens World,可以在現實之上呈現遠端位置消費者的數位表示。您可以創建混合實境體驗。 COVID-19 爆發後,遠距工作和身臨其境型體驗需求等趨勢預計將獲得發展動能。從這個角度來看,3D遠距臨場系統系統對於確保工作流程極為重要。

3D遠距臨場系統市場趨勢

使用者體驗的改善預計將推動軟體領域的成長。

- 遠端沉浸和 3D 技術,無論是與虛擬實境還是擴增實境(AR) 捆綁在一起,都可以增加遠端位置使用者的存在感。除了改善目前透過 2D 視訊會議實現的用戶通訊體驗之外,該技術還可以用於其他幾個領域,以減少行動的需要。

- 此外,遠端協作等應用程式將受益於這些解決方案,其中來自不同學科的團隊必須與 3D資料和模型密切合作,例如設計、製造、醫療保健、物理科學、架構、天文學、數位人文和教育。 .預計將推動需求。

- 此外,旨在加速採用標準視訊會議以實現現實生活體驗的舉措正在推動市場成長。例如,去年,Facebook 現實實驗室的研究人員宣布開發出虛擬遠距臨場系統系統,該系統利用逼真的化身來捕捉和傳達現實世界中社交互動的凝視和目光接觸訊號。

- 根據統計預測,3D遠距臨場系統系統可以透過更快的決策速度、減少差旅成本和差旅時間,將組織生產力提高高達 40%。

歐洲佔據壓倒性市場佔有率

- 為了確保 3D遠距臨場系統系統的沉浸式體驗,我們進行了各種研究。例如,英國萊斯特德蒙福特大學的研究人員正在進行計劃,開發新演算法,以減少廣泛用於 3D遠距臨場系統的點雲的有損壓縮。

- 與傳統視訊技術相比,3D 點雲具有許多優勢,包括自由觀點渲染以及自然和合成物件的混合。歐盟資助的OPT-PCC計劃將開發新的資料壓縮演算法,透過高效的壓縮方法來最佳化影像速率失真性能,增加儲存容量並提高頻寬利用率,這是有可能的。

- AR 和 MR 等先進技術的日益普及預計將為 3D遠距臨場系統市場的普及鋪平道路。

- 作為產業發展策略的一部分,英國政府去年宣布投資4億歐元(4.3328億美元),用於在該國開發前沿研發計劃,涵蓋AR、VR和MR等身臨其境型技術。我們支持你自始至終。這些投資預計將為英國公司增加創建新應用程式、工具和虛擬體驗的機會。

- 基於混合實境(MR) 的新興企業定期吸引投資者進行產品創新資金,以抓住市場成長機會。例如,Zapper 宣布正在為其 MR 設備尋求投資。這家新興企業最近發布了其應用程式的下一版本。

- 同樣,去年,總部位於倫敦的新興企業Hyper 建構了一個創新的混合實境(MR) 協同設計平台,解決了瓶頸問題。由於 EIT Digital 支援的「HyperCRC」創新活動,Hyper 推出了一個空間設計平台,成功地將 VR 與物理精確的運動軌跡模型融合在一起。

- 此外,Hyper 還提供了一個將 VR 與現實世界運動軌跡模型結合的空間設計平台。該公司提供標準設計包,讓客戶可以從 40 種材料中進行選擇,並在四個身臨其境型3D 環境中自訂四個物件。此外,該技術允許公司的客戶進行遠端協作和共同設計。

3D遠距臨場系統產業概況

由於參與者眾多,3D遠距臨場系統市場高度分散。市場主要參與者有 TelePresence Tech、思科系統公司、微軟公司、Teliris, Inc. (Dimension Data)、Digital Video Enterprises Inc.、Musion、Polycom Inc.、中興通訊公司等。近期市場的主要發展有:

2022 年 11 月,墨西哥新興企業Inbiodroid 發起了 Kickstarter宣傳活動,為其第二版遠距臨場系統化身機器人提供資金。公司的使命是消除限制人類工業發展的物理障礙,開創一個成長和進步不受空間和時間限制的新時代。

