|

市場調查報告書

商品編碼

1403949

工業馬達:市場佔有率分析、產業趨勢與統計、2024-2029 年成長預測Industrial Motors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

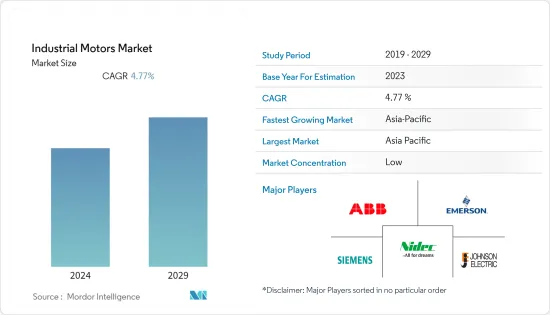

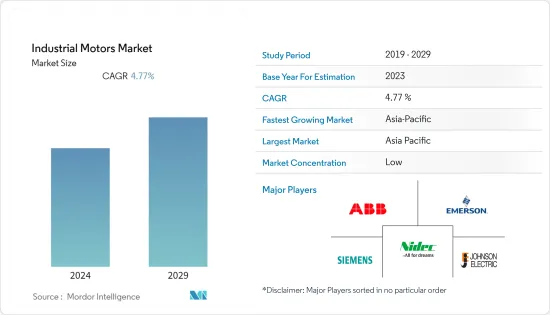

預計2024年工業馬達市場規模為212.9億美元,2029年將達281.7億美元,預測期內複合年成長率為4.77%。

新興市場產業部門的擴張、先進機械和自動化的普及正在支持市場成長。

主要亮點

- 電機是工業生產的重要動力。設計和開發工業馬達的全新先進方法包括對準、馬達監控、連接、測試、節省成本和時間等要素,同時提高安全性。節能馬達和智慧型驅動器還可以提高效率和性能,同時使故障排除更加容易。

- 對工業 4.0 的日益關注主要推動了工業電機市場的發展。工業自動化正在推動多個地區製造業生產力的提高,預計需求強勁。根據工業能源加速器的數據,多個產業消耗的全部電能中近 70% 是由世界各地安裝的數百萬台電動馬達使用的。這些趨勢推動了對提高工業馬達能效的創新的需求。

- 此外,產業參與者正專注於擴大製造業務,進一步推動市場成長。例如,2022年7月,三菱電機向其子公司Mitsubishi Electric India Pvt. Ltd.投資約31億日元(20,753,139美元)或2180萬歐元(23,078,570美元),在印度建設新工廠,並宣布將提供資金來建構其他活動計劃於2023年12月開始,新工廠將生產逆變器和其他工廠自動化(FA)控制系統產品,以增強公司滿足印度強勁需求的能力。這些案例可能為該地區研究市場的成長提供良好的前景。

- 在工業應用中,AC馬達通常更可靠並且需要更少的維護。AC馬達不需要換向器、電刷或滑環,因此不存在經常磨損的零件。這使得交流馬達非常適合不易接近、可以連續運作或長時間無人監管的應用。此外,重要的市場趨勢之一是開拓具有高功率重量比的工業馬達。由於大型電動存在攜帶性和高能耗的問題,一些製造商正在開發高功率重量比的電動。

- 然而,工業馬達的高安裝和維護成本等挑戰正在影響所研究市場的成長,特別是在價格敏感的新興市場。

- 研究市場宏觀經濟因素的影響也更大,因為工業部門的投資很大程度上受到製成品市場需求、地區總體經濟狀況和地緣政治局勢等因素的影響。因此,預計這些因素將繼續在確定預測期內研究市場的成長軌跡方面發揮關鍵作用。

工業馬達市場趨勢

低壓佔較大市場佔有率

- 低壓馬達的行業標準差異很大。一些製造商更改了低壓馬達的分類。根據 IEC 600038 標準(國際電工委員會),所有額定功率電壓不超過 1000 伏特的馬達被視為低電壓 (LV)。

- 與市場上的其他馬達相比,低壓引擎在多個行業中具有廣泛的應用。低壓馬達的典型應用包括中游和下游石油和天然氣、水、污水、食品以及食品和食品和飲料產業。

- 多功能低壓馬達採用經濟實惠的標準設計,易於安裝和快速啟動,具有高生產率、高可靠性、更高的安全性和高效的電力使用。低壓電機也可以設計用於沒有專門開發的引擎的應用。歐盟委員會的生態設計法規最近透過實施和建立 IEC(國際電工委員會)定義的國際效率等級 (IE) 來解決低壓電機問題。這些規定使 IE3 成為最低標準,使 IE5 成為獨特的超高級額定功率,其中還包括具有變速驅動器的馬達。

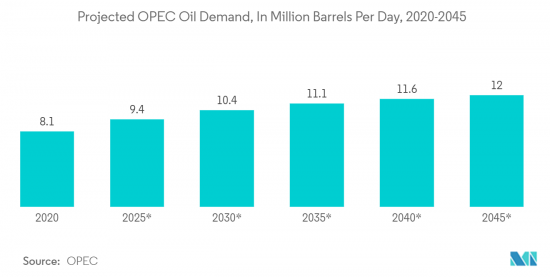

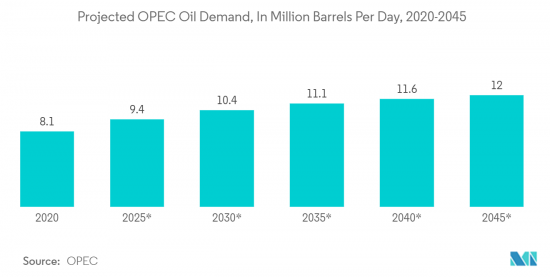

- 此外,由於油價上漲,石油和天然氣行業對低壓馬達的強勁需求預計將在預測期內恢復。例如,根據OPEC的數據,到2045年,OPEC國家的石油需求預計將從810萬桶/日增加到1,200萬桶/日。鑑於這些趨勢,各公司正在專注於為石油和天然氣行業開發低壓馬達解決方案,以抓住新的成長機會。

亞太地區正在經歷顯著成長

- 製造業是亞太地區尤其是中國經濟的支柱之一,正經歷快速轉型。這一重大轉變使該國處於市場領先地位。在過去的二十年裡,中國製造商的能力已從生產低成本產品發展到生產更複雜的產品,但強大的工業機械和馬達仍然至關重要。

- 智慧製造措施預計也將推動工業馬達在該國的採用。根據工業和資訊化部介紹,中國政府已啟動多個智慧製造試點計劃。 「十三五」規劃目標是到2025年建立智慧型製造體系,完成重點產業轉型。由於這些舉措,汽車製造商正在擴大其在中國的製造設施,為預測期內的工業馬達需求提供了積極的前景。

- 其他國家也出現了類似的趨勢。例如,2022年10月,印度政府宣布將透過國際競標競標探勘開發42個油氣田。印度打算在2025年將其石油和天然氣探勘和生產面積增加一倍,達到50萬平方公里,到2030年增加到100萬平方公里,增加國內產量,減少對進口燃料的依賴。這為石油和天然氣行業的工業電機需求創造了良好的前景。工業馬達在上游石油和天然氣產業中發揮重要作用,廣泛用於驅動泵浦和壓縮機系統等設備。

- 此外,在跨國公司尋求向中國境外擴張的投資增加的推動下,東南亞工業部門近年來也取得了顯著發展。泰國、馬來西亞和印尼等國家正迅速崛起為該地區的主要工業國家,預計將有利於預測期內東南亞研究市場的成長。

工業馬達產業概況

工業電機市場包括ABB集團、西門子股份公司、艾默生電氣有限公司和Johnson Electric。雖然透過創新獲得永續的競爭優勢是可能的,但企業在市場競爭中脫穎而出變得越來越困難。供應商高度集中,買家可以從眾多供應商中進行選擇。儘管市場上的參與者多種多樣,但擁有高標準、高品質和全球影響力的參與者仍然屈指可數。

2023年7月,Electrified Automation推出了新系列電動馬達。這種新的馬達架構旨在為尋求可靠且響應迅速的供應鏈的OEM最大限度地提高自動化和大量生產潛力。此外,新型 EA 193 系列永磁電動支援從工業到兩輪公路式的廣泛應用。

2023年6月,ABB開發出新一代AMI 5800 NEMA模組化感應電動機。 AMI 5800 馬達旨在為泵浦、風扇、壓縮機、擠出機、輸送機和破碎機等要求嚴苛的應用提供可靠性和能源效率,可提供高達1750 HP 的功率,是採礦、化學石油和天然氣的理想選擇,它具有高度可自訂性和模組化,適用於多種行業的應用,包括傳統發電、水泥和金屬等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 宏觀趨勢對工業馬達市場的影響

第5章市場動態

- 市場促進因素

- 政府法規對能源效率的需求

- 擴大轉向智慧電機

- 市場挑戰

- 攜帶性問題

- 購買新設備和升級現有設備的初始投資較高

第6章市場區隔

- 依馬達類型

- 交流 (AC) 電機

- 直流 (DC) 電機

- 其他馬達(伺服馬達和電子換向器馬達(EC馬達)

- 按電壓

- 高電壓

- 中壓

- 低電壓

- 按最終用戶

- 油和氣

- 發電

- 礦業/金屬

- 用水和污水管理

- 化工/石化

- 離散製造

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第7章競爭形勢

- 公司簡介

- ABB Ltd.

- Emerson Electric Co.

- Siemens

- Nidec Industrial Solutions

- Johnson Electric Holdings Limited

- Arc Systems Inc.

- Ametek Inc.

- Toshiba Electronic Devices and Storage Corporation

- Wolong Industrial Motors

- Allen-Bradly Co. LLC(Rockwell Automation Inc.)

- Maxon Motor AG

- Franklin Electric Co. Inc.

- Fuji Electric Co. Ltd

- ATB Austria Antriebstechnik AG

- Menzel Elektromotoren GmbH

第8章投資分析

第9章市場的未來

The Industrial Motors Market size is estimated at USD 21.29 billion in 2024 and is expected to reach USD 28.17 billion by 2029, registering a CAGR of 4.77% during the forecast period. The expanding footprint of the industrial sector across developing regions, along with the growing penetration of advanced machinery and automation, supports the studied market's growth.

Key Highlights

- Motors are the significant driving force of industrial production. The new and advanced approaches for designing and developing industrial motors include factors like alignment, motor monitoring, connections, testing, and saving costs and time while improving safety and security. Energy-saving motors and intelligent drives also boost efficiency and performance while facilitating troubleshooting.

- The growing focus on Industry 4.0 primarily drives the market for industrial motors. Industrial automation drives the manufacturing sector toward more productivity in several regions, expecting to show strong demand. According to Industrial Energy Accelerator, nearly 70% of all electrical energy consumed by several industries is used by the millions of electrical motors installed globally. Such trends drive the demand for innovations in industrial motor technology to make them energy efficient.

- The industry players also focus on expanding their manufacturing operations, further supporting the market growth. For instance, in July 2022, Mitsubishi Electric Corporation revealed that it would fund the construction of a new factory in India by investing roughly JPY 3.1 billion (USD 20753139), or EUR 21.8 million (USD 23078570), in its subsidiary Mitsubishi Electric India Pvt. Ltd. The new facility, whose activities are scheduled to begin in December 2023, will likely produce inverters and other factory automation (FA) control system goods, enhancing the company's capacity to satisfy India's booming demand. Such an instance will create a favorable outlook for the growth of the studied market in the region.

- In Industrial applications, AC motors are generally more reliable with low maintenance requirements, and the bearing life frequently limits the service life of AC motors. Since the motors do not need commutators, brushes, or slip rings, they don't have parts that wear out regularly. This factor makes the motors ideal for applications that are not easily accessible, continuously available to operate, or will work without supervision for long periods. Furthermore, one critical trend in the market is the development of high power-to-weight ratio industrial motors. Several manufacturers are developing electric motors with a high power-to-weight ratio, as large electric motors have portability and high energy consumption issues.

- However, factors such as the higher installation and maintenance cost of industrial motors challenge the growth of the studied market, especially in developing markets, wherein price sensitivity is higher.

- The impact of macroeconomic factors is also on the higher side in the studied market, as investments in the industrial sector are largely influenced by factors such as the market demand for manufactured products, the general economic condition of the region, and the geopolitical situation. Hence, during the forecast period, these factors are anticipated to continue to play a pivotal role in determining the growth trajectory of the studied market.

Industrial Motors Market Trends

Low Voltage to Hold Significant Market Share

- The industry standards for low-voltage motors vary broadly. Several manufacturers have different motor classifications that are considered low-voltage motors. According to the IEC 600038 standard (International Electrotechnical Commission's), any motor rating up to 1000 volts is regarded as a low voltage (LV).

- Compared to other motors in the market, low-voltage engines have a wide range of applications across multiple industries. Some of the primary applications of low-voltage motors are in the mid-stream and downstream oil and gas, water, wastewater, food, and beverage industries, etc.

- Multi-purpose low voltage motors provide simple installation and quick start and have an affordable standardized design with high productivity, high reliability, increased safety, and very efficient electricity use. Low-voltage motors can also be designed for applications without a specially developed engine. The European Commission Ecodesign Regulation recently addressed this for low-voltage motors by enforcing and establishing (IE) International Efficiency classes defined by the IEC (International Electrotechnical Commission). It set IE3 as the minimum standard and IE5 as a unique ultra-premium rating, including motors with variable-speed drives.

- Additionally, over the forecast period, rising oil prices are expected to create a strong rebound demand for LV motors from the oil and gas industry. For instance, according to OPEC, crude oil demand in the OPEC member countries is anticipated to grow from 8.1 million barrels per day to 12 million barrels per day by 2045. Considering such trends, companies are now focusing on developing low-voltage motor solutions for the oil and gas sector to grab emerging opportunities, creating a favorable outlook for the growth of the studied market.

Asia-Pacific to Witness Significant Growth

- Manufacturing is one of the pillars of several countries of the Asia Pacific region, specifically of the Chinese economy, and is undergoing a rapid transformation. This large-scale transformation has put the country in a leading position in the market. Over the last two decades, Chinese manufacturers have evolved their capabilities from producing low-cost goods to creating more advanced products, wherein competent industrial machinery and motors remain pivotal.

- The adoption of industrial motors in the country is also expected to be driven by smart manufacturing initiatives. According to the Ministry of Industry and Information Technology, the Chinese government initiated several smart manufacturing pilot projects. As per the 13th five-year plan, the country aims to establish its intelligent manufacturing system and complete the critical industry transformation by 2025. As a result of such initiatives, automakers have been expanding their manufacturing facilities in China, creating a favorable outlook for the demand for industrial motors during the forecast period.

- A similar trend has been observed across other countries. For instance, the government of India, in October 2022, announced that it put up 42 oil and gas blocks for exploration and development through international competitive bidding. India will more than double the area under investigation and production of oil and gas to 0.5 million square kilometers by 2025 and 1 million sq. km. by 2030, intending to raise domestic output and cut reliance on imported fuel, thus creating a favorable outlook for demand for industrial motors in the oil and gas industry as industrial motors play a vital role in the upstream of the oil and gas industry and are widely used to drive equipment such as pump and compressor systems.

- Furthermore, in recent years, the industrial sector in Southeast Asia has also flourished significantly, driven by the growing investment by MNCs exploring destinations outside China. Countries such as Thailand, Malaysia, and Indonesia are fast emerging among the leading industrialized economies in the region, which is anticipated to favor the studied market's growth in Southeast Asia during the forecast period.

Industrial Motors Industry Overview

The industrial motor market is moving towards a fragmented stage, owing to the presence of a large number of companies, such as the ABB Group, Siemens AG, Emerson Electric Co. Inc., and Johnson Electric. Through innovation, sustainable competitive advantage can be attained, but it has become increasingly challenging for firms to differentiate themselves from market competition. Because the concentration of suppliers is high, buyers can choose among different vendors. Although the market comprises various players, a handful of them are still prominent for their high standards, excellent quality, and global reach.

In July 2023, Electrified Automation launched a new range of electric motors. The new motor architecture is designed to maximize the potential of automation and high-volume production for OEMs looking for a reliable, responsive supply chain. Furthermore, the new EA 193 Series permanent magnet electric motors will support a range of applications from industrial to two-wheel-on-road.

In June 2023, ABB developed the new generation AMI 5800 NEMA modular induction motor. Designed to offer reliability and energy efficiency in demanding applications such as pumps, fans, compressors, extruders, conveyors, and crushers, the AMI 5800 motor's power output of up to 1750 HP offers the capability of a high degree of customization and modularity to suit applications in a wide range of industries including mining, chemical oil and gas, conventional power generation, and cement and metals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macro Trends on the Industrial Motors Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Energy Efficiency Owing to Government Regulations

- 5.1.2 Growing Shift towards Smart Motors

- 5.2 Market Challenges

- 5.2.1 Portability Issues

- 5.2.2 High Initial Investment for Procuring New Equipment and Upgrading Existing Equipment

6 MARKET SEGMENTATION

- 6.1 By Type of Motor

- 6.1.1 Alternating Current (AC) Motors

- 6.1.2 Direct Current (DC) Motor

- 6.1.3 Other Types of Motors (Servo and Electronically Commutated Motors (EC))

- 6.2 By Voltage

- 6.2.1 High Voltage

- 6.2.2 Medium Voltage

- 6.2.3 Low Voltage

- 6.3 By End User

- 6.3.1 Oil and Gas

- 6.3.2 Power Generation

- 6.3.3 Mining and Metals

- 6.3.4 Water and Wastewater Management

- 6.3.5 Chemicals and Petrochemicals

- 6.3.6 Discrete Manufacturing

- 6.3.7 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 South Africa

- 6.4.5.3 Rest of Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Emerson Electric Co.

- 7.1.3 Siemens

- 7.1.4 Nidec Industrial Solutions

- 7.1.5 Johnson Electric Holdings Limited

- 7.1.6 Arc Systems Inc.

- 7.1.7 Ametek Inc.

- 7.1.8 Toshiba Electronic Devices and Storage Corporation

- 7.1.9 Wolong Industrial Motors

- 7.1.10 Allen - Bradly Co. LLC (Rockwell Automation Inc.)

- 7.1.11 Maxon Motor AG

- 7.1.12 Franklin Electric Co. Inc.

- 7.1.13 Fuji Electric Co. Ltd

- 7.1.14 ATB Austria Antriebstechnik AG

- 7.1.15 Menzel Elektromotoren GmbH