|

市場調查報告書

商品編碼

1403967

日本汽車天窗:市場佔有率分析、產業趨勢與統計、2024年至2029年成長預測Japan Automotive Sunroof - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

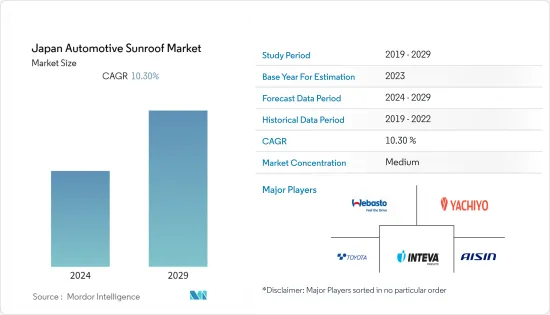

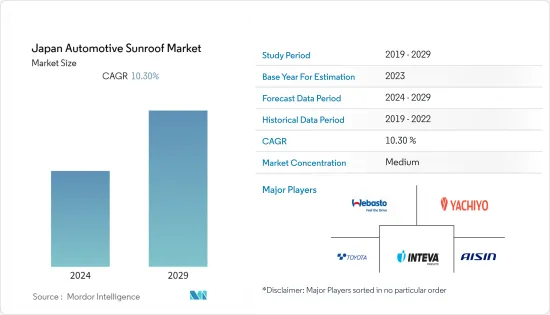

日本汽車天窗市場目前估值為 5.2878 億美元,預計未來五年將成長至 9.522 億美元,預測期內收益複合年成長率為 10.30%。

從中期來看,由於人均收入的增加以及消費者在更有效的通風和更明亮的內飾上的支出以改善整體駕駛體驗,小客車銷量的增加將對行業需求產生積極影響。我認為這將會對行業需求帶來正面影響。此外,天窗材料的技術進步將推動汽車天窗的需求。因此,持續的設計升級和材料進步以減輕重量並提高穩定性正在推動行業成長。

玻璃技術的創新、對安全性、舒適性和便利性的需求不斷增加、對高檔汽車的需求不斷增加以及汽車玻璃表面區域(包括大型天窗)美觀性的提高等因素正在推動汽車天窗市場的成長。

為了增加對天窗的需求,汽車正在安裝有色玻璃和紫外線反射玻璃,以避免不必要的熱量和陽光,市場在預測期內可能會顯著成長。

日本汽車天窗市場趨勢

運動型多功能車的採用率很高

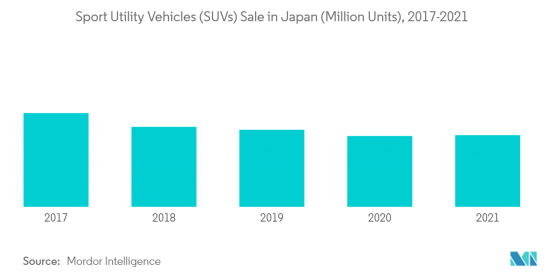

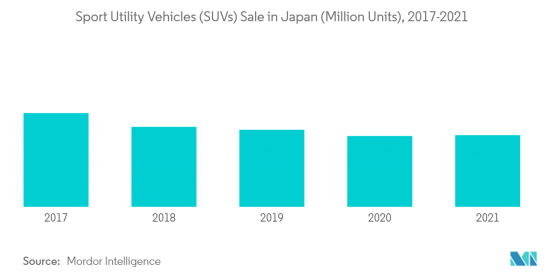

運動型多用途車是最受歡迎的汽車領域之一,因為其車輛種類繁多,在行駛里程、功率和功能方面具有無與倫比的多功能性。在日本,迷你SUV受到消費者的青睞並且正在推動市場發展。

SUV(運動型多用途車)是大型車輛,非常適合崎嶇地形和越野。這些車可容納約 5 至 7 人。 SUV 汽車天窗市場還包括多功能車 (MUV) 系列。

許多領先公司正在微型SUV和跨界車領域推出新產品,以吸引更多終端用戶並贏得市場佔有率。例如

- 2023年5月,斯巴魯公司加強了其SUV陣容。在即將於10月開幕的Japan Mobility Show 2023上,我們發布了Levorg的SUV版本,並對Forester和Outback進行了一些改進,以增強產品競爭力。

- 2023 年 1 月,豐田汽車公司在日本推出了豐田LexusRX350h。配備全景天窗。

- 2023年,豐田陸地巡洋艦300將在日本上市。配備天窗,其頂板由鋁製成。

上述發展和全國運動型多用途車銷售的增加可能會在預測期內推動天窗的需求。

全景天窗佔據主要市場佔有率

全景天窗擴大採用智慧玻璃技術是汽車全景天窗成長的主要原因之一。智慧玻璃在汽車行業廣受歡迎,並且擴大被汽車採用。智慧玻璃根據光強度、熱和電壓的變化來改變光的特性。

全景天窗是一款新產品。全景天窗的誕生源自於消費者對大開口天窗的需求。該系統是一個固定/可操作的玻璃面板,為前排和後排座椅提供了一個開口。全景天窗之所以立即獲得成功,是因為其大玻璃面板(而不是通常的金屬頂部)提供的寬敞感。

這一趨勢始於豪華轎車和旅行車,現已蔓延到 SUV 和豪華轎車。全景天窗有一個從前排座椅延伸到後排座椅的長面板,以及兩個不同的面板,第二個面板通常像普通天窗一樣向後滑動。

關閉車頂的滑動蓋是全景天窗系統的關鍵補充,讓乘客在炎熱的陽光下保持車內涼爽。如今,汽車的外觀是重中之重,全景天窗位居榜首,使其外觀引人注目,引人注目。

隨著梅賽德斯-奔馳、奧迪、起亞和寶馬等主要汽車製造商為其頂級轎車和 SUV 標配全景天窗,這些汽車細分市場的市場預計將在未來五年內加速成長。 。

當車輛碰撞或事故發生時,全景天窗特別容易破裂或彈出。因此,新興市場的供應商正在專注於開發全景天窗安全氣囊,以幫助減少事故並增強消費者信心。

各大汽車製造商紛紛推出配備全景天窗的新車,以改善車內空間,預計該市場在預測期內將大幅成長。例如

- 2022年11月,豐田汽車公司在日本推出了新款豐田Innova。全新Innova配備了全景天窗。

上述全國範圍內的開拓可能會在預測期內出現顯著的市場成長。

日本汽車天窗產業概況

日本汽車天窗市場由幾家主要企業主導,包括愛信精機集團、英納法屋頂系統集團、Webasto Corporation、Inteva Products 和 Yachi Sangyo。領先的汽車零件製造商正在全國擴大其製造設施,這可能是預測期內市場的一個利潤豐厚的機會。例如

AGC Inc.計劃於2023年1月開始生產與遠紅外線相容的擋風玻璃。

2022年9月,AGC擴大了汽車玻璃產品的使用。 AGC的大型顯示器蓋板玻璃業務是在考慮自動駕駛汽車內裝方面先於其他公司開發的,目前正在不斷成長。

2021年6月,偉巴斯特宣布將為新款賓士S-Class配套優雅的滑動式全景天窗。兩個車頂模組允許車輛後部的駕駛員和乘客座椅單獨且獨立地配置。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場抑制因素

- 波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模-美元)

- 依材料類型

- 玻璃

- 材料

- 其他材料類型

- 按車型

- 兩廂車

- 轎車

- 高級車

- 按類型

- 內建天窗

- 彈出式天窗

- 傾斜和滑動天窗

- 全景天窗

第6章競爭形勢

- 供應商市場佔有率

- 公司簡介

- Sunroof Center

- Webasto Group

- ACS France SAS

- Inteva Products

- Inalfa Roof Systems Group

- Mitsuba Corp.

- Yachiyo Industry Co. Ltd.

- Automotive Sunroof Company

- Evana Automation

- Retro Vehicle Enhancement Ltd.

- Toyota Industries Corporation

第7章 市場機會及未來趨勢

The Japanese automotive sunroof market was valued at USD 528.78 million in the current year and is projected to grow to USD 952.20 million by the next five years, registering a CAGR of 10.30% in terms of revenue during the forecast period.

Over the medium term, increasing passenger vehicle sales in conjunction with rising per capita income and consumer spending toward effective ventilation and brighter vehicle interiors to enhance the overall driving experience will positively influence the industry demand. Moreover, technological advancements in sunroof materials drive automotive sunroof demand. Thereby, ongoing design upgrades and material advancements to reduce weight and provide stability are boosting the industry's growth.

Owing to factors such as innovation in glass technology and the rise in demand for safety, comfort, & convenience features, the rise in demand for premium cars and better aesthetic appeal of the glass surface area in automobiles, including larger sunroofs propel the growth for the automotive sunroof market.

To augment the demand for sunroofs, vehicles are now fitted with tinted or UV-reflective glasses to avoid unwanted heat and sunlight, which in turn is likely to witness major growth for the market during the forecast period.

Japan Automotive Sunroof Market Trends

High Adoption in Sports Utility Vehicles

Sport utility vehicles constitute one of the most popular automotive segments due to a wide range of vehicles of unmatched versatility in range, power output, and features. In the country, mini SUVs are preferred by consumers and are driving the market.

SUVs (Sports Utility Vehicles) are big cars, ideal for rough surfaces and off-road. These cars can accommodate about five to seven people. The automotive sunroof market for SUVs includes the scope for the multi-utility vehicle (MUV).

Many major players are launching new products in the mini SUV and Crossover segment to attract more end-users and gain market share. For instance,

- In May 2023, Subaru Corporation strengthened its SUV lineup. For the 'Japan Mobility Show 2023' that will open in October, the automaker released an SUV version of its 'Levorg' and also partially improved its 'Forester' and 'Outback' to enhance product competitiveness.

- In January 2023, Toyota Motor introduced the Toyota Lexus RX350h in Japan. The vehicle comes with a panoramic sunroof.

- In 2023, Toyota Motor introduced the Toyota Land Cruiser 300 in Japan. The vehicle comes with a Sunroof whose roof panel is made of Aluminum.

The above-mentioned development and rise in the sale of sport utility vehicles across the country is likely to enhance the demand for sunroofs during the forecast period.

Panoramic Sunroof Holds Major Market Share

Owing to the growing adoption of smart glass technology in panoramic sunroofs is one of the major reasons for the automotive panoramic sunroof growth. Smart glasses have gained immense popularity in the automotive industry and are increasingly being used in vehicles. Smart glass modifies the properties of light based on variations in light intensity, heat, and voltage fluctuations.

Panoramic sunroofs are the new entrant into the lot. They are the outcome of the consumer demand for large open sunroofs. The system offers openings above both the front and the rear seats with fixed/operable glass panels. The spacious feeling offered by large glass panes (replacing the regular metal top) is the reason for the instant success of the panoramic sunroof.

The trend that started with its employment in limousines and wagons has now spread to SUVs and premium sedan cars. Panoramic sunroofs are now available either as a single longer panel that extends from the front seats to the rear or as two different panes, where the second pane often slides back as a regular sunroof.

Slide cover to close the roof was a major addition to the panoramic sunroof system, allowing passengers to stay cool inside on a hot sunny day. These days, priority is given to the visual appearance of a car, with the panoramic sunroof as a crowning achievement, giving an attractive look that demands attention.

With major automakers, such as Mercedes-Benz, Audi, Kia, and BMW, offering panoramic sunroofs as standard equipment for their top-end sedans and SUVs, the market for these vehicle segments is expected to continue to gain pace in the coming five years.

Panoramic sunroofs are prone to shattering or sunroof ejection, particularly during vehicle crashes or accidents. Thus, vendors in the market are focusing on developing panoramic sunroof airbags aimed at reducing incidents and helping to enhance consumer confidence.

Major Vehicle manufacturers launched new vehicle models with panoramic sunroof, which enhances the vehicle interiors and is likely to witness major growth for the market during the forecast period. For instance,

- In November 2022, Toyota Motor Corporation launched the New Toyota Innova model in Japan. The new Innova comes with a Panoramic sunroof.

The above-mentioned development across the country is likely to witness major growth for the market during the forecast period.

Japan Automotive Sunroof Industry Overview

Several key players, such as Aisin Seiki Group, Inalfa Roofs Systems Group, Webasto Corporation, Inteva Products, Yachi Industry Co. Ltd. , and others, dominate the Japanese automotive sunroof market. Major automotive component manufacturers are expanding their manufacturing facilities across the country, which in turn is likely to be a lucrative opportunity for the market during the forecast period. For instance,

In January 2023, AGC Inc. (AGC) has been focusing on the development of glass technology for next-generation vehicles. The company plans to start the production of a windshield that supports far-infrared radiation.

In September 2022, AGC Inc. expanded the application range of automotive glass products. AGC's large display cover glass business, developed with autonomous vehicle interiors in mind ahead of other companies, is growing.

In June 2021, Webasto announced that it is supplying the elegant sliding panorama sunroof for the new Mercedes-Benz S-Class. Two roof modules allow the driver and passenger in the rear of the vehicle to determine their desired settings individually and independently of each other.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Material Type

- 5.1.1 Glass

- 5.1.2 Fabric

- 5.1.3 Other Material Types

- 5.2 By Vehicle Type

- 5.2.1 Hatchback

- 5.2.2 Sedan Cars

- 5.2.3 Premium Cars

- 5.3 By Type

- 5.3.1 Built-in Sunroof

- 5.3.2 Pop-Up Sunroof

- 5.3.3 Tilt and Slide Sunroof

- 5.3.4 Panoramic Sunroof

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Sunroof Center

- 6.2.2 Webasto Group

- 6.2.3 ACS France SAS

- 6.2.4 Inteva Products

- 6.2.5 Inalfa Roof Systems Group

- 6.2.6 Mitsuba Corp.

- 6.2.7 Yachiyo Industry Co. Ltd.

- 6.2.8 Automotive Sunroof Company

- 6.2.9 Evana Automation

- 6.2.10 Retro Vehicle Enhancement Ltd.

- 6.2.11 Toyota Industries Corporation