此外,PROMETHEUS 2.0是一款配備遠距臨場系統技術的尖端分身機器人,它是一個人形機器人身體,可以在世界任何地方即時再現使用者的動作。使用目前正在開發的具有先進功能的全新AVATAR SYSTEM PROTOTYPE,用戶將能夠透過身臨其境型平台和主動通訊介面將他們的意識、技能、動作和意圖傳輸到PROMETHEUS 2.0。

2022 年 2 月,思科為 Webex Hologram 推出了逼真的即時遠端遠距臨場系統功能,這是一項電話會議服務,自 2021 年 10 月以來已逐步向少數客戶推出。這項新服務使用相機陣列和 HoloLens 或 Magic Leap AR 頭戴式顯示器。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場抑制因素介紹

- 市場促進因素

- 改善使用者體驗

- 組織對節省時間的技術的需求不斷成長

- 市場抑制因素

- 高成本且商業化有限

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 解決方案類型

- 軟體

- 硬體

- 目的

- 教育

- 廣告

- 會議

- 客戶服務

- 其他用途

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章競爭形勢

- 公司簡介

- TelePresence Tech

- Cisco Systems Inc.

- Microsoft Corporation

- Holoxica Limited

- Valorem Reply

- Teliris Inc.(Dimension Data)

- Digital Video Enterprises Inc.

- Musion 3D

- Polycom Inc.

- ZTE Corporation

- MDH Hologram Ltd.

- Primasonic Spectrum Private Ltd.

第7章 投資分析

第8章 市場機會及未來趨勢

The 3D Telepresence Market size is estimated at USD 2.40 billion in 2024, and is expected to reach USD 4.90 billion by 2029, growing at a CAGR of 15.37% during the forecast period (2024-2029).

Key Highlights

- The growing adoption of advanced technologies, such as AR and MR, is expected to pave the path for a new collaborative platform called 3D telepresence. The increasing adoption of advanced technologies, such as AR and MR, is expected to pave the way for a new collaborative platform called 3D telepresence.

- Audio and visual applications like Google Hangouts, Facetime, Skype, and other video conferencing platforms for offices exist today for use across enterprises to enable remote communication.

- Although the quality of experience, concerning audio and visual transmission, has significantly improved over the years, 2D video technology has several inherent drawbacks, like loss of non-verbal cues, such as eye contact and gestures, which cannot be mitigated easily. Some of these issues are addressed by 3D telepresence, which provides rendering and streaming of 3D video data between two or more parties, boosting the adoption of 3D telepresence globally.

- While intelligent conference rooms are being developed by companies like Cisco (Spark system), a bundle of cameras, 4K screen speakers, and supporting devices, technology advancements result in more life-like experiences through telepresence.

- Cisco, Microsoft, Teliris, Huwaei, and Sony are among the early entrants in the telepresence space. Since its inception, the technology has overcome a few challenges, such as interoperability between telepresence systems from different vendors and compatibility with networks provided by various telecom companies.

- The technology has been showcased in several entertainment demonstrations, like Musion 3D. However, to date, the practical applications have been limited by the high cost of such 3D systems compared to 2D telepresence/video conferencing.

- The remote consumer's digital representations could be rendered over the real by taking advantage of recent advances in augmented reality (AR), coupled with 3D, such as Atheer air Glasses, Google Glass, and Microsoft hololens world, creating a mixed-reality experience. Following the COVID-19 pandemic, trends such as remote working and the need for immersive experiences were expected to gain momentum. In such a regard, 3D telepresence systems were crucial in ensuring workflow.

3D Telepresence Market Trends

Enhanced User Experience is expected to Drive the Growth in software segment.

- The tele-immersion technology and 3D technology provide an increased presence for remote users, whether bundled with virtual or augmented reality (AR). Aside from enhancing the user experience in terms of communication, which is currently performed with 2D video conferencing, there is a potential use of this technology in several other areas that would reduce the need for travel.

- Moreover, applications, such as in remote collaboration, where multi-disciplinary teams have to work closely with 3D data or models, like in design, manufacturing, medicine, physical sciences, architecture, astronomy, digital humanities, and education, among various other applications, are expected to drive the demand for these solutions.

- Further, initiatives aimed at pushing the deployment of standard video conferencing to achieve real-world experience are driving the market growth. For instance, in the previous year, researchers from Facebook Reality Labs announced the development of a virtual telepresence system that utilizes photorealistic avatars to capture and convey the gaze and eye contact signals of social interactions in the real world.

- Statistical forecasts suggest that an organization could boost its productivity by up to 40% due to quick decision-making, saving travel costs and travel time because of the 3D telepresence systems.

Europe to have a Dominant Share in the Market

- Various research studies are conducted to ensure an immersive experience in 3D telepresence systems. For instance, researchers from the De Montfort University in Leicester, United Kingdom, are working on a project to develop new algorithms that could reduce lossy compression of point clouds whose usage is widely observed in 3D telepresence.

- Compared to traditional video technology, 3D point clouds offer various advantages, such as free-viewpoint rendering and a mix of natural and synthetic objects. The EU-funded OPT-PCC project is developing new data compression algorithms to optimize the image rate-distortion performance with efficient compression methods that could increase storage capability and improve bandwidth usage.

- The growing adoption of advanced technologies, such as AR and MR, is expected to pave the path for increased adoption of the 3D telepresence market.

- As part of its industrial development strategy, the United Kingdom government announced an investment of EURO 400 million (USD 433.28 million) the previous year to back cutting-edge R&D projects across the country, covering immersive technologies like AR, VR, and MR. Such investments are expected to increase opportunities for United Kingdom-based businesses to create new apps, tools, and virtual experiences.

- Mixed reality (MR) based startups regularly attract investors' funds for product innovations to seize market growth opportunities. For instance, Zapper announced raising investments for its MR device. The startup recently released the next version of its app.

- Similarly, the previous year, Hyper, a London-based startup, created an innovative Mixed Reality (MR) co-design platform that addresses the bottleneck. Hyper has introduced a spatial design platform that can successfully merge VR with physically accurate, motion-tracked models, owning to the EIT Digital-supported "HyperCRC" innovation activity.

- Moreover, Hyper provides a spatial design platform that combines VR with real-world motion-tracked models. The company offers a standard design package that allows customers to choose from 40 different materials and customize four objects within four immersive 3D environments. Furthermore, the technology enables the company's clients to collaborate and co-design remotely.

3D Telepresence Industry Overview

The 3D Telepresence Market is Highly fragmented due to the presence of a large number of players. Major players in the market include TelePresence Tech, Cisco Systems Inc., Microsoft Corporation, Teliris, Inc. (Dimension Data), Digital Video Enterprises Inc., Musion, Polycom Inc., and ZTE Corporation. Some key recent developments in the market are as follows:

In November 2022, Inbiodroid, a Mexican startup, launched a Kickstarter campaign to fund the second version of its telepresence avatar robot. The company's mission was to break down the physical barriers that limited humanity's industrial progress and ushered in a new era in which growth and advancement were not limited by space or time.

Moreover, PROMETHEUS 2.0, the most advanced Avatar robot with telepresence technology, is a humanoid robotic body capable of replicating its user's movements in real-time from anywhere in the world. Using a completely new AVATAR SYSTEM PROTOTYPE - with advanced features currently in development - users can transfer their awareness, skills, movements, and intentions to PROMETHEUS 2.0 via an immersive platform and an active communication interface.

In February 2022, Cisco rolled out a photorealistic real-time remote telepresence feature for Webex Hologram, its teleconferencing service that was slowly rolling out with a handful of clients since October 2021. The new service uses a camera array and a HoloLens or Magic Leap AR head-mounted display.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Enhanced User Experience

- 4.3.2 Increasing Demand For Time-Saving Technologies In Organizations

- 4.4 Market Restraints

- 4.4.1 High Costs And Limited Commercialization

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Solution Type

- 5.1.1 Software

- 5.1.2 Hardware

- 5.2 Application

- 5.2.1 Education

- 5.2.2 Advertising

- 5.2.3 Conferencing

- 5.2.4 Customer Service

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 TelePresence Tech

- 6.1.2 Cisco Systems Inc.

- 6.1.3 Microsoft Corporation

- 6.1.4 Holoxica Limited

- 6.1.5 Valorem Reply

- 6.1.6 Teliris Inc. (Dimension Data)

- 6.1.7 Digital Video Enterprises Inc.

- 6.1.8 Musion 3D

- 6.1.9 Polycom Inc.

- 6.1.10 ZTE Corporation

- 6.1.11 MDH Hologram Ltd.

- 6.1.12 Primasonic Spectrum Private Ltd